Online shoppers who pay with their Coinbase Card via Apple Pay and Google Pay will begin enjoying crypto rebates.

In an announcement issued on Coinbase’s blog on Tuesday, the exchange service revealed that starting in June, some whitelisted customers will be selected to begin enjoying the crypto rebate feature.

As part of the announcement, Coinbase revealed that customers who use their Coinbase Card via Apple Pay and Google Pay can earn up to 4% in crypto rewards for online shopping.

“Splurging for guacamole with your Coinbase Card is a no-brainer when you can earn 1% back in Bitcoin or 4% back in Stellar Lumens,” the announcement added.

As previously reported by Cointelegraph, Coinbase became a direct Visa card issuer back in February 2020. By March 2020, Coinbase Card users in Europe could already utilize their cards via Google Play.

The Coinbase announcement comes amid significant growth in mobile phone payments in the United States. While mobile phone payment penetration in the U.S. still lags behind China, the sector experienced 29% growth in 2020.

Apart from receiving up to 4% in crypto rebates, the exchange said it has other plans to expand its Coinbase Card reward program. Since June 2019, Coinbase Card has added more countries to its coverage while increasing its supported digital currencies to even include stablecoins like Dai.

Crypto debit cards have continued to be a significant part of efforts to promote retail cryptocurrency utilization for microtransactions. Meanwhile, payment giants like PayPal have also entered the retail crypto payment arena, with U.S. customers able to pay for online shopping with Bitcoin (BTC).

According to a Mastercard survey from May, 40% of respondents across the globe expressed interest in adopting crypto payments in 2022

Author: jamrockbrown

Altcoin day trading madness: 100% rebound in hours for Polygon, Maker

The volatility of the cryptocurrency space was on full display again on Monday, as several altcoins experienced gigantic price rebounds following the market crash of the past week or so.

Two altcoins in particular doubled in value in just over 12 hours leading into Monday morning, as Polygon (MATIC) and Maker (MAKER) recorded over 100% growth amid a strong market bounce.

Polygon climbed from a valuation of $0.75 late on Sunday afternoon, to a peak of $1.51 by early on Monday morning — marking 101% gains in less than a day.

The rapid rebound comes shortly after Polygon suffered 72% losses in less than a week, as it fell from a valuation of $2.68 to $0.74 since May 18.

A similar pattern was observed in the governance token of the MakerDAO protocol, Maker, on Monday. The coin price rose from $1,835 on Sunday, to $3,694 by Monday morning, equating to a 101% increase.

Like Polygon, Maker’s miraculous pump follows a 71% decline since the coin hit an all-time high in early May, and a 63% decline in the past week alone.

The intensity of the rebounds experienced by coins on the day appeared to be tied to the severity of their recent market crashes. As such, the altcoin market proved to be the ripest venue for day traders on Monday, many of whom could feasibly have doubled their money between supper and breakfast.

Bitcoin (BTC) and Ether (ETH) were subject to less dramatic rebounds, with the foremost cryptocurrencies gaining 17% and 32% respectively. Both coins experienced less volatility throughout the duration of the recent market pump, and their subsequent losses proved to be less severe, with BTC and ETH losing 51% and 60% respectively since their recent all-time highs.

Many traders rejoice in such volatility, yet the harsh fact remains that day trading is a full-time job, and according to some estimates as little as 1% of day traders actually turn a profit.

Setting Up and Using Acropolis File Services (AFS) on Nutanix AOS 5.0

This article will show you the steps involved to setup Acropolis File Services (AFS) on a cluster running AOS 5.0.

Acropolis File Services (AFS) uses a scale-out architecture that provides Server Message Block (SMB) file shares to Windows clients for home directory and user profiles. Acropolis File Services consist of three or more file server VMs (FSVM). There is one file server maximum per cluster image. A set of file server VMs is also known as a Acropolis File Services cluster. Multiple file server clusters can be created on a Nutanix cluster.

With the AOS 5.0 release, Acropolis File Services can be used when running ESXi or AHV as the hypervisor on your Nutanix cluster.

A great document to refer to is the Acropolis File Services Guide, which can be found on the Nutanix portal here: https://portal.nutanix.com/#/page/docs/details?targetId=Acropolis-File-Services-Guide-v20:Acropolis-File-Services-Guide-v20

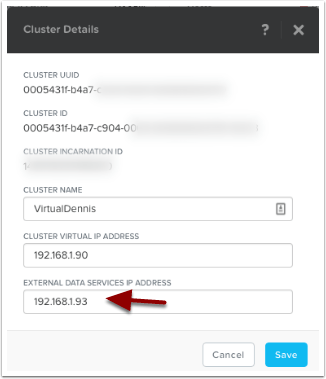

Setup the Cluster Data Services IP

One of the prerequisites for AFS is to setup a Cluster Data Services IP. We can set that up by clicking on the cluster name in Prism. In the sample below, I’m clicking on the cluster name.

Setup the External Data Services IP Address by typing in a new unused IP address into the field as shown below. Then select the “Save” button.

File Services

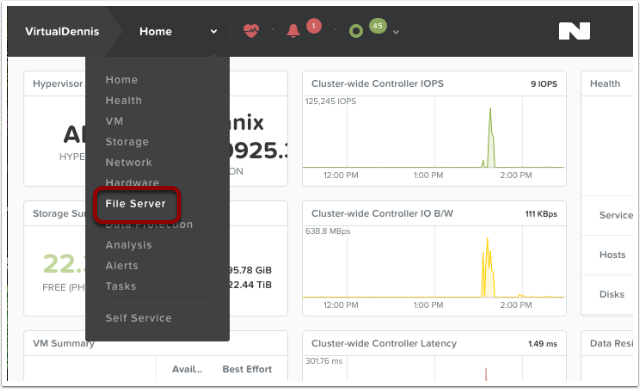

Now we can start the configuration of File Services by selecting the main menu in Prism, then choose “File Server” from the dropdown.

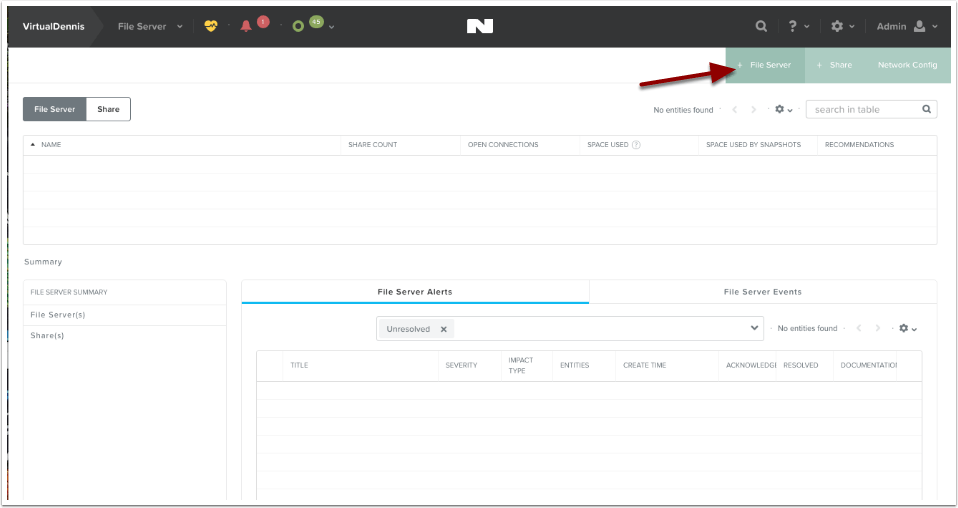

To begin creating a new file server, click on the button labeled “+ File Server” in the upper right-hand side of the screen.

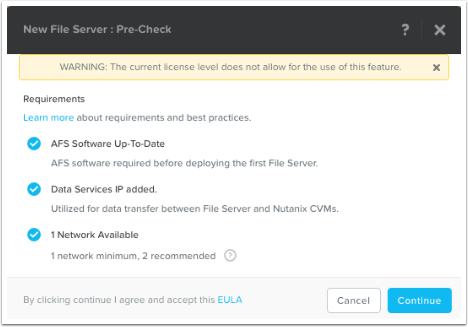

File Services Pre-Check

The system will now show you a few “pre-checks” that are performed to make sure the requirements are met. If any of these items do not have a blue check-mark next to them, go ahead and resolve the item then try it again. To continue, click on the “Continue” button.

Note: The error “WARNING: The current license level does not allow for the use of this feature.” is only a Warning. You can still proceed to use the feature (and test it out), however please contact your Nutanix Account team to resolve.

File Server Basics

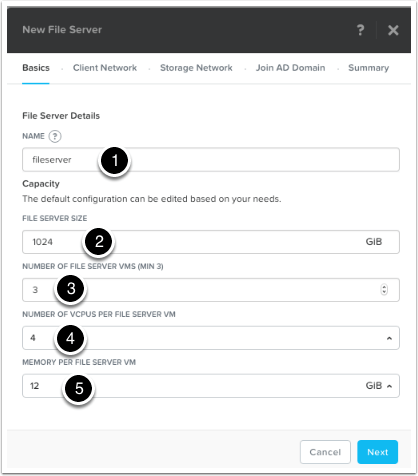

Next, fill in the File Server details:

(1) Name: This is the name of the File Server that will be used when browsing to the file share.

(2) File Server Size: This is the amount of storage reserved for File Services (from the Nutanix Storage Pool). Currently, a minimum of 1 TB is required.

(3) Number of File Servers VMs: This is the number of file servers that will be deployed in the cluster. A minimum of 3 VM’s is needed to make a distributed file server. Additional VM’s can be added later through the “Scale Up” wizard.

(4) Number of vCPUs per File Server VM: This is the amount of vCPU’s assigned to each File Server VM.*

(5) Memory Per File Server VM: This is the amount of RAM assigned to each File Server VM.*

* For sizing the amount of vCPU’s and RAM assigned to each File Server VM, refer to this section of the Acropolis File Services Guide: https://portal.nutanix.com/#/page/docs/details?targetId=Acropolis-File-Services-Guide-v20:acr-file-server-system-limits-r.html

Press “Next” to proceed.

Client Network Configuration

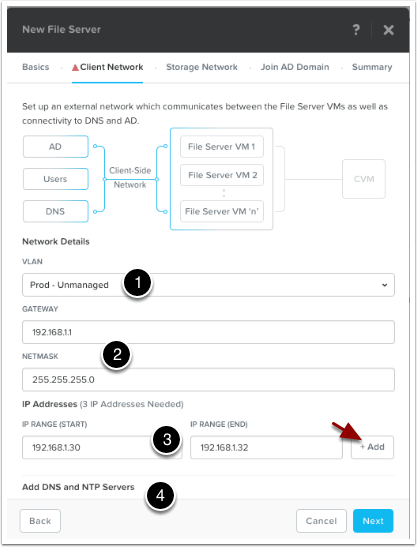

The Client Network screen will be shown outlining how the File Server VM’s will communicate out onto the network, to DNS, AD and to the end users.

(1) Pick the VLAN that you want this traffic on from the dropdown under Network Details, “VLAN“. In my example below, I only have 1 network which is pretty flat. If yours is like this, just choose your standard VLAN.

(2) Type in the network Gateway and Subnet Mask for the network you chose.

(3) Allocate a range of at least 3 IP Addresses, which will be used for the File Server VM’s client-side traffic. Once you fill in the range, click on the “+Add” button.

(4) The DNS and NTP settings should auto-populate (pulled from the cluster), but scroll down and verify the settings (Note: the NTP server should be the domain controller!)

Once completed, click on the “Next” button to continue.

Storage Network Configuration

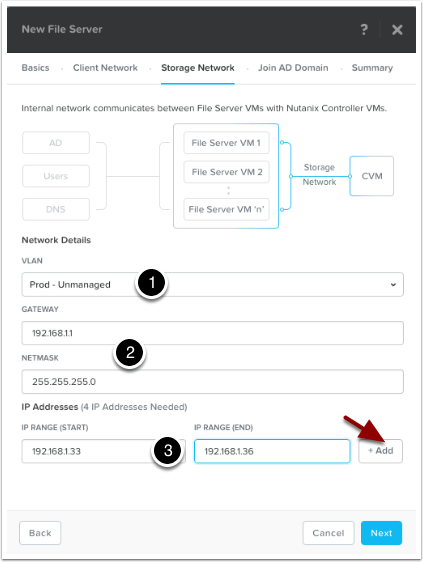

The Storage Network screen will be shown outlining how the File Server VM’s will communicate with the Nutanix Controller VM’s.

(1) Pick the VLAN that you want this traffic on from the dropdown under Network Details, “VLAN“. In my example below, I only have 1 network which is pretty flat. If yours is like this, just choose your standard VLAN.

(2) Type in the network Gateway and Subnet Mask for the network you chose.

(3) Allocate a range of at least 4 IP Addresses, which will be used for the File Server VM’s storage traffic. Once you fill in the range, click on the “+Add” button.

Once finished, click on the “Next” button to continue.

Joining Active Directory

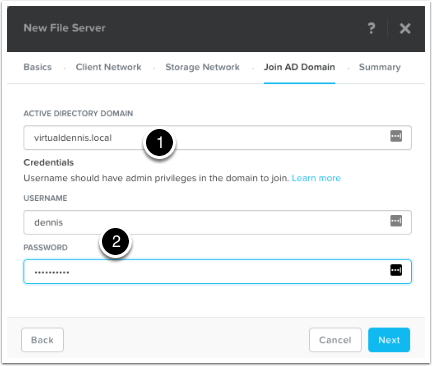

To join the file services to your active directory domain, type in your active directory domain name (1).

Type in a username and password for a user that will have admin level privileges to join the domain (2).

Once completed, click on the “Next” button to continue.

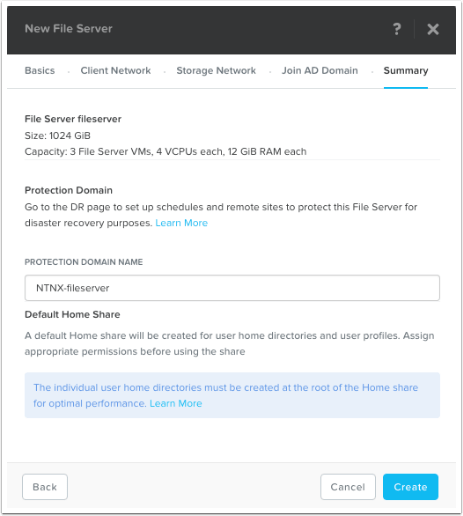

Summary and Protection Domain Setup

On the Summary screen, the wizard will show you how the file services will be configured. It will also ask you what you want to call the Protection Domain that will be created automatically. As noted, don’t forget to edit the Protection Domain (under the Menu –> Data Protection screen) to setup schedules and potential replication. For more information on setting up the Protection Domain, refer to the Acropolis File Services Guide located here: https://portal.nutanix.com/#/page/docs/details?targetId=Acropolis-File-Services-Guide-v20:acr-file-server-async-dr-c.html

As noted near the bottom of the screen, create user directories in the root of the home share for optimal performance. AFS creates a default home share for user home directory and user profiles. Individual user home directories must be created at the root of the Home share for optimal performance.

Click on the “Create” button to start the File Services deployment.

Monitoring File Services Deployment

You can monitor the File Services Deployment from the “Tasks” menu icon at the top of the screen.

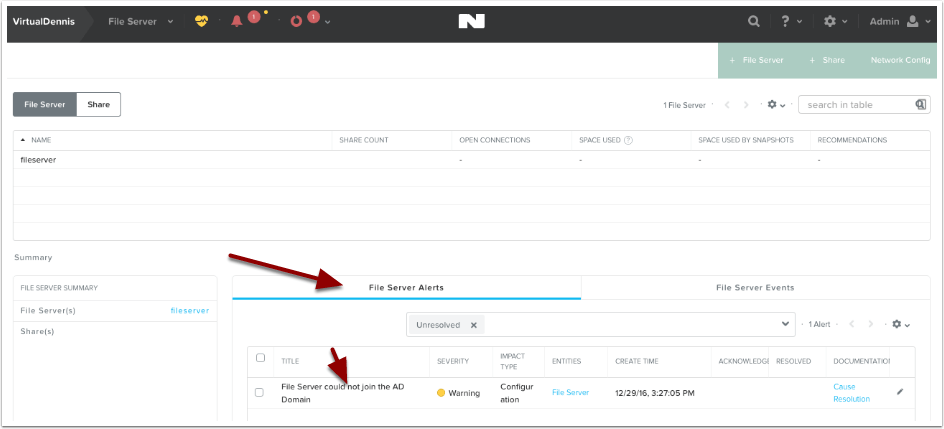

Monitor for any Errors in Deployment

Prism will show you any errors that might show up during the deployment. In my example below, you’ll see that it couldn’t join the Active Directory Domain for some reason.

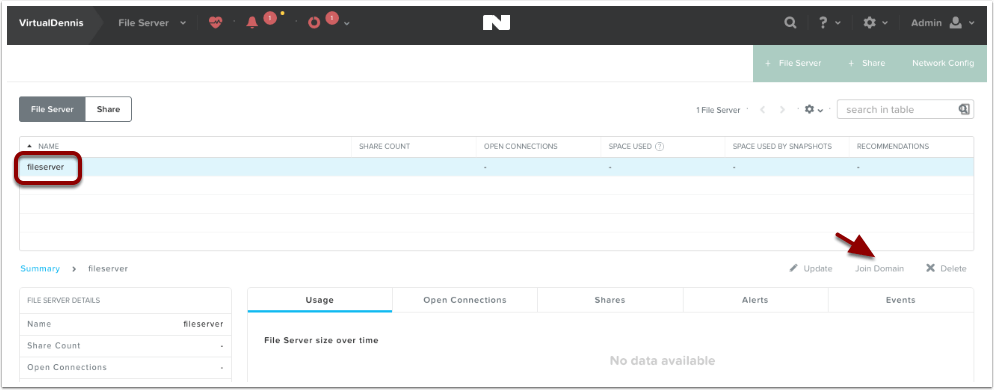

In my example, the file server couldn’t join the Active Directory domain and I needed to try again. By selecting the File Server in the list, an option will appear to “Join Domain”. I was able to try again and this time it worked. Note: Your domain needs to be at the functional level of Windows Server 2008 R2 or higher.

Successful Deployment

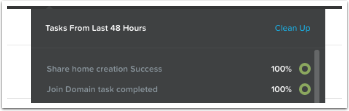

Once the deployment and join to the domain is completed, the tasks icon will show joining the domain completed successfully and a default “home” share was created.

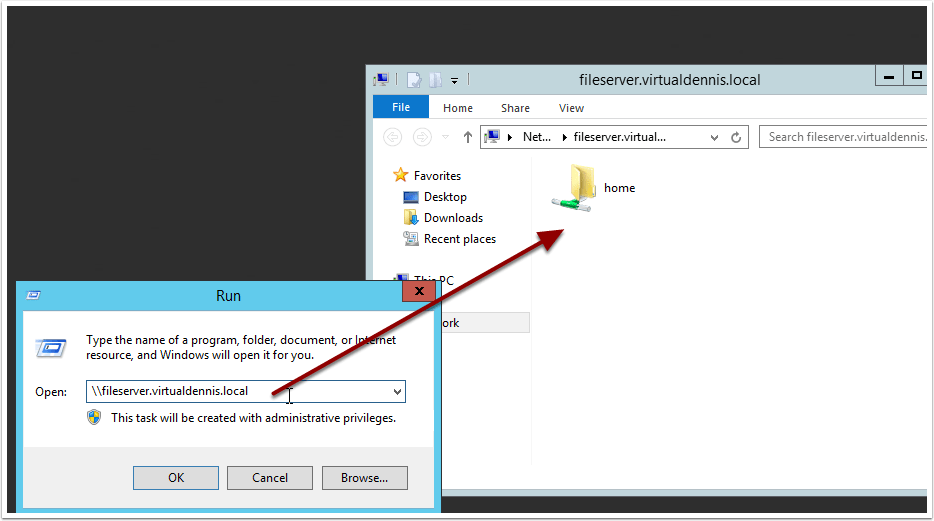

Once successfully deployed, you can now browse to the file server using the \\file-server-name path syntax, which you’ll see the default “home” share that has been created.

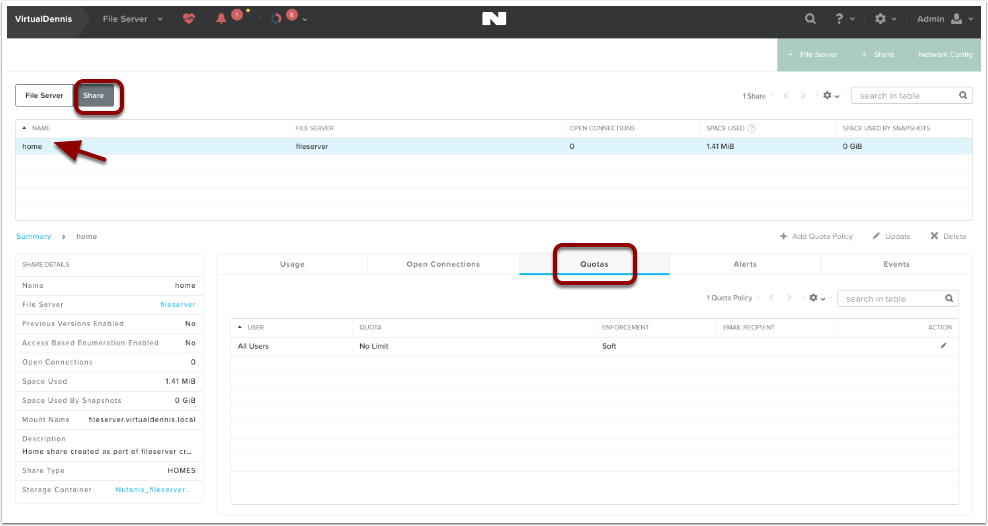

Quota Management

By default, all users accessing the “home” share do not have any quotas in place. If you would like to change this, select the “home” share from the “Share” submenu, and click on the “Quotas” tab. Here you can edit the existing default quota or add additional quota policies.

Enabling Windows Previous Versions

A Windows Previous version allows you to create and view manual or automatic snapshots of share (or volumes) when the share is in use. The share snapshots are read-only and point-in-time (snapshots taken at a certain time) copies. You can view or restore removed or overwritten files. This allows you to choose a share snapshot from the same file at different times during the file’s history. Snapshots can be scheduled for regular or frequent intervals to provide same-day protection against accidental deletions. WPV can be enabled for each object in a share.

WPV is disabled by default. You can enable WPV during or after share creation. Share updates are supported for both general-purpose and home shares.

To enable or disable Windows Previous Versions after share creation, do the following.

- In the Prism web console, go to Home > File Server.

- Click the Share tab in the view selector.

- Select a share and click Update in the action links.

- Select Enable Windows Previous Version (WPV) to check (enable) or clear (disable) the box.

- Click Save. Be sure the WPV box is checked to enable.

Microsoft to invest $1BN in Malaysian data centres

Microsoft is set to invest $1bn in Malaysia to set up data centres in the country over the next five years, reported Reuters on Monday.

According to a statement from the Malaysian Prime Minister, the technology giant will make the investment through a partnership programme with government agencies and local companies.

In February, the government had granted special permission to Microsoft, Google, Amazon and Telekom Malaysia to build data centres and provide cloud services.

Investments from those cloud service providers were expected to total between $2.91bn-$3.64bn over the next five years.

As part of the Bersama Malaysia initiative, Microsoft would establish its first “datacentre region”, consisting of multiple data centres in Malaysia to manage data from several countries, Prime Minister Muhyiddin Yassin said at an event marking the launch of the programme.

“The upcoming datacenter region will be a game-changer for Malaysia,” Microsoft Executive Vice President Jean-Philippe Courtois said in a statement, adding that it would enable the government and businesses to “transform” their operations.

Included in the programme was assistance from Microsoft to help up to a million Malaysians sharpen their digital skills by the end of 2023.

ETH price reaches new all-time high

BlackRock Has Begun Trading Bitcoin Futures

Investments giant BlackRock has indeed “started to dabble” in the bitcoin market, according to regulatory filings published Wednesday.

A source familiar with the matter told CoinDesk the asset manager held $6.5 million in CME bitcoin futures contracts earlier this year. Those contracts had appreciated $360,457 on reporting day, according to documents reviewed by CoinDesk.

The holdings represented 0.03% of BlackRock’s massive Global Allocation Fund on reporting day Jan. 31 – “very small,” the source said. (The gains represent just 0.0014%.) BlackRock’s original 37 contracts expired on March 26.

Samsung Cloud is closing down – so migrate your photos and files now

Samsung Cloud will no longer support Gallery Sync, Samsung Cloud Drive or Premium Storage

Samsung Cloud is a cloud storage service that allows owners of Samsung devices to create copies of their data or free up local storage space for apps, music and other files.

However, Samsung is about to begin the process of cutting back this service, withdrawing the ability to store photos and files off-device. Soon, Samsung Cloud will only allow users to store lightweight items, such as contacts, calendars and notes.

According to a notice on the website, the automatic photo and file sync features will be supported by Microsoft OneDrive instead, but only if users take the necessary action before the deadline.

Check out our list of the best micro SD cards on the market

Here’s our rundown of the best USB flash drives out there

We’ve built a list of the best rugged hard drives around.

Samsung Cloud will no longer support Gallery Sync, Samsung Cloud Drive or Premium Storage

Samsung Cloud is a cloud storage service that allows owners of Samsung devices to create copies of their data or free up local storage space for apps, music and other files.

However, Samsung is about to begin the process of cutting back this service, withdrawing the ability to store photos and files off-device. Soon, Samsung Cloud will only allow users to store lightweight items, such as contacts, calendars and notes.

According to a notice on the website, the automatic photo and file sync features will be supported by Microsoft OneDrive instead, but only if users take the necessary action before the deadline.

Check out our list of the best micro SD cards on the market

Here’s our rundown of the best USB flash drives out there

We’ve built a list of the best rugged hard drives around

Samsung Cloud deadlines

The pace of the Samsung Cloud shutdown will depend on the region in which you are located. The deadlines for Group 1, which consists of the UK, US, Australia and many European countries, differ from the deadlines for Group 2, which covers much of Asia, Africa and the Middle East.

Members of Group 1 will need to migrate their Samsung Cloud data to OneDrive by the end of tomorrow, March 31. Affected smartphone owners should receive a notification that prompts them to activate the migration process, which is made easy thanks to a OneDrive integration.

If this deadline is missed, Group 1 users will have until June 30 to download their Samsung Cloud data to their device or a computer. On July 1, all photos and files held in Samsung Cloud will be deleted outright and will no longer be recoverable.

Group 2 has been given a little more time to make the necessary arrangements. These users have until May 31 to migrate their data to OneDrive and until August 31 to perform a manual download. On September 1, Samsung Cloud will no longer store the photos or files of any user, in any territory.

Anyone that holds a Premium Storage subscription can expect their plan to be cancelled on either April 1 (Group 1) or June 1 (Group 2) and may receive a refund.

OneDrive storage capacity

Although free Microsoft OneDrive accounts are usually allocated only 5GB of storage, anyone migrating from Samsung Cloud will be given 15GB of storage free of charge, the same capacity as the free Samsung account.

However, the expanded OneDrive storage offer will expire after one year. After that, users will either have to pay to increase their OneDrive storage capacity or transfer their data to an external hard drive, portable SSD or another cloud backup service.

Working from home is the future, yet VMware just extended vSphere 6.5 support for a year because remote upgrades are too hard

VMware has extended support for vSphere 6.5 and vCenter 6.5 by a year, and says it needs to do so because customers are struggling to upgrade while their teams work from home/live in their offices.

News of the extension emerged in a Friday post by Paul Turner, veep for product management at VMware’s Cloud Platform Business Unit.

“This month marks a full year that many businesses transitioned to a work from home model with the onset of the global pandemic,” Turner wrote. “That’s created challenges for some of our customers with regards to IT operations and strategic planning. It has also led to uncertainty as to when your business operations will return to normal.”

“We can help address some of your challenges by offering you both flexibility and continued support as we all work together to get to the other side of this pandemic.”

The change means that vSphere 6.5 will reach end of general support(EoGS) on November 15th, 2022. A year later VMware will also stop offering technical guidance.

The new end of support dates now mirror those for vSphere 6.7.

But even with an extra year, vCenter 6.5 have work to do because the client to drive it requires Adobe Flash. And Flash was put to rest in January 2021. If you can keep old Flash-enabled browsers enabled in your environment, cross your fingers, and feel free to stick with vCenter 6.5. Otherwise, VMware recommends an upgrade to vCenter 6.7 and its shiny new HTML5 client

Users of VMWare’s virtual storage array, VSAN, have also been given some extra time. Versions 6.5 and 6.6 were slated to go EoGS in November 2021. Support will now end in October 2022. End of technical guidance remains at November 2023 for both versions.

This isn’t the first time VMware has pointed out the negative effects of working from home: on in its Q3 2021 results call then-VMware-CEO Pat Gelsinger attributed slow signoff of major deals to customers who couldn’t get their teams back into the office to work on major projects.