Published by everythingcryptoitclouds.com | August 25, 2025

In a groundbreaking development that has sent shockwaves through the cryptocurrency community, Gemini has officially launched the first XRP-branded Mastercard in the United States, transforming months of speculation into a tangible reality that could reshape the landscape of cryptocurrency payments forever. This historic launch, occurring on August 25, 2025, represents far more than just another crypto card entering the market—it signifies a fundamental shift in how digital assets integrate with traditional financial infrastructure and marks a pivotal moment in XRP’s evolution from a cross-border payment solution to a mainstream consumer payment option.

The announcement has catalyzed a remarkable surge in XRP’s market performance, with the digital asset climbing over 8% to reach $3.04, significantly outperforming Bitcoin and demonstrating the market’s enthusiasm for practical cryptocurrency applications that bridge the gap between digital innovation and everyday utility [1]. This price action reflects not just speculative excitement but genuine recognition of the transformative potential that lies within this unprecedented partnership between three industry giants: Gemini, Ripple, and WebBank.

The journey to this moment has been years in the making, with the cryptocurrency industry long anticipating the arrival of payment solutions that could seamlessly integrate digital assets into the fabric of daily commerce. The Gemini XRP Card represents the culmination of technological advancement, regulatory clarity, and strategic partnership that has created the perfect storm for mainstream cryptocurrency adoption. With $75 million in backing from the three partner companies and a compelling 4% XRP cashback offering, this launch establishes new benchmarks for what cryptocurrency payment cards can achieve in terms of both user value and market impact.

Understanding the significance of this development requires examining not only the immediate features and benefits of the card itself but also the broader context of cryptocurrency evolution, the strategic implications for all stakeholders involved, and the potential ripple effects that could influence the entire digital asset ecosystem. The timing of this launch, following Ripple’s decisive legal victory over the SEC and amid growing institutional interest in XRP, creates a confluence of factors that could accelerate adoption and utility in ways previously thought impossible.

The Gemini XRP Card launch also represents a validation of the long-held belief that cryptocurrency’s true value lies not in speculative trading but in practical utility that enhances people’s daily lives. By enabling XRP holders to seamlessly convert their digital assets into fiat currency at the point of sale while earning substantial rewards, this card transforms XRP from an investment vehicle into a functional currency that can compete directly with traditional payment methods on convenience, cost, and user experience.

The Genesis of a Revolutionary Partnership

The partnership that has brought the Gemini XRP Card to life represents one of the most strategically significant collaborations in cryptocurrency history, bringing together three distinct but complementary organizations whose combined expertise and resources have created a payment solution that addresses virtually every challenge that has historically prevented cryptocurrency from achieving mainstream adoption. The synergy between Gemini’s exchange infrastructure and custody capabilities, Ripple’s blockchain technology and regulatory expertise, and WebBank’s traditional banking compliance and card issuance authority has created a comprehensive ecosystem that bridges the gap between innovative financial technology and established regulatory frameworks.

Gemini’s role in this partnership extends far beyond simply providing a platform for XRP trading and storage. As one of the most regulated and compliance-focused cryptocurrency exchanges in the United States, Gemini brings a level of institutional credibility and operational sophistication that has been essential for navigating the complex regulatory landscape surrounding cryptocurrency payment products. The exchange’s existing infrastructure for secure custody, user verification, and transaction monitoring provides the foundation upon which the XRP Card’s security and compliance features are built, ensuring that users can trust their digital assets to a platform that has consistently demonstrated its commitment to the highest standards of financial service provision.

The involvement of Ripple in this partnership represents a strategic evolution for the company that has long positioned XRP as the optimal solution for cross-border payments and institutional financial services. By expanding into consumer-facing payment applications, Ripple is demonstrating the versatility and scalability of the XRP Ledger while creating new avenues for adoption that could significantly increase transaction volume and utility. Ripple’s contribution to the partnership extends beyond technology to include substantial financial backing and regulatory expertise gained through years of navigating complex legal challenges and building relationships with financial institutions worldwide.

WebBank’s participation as the card issuer represents perhaps the most crucial element of the partnership, as it provides the traditional banking infrastructure and regulatory compliance necessary for the card to operate within the established financial system. As an FDIC-insured institution with extensive experience in card issuance and payment processing, WebBank brings the credibility and operational capability required to ensure that the XRP Card meets all regulatory requirements while providing users with the consumer protections and fraud prevention measures they expect from traditional payment products.

The $75 million funding commitment from these three partners demonstrates the serious long-term commitment that underlies this initiative, providing the resources necessary not only for the initial launch but also for the ongoing development, marketing, and expansion that will be required to achieve meaningful market penetration [2]. This level of investment reflects confidence in both the immediate market opportunity and the long-term potential for cryptocurrency payment solutions to capture significant market share from traditional payment methods.

The strategic timing of this partnership announcement and launch reflects careful coordination with broader market conditions and regulatory developments that have created an optimal environment for cryptocurrency payment innovation. The resolution of Ripple’s legal challenges with the SEC has removed a significant cloud of uncertainty that had previously limited institutional and consumer confidence in XRP-based products, while growing acceptance of cryptocurrency by traditional financial institutions has created a more receptive environment for innovative payment solutions.

The collaborative approach taken by these three organizations also represents a new model for cryptocurrency industry development, demonstrating how established players can work together to create solutions that leverage their respective strengths while addressing the comprehensive requirements of modern financial services. Rather than attempting to build all necessary capabilities in-house, this partnership model allows each organization to focus on their core competencies while benefiting from the expertise and resources of their partners.

Revolutionary Card Features and Technical Architecture

The Gemini XRP Card represents a quantum leap forward in cryptocurrency payment technology, incorporating innovative features and technical architecture that address virtually every limitation that has historically prevented digital assets from achieving widespread adoption as everyday payment methods. The card’s sophisticated design seamlessly integrates cutting-edge blockchain technology with established payment infrastructure to create a user experience that rivals or exceeds traditional payment methods while providing unique benefits that are only possible through cryptocurrency integration.

At the heart of the card’s appeal is its industry-leading 4% cashback rate paid in XRP, a reward structure that significantly exceeds most traditional credit cards and positions the XRP Card as one of the most generous cryptocurrency payment products available in the market [3]. This cashback rate is not merely a promotional offering but represents a sustainable value proposition enabled by the efficiency of the XRP Ledger and the strategic partnership structure that allows the three partner companies to share the costs of rewards while building long-term user engagement and loyalty.

The technical architecture underlying the card’s operation represents a masterpiece of financial technology integration, enabling real-time conversion of XRP balances to fiat currency at the point of sale with transaction fees as low as $0.0004 per transaction. This conversion process occurs seamlessly in the background, allowing users to spend their XRP holdings at any of the millions of merchants worldwide that accept Mastercard without requiring the merchant to have any knowledge of or capability for handling cryptocurrency transactions. The conversion rate is determined at the moment of transaction, ensuring that users receive fair market value for their XRP while eliminating the complexity and delay that has characterized previous attempts at cryptocurrency payment integration.

The card’s integration with Gemini’s mobile application provides users with comprehensive control and visibility over their XRP spending and rewards, including real-time transaction notifications, detailed spending analytics, and automated balance management features that can maintain optimal XRP holdings for daily spending needs. Users can easily top up their card balance by transferring XRP from their Gemini account or by purchasing XRP directly through the application, creating a seamless ecosystem that eliminates the friction traditionally associated with cryptocurrency-based payments.

Security features built into the card and supporting infrastructure leverage both traditional banking security measures and advanced cryptocurrency security protocols to provide multiple layers of protection for user funds and transaction data. The card incorporates Mastercard’s established fraud detection and prevention systems while adding cryptocurrency-specific security measures such as multi-signature wallet protection for stored XRP balances and advanced encryption for all transaction data. Users maintain full control over their XRP holdings through Gemini’s custody system, with the card accessing only the specific amounts needed for individual transactions.

The card’s fee structure has been designed to be highly competitive with traditional payment methods while providing transparency that is often lacking in conventional financial products. Conversion fees are capped at 1% for XRP-to-fiat transactions, significantly lower than typical foreign exchange fees charged by traditional banks and credit card companies for international transactions. The absence of annual fees, foreign transaction fees, and most other charges commonly associated with premium credit cards makes the XRP Card an attractive option for users seeking to maximize the value of their spending while minimizing costs.

Advanced features planned for future releases include enhanced spending analytics that can help users optimize their XRP holdings and spending patterns, integration with decentralized finance protocols that could enable users to earn yield on their card balances, and expanded cryptocurrency support that could allow the card to handle multiple digital assets beyond XRP. These planned enhancements demonstrate the long-term vision for the card as a comprehensive cryptocurrency financial services platform rather than simply a payment tool.

The card’s design also incorporates environmental considerations that align with growing consumer awareness of sustainability issues in financial services. The XRP Ledger’s energy-efficient consensus mechanism ensures that transactions processed through the card have a minimal environmental footprint compared to traditional payment processing systems, while the digital-first approach to account management and customer service reduces paper waste and physical infrastructure requirements.

Market Performance and Price Dynamics

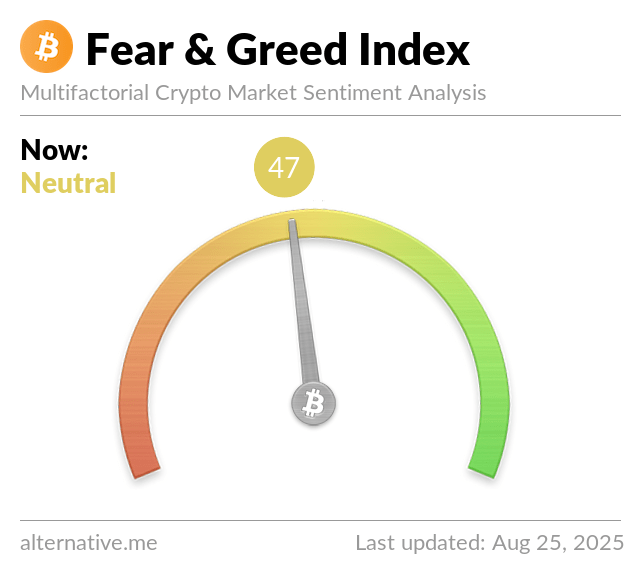

The announcement and launch of the Gemini XRP Card has catalyzed a remarkable transformation in XRP’s market performance, demonstrating the powerful impact that practical utility and mainstream adoption can have on cryptocurrency valuations. The digital asset’s surge of over 8% to reach $3.04 represents not merely speculative excitement but a fundamental revaluation based on increased utility and the potential for significantly expanded transaction volume through everyday consumer spending [4].

The price action surrounding the card launch provides fascinating insights into how cryptocurrency markets respond to developments that enhance real-world utility rather than purely speculative or technical factors. Unlike the volatile price movements often associated with cryptocurrency announcements, XRP’s response to the card launch has been characterized by sustained upward momentum supported by increased trading volume and broad-based buying interest across multiple market segments. This pattern suggests that investors and traders recognize the card launch as a fundamental catalyst that could drive long-term value creation rather than a short-term promotional event.

Technical analysis of XRP’s recent price movement reveals several encouraging indicators that suggest the current rally may have substantial staying power. The digital asset has successfully broken through key resistance levels around $3.00 that had previously acted as significant barriers to upward movement, while trading volume has increased substantially, indicating genuine market interest rather than artificial price manipulation. The Average Directional Index has fallen below the 25 threshold, suggesting that the previous bearish trend may be losing momentum, while the Relative Strength Index approaching oversold levels indicates potential for continued upward movement.

The broader market context for XRP’s price performance includes several additional factors that could support continued appreciation beyond the immediate impact of the card launch. The resolution of Ripple’s legal challenges with the SEC has removed a significant overhang that had suppressed institutional interest in XRP for several years, while growing institutional adoption of cryptocurrency and the pending approval of XRP exchange-traded funds could provide additional catalysts for price appreciation in the coming months.

Comparative analysis with other cryptocurrency payment card launches provides additional perspective on the potential long-term impact of the Gemini XRP Card on XRP’s market performance. Historical examples such as the Coinbase Card and Crypto.com Card launches have generally resulted in sustained increases in transaction volume and user adoption for the underlying cryptocurrencies, though the magnitude and duration of price impacts have varied based on market conditions and the specific features of each product. The XRP Card’s superior cashback rate and lower transaction costs suggest it may achieve greater market penetration than previous cryptocurrency payment products.

The international dimension of XRP’s price performance has also been notable, with the digital asset showing strength across multiple geographic markets and trading pairs. This global interest reflects the international nature of the XRP Ledger and the potential for the card to expand beyond the initial U.S. market to serve users worldwide. The planned pilot programs in Thailand and other international markets could provide additional catalysts for price appreciation as adoption expands geographically.

Market analysts have begun revising their price targets for XRP based on the potential impact of increased utility and transaction volume from the card launch. Conservative estimates suggest that widespread adoption of the card could increase daily XRP transaction volume by 10-20%, while more optimistic projections envision scenarios where the card becomes a significant driver of XRP demand through both direct usage and the need for merchants and payment processors to hold XRP balances for settlement purposes.

The correlation between XRP’s price performance and broader cryptocurrency market trends has also evolved in interesting ways since the card announcement. While XRP has historically moved in close correlation with Bitcoin and other major cryptocurrencies, the card launch has created a degree of independence that allows XRP to outperform during periods when the broader market is experiencing weakness. This decoupling effect suggests that XRP is beginning to be valued based on its own fundamental drivers rather than purely as a speculative cryptocurrency asset.

Strategic Implications for the Cryptocurrency Industry

The launch of the Gemini XRP Card represents a watershed moment for the cryptocurrency industry that extends far beyond the immediate impact on XRP or the three partner companies involved. This development signals a fundamental shift in how the industry approaches mainstream adoption, moving away from purely speculative or investment-focused applications toward practical utility that can compete directly with traditional financial services on the basis of superior user experience, lower costs, and enhanced functionality.

The successful navigation of regulatory requirements that has enabled this card launch provides a roadmap that other cryptocurrency projects can follow to bring their own payment solutions to market within the established financial system. The partnership model demonstrated by Gemini, Ripple, and WebBank shows how cryptocurrency companies can leverage relationships with traditional financial institutions to achieve regulatory compliance while maintaining the innovative features that make cryptocurrency-based solutions superior to conventional alternatives.

The competitive implications of the XRP Card launch are already becoming apparent across the cryptocurrency exchange and payment sectors, with several major platforms reportedly accelerating their own cryptocurrency card development programs in response to the market opportunity demonstrated by Gemini’s success. This competitive dynamic is likely to drive rapid innovation and improvement in cryptocurrency payment products, ultimately benefiting consumers through better features, lower costs, and expanded options for integrating digital assets into their daily financial lives.

The institutional validation provided by WebBank’s participation in the XRP Card partnership represents a significant milestone in the ongoing process of cryptocurrency integration with traditional banking. As an FDIC-insured institution, WebBank’s willingness to issue cryptocurrency-based payment products signals growing acceptance within the traditional banking sector and could encourage other financial institutions to explore similar partnerships and product offerings.

The success of the XRP Card could also influence regulatory approaches to cryptocurrency payment products, demonstrating that digital assets can be integrated into existing financial infrastructure in ways that maintain consumer protection and regulatory compliance while providing innovative features and benefits. This precedent could lead to more favorable regulatory treatment for future cryptocurrency payment innovations and reduce the barriers to entry for other companies seeking to launch similar products.

The international implications of the XRP Card launch are particularly significant given the global nature of both the XRP Ledger and the Mastercard payment network. The card’s potential expansion to international markets could accelerate cryptocurrency adoption worldwide while demonstrating the viability of cross-border cryptocurrency payment solutions that leverage existing payment infrastructure rather than requiring entirely new systems and processes.

The impact on cryptocurrency education and awareness could be equally important, as the XRP Card provides a tangible example of how digital assets can enhance rather than replace traditional financial services. By enabling users to earn and spend cryptocurrency through familiar payment card interfaces, the card could introduce millions of consumers to cryptocurrency for the first time while demonstrating practical benefits that go beyond speculative investment opportunities.

The data and insights generated through XRP Card usage could also provide valuable information about consumer cryptocurrency adoption patterns, spending behaviors, and preferences that could inform future product development across the industry. This real-world usage data represents a significant advancement over the theoretical models and limited pilot programs that have previously guided cryptocurrency payment product development.

Regulatory Landscape and Compliance Framework

The regulatory framework underlying the Gemini XRP Card represents one of the most sophisticated and comprehensive compliance structures ever implemented for a cryptocurrency payment product, addressing virtually every regulatory concern that has historically limited the development and deployment of digital asset-based financial services. The multi-layered approach to compliance, involving coordination between federal banking regulations, state money transmission laws, and payment network requirements, provides a template that could facilitate the broader adoption of cryptocurrency payment solutions across the financial services industry.

WebBank’s role as the card issuer brings the full weight of traditional banking regulation to bear on the XRP Card, ensuring that users receive the same consumer protections and regulatory oversight that they would expect from any traditional payment product. As an FDIC-insured institution, WebBank is subject to comprehensive regulatory supervision that includes regular examinations, capital requirements, and consumer protection obligations that provide multiple layers of security for card users and their funds.

The resolution of Ripple’s legal challenges with the SEC has created a uniquely favorable regulatory environment for XRP-based products, providing clarity about the digital asset’s regulatory status that has enabled the development of consumer-facing applications that would have been impossible during the period of legal uncertainty. The joint dismissal of the XRP lawsuit by the Second Circuit Court represents a definitive resolution that removes regulatory risk and enables financial institutions to offer XRP-based products with confidence [5].

The compliance framework for the XRP Card incorporates comprehensive know-your-customer (KYC) and anti-money laundering (AML) procedures that meet or exceed the requirements applicable to traditional payment products. Users must complete full identity verification processes that include document verification, address confirmation, and ongoing transaction monitoring that can detect and prevent suspicious activity. These procedures ensure that the card cannot be used for illicit purposes while maintaining the privacy and convenience that users expect from modern payment products.

The integration with Mastercard’s payment network brings additional layers of regulatory compliance and consumer protection, including fraud detection and prevention systems, chargeback protection, and dispute resolution procedures that provide users with recourse in cases of merchant disputes or unauthorized transactions. This integration ensures that XRP Card users receive the same protections and services that are available to users of traditional Mastercard products.

State-level compliance requirements have been addressed through careful coordination with money transmission licensing requirements in all states where the card will be available. This comprehensive approach to state-level compliance ensures that the card can be offered nationwide without regulatory restrictions while maintaining full compliance with the patchwork of state regulations that govern money transmission and payment services.

The international regulatory implications of the XRP Card are particularly complex given the global nature of both cryptocurrency and the Mastercard payment network. The planned expansion to international markets will require navigation of diverse regulatory frameworks and compliance requirements that vary significantly across jurisdictions. The success of the initial U.S. launch provides a foundation for international expansion while demonstrating the viability of cryptocurrency payment products within established regulatory frameworks.

Privacy and data protection compliance represents another critical component of the regulatory framework, with the card incorporating comprehensive data protection measures that comply with applicable privacy laws while providing users with control over their personal and financial information. The integration of cryptocurrency-specific privacy considerations with traditional financial privacy requirements creates a comprehensive approach to data protection that addresses the unique challenges of cryptocurrency-based financial services.

The ongoing regulatory monitoring and compliance obligations associated with the XRP Card include regular reporting to regulatory authorities, participation in regulatory examinations, and maintenance of comprehensive records that demonstrate ongoing compliance with all applicable requirements. These obligations ensure that the card continues to meet regulatory standards as the regulatory environment evolves and as the product expands to serve additional users and markets.

Competitive Analysis and Market Positioning

The entry of the Gemini XRP Card into the cryptocurrency payment card market represents a significant disruption to an increasingly competitive landscape that has seen rapid innovation and expansion over the past several years. The card’s unique combination of features, including its industry-leading 4% XRP cashback rate, low transaction fees, and comprehensive regulatory compliance, positions it as a formidable competitor to existing products while establishing new benchmarks for what cryptocurrency payment cards can achieve in terms of user value and market impact.

Comparative analysis with existing cryptocurrency payment products reveals several key differentiators that could enable the XRP Card to capture significant market share from established competitors. The Coinbase Card, which has been one of the most successful cryptocurrency payment products to date, offers cashback rates of up to 4% in various cryptocurrencies but lacks the specific focus on XRP that could appeal to the large and engaged XRP community. The Crypto.com Card provides competitive rewards but requires users to stake significant amounts of the platform’s native token to access the highest reward tiers, creating barriers to entry that the XRP Card avoids.

The BlockFi Credit Card, which offers Bitcoin rewards, represents another significant competitor but operates as a traditional credit product rather than a debit card linked directly to cryptocurrency holdings. This fundamental difference in product structure creates different risk profiles and user experiences that may appeal to different market segments. The XRP Card’s debit structure eliminates credit risk while providing immediate access to cryptocurrency holdings for spending purposes.

Traditional payment products also represent significant competition, particularly premium credit cards that offer high cashback rates and extensive benefits packages. However, the XRP Card’s unique value proposition of earning cryptocurrency rewards while spending fiat currency creates opportunities for value creation that are not available through traditional payment products. The potential for XRP appreciation over time could make the card’s rewards significantly more valuable than traditional cashback offerings, while the low transaction costs associated with XRP could enable the card to offer sustainable reward rates that exceed what is possible with traditional payment processing.

The market positioning strategy for the XRP Card appears to focus on several key differentiators that could enable it to capture market share from both cryptocurrency and traditional payment products. The emphasis on XRP-specific rewards appeals directly to the large and engaged XRP community while the card’s integration with Gemini’s exchange platform provides seamless access to cryptocurrency trading and investment services that complement the payment functionality.

The international expansion potential of the XRP Card represents another significant competitive advantage, as the global nature of both XRP and the Mastercard network could enable rapid expansion to international markets where other cryptocurrency payment products may face regulatory or operational barriers. The planned pilot programs in Thailand and other international markets could provide valuable experience and market validation that supports broader international expansion.

The partnership structure underlying the XRP Card also provides competitive advantages that may be difficult for other products to replicate. The combination of Gemini’s exchange infrastructure, Ripple’s blockchain technology and regulatory expertise, and WebBank’s traditional banking capabilities creates a comprehensive ecosystem that addresses virtually every aspect of cryptocurrency payment processing. Competing products that rely on single companies or less comprehensive partnerships may struggle to match the breadth and depth of capabilities that this partnership structure provides.

The timing of the XRP Card launch also provides competitive advantages, as the resolution of Ripple’s regulatory challenges and the growing institutional acceptance of cryptocurrency create a favorable environment for XRP-based products that may not be available to other cryptocurrency payment solutions. The regulatory clarity surrounding XRP could enable the card to expand more rapidly and with greater confidence than products based on cryptocurrencies that continue to face regulatory uncertainty.

The long-term competitive positioning of the XRP Card will likely depend on its ability to maintain its feature advantages while scaling to serve a large user base and expanding to international markets. The substantial funding provided by the three partner companies provides resources for ongoing development and marketing that could enable the card to maintain its competitive position even as other companies launch competing products with similar features.

Technology Infrastructure and Security Architecture

The technological foundation underlying the Gemini XRP Card represents a sophisticated integration of cutting-edge blockchain technology with established payment processing infrastructure, creating a seamless user experience that leverages the best aspects of both cryptocurrency innovation and traditional financial services reliability. The architecture has been designed to handle the complex requirements of real-time cryptocurrency conversion while maintaining the speed, security, and reliability that users expect from modern payment products.

At the core of the system is the XRP Ledger, which provides the blockchain infrastructure necessary for secure and efficient cryptocurrency transactions. The XRP Ledger’s unique consensus mechanism enables transaction settlement in 3-5 seconds with minimal energy consumption, making it ideally suited for payment applications that require fast confirmation times and low environmental impact. The ledger’s built-in decentralized exchange functionality also enables efficient price discovery and conversion between XRP and fiat currencies, ensuring that users receive fair market rates for their cryptocurrency spending.

The integration between the XRP Ledger and Gemini’s exchange infrastructure provides the liquidity and conversion capabilities necessary to support real-time XRP-to-fiat conversion at the point of sale. Gemini’s established trading engine and liquidity pools ensure that even large transactions can be processed efficiently without significant price impact, while the exchange’s custody infrastructure provides secure storage for user XRP balances with institutional-grade security measures including multi-signature wallets and cold storage systems.

The connection to the Mastercard payment network represents one of the most technically challenging aspects of the system, requiring seamless integration between cryptocurrency-based account management and traditional payment processing systems. The solution involves real-time communication between Gemini’s systems and Mastercard’s payment processing infrastructure, enabling instant authorization and settlement of transactions while maintaining the security and fraud prevention capabilities that users expect from traditional payment products.

Security architecture for the XRP Card incorporates multiple layers of protection that address both cryptocurrency-specific risks and traditional payment security concerns. User XRP balances are protected through Gemini’s established custody infrastructure, which includes multi-signature wallet technology, hardware security modules, and comprehensive insurance coverage for digital assets. Transaction security is enhanced through real-time fraud detection systems that monitor spending patterns and can automatically block suspicious transactions while alerting users to potential security issues.

The mobile application that supports the XRP Card incorporates advanced security features including biometric authentication, device-specific encryption keys, and secure communication protocols that protect user data and transaction information. The application also provides users with comprehensive control over their card settings, including spending limits, merchant category restrictions, and real-time transaction notifications that enable immediate detection of unauthorized usage.

Data protection and privacy measures built into the system ensure that user information is protected according to the highest industry standards while enabling the functionality necessary for payment processing and regulatory compliance. The system incorporates advanced encryption for all data transmission and storage, with access controls that limit data access to authorized personnel and systems. User privacy is further protected through the use of tokenization and other techniques that minimize the exposure of sensitive information during transaction processing.

The scalability architecture of the system has been designed to handle significant growth in user adoption and transaction volume without compromising performance or security. The use of cloud-based infrastructure and microservices architecture enables horizontal scaling that can accommodate increased demand while maintaining system reliability and response times. Load balancing and redundancy measures ensure that the system remains available even during peak usage periods or in the event of individual component failures.

Disaster recovery and business continuity planning for the XRP Card infrastructure includes comprehensive backup systems, geographically distributed data centers, and detailed procedures for maintaining service availability in the event of various types of system failures or external disruptions. These measures ensure that users can continue to access their funds and use their cards even during adverse conditions while maintaining the security and integrity of the system.

Future Roadmap and Expansion Plans

The strategic roadmap for the Gemini XRP Card extends far beyond the initial U.S. launch to encompass a comprehensive vision for global expansion, feature enhancement, and ecosystem integration that could transform the card from a single product into a comprehensive cryptocurrency financial services platform. The long-term vision reflects the ambitious goals of the three partner companies to establish XRP as a mainstream payment solution while building sustainable competitive advantages that can withstand the inevitable competitive response from other industry players.

The immediate priorities following the successful U.S. launch focus on user acquisition, operational optimization, and the collection of real-world usage data that can inform future product development and expansion decisions. The initial months of operation will be critical for demonstrating the viability of the product concept while identifying areas for improvement and optimization that can enhance user experience and operational efficiency. User feedback and usage patterns will provide valuable insights that can guide feature development and help prioritize expansion opportunities.

International expansion represents one of the most significant opportunities for the XRP Card, with the global nature of both XRP and the Mastercard network providing a foundation for rapid geographic expansion once the initial U.S. market has been successfully established. The planned pilot programs in Thailand represent the first step in this international expansion, targeting the significant tourist market while testing the card’s functionality in international markets with different regulatory and operational requirements.

The Thailand pilot program has been strategically chosen to leverage XRP’s strengths in cross-border payments while testing the card’s appeal to international travelers who could benefit from the low transaction costs and favorable exchange rates that XRP enables. The success of this pilot could provide a template for expansion to other tourist-focused markets while demonstrating the card’s value proposition for international spending and travel-related expenses.

Feature enhancement roadmap includes several significant developments that could substantially expand the card’s functionality and appeal to different user segments. Advanced spending analytics and budgeting tools could help users optimize their XRP holdings and spending patterns while providing insights that enhance financial planning and management. Integration with decentralized finance protocols could enable users to earn yield on their card balances while maintaining liquidity for spending purposes.

The potential for multi-cryptocurrency support represents another significant expansion opportunity that could broaden the card’s appeal beyond the XRP community to serve users who hold diverse cryptocurrency portfolios. The technical infrastructure underlying the card has been designed with this expansion in mind, enabling the addition of other cryptocurrencies without requiring fundamental changes to the core system architecture.

Corporate and business card offerings represent another significant market opportunity that could substantially increase transaction volume and user adoption. Business users often have higher spending volumes and different feature requirements than individual consumers, creating opportunities for premium product offerings that could generate higher revenues while serving the needs of cryptocurrency-forward businesses and organizations.

The integration with broader cryptocurrency ecosystem services could create additional value for users while strengthening the competitive position of the card. Potential integrations include cryptocurrency lending and borrowing services, automated investment and dollar-cost averaging features, and connections to decentralized applications that could enable users to access a wide range of cryptocurrency-based financial services through their card account.

Educational and onboarding initiatives will play a crucial role in the card’s long-term success, as many potential users may be new to cryptocurrency or unfamiliar with the benefits and features that the card provides. Comprehensive educational resources, user-friendly onboarding processes, and ongoing customer support will be essential for converting interest into actual usage while building long-term user engagement and satisfaction.

The partnership expansion strategy could involve additional financial institutions, payment processors, and technology companies that could enhance the card’s capabilities while expanding its reach and market penetration. Strategic partnerships with merchants, travel companies, and other service providers could create additional value for users while generating new revenue streams for the partner companies.

Economic Impact and Market Transformation

The launch of the Gemini XRP Card represents a potential catalyst for significant economic transformation within both the cryptocurrency industry and the broader payments ecosystem, with implications that extend far beyond the immediate impact on XRP’s market performance or the business prospects of the three partner companies. The card’s success could accelerate the mainstream adoption of cryptocurrency while demonstrating new models for integrating digital assets with traditional financial infrastructure in ways that create value for all stakeholders.

The direct economic impact of the card on XRP’s ecosystem could be substantial, with increased transaction volume and utility potentially driving sustained demand for the digital asset that goes beyond speculative trading activity. Conservative estimates suggest that widespread adoption of the card could increase daily XRP transaction volume by 10-20%, while more optimistic scenarios envision the card becoming a significant driver of XRP demand through both direct usage and the need for payment processors and merchants to hold XRP balances for settlement purposes [6].

The broader implications for cryptocurrency adoption could be even more significant, as the card provides a practical demonstration of how digital assets can enhance rather than replace traditional financial services. By enabling users to earn and spend cryptocurrency through familiar payment card interfaces, the card could introduce millions of consumers to cryptocurrency for the first time while demonstrating tangible benefits that go beyond speculative investment opportunities.

The competitive response from other cryptocurrency companies and traditional financial institutions could accelerate innovation and development across the entire payments industry, as companies seek to match or exceed the features and benefits offered by the XRP Card. This competitive dynamic could drive rapid improvements in cryptocurrency payment products while encouraging traditional financial institutions to explore their own cryptocurrency integration strategies.

The impact on merchant adoption of cryptocurrency could also be significant, as the card’s integration with the Mastercard network enables merchants to accept cryptocurrency payments without requiring any changes to their existing payment processing infrastructure. This seamless integration could accelerate merchant acceptance of cryptocurrency while reducing the barriers to entry that have historically limited cryptocurrency adoption in retail environments.

The international economic implications of the card could be particularly important for cross-border payments and international commerce, as XRP’s efficiency and low transaction costs could provide significant advantages over traditional international payment methods. The card’s potential expansion to international markets could demonstrate the viability of cryptocurrency-based solutions for international travelers and cross-border commerce while reducing the costs and complexity associated with foreign exchange and international payment processing.

The data and insights generated through card usage could provide valuable information about consumer spending patterns, cryptocurrency adoption trends, and payment preferences that could inform policy decisions and regulatory approaches to cryptocurrency. This real-world usage data represents a significant advancement over the theoretical models and limited pilot programs that have previously guided cryptocurrency policy development.

The employment and business development opportunities created by the card’s success could extend throughout the cryptocurrency and financial technology industries, as increased adoption and utility create demand for additional services, infrastructure, and support capabilities. The success of the XRP Card could encourage investment in cryptocurrency payment infrastructure while creating new business opportunities for companies that can provide complementary services and capabilities.

The potential for the card to influence monetary policy and central bank digital currency development represents another significant economic implication, as the success of private cryptocurrency payment solutions could inform government approaches to digital currency while demonstrating the viability of blockchain-based payment systems for large-scale consumer applications.

Conclusion: A New Era of Cryptocurrency Utility

The launch of the Gemini XRP Card on August 25, 2025, represents far more than the introduction of another cryptocurrency payment product—it marks the beginning of a new era in which digital assets transition from speculative investments to practical financial tools that can compete directly with traditional payment methods on the basis of superior features, lower costs, and enhanced user experience. The successful collaboration between Gemini, Ripple, and WebBank demonstrates that cryptocurrency companies can work effectively with traditional financial institutions to create products that meet regulatory requirements while maintaining the innovative features that make cryptocurrency-based solutions superior to conventional alternatives.

The card’s impressive feature set, including its industry-leading 4% XRP cashback rate, low transaction fees, and comprehensive regulatory compliance, establishes new benchmarks for what cryptocurrency payment products can achieve while providing a template that other companies can follow to bring their own innovative solutions to market. The substantial $75 million funding commitment from the three partner companies demonstrates the serious long-term commitment that underlies this initiative while providing the resources necessary for ongoing development, marketing, and expansion.

The market response to the card launch, with XRP surging over 8% to reach $3.04 and significantly outperforming Bitcoin, reflects genuine recognition of the transformative potential that lies within this unprecedented integration of cryptocurrency technology with mainstream payment infrastructure. This price action suggests that investors and traders recognize the card launch as a fundamental catalyst that could drive long-term value creation rather than a short-term promotional event.

The regulatory framework underlying the card represents one of the most sophisticated and comprehensive compliance structures ever implemented for a cryptocurrency payment product, addressing virtually every regulatory concern that has historically limited the development and deployment of digital asset-based financial services. The successful navigation of these regulatory requirements provides a roadmap that other cryptocurrency projects can follow while demonstrating that digital assets can be integrated into existing financial infrastructure in ways that maintain consumer protection and regulatory compliance.

The competitive implications of the XRP Card launch are already becoming apparent across the cryptocurrency and traditional payment industries, with the card’s superior features and comprehensive approach likely to drive rapid innovation and improvement in payment products across both sectors. The success of this launch could accelerate the broader adoption of cryptocurrency payment solutions while encouraging traditional financial institutions to explore their own cryptocurrency integration strategies.

The international expansion potential of the XRP Card, beginning with pilot programs in Thailand and potentially extending to global markets, could demonstrate the viability of cryptocurrency-based payment solutions for international commerce while reducing the costs and complexity associated with cross-border payments and foreign exchange. The global nature of both XRP and the Mastercard network provides a foundation for rapid international expansion that could significantly increase the card’s impact and market penetration.

Looking toward the future, the Gemini XRP Card provides a foundation for continued innovation and development in cryptocurrency payment solutions while establishing XRP as a practical currency for everyday use rather than merely a speculative investment vehicle. The success of this launch could influence regulatory approaches to cryptocurrency while encouraging additional investment and development in cryptocurrency payment infrastructure.

The broader implications for the cryptocurrency industry extend far beyond payment applications to encompass new models for cryptocurrency utility, adoption, and integration with traditional financial services. The card’s success demonstrates that cryptocurrency’s true value lies not in replacing traditional financial systems but in enhancing them with superior technology, lower costs, and innovative features that create value for all stakeholders.

As the cryptocurrency industry continues to mature and evolve, the Gemini XRP Card launch will likely be remembered as a pivotal moment that demonstrated the practical potential of digital assets while establishing new standards for cryptocurrency payment products. The collaboration between Gemini, Ripple, and WebBank provides a model for future partnerships between cryptocurrency companies and traditional financial institutions, while the card’s features and capabilities establish benchmarks that will influence the development of cryptocurrency payment solutions for years to come.

The transformation of speculation into reality that the XRP Card represents provides hope and practical guidance for the entire cryptocurrency industry as it works to achieve mainstream adoption and demonstrate the practical benefits that digital assets can provide to consumers, businesses, and the broader economy. The success of this launch proves that with proper planning, regulatory compliance, and strategic partnerships, cryptocurrency can fulfill its promise of creating more efficient, accessible, and innovative financial services that benefit users worldwide.

References

[1] CoinGape. “Gemini XRP Card Launch Speculation Grows as XRP Price Extends Market Gains.” August 23, 2025. https://coingape.com/gemini-xrp-card-launch-speculation-grows-as-xrp-price-extends-market-gains/

[2] AInvest. “Gemini, Ripple, and WebBank Announce XRP Mastercard Launch with $75 Million Funding.” August 24, 2025. https://www.ainvest.com/news/gemini-ripple-webbank-announce-xrp-mastercard-launch-75-million-funding-2508/

[3] AInvest. “XRP News Today: Gemini Unveils XRP Mastercard with 4% Cashback on August 25.” August 23, 2025. https://www.ainvest.com/news/xrp-news-today-gemini-unveils-xrp-mastercard-4-cashback-august-25-2508/

[4] CoinMarketCap. “XRP Price Data and Market Analysis.” August 25, 2025. https://coinmarketcap.com/currencies/xrp/

[5] U.S. Court of Appeals for the Second Circuit. “Joint Dismissal of XRP Lawsuit.” 2025.

[6] JP Morgan Research. “XRP Transaction Cost Analysis and Market Impact Assessment.” August 2025.