Published by everythingcryptoitclouds.com | August 17, 2025

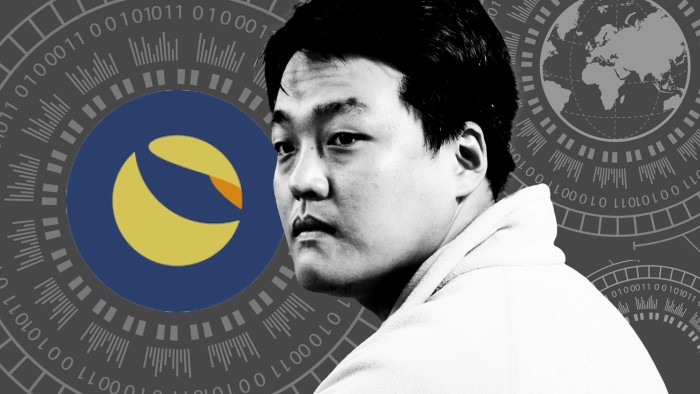

In a dramatic conclusion to one of cryptocurrency’s most devastating collapses, Do Hyeong Kwon, the 33-year-old South Korean entrepreneur behind the Terra Luna ecosystem, pleaded guilty to fraud charges in a New York federal court on August 12, 2025. The case represents not just the downfall of a once-promising blockchain project, but a watershed moment that exposes the vulnerabilities inherent in algorithmic stablecoins and the devastating consequences of deceptive practices in the rapidly evolving digital asset space.

Kwon’s guilty plea to conspiracy to defraud and wire fraud charges caps a spectacular fall from grace for the former Stanford computer science graduate who once commanded a cryptocurrency empire valued at over $50 billion. The collapse of TerraUSD (UST) and Luna in May 2022 sent shockwaves through global financial markets, wiping out an estimated $40 billion in investor value and triggering a broader cryptocurrency market downturn that continues to influence regulatory approaches worldwide [1].

The case serves as a stark reminder of the importance of transparency, regulatory compliance, and genuine innovation in the cryptocurrency sector. As the industry continues to mature and seek mainstream adoption, the lessons learned from the Terra Luna debacle will undoubtedly shape the future development of stablecoins, decentralized finance protocols, and the broader digital asset ecosystem.

The Rise and Promise of Terra Luna

To understand the magnitude of Do Kwon’s fraud, it’s essential to examine the ambitious vision that initially attracted billions of dollars in investment to the Terra ecosystem. Founded in 2018, Terraform Labs positioned itself at the forefront of the decentralized finance revolution, promising to create a new financial infrastructure that would democratize access to financial services and eliminate the need for traditional banking intermediaries [2].

The Terra blockchain distinguished itself from competing platforms through its innovative approach to stablecoin design. Unlike traditional stablecoins that maintain their dollar peg through collateral reserves of fiat currency or other assets, TerraUSD was designed as an “algorithmic stablecoin” that would maintain its $1 value through a complex mechanism involving the burning and minting of Luna tokens. This approach promised to create a truly decentralized stablecoin that wouldn’t rely on centralized entities or traditional financial infrastructure.

The elegance of the Terra Protocol, as it was marketed, lay in its supposed ability to automatically maintain price stability through market forces. When TerraUSD traded above $1, the protocol would mint new UST and burn Luna, increasing the supply of UST and reducing the supply of Luna. Conversely, when UST traded below $1, users could burn UST to mint Luna, reducing UST supply and increasing Luna supply. This mechanism was presented as a self-regulating system that would maintain the dollar peg without human intervention or centralized control.

The Terra ecosystem expanded rapidly beyond its core stablecoin functionality. The platform hosted a growing array of decentralized finance applications, including Anchor Protocol, which offered an attractive 20% annual return on UST deposits, and Mirror Protocol, which allowed users to trade synthetic versions of traditional financial assets. These applications created a comprehensive DeFi ecosystem that attracted both retail and institutional investors seeking high yields and innovative financial products.

By early 2022, the Terra ecosystem had achieved remarkable growth metrics that seemed to validate Kwon’s vision. The total value locked in Terra-based protocols exceeded $30 billion, making it one of the largest DeFi ecosystems in the cryptocurrency space. Luna had become one of the top ten cryptocurrencies by market capitalization, while UST had grown to become the third-largest stablecoin after Tether and USD Coin. The success attracted high-profile investors and partnerships, including backing from major venture capital firms and integration with leading cryptocurrency exchanges.

However, beneath this veneer of success lay a web of deception and market manipulation that would ultimately lead to the ecosystem’s catastrophic collapse. As prosecutors would later reveal, the stability and growth of the Terra ecosystem were built not on innovative technology and market forces, but on a foundation of lies, secret interventions, and fraudulent misrepresentations that misled investors about the true nature of the system they were investing in.

The Anatomy of Deception: How the Fraud Unfolded

The criminal charges against Do Kwon reveal a sophisticated scheme of deception that spanned multiple years and involved systematic misrepresentation of virtually every aspect of the Terra ecosystem. Rather than the decentralized, algorithmic system that was promised to investors, the Terra Protocol operated through a series of secret interventions and manipulative practices designed to create the illusion of stability and organic growth [2].

The most damaging revelation centers on the events of May 2021, when TerraUSD experienced its first major depeg, falling significantly below its intended $1 value. This incident represented a critical test of the algorithmic stabilization mechanism that formed the core of Terra’s value proposition. According to Kwon’s own admission in court, when faced with this crisis, he chose deception over transparency, telling investors that the Terra Protocol’s computer algorithm had successfully restored the coin’s value [1].

In reality, Kwon had secretly arranged for a high-frequency trading firm to purchase millions of dollars worth of TerraUSD tokens to artificially prop up the price and restore the peg. This intervention directly contradicted the fundamental premise of the Terra ecosystem—that it operated through decentralized, algorithmic mechanisms without human intervention or centralized control. By failing to disclose this crucial information, Kwon misled investors about the true nature of the system and its ability to maintain stability through purely algorithmic means.

The deception extended far beyond this single incident. Prosecutors detailed a comprehensive pattern of misrepresentation that touched every major component of the Terra ecosystem. The Luna Foundation Guard (LFG), which was presented to investors as an independent governing body tasked with defending UST’s peg through strategic reserve management, was actually under Kwon’s direct control. Rather than operating as the decentralized governance mechanism it was portrayed as, the LFG served as a vehicle for Kwon to manipulate markets and misappropriate hundreds of millions of dollars in assets.

The Mirror Protocol, one of Terra’s flagship DeFi applications, was similarly misrepresented to investors and users. While marketed as a decentralized platform that operated autonomously through smart contracts and community governance, Kwon maintained secret control over the protocol’s operations. He used automated trading bots to manipulate the prices of synthetic assets traded on Mirror, creating artificial market conditions that benefited the Terra ecosystem while misleading users about the true nature of the platform’s operations.

Perhaps most egregiously, Kwon made false claims about the real-world adoption and utility of the Terra blockchain. He repeatedly stated that the Terra network was processing billions of dollars in financial transactions for Chai, a popular Korean payment platform. These claims were central to Terra’s value proposition, as they suggested that the blockchain had achieved meaningful real-world adoption beyond speculative trading. In reality, Chai processed transactions through traditional financial networks, not the Terra blockchain, making these claims entirely fabricated.

The Genesis Stablecoins represented another layer of deception in Kwon’s scheme. He made false representations about the use of a supply of one billion stablecoins that were supposedly held in reserve for Terraform’s operations. Rather than serving their stated purpose, Kwon used at least $145 million worth of these tokens to fund fake blockchain transactions and manipulate trading bot activities designed to artificially inflate the prices of synthetic assets on Mirror Protocol.

These fraudulent activities created a false impression of organic growth and adoption that attracted billions of dollars in additional investment. As prosecutors noted, Kwon’s constructed financial world was built on lies and manipulative techniques designed to mislead investors, users, business partners, and government regulators about Terraform’s actual business operations and the true risks associated with the Terra ecosystem.

The Technical Illusion: Understanding Algorithmic Stablecoin Vulnerabilities

The Terra Luna collapse exposed fundamental flaws in the algorithmic stablecoin model that extend far beyond Do Kwon’s fraudulent activities. While the criminal charges focus on specific acts of deception and market manipulation, the technical failure of the Terra Protocol reveals deeper issues with the concept of purely algorithmic price stability that have important implications for the broader cryptocurrency industry.

Algorithmic stablecoins represent an ambitious attempt to solve one of the most challenging problems in cryptocurrency design: creating a digital asset that maintains a stable value without relying on centralized entities or traditional financial infrastructure. The theoretical appeal of such systems is obvious—they promise to combine the benefits of stable value with the decentralized, permissionless nature of blockchain technology. However, the Terra Luna collapse demonstrated that the practical implementation of these systems faces significant challenges that may be insurmountable.

The core vulnerability in the Terra Protocol lay in its reliance on market confidence and positive feedback loops to maintain stability. The system worked effectively when demand for UST was growing and Luna prices were rising, creating a virtuous cycle that reinforced the peg. However, this same mechanism created the potential for devastating death spirals when market conditions reversed. When large-scale selling pressure emerged in May 2022, the protocol’s response—minting massive amounts of Luna to defend the UST peg—created hyperinflationary conditions that destroyed the value of both tokens.

The technical analysis of the collapse reveals that the Terra Protocol was fundamentally vulnerable to coordinated attacks or large-scale redemptions that could overwhelm the system’s stabilization mechanisms. Unlike traditional stablecoins backed by fiat currency reserves, algorithmic stablecoins have no external source of value to fall back on during periods of extreme stress. Their stability depends entirely on market participants’ continued belief in the system’s ability to maintain the peg, creating a fragile equilibrium that can be shattered by loss of confidence.

The role of Anchor Protocol in the Terra ecosystem’s collapse cannot be understated. By offering a 20% annual return on UST deposits, Anchor created massive demand for the stablecoin that helped fuel the ecosystem’s growth. However, this yield was unsustainable and was effectively subsidized by Luna token inflation and external funding. When the subsidies became insufficient to maintain the high yields, the resulting outflows from Anchor created selling pressure on UST that the algorithmic stabilization mechanism could not handle.

The interconnected nature of the Terra ecosystem amplified these vulnerabilities. Rather than creating resilience through diversification, the tight coupling between UST, Luna, and various DeFi protocols created systemic risk that caused the entire ecosystem to collapse simultaneously. When UST lost its peg, the resulting Luna inflation destroyed the value of the collateral backing other Terra-based protocols, creating a cascade of failures that wiped out the entire ecosystem within a matter of days.

From a technical perspective, the Terra collapse highlighted the importance of robust stress testing and conservative design principles in cryptocurrency systems. The protocol’s designers had modeled various scenarios and believed they had created sufficient safeguards to maintain stability. However, they underestimated the speed and scale at which modern cryptocurrency markets can move, particularly when leveraged positions and algorithmic trading systems amplify selling pressure.

The incident also demonstrated the challenges of creating truly decentralized governance systems for complex financial protocols. While the Terra ecosystem was marketed as being governed by its community of token holders, the reality was that key decisions were made by a small group of insiders who had disproportionate influence over the system’s operations. This concentration of power made the system vulnerable to the kind of manipulation that Kwon engaged in, while also limiting the community’s ability to respond effectively to emerging threats.

The Regulatory Response: Implications for the Cryptocurrency Industry

Do Kwon’s guilty plea and the broader Terra Luna collapse have had profound implications for cryptocurrency regulation worldwide, accelerating efforts by governments and regulatory agencies to establish comprehensive frameworks for digital asset oversight. The case has become a touchstone for policymakers seeking to balance innovation with investor protection, and its lessons are being incorporated into regulatory approaches across multiple jurisdictions.

In the United States, the Securities and Exchange Commission’s successful civil enforcement action against Kwon and Terraform Labs has strengthened the agency’s position that many cryptocurrency tokens should be classified as securities subject to federal securities laws. The SEC’s $4.55 billion settlement with Terraform Labs represents one of the largest enforcement actions in the agency’s history and sends a clear message that cryptocurrency projects cannot operate outside the bounds of existing financial regulations [1].

The criminal prosecution by the Southern District of New York has demonstrated that traditional fraud statutes apply fully to cryptocurrency schemes, regardless of the technological complexity or innovative nature of the underlying systems. U.S. Attorney Jay Clayton’s characterization of Kwon’s actions as “one of the largest frauds in history” reflects the government’s commitment to treating cryptocurrency fraud with the same seriousness as traditional financial crimes [2].

The international dimensions of the case have also highlighted the importance of cross-border cooperation in cryptocurrency enforcement. Kwon’s extradition from Montenegro, where he had been detained while attempting to travel on false documents, required coordination between multiple law enforcement agencies and demonstrated that geographic boundaries provide little protection for cryptocurrency fraudsters in an increasingly connected world.

The regulatory response has extended beyond enforcement actions to include new rules and guidance designed to prevent similar incidents in the future. The collapse of Terra Luna, along with other high-profile cryptocurrency failures in 2022, has accelerated efforts to establish comprehensive stablecoin regulations that would require issuers to back their tokens with high-quality, liquid assets and submit to regular audits and oversight.

European regulators have incorporated lessons from the Terra Luna collapse into the Markets in Crypto-Assets (MiCA) regulation, which establishes comprehensive rules for cryptocurrency operations across the European Union. The regulation includes specific provisions for stablecoins that would have prevented many of the practices that led to Terra’s collapse, including requirements for full reserve backing and restrictions on the use of algorithmic stabilization mechanisms.

In Asia, where Terra Luna had significant adoption and where the collapse caused substantial losses for retail investors, regulators have taken increasingly aggressive stances toward cryptocurrency oversight. South Korea, Kwon’s home country, has implemented new rules requiring cryptocurrency exchanges to implement stronger customer protection measures and has increased penalties for cryptocurrency-related crimes.

The regulatory response has also focused on the role of cryptocurrency exchanges and other intermediaries in facilitating fraudulent schemes. Many exchanges that listed UST and Luna tokens have faced scrutiny over their due diligence processes and their responsibility to protect customers from fraudulent projects. This has led to enhanced listing standards and more rigorous ongoing monitoring of listed tokens.

The Terra Luna case has also influenced the development of central bank digital currencies (CBDCs), with many central banks citing the risks demonstrated by algorithmic stablecoins as justification for developing government-issued digital currencies. The collapse has strengthened arguments that only central banks have the credibility and resources necessary to maintain stable digital currencies at scale.

The Human Cost: Investor Losses and Market Impact

Behind the technical details and legal proceedings of the Terra Luna collapse lies a devastating human story of financial loss and shattered trust that extends far beyond the $40 billion in direct investor losses. The collapse affected millions of individuals worldwide, from sophisticated institutional investors to retail participants who had been attracted by the promise of high yields and innovative financial products.

The scale of the losses was unprecedented in cryptocurrency history. At its peak in April 2022, the combined market capitalization of UST and Luna exceeded $80 billion, making Terra one of the largest cryptocurrency ecosystems in the world. When the collapse occurred in May 2022, virtually all of this value was wiped out within a matter of days, creating losses that dwarfed previous cryptocurrency market crashes.

Retail investors bore a disproportionate share of these losses. Many had been attracted to the Terra ecosystem by Anchor Protocol’s promise of 20% annual returns on UST deposits, yields that seemed too good to be true but were marketed as sustainable through innovative DeFi mechanisms. These investors, many of whom were new to cryptocurrency and lacked the technical knowledge to understand the risks they were taking, lost their life savings when the ecosystem collapsed.

The psychological impact of the collapse extended beyond financial losses. Many investors had been drawn to cryptocurrency by the promise of financial independence and the opportunity to participate in a revolutionary new financial system. The Terra Luna collapse shattered these dreams and created lasting skepticism about the cryptocurrency industry’s claims of innovation and democratization.

The collapse also had significant impacts on institutional investors and cryptocurrency funds that had allocated substantial portions of their portfolios to Terra-based assets. Several prominent cryptocurrency hedge funds and investment firms suffered massive losses that forced them to close or significantly reduce their operations. The Three Arrows Capital hedge fund, which had been one of the largest investors in the Terra ecosystem, collapsed shortly after the Terra Luna crash, creating additional contagion effects throughout the cryptocurrency industry.

The broader cryptocurrency market experienced severe volatility in the wake of the Terra Luna collapse. The incident triggered a broader loss of confidence in algorithmic stablecoins and DeFi protocols, leading to significant outflows from other projects and contributing to a prolonged bear market that lasted through 2022 and into 2023. Bitcoin, Ethereum, and other major cryptocurrencies all experienced significant declines as investors reassessed the risks associated with digital assets.

The collapse also had real-world economic impacts in countries where Terra Luna had achieved significant adoption. In South Korea, where Kwon was a prominent figure in the local technology scene, the collapse led to protests and calls for stronger cryptocurrency regulation. Many Korean investors had been particularly exposed to Terra-based assets, and the losses contributed to broader skepticism about cryptocurrency investments in the country.

The incident highlighted the interconnected nature of modern financial markets and the potential for cryptocurrency events to have broader economic implications. While the direct losses were concentrated among cryptocurrency investors, the collapse contributed to broader market volatility and influenced monetary policy discussions as central banks grappled with the implications of digital asset adoption.

The human cost of the Terra Luna collapse serves as a sobering reminder of the real-world consequences of financial fraud and the importance of robust investor protection measures in emerging markets. The victims of Kwon’s scheme were not abstract market participants but real people whose lives were significantly impacted by his fraudulent activities.

Lessons for the Future: Building a More Resilient Cryptocurrency Ecosystem

The Terra Luna collapse and Do Kwon’s subsequent conviction offer crucial lessons for the cryptocurrency industry as it continues to evolve and seek mainstream adoption. These lessons extend beyond the specific technical and regulatory issues raised by the case to encompass broader questions about innovation, risk management, and the social responsibility of technology entrepreneurs.

The most fundamental lesson concerns the importance of transparency and honest communication in cryptocurrency projects. Kwon’s fraud was enabled by his ability to misrepresent the true nature of the Terra ecosystem to investors and users. The cryptocurrency industry’s culture of rapid innovation and bold claims about revolutionary technology can create environments where exaggeration and misrepresentation become normalized. The Terra Luna case demonstrates the devastating consequences that can result when this culture crosses the line into outright fraud.

The incident also highlights the critical importance of robust technical design and conservative risk management in cryptocurrency systems. The Terra Protocol’s vulnerability to death spirals was a known theoretical risk that the project’s developers believed they had adequately addressed through various safeguards and mechanisms. However, the collapse demonstrated that theoretical models and stress tests may be insufficient to predict the behavior of complex systems under extreme market conditions.

The role of economic incentives in cryptocurrency systems deserves particular attention. Anchor Protocol’s unsustainable 20% yields were a key driver of demand for UST, but they also created systemic risks that ultimately contributed to the ecosystem’s collapse. The incident demonstrates the importance of ensuring that yield-generating mechanisms in DeFi protocols are genuinely sustainable rather than relying on token inflation or external subsidies that may not be available during periods of stress.

The Terra Luna case also underscores the importance of genuine decentralization in cryptocurrency projects. While the Terra ecosystem was marketed as being decentralized and governed by its community, the reality was that Kwon maintained significant control over key components of the system. This concentration of power enabled his fraudulent activities while also making the system vulnerable to single points of failure. True decentralization requires not just technical distribution of control but also governance structures that prevent any individual or small group from exercising disproportionate influence.

The regulatory implications of the case suggest that the cryptocurrency industry must embrace compliance and work constructively with regulators rather than attempting to operate in legal gray areas. Kwon’s attempts to evade regulatory oversight ultimately contributed to his downfall and created additional legal risks for the entire Terra ecosystem. Projects that proactively engage with regulators and implement robust compliance programs are likely to be more successful in the long term.

The incident also demonstrates the importance of investor education and due diligence in cryptocurrency markets. Many Terra Luna investors were attracted by high yields and innovative technology without fully understanding the risks they were taking. The cryptocurrency industry has a responsibility to provide clear, accurate information about the risks associated with different types of investments and to avoid marketing practices that may mislead unsophisticated investors.

From a technical perspective, the collapse highlights the need for more conservative approaches to stablecoin design. While algorithmic stablecoins remain an active area of research and development, the Terra Luna case suggests that purely algorithmic approaches may be inherently unstable. Future stablecoin projects may need to incorporate hybrid models that combine algorithmic mechanisms with more traditional forms of collateral backing.

The case also underscores the importance of stress testing and scenario planning in cryptocurrency system design. The Terra Protocol’s developers had conducted various forms of analysis and believed their system was robust, but they failed to adequately account for the speed and scale at which modern cryptocurrency markets can move. Future projects should incorporate more comprehensive stress testing that accounts for extreme scenarios and the potential for coordinated attacks or mass redemptions.

The Path Forward: Rebuilding Trust in Digital Assets

As the cryptocurrency industry processes the lessons of the Terra Luna collapse and Do Kwon’s conviction, the focus must shift toward rebuilding trust and demonstrating that digital assets can provide genuine value to users and investors. This process will require sustained effort across multiple dimensions, from technical innovation to regulatory compliance to cultural change within the industry.

The development of more robust stablecoin designs represents one of the most important technical challenges facing the industry. While the Terra Luna collapse has cast doubt on purely algorithmic approaches, it has also accelerated research into hybrid models that combine the benefits of algorithmic mechanisms with more traditional forms of backing. These new approaches may incorporate features such as partial collateralization, dynamic reserve requirements, and circuit breakers that can halt operations during periods of extreme stress.

The regulatory landscape for cryptocurrencies will continue to evolve in response to incidents like the Terra Luna collapse. Rather than viewing regulation as an obstacle to innovation, the industry should embrace clear rules and oversight as essential components of a mature financial system. Projects that proactively engage with regulators and implement robust compliance programs will be better positioned to succeed in an increasingly regulated environment.

The role of cryptocurrency exchanges and other intermediaries in protecting investors will also continue to evolve. The Terra Luna collapse has highlighted the importance of due diligence in token listings and ongoing monitoring of listed projects. Exchanges that implement more rigorous standards and provide better investor protection are likely to gain competitive advantages as the market matures.

Investor education remains a critical component of building a more resilient cryptocurrency ecosystem. The industry must move beyond marketing hype and provide clear, accurate information about the risks and benefits of different types of digital assets. This includes developing better tools and resources to help investors understand complex technical concepts and make informed decisions about their investments.

The development of better governance mechanisms for decentralized projects represents another important area for innovation. The Terra Luna case demonstrated the risks associated with concentrated control in supposedly decentralized systems. Future projects will need to develop more robust governance structures that genuinely distribute power among stakeholders while maintaining the ability to respond effectively to emerging threats and opportunities.

The cryptocurrency industry must also grapple with questions of social responsibility and the broader impact of digital asset innovation. The Terra Luna collapse affected millions of people worldwide and contributed to broader skepticism about cryptocurrency technology. Industry participants have a responsibility to consider the potential consequences of their innovations and to prioritize the interests of users and investors over short-term profits.

The integration of traditional financial institutions into the cryptocurrency ecosystem will continue to accelerate, bringing both opportunities and challenges. These institutions bring valuable expertise in risk management and regulatory compliance, but they also introduce new forms of centralization and potential systemic risk. The industry will need to find ways to benefit from institutional participation while preserving the innovative and decentralized characteristics that make cryptocurrencies valuable.

The development of central bank digital currencies (CBDCs) will also influence the future of the cryptocurrency ecosystem. While CBDCs may compete with some cryptocurrency use cases, they may also provide important infrastructure and legitimacy that benefits the broader digital asset ecosystem. The industry will need to adapt to a world where government-issued digital currencies coexist with private cryptocurrencies.

Conclusion: A Turning Point for Cryptocurrency

Do Kwon’s guilty plea represents more than just the conclusion of a high-profile fraud case—it marks a turning point for the cryptocurrency industry as it transitions from its experimental early phase to a more mature and regulated financial sector. The $40 billion Terra Luna collapse serves as a stark reminder of the real-world consequences of financial fraud and the importance of building robust, transparent, and genuinely innovative systems.

The case has exposed fundamental vulnerabilities in algorithmic stablecoin designs and highlighted the risks associated with concentrated control in supposedly decentralized systems. It has also demonstrated the global reach of cryptocurrency fraud and the determination of law enforcement agencies to hold bad actors accountable, regardless of the technological complexity of their schemes.

As Kwon faces up to 25 years in prison for his crimes, the cryptocurrency industry must confront the difficult questions raised by the Terra Luna collapse. How can the promise of decentralized finance be realized without creating new forms of systemic risk? How can innovation be encouraged while protecting investors from fraud and manipulation? How can the industry build trust and legitimacy while preserving the characteristics that make cryptocurrencies valuable?

The answers to these questions will shape the future of digital assets and determine whether cryptocurrencies can fulfill their potential to create a more open, accessible, and efficient financial system. The Terra Luna collapse was a devastating setback for the industry, but it also provides valuable lessons that can inform better practices and more robust systems going forward.

The victims of Kwon’s fraud deserve justice, and his conviction represents an important step toward accountability. However, the ultimate measure of the industry’s response to this crisis will be whether it can learn from these mistakes and build a more resilient and trustworthy ecosystem that genuinely serves the interests of users and investors.

The cryptocurrency industry stands at a crossroads. The path forward requires embracing transparency, regulatory compliance, and genuine innovation while rejecting the kind of fraudulent practices that led to the Terra Luna collapse. Only by taking this path can the industry rebuild trust and demonstrate that digital assets can provide real value to society.

As the sentencing phase of Kwon’s case approaches in December 2025, the cryptocurrency community will be watching closely to see how justice is served and what precedents are set for future cases. The outcome will send important signals about the consequences of cryptocurrency fraud and the commitment of the legal system to protecting investors in this emerging asset class.

The Terra Luna saga is far from over, but Do Kwon’s guilty plea marks the beginning of the end of one of cryptocurrency’s darkest chapters. The industry now has the opportunity to learn from this experience and build a better future for digital assets—one based on transparency, innovation, and genuine value creation rather than deception and manipulation.

References

[1] Reuters. “Do Kwon pleads guilty to US fraud charges in $40 billion crypto collapse.” Reuters Legal, August 12, 2025. https://www.reuters.com/legal/government/do-kwon-pleads-guilty-us-fraud-charges-40-billion-crypto-collapse-2025-08-12/

[2] U.S. Department of Justice, Southern District of New York. “Do Kwon Pleads Guilty To Fraud.” Press Release, August 12, 2025. https://www.justice.gov/usao-sdny/pr/do-kwon-pleads-guilty-fraud