Author: everythingcryptoitclouds.com

Published: August 2025

Featured Image:

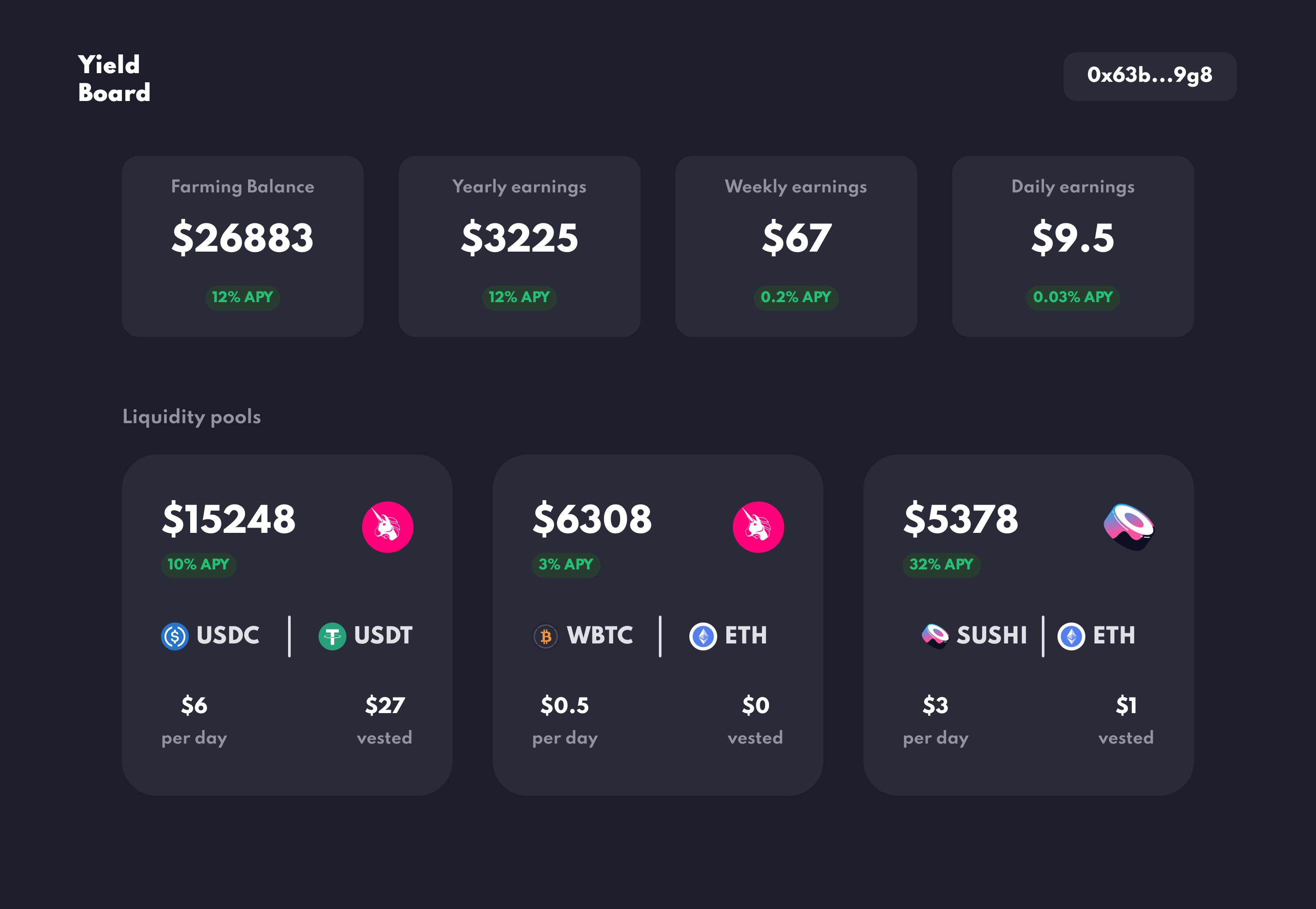

Advanced DeFi yield farming dashboard showing liquidity pools and earning opportunities

Six months ago, I embarked on a journey into the world of decentralized finance (DeFi) yield farming with a modest $5,000 investment. Today, that initial investment has grown to over $15,000, representing a remarkable 200% return in just half a year. This isn’t a story about getting lucky with a meme coin or timing the market perfectly – it’s about understanding the mechanics of DeFi yield farming and implementing a systematic approach to generating passive income through liquidity provision and strategic farming.

The world of DeFi yield farming can seem intimidating to newcomers, with its complex terminology, multiple protocols, and ever-changing landscape of opportunities. However, beneath the surface complexity lies a powerful set of tools that can generate substantial returns for those willing to learn and adapt. This comprehensive guide will walk you through my personal journey, the strategies I employed, and the lessons learned along the way.

Yield farming represents one of the most dynamic and potentially lucrative aspects of the cryptocurrency ecosystem. Unlike traditional staking, which involves simply holding tokens to earn rewards, yield farming requires active participation in DeFi protocols by providing liquidity, lending assets, or participating in governance mechanisms. The rewards can be substantial, but they come with increased complexity and risk that must be carefully managed.

Understanding DeFi Yield Farming Fundamentals

DeFi yield farming, also known as liquidity mining, is the practice of using cryptocurrency holdings to earn returns through various decentralized finance protocols. At its core, yield farming involves providing liquidity to DeFi platforms in exchange for rewards, which can come in the form of trading fees, governance tokens, or additional cryptocurrency distributions.

The concept emerged from the need to bootstrap liquidity for decentralized exchanges and lending platforms. Traditional financial markets rely on market makers and institutional liquidity providers, but DeFi protocols needed to incentivize individual users to provide this crucial service. Yield farming was the solution – offering attractive rewards to users who would lock their assets in smart contracts to facilitate trading and lending activities.

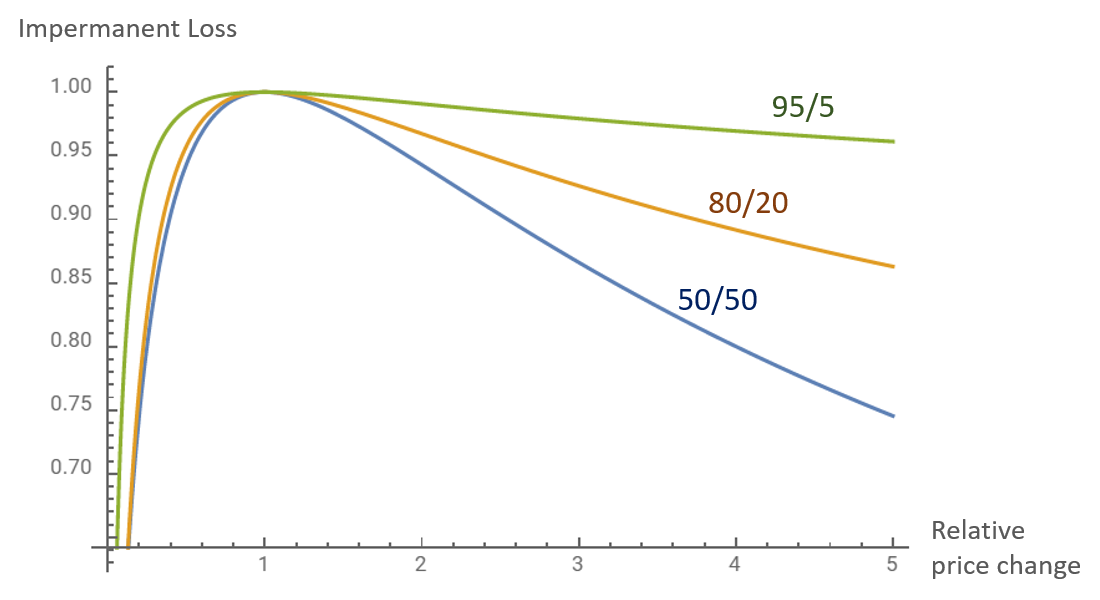

Understanding impermanent loss: how price changes affect liquidity provider returns

The mechanics of yield farming vary depending on the specific protocol and strategy employed. In its simplest form, you might provide two tokens to a liquidity pool on a decentralized exchange like Uniswap or SushiSwap. In return, you receive liquidity provider (LP) tokens representing your share of the pool. These LP tokens can then be staked in farming contracts to earn additional rewards, often in the form of the platform’s native governance token.

More complex yield farming strategies involve multiple layers of protocols and can include lending, borrowing, and leveraging positions across different platforms. For example, you might deposit USDC into a lending protocol like Compound to earn interest, then use the received cUSDC tokens as collateral to borrow other assets, which are then deployed in additional yield farming opportunities.

The rewards in yield farming come from several sources. Trading fees represent the most sustainable source of yield, as they’re generated by actual economic activity on the platform. Many decentralized exchanges distribute a portion of trading fees to liquidity providers proportional to their share of the pool. Additionally, many protocols distribute governance tokens to incentivize participation, creating additional yield opportunities.

Understanding Annual Percentage Yield (APY) calculations is crucial for evaluating yield farming opportunities. However, APY in DeFi can be misleading due to the volatile nature of reward tokens and the compounding effects of reinvesting rewards. What appears to be a 100% APY might actually result in lower returns if the reward token’s price declines significantly during the farming period.

Impermanent loss represents one of the most important concepts to understand in yield farming. When you provide liquidity to a trading pair, you’re exposed to the relative price movements between the two tokens. If one token significantly outperforms the other, you would have been better off simply holding the tokens rather than providing liquidity. This “loss” is called impermanent because it only becomes permanent when you withdraw your liquidity.

The DeFi ecosystem operates on the principle of composability, often referred to as “money legos.” This means that different protocols can be combined and stacked to create more complex strategies. Your LP tokens from one protocol can be used as collateral in another, which can then be leveraged to participate in additional farming opportunities. This composability is what makes DeFi so powerful but also increases the complexity and risk of yield farming strategies.

My Personal Journey: From $5,000 to $15,000

When I first decided to explore DeFi yield farming, I approached it with the same methodical research and risk management principles I apply to all my investments. I started by allocating $5,000 – an amount I could afford to lose completely if things went wrong. This conservative approach proved crucial as I navigated the learning curve and inevitable mistakes that come with any new investment strategy.

My initial strategy focused on established protocols with proven track records and reasonable risk profiles. I began with Compound Finance, one of the oldest and most trusted DeFi lending protocols. I deposited $2,000 worth of USDC into Compound, earning approximately 3% APY in COMP tokens plus the base lending rate. While the returns weren’t spectacular, this gave me hands-on experience with DeFi protocols and smart contract interactions.

The next step involved exploring liquidity provision on Uniswap V3. I allocated $1,500 to provide liquidity for the ETH/USDC pair, carefully selecting a price range that I believed would capture most trading activity. Uniswap V3’s concentrated liquidity feature allows liquidity providers to specify price ranges, potentially earning higher fees but requiring more active management.

Image Placement: [Portfolio tracking screenshot showing the progression from $5,000 to $15,000 over 6 months]

My breakthrough came when I discovered the potential of yield farming on layer 2 solutions, particularly Polygon (formerly Matic). The lower transaction costs on Polygon made it economically viable to implement more complex strategies and compound rewards more frequently. I bridged $1,000 worth of assets to Polygon and began farming on QuickSwap, earning QUICK tokens in addition to trading fees.

The real acceleration in my returns occurred during the third month when I began implementing more sophisticated strategies. I discovered Convex Finance, a protocol that optimizes Curve Finance yields by pooling user deposits and using the combined voting power to maximize CRV rewards. By depositing my Curve LP tokens into Convex, I was able to earn additional CVX tokens while still receiving boosted CRV rewards.

One of my most successful strategies involved farming on Olympus DAO during its early growth phase. I purchased OHM tokens and staked them in the protocol’s bonding mechanism, earning extremely high APY rates that exceeded 7,000% at times. While these rates were clearly unsustainable long-term, I was able to capitalize on the early growth phase before gradually reducing my exposure as the protocol matured.

Risk management played a crucial role throughout my journey. I never allocated more than 20% of my farming capital to any single protocol or strategy, and I maintained a portion of my portfolio in stablecoins to take advantage of new opportunities as they arose. I also set strict rules about when to take profits, typically harvesting 25% of my gains whenever a position doubled in value.

The importance of staying informed cannot be overstated in the rapidly evolving DeFi space. I spent considerable time following DeFi Twitter, joining Discord communities, and reading protocol documentation to stay ahead of new opportunities and potential risks. This research led me to early participation in several successful protocols, including early farming opportunities on Trader Joe (Avalanche) and SpookySwap (Fantom).

My portfolio allocation evolved significantly over the six-month period. What started as a conservative approach focused on established protocols gradually shifted to include more aggressive strategies on newer platforms. By month four, I was actively farming on five different blockchains (Ethereum, Polygon, Avalanche, Fantom, and Arbitrum) and participating in over a dozen different protocols.

The final two months of my journey involved optimizing my strategies based on lessons learned. I developed a systematic approach to evaluating new opportunities, focusing on factors like total value locked (TVL), team reputation, audit status, and tokenomics. This systematic approach helped me avoid several potential pitfalls while identifying genuinely promising opportunities.

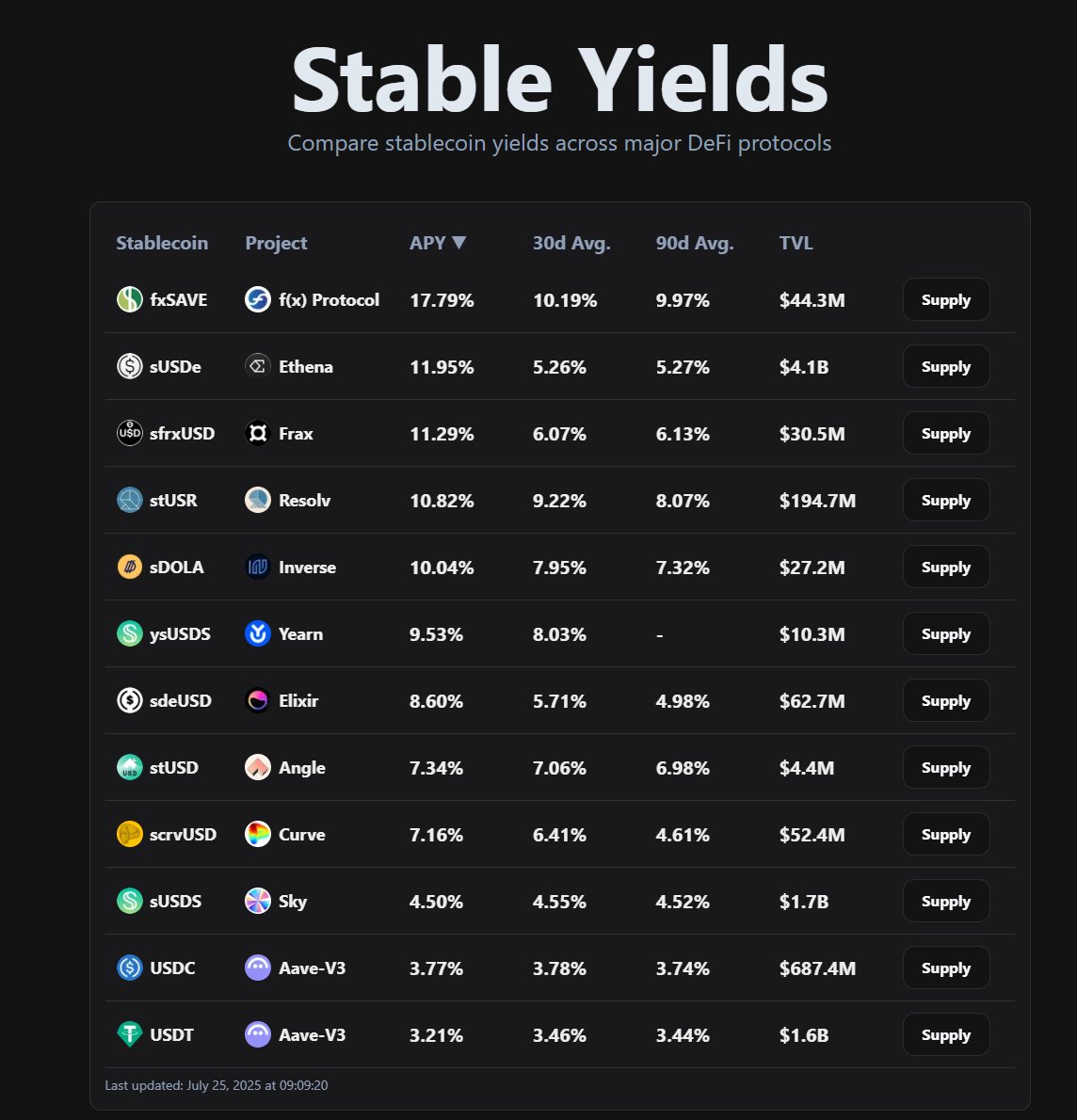

Top DeFi Protocols for Yield Farming

The DeFi ecosystem offers numerous protocols for yield farming, each with unique features, risk profiles, and reward mechanisms. Understanding the strengths and characteristics of different protocols is essential for building a diversified and profitable yield farming strategy.

Uniswap remains the gold standard for decentralized exchanges and liquidity provision. Uniswap V3’s concentrated liquidity feature allows sophisticated liquidity providers to earn higher fees by providing liquidity within specific price ranges. The protocol’s deep liquidity, strong brand recognition, and continuous innovation make it a cornerstone of most yield farming strategies. However, the high gas fees on Ethereum can make smaller positions uneconomical.

Curve Finance specializes in stablecoin and similar-asset trading, offering some of the most efficient and low-slippage trading for these pairs. Curve’s unique bonding curve algorithm and vote-escrowed tokenomics create compelling yield farming opportunities. The protocol’s CRV token can be locked for veCRV, which provides boosted rewards and governance voting power. Convex Finance has built an entire ecosystem around optimizing Curve yields, making it easier for smaller users to access boosted rewards.

Comprehensive comparison showing APY rates, TVL, and risk ratings for top DeFi protocols

Compound Finance pioneered the concept of algorithmic money markets in DeFi. Users can lend assets to earn interest or borrow against collateral, with interest rates determined by supply and demand dynamics. The protocol’s COMP token distribution created one of the first major yield farming opportunities, and it remains a reliable source of yield for conservative farmers. The protocol’s long track record and multiple security audits make it one of the safer options in DeFi.

Aave has emerged as Compound’s primary competitor, offering additional features like flash loans, credit delegation, and variable vs. stable interest rates. Aave’s multi-chain deployment across Ethereum, Polygon, Avalanche, and other networks provides opportunities to farm AAVE tokens while earning lending yields. The protocol’s Safety Module allows AAVE holders to stake their tokens to earn additional rewards while providing insurance for the protocol.

SushiSwap began as a Uniswap fork but has evolved into a comprehensive DeFi platform offering AMM trading, lending (Kashi), and yield farming (Onsen). The protocol’s SUSHI token provides governance rights and a share of platform fees through the SushiBar staking mechanism. SushiSwap’s multi-chain presence and innovative features like Miso (token launchpad) create diverse yield farming opportunities.

PancakeSwap dominates the Binance Smart Chain (BSC) ecosystem, offering high yields with lower transaction costs compared to Ethereum-based protocols. The platform’s CAKE token can be staked in Syrup Pools to earn various partner tokens, creating a diverse range of farming opportunities. While BSC has faced criticism for centralization, the lower costs make it accessible for smaller farmers.

Yearn Finance revolutionized yield farming through its automated vault strategies. Yearn’s vaults automatically compound rewards and optimize strategies across multiple protocols, making sophisticated yield farming accessible to average users. The protocol’s YFI token has become one of the most valuable governance tokens in DeFi, and the vault strategies consistently deliver competitive yields with minimal user intervention.

Olympus DAO introduced the concept of protocol-owned liquidity and (3,3) game theory to DeFi. While the protocol’s extremely high APY rates attracted significant attention, the sustainability of the model remains debated. The protocol’s bonding mechanism allows users to purchase OHM tokens at a discount in exchange for LP tokens or other assets, creating unique yield farming opportunities.

Layer 2 and alternative blockchain protocols have created new yield farming frontiers with lower costs and faster transactions. Polygon’s ecosystem includes protocols like QuickSwap, Aave, and Curve, offering similar yields to Ethereum with significantly lower transaction costs. Avalanche’s Trader Joe and Pangolin provide high yields in the rapidly growing Avalanche ecosystem.

Fantom’s ecosystem, anchored by SpookySwap and SpiritSwap, offers some of the highest yields in DeFi, though with correspondingly higher risks due to the newer ecosystem. The low transaction costs on Fantom make it ideal for active yield farming strategies that require frequent compounding and position adjustments.

When selecting protocols for yield farming, consider factors beyond just the advertised APY. Protocol security, audit history, team reputation, and tokenomics all play crucial roles in long-term success. Diversifying across multiple protocols and blockchains can help manage risks while capturing opportunities across the broader DeFi ecosystem.

Understanding and Managing Impermanent Loss

Impermanent loss represents one of the most misunderstood and potentially costly aspects of DeFi yield farming. This phenomenon occurs when the relative prices of tokens in a liquidity pool change compared to when you first deposited them. Understanding how impermanent loss works and implementing strategies to manage it is crucial for successful yield farming.

The mathematics behind impermanent loss are based on the constant product formula used by automated market makers (AMMs). When you provide liquidity to a 50/50 pool, the AMM automatically rebalances your position as prices change to maintain the constant product relationship. This rebalancing means you’ll end up with more of the token that decreased in price and less of the token that increased in price.

To illustrate impermanent loss with a concrete example, imagine you provide $1,000 worth of liquidity to an ETH/USDC pool when ETH is trading at $2,000. You would deposit 0.25 ETH and 500 USDC. If ETH’s price doubles to $4,000, the AMM rebalances your position to approximately 0.177 ETH and 707 USDC, maintaining the 50/50 value split. However, if you had simply held the original 0.25 ETH and 500 USDC, you would have $1,500 worth of assets instead of the $1,414 in the pool.

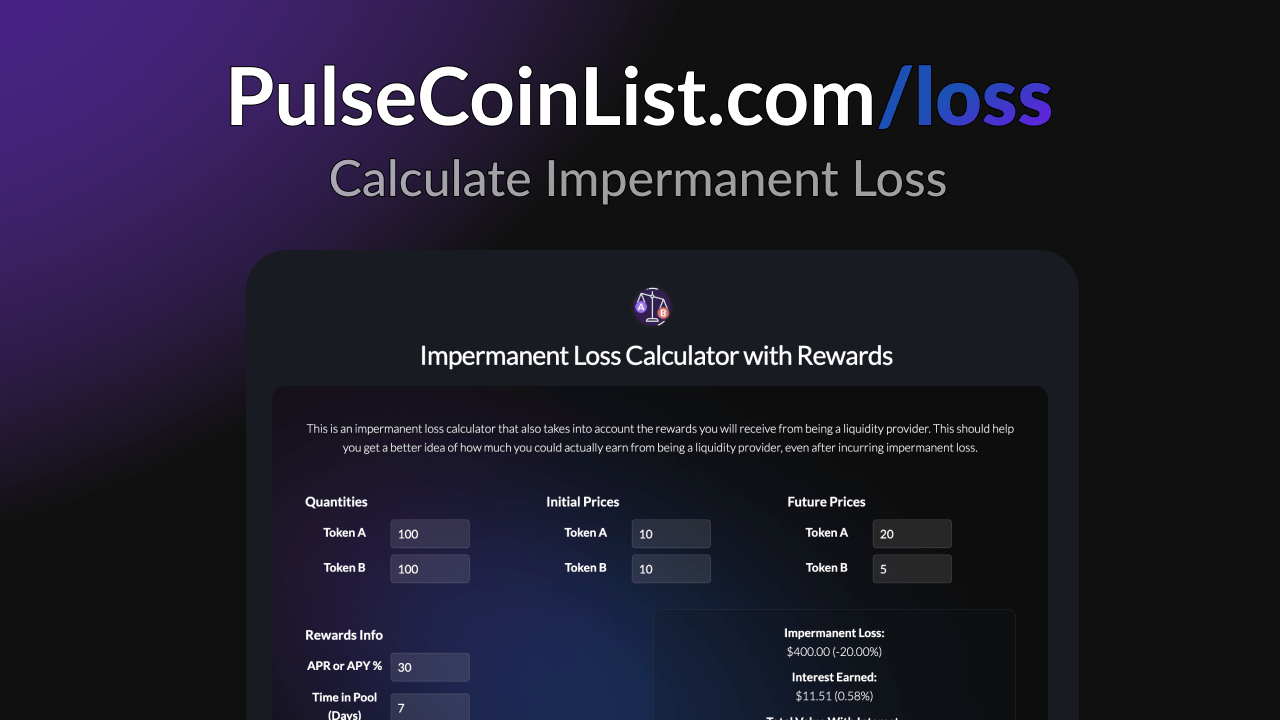

Interactive impermanent loss calculator showing different scenarios and loss percentages

The severity of impermanent loss depends on the magnitude of price divergence between the paired tokens. A 25% price change results in approximately 0.6% impermanent loss, while a 100% price change (doubling) results in about 5.7% impermanent loss. Extreme price movements can result in much higher losses – a 500% price increase leads to approximately 25% impermanent loss.

Several strategies can help mitigate impermanent loss risks. Providing liquidity to stablecoin pairs eliminates impermanent loss since both tokens maintain similar values. Pairs like USDC/USDT or DAI/USDC on Curve Finance offer yields from trading fees without the risk of impermanent loss. However, these pairs typically offer lower yields compared to more volatile pairs.

Correlated asset pairs can reduce impermanent loss while still providing attractive yields. Pairs like ETH/stETH (Lido staked Ethereum) or wBTC/renBTC have minimal price divergence since they represent the same underlying asset. These pairs often offer competitive yields while maintaining low impermanent loss risk.

Concentrated liquidity strategies on Uniswap V3 can help manage impermanent loss by allowing you to provide liquidity within specific price ranges. By setting tight ranges around the current price, you can earn higher fees while limiting exposure to large price movements. However, this strategy requires active management as your liquidity becomes inactive if prices move outside your specified range.

Hedging strategies can offset impermanent loss through derivatives or options positions. Some sophisticated farmers use perpetual futures or options to hedge their liquidity positions, though this adds complexity and additional costs. The goal is to structure hedges that profit when impermanent loss occurs, offsetting the losses from liquidity provision.

Yield farming rewards often compensate for impermanent loss, making the overall strategy profitable despite the loss. Many protocols specifically design their reward structures to exceed expected impermanent loss, ensuring that liquidity providers remain profitable. When evaluating opportunities, consider the total return including both trading fees and farming rewards versus the potential impermanent loss.

Time horizon considerations are important for managing impermanent loss. Impermanent loss only becomes “permanent” when you withdraw your liquidity. If you believe the relative prices of your paired tokens will eventually revert, you might choose to wait rather than crystallizing the loss. However, this strategy requires conviction in your price predictions and tolerance for extended periods of unrealized losses.

Some newer protocols are experimenting with impermanent loss protection mechanisms. Bancor V2.1 introduced impermanent loss insurance that fully protects liquidity providers after 100 days of providing liquidity. While these protections come with trade-offs (often lower yields), they can be attractive for risk-averse farmers.

Monitoring tools and calculators can help you track impermanent loss in real-time. Platforms like APY.vision, DeBank, and Zapper provide detailed analytics on your liquidity positions, including current impermanent loss calculations. Regular monitoring allows you to make informed decisions about when to exit positions or adjust strategies.

Advanced Yield Farming Strategies

As the DeFi ecosystem has matured, sophisticated strategies have emerged that can significantly enhance returns for experienced yield farmers. These advanced techniques require deeper understanding of protocol mechanics and careful risk management but can provide substantial advantages over basic farming approaches.

Leveraged yield farming involves borrowing assets to increase your farming position size, amplifying both potential returns and risks. The strategy typically involves depositing collateral into a lending protocol, borrowing additional assets, and using those borrowed assets to farm yields that exceed the borrowing costs. Platforms like Alpha Homora and Leverage have built specialized infrastructure for leveraged yield farming.

A typical leveraged farming strategy might involve depositing ETH as collateral, borrowing USDC, providing ETH/USDC liquidity, and farming the resulting LP tokens. If the farming yields exceed the borrowing costs, you profit from the leverage. However, this strategy is extremely risky as liquidation can occur if your collateral value falls below the required threshold.

Image Placement: [Advanced strategy flowchart showing leveraged yield farming process]

Cross-chain yield farming has become increasingly popular as bridge technology has improved. This strategy involves moving assets between different blockchains to capture the highest yields available across the ecosystem. For example, you might farm on Polygon during high-yield periods, then bridge assets to Avalanche when better opportunities emerge there.

The key to successful cross-chain farming is understanding the costs and risks associated with bridging assets. Bridge fees, slippage, and potential smart contract risks must be weighed against the additional yields available on different chains. Some farmers maintain positions across multiple chains simultaneously to capture diverse opportunities.

Automated strategy platforms like Yearn Finance, Harvest Finance, and Beefy Finance have democratized access to sophisticated yield farming strategies. These platforms pool user funds and deploy them across multiple protocols using automated strategies that would be difficult or expensive for individual users to implement. While these platforms charge management fees, they often deliver superior risk-adjusted returns through professional strategy development and execution.

Governance token farming represents another advanced strategy that involves participating in protocol governance to earn additional rewards. Many protocols distribute governance tokens to active participants, and some offer additional rewards for voting or participating in governance proposals. This strategy requires staying informed about governance activities and actively participating in protocol decision-making.

Liquidity mining arbitrage involves identifying and exploiting temporary inefficiencies in reward distributions across different protocols. This might involve quickly moving liquidity to newly launched farming programs that offer temporarily inflated rewards, then exiting before rewards normalize. Success requires rapid execution and deep market knowledge.

Flash loan strategies enable sophisticated arbitrage and liquidation opportunities without requiring significant capital. Flash loans allow you to borrow large amounts of cryptocurrency within a single transaction, execute complex strategies, and repay the loan before the transaction completes. While technically challenging to implement, flash loan strategies can be extremely profitable for skilled practitioners.

Options strategies are beginning to emerge in DeFi, allowing farmers to hedge their positions or generate additional income through covered call strategies. Platforms like Opyn and Hegic enable sophisticated options strategies that can complement traditional yield farming approaches. These strategies require deep understanding of options mechanics and careful risk management.

Yield farming with synthetic assets opens up additional opportunities by providing exposure to assets that might not be directly available for farming. Platforms like Synthetix allow you to farm with synthetic versions of stocks, commodities, or other cryptocurrencies, potentially accessing unique yield opportunities while maintaining exposure to desired assets.

Multi-protocol strategies involve coordinating positions across multiple DeFi protocols to optimize returns and manage risks. This might involve using Compound for lending, Uniswap for liquidity provision, and Convex for Curve optimization simultaneously. The complexity of managing multiple positions requires sophisticated tracking and risk management systems.

When implementing advanced strategies, it’s crucial to thoroughly understand the risks involved and start with small positions while learning. Many advanced strategies that work well in favorable market conditions can become problematic during periods of high volatility or market stress. Continuous education and staying updated with the latest protocol developments are essential for long-term success.

Risk Management in DeFi Yield Farming

Effective risk management is the cornerstone of successful DeFi yield farming. The high-yield opportunities in DeFi come with correspondingly high risks that must be carefully identified, assessed, and managed to protect your capital and ensure sustainable returns over time.

Smart contract risk represents the most fundamental risk in DeFi yield farming. Every protocol you interact with relies on smart contracts that, despite thorough auditing, may contain bugs or vulnerabilities that could be exploited by malicious actors. The collapse of several high-profile DeFi protocols has demonstrated that even audited and seemingly secure contracts can fail catastrophically.

To mitigate smart contract risks, prioritize protocols with strong track records, multiple security audits, and significant total value locked (TVL). Newer protocols with unproven smart contracts should represent only a small portion of your portfolio, regardless of the attractive yields they might offer. Diversifying across multiple protocols can help limit the impact of any single contract failure.

Image Placement: [Risk assessment matrix showing different DeFi risks and mitigation strategies]

Liquidity risks can prevent you from exiting positions when needed, particularly during market stress. Some yield farming strategies involve locking tokens for extended periods, while others may face liquidity constraints during market downturns. Always maintain a portion of your portfolio in liquid assets and understand the exit mechanisms for each of your positions.

Oracle risks arise from the dependence of many DeFi protocols on external price feeds. Oracle manipulation or failures can trigger liquidations, cause incorrect pricing, or enable arbitrage attacks that drain protocol funds. Understanding how protocols source their price data and the potential vulnerabilities in their oracle systems is crucial for risk assessment.

Governance risks stem from the decentralized nature of DeFi protocols. Token holders typically have the power to change protocol parameters, upgrade smart contracts, or even drain treasury funds. Malicious governance proposals or the concentration of governance tokens in few hands can pose significant risks to protocol users.

Regulatory risks continue to evolve as governments worldwide develop frameworks for DeFi regulation. Changes in regulatory treatment could affect the legality, taxation, or accessibility of DeFi protocols. Staying informed about regulatory developments and maintaining compliance with local laws is essential for long-term participation in DeFi.

Market risks encompass the volatility of cryptocurrency prices and their impact on your farming positions. Sudden market movements can trigger liquidations in leveraged positions, cause significant impermanent loss, or reduce the value of reward tokens. Understanding your exposure to different market scenarios and maintaining appropriate position sizes is crucial.

Implementing a comprehensive risk management framework involves several key components. Position sizing should ensure that no single position can cause catastrophic losses to your overall portfolio. A common rule is to limit exposure to any single protocol to 10-20% of your total farming capital, with newer or riskier protocols receiving even smaller allocations.

Diversification across protocols, blockchains, and strategies can help reduce concentration risk. This might involve farming on multiple chains, using different types of strategies (lending, liquidity provision, governance farming), and maintaining exposure to various sectors of the DeFi ecosystem.

Regular monitoring and rebalancing of your portfolio can help optimize returns while managing risks. Set up alerts for significant changes in yields, protocol parameters, or market conditions. Consider taking profits periodically and reinvesting in different opportunities to maintain optimal diversification.

Emergency procedures should be established for various risk scenarios. This includes knowing how to quickly exit positions, having backup plans for bridge failures or network congestion, and maintaining emergency funds in stablecoins for new opportunities or risk mitigation.

Insurance options are beginning to emerge in DeFi, though coverage is still limited and expensive. Platforms like Nexus Mutual and Cover Protocol offer smart contract insurance for some protocols. While insurance can provide additional protection, it should be viewed as one component of a broader risk management strategy rather than a complete solution.

Continuous education and staying informed about protocol developments, security incidents, and market conditions are essential for effective risk management. The DeFi space evolves rapidly, and new risks emerge regularly. Participating in community discussions, following security researchers, and staying updated with protocol announcements can help you identify and respond to emerging risks.

Tools and Platforms for Tracking Performance

Successful DeFi yield farming requires sophisticated tracking and analysis tools to monitor performance, identify opportunities, and manage risks effectively. The complexity of DeFi strategies, with multiple protocols, tokens, and chains involved, makes manual tracking nearly impossible for serious farmers.

Portfolio tracking platforms have become essential infrastructure for DeFi participants. Zapper provides a comprehensive dashboard that aggregates positions across multiple protocols and chains, showing your total portfolio value, yield farming positions, and historical performance. The platform’s clean interface and broad protocol support make it popular among both beginners and experienced farmers.

DeBank offers similar portfolio tracking capabilities with additional features for analyzing DeFi positions. The platform provides detailed breakdowns of your positions across different protocols, tracks unclaimed rewards, and offers social features that allow you to follow successful farmers and learn from their strategies.

Image Placement: [Portfolio tracking dashboard showing multiple DeFi positions and performance metrics]

APY.vision specializes in liquidity pool analytics, providing detailed insights into impermanent loss, fees earned, and overall performance of your liquidity positions. The platform’s sophisticated analytics help you understand whether your liquidity provision strategies are profitable after accounting for impermanent loss and gas costs.

Yield farming aggregators like Yearn Finance, Harvest Finance, and Beefy Finance not only provide automated strategies but also offer excellent tracking tools for monitoring performance. These platforms typically provide detailed breakdowns of strategy performance, fee structures, and risk metrics.

DeFiPulse and DeFiLlama serve as essential resources for discovering new opportunities and tracking the overall DeFi ecosystem. These platforms provide comprehensive data on protocol TVL, yields, and trends that can help you identify emerging opportunities and assess the relative attractiveness of different farming options.

Tax tracking becomes increasingly complex with active yield farming strategies. Platforms like CoinTracker, Koinly, and TaxBit have developed specialized features for DeFi activities, automatically categorizing transactions, calculating impermanent loss, and generating tax reports. However, the complexity of DeFi often requires manual review and adjustment of automated calculations.

Custom spreadsheet solutions remain popular among sophisticated farmers who want complete control over their tracking and analysis. Building comprehensive spreadsheets that track positions, calculate returns, and model different scenarios can provide insights that aren’t available through standard platforms. However, this approach requires significant time investment and technical skills.

On-chain analytics tools like Dune Analytics and Nansen provide deeper insights into protocol performance and market trends. These platforms allow you to analyze transaction data, identify whale movements, and understand the broader market dynamics that might affect your farming strategies.

Mobile applications have become increasingly important for monitoring positions and responding to market changes. Most major platforms now offer mobile apps or mobile-optimized websites that allow you to check positions, claim rewards, and make adjustments while away from your computer.

Alert systems are crucial for active yield farming strategies. Setting up alerts for significant changes in yields, impermanent loss thresholds, or market conditions can help you respond quickly to changing circumstances. Many platforms offer built-in alert systems, while others integrate with services like IFTTT or Zapier for custom notifications.

Performance benchmarking helps you evaluate the success of your strategies relative to simpler alternatives. Comparing your yield farming returns to basic buy-and-hold strategies, traditional staking yields, or DeFi indices can help you assess whether the additional complexity and risk of yield farming is justified.

Risk monitoring tools help you track your exposure to different types of risks across your portfolio. This might include monitoring your exposure to specific protocols, tracking correlation between your positions, or analyzing your sensitivity to different market scenarios.

When selecting tracking tools, consider factors like protocol coverage, update frequency, user interface quality, and integration capabilities. The DeFi space evolves rapidly, so tools that quickly add support for new protocols and features are particularly valuable. Additionally, consider the privacy implications of using third-party tracking services and whether you’re comfortable sharing your wallet addresses and transaction data.

Conclusion and Future Outlook

My journey from $5,000 to $15,000 through DeFi yield farming demonstrates the significant potential of this emerging investment strategy. However, it’s important to emphasize that these results required substantial time investment, continuous learning, and careful risk management. Yield farming is not a passive investment strategy – it requires active monitoring, strategic thinking, and the ability to adapt quickly to changing market conditions.

The DeFi ecosystem continues to evolve rapidly, with new protocols, strategies, and opportunities emerging regularly. Layer 2 solutions are making yield farming more accessible by reducing transaction costs, while cross-chain bridges are creating new arbitrage and farming opportunities across different blockchains. The integration of traditional finance concepts like options, futures, and structured products into DeFi is creating even more sophisticated strategies for advanced users.

Looking ahead, several trends are likely to shape the future of DeFi yield farming. Institutional adoption is bringing more capital and sophistication to the space, potentially reducing yields but also increasing stability and legitimacy. Regulatory clarity will likely emerge in major jurisdictions, providing more certainty for long-term planning while potentially restricting some current practices.

The sustainability of high yields in DeFi remains an ongoing question. Many current yields are subsidized by token emissions and venture capital funding, which may not be sustainable long-term. However, as the ecosystem matures and generates more genuine economic value through trading fees and other activities, more sustainable yield sources are likely to emerge.

For those considering entering the DeFi yield farming space, start small and focus on learning rather than maximizing returns initially. The complexity and risks involved require substantial education and experience to navigate successfully. Begin with established protocols and simple strategies before progressing to more advanced techniques.

Risk management cannot be overstated in its importance. The high yields available in DeFi come with correspondingly high risks, and many farmers have lost significant amounts due to smart contract failures, liquidations, or market volatility. Never invest more than you can afford to lose, and always maintain diversification across protocols and strategies.

The future of DeFi yield farming looks promising, but it will likely become more competitive and sophisticated over time. Those who invest in education, develop strong risk management practices, and stay adaptable to changing conditions will be best positioned to succeed in this dynamic and evolving space.

My $10,000 profit in six months represents just one example of what’s possible in DeFi yield farming. With the right approach, continuous learning, and careful risk management, the opportunities in this space can provide substantial returns for those willing to put in the effort to understand and navigate this complex but rewarding ecosystem.

Disclaimer: This article describes personal experiences and should not be considered financial advice. DeFi yield farming involves significant risks, including the potential for total loss of capital. Smart contract failures, impermanent loss, and market volatility can result in substantial losses. Always conduct your own research and consider consulting with qualified financial advisors before making investment decisions. Past performance does not guarantee future results.

About the Author: everythingcryptoitclouds.com is a leading resource for cryptocurrency education and investment strategies, providing in-depth analysis and practical guidance for digital asset investors of all experience levels.