Author: everythingcryptoitclouds.com

Published: August 2025

Featured Image:

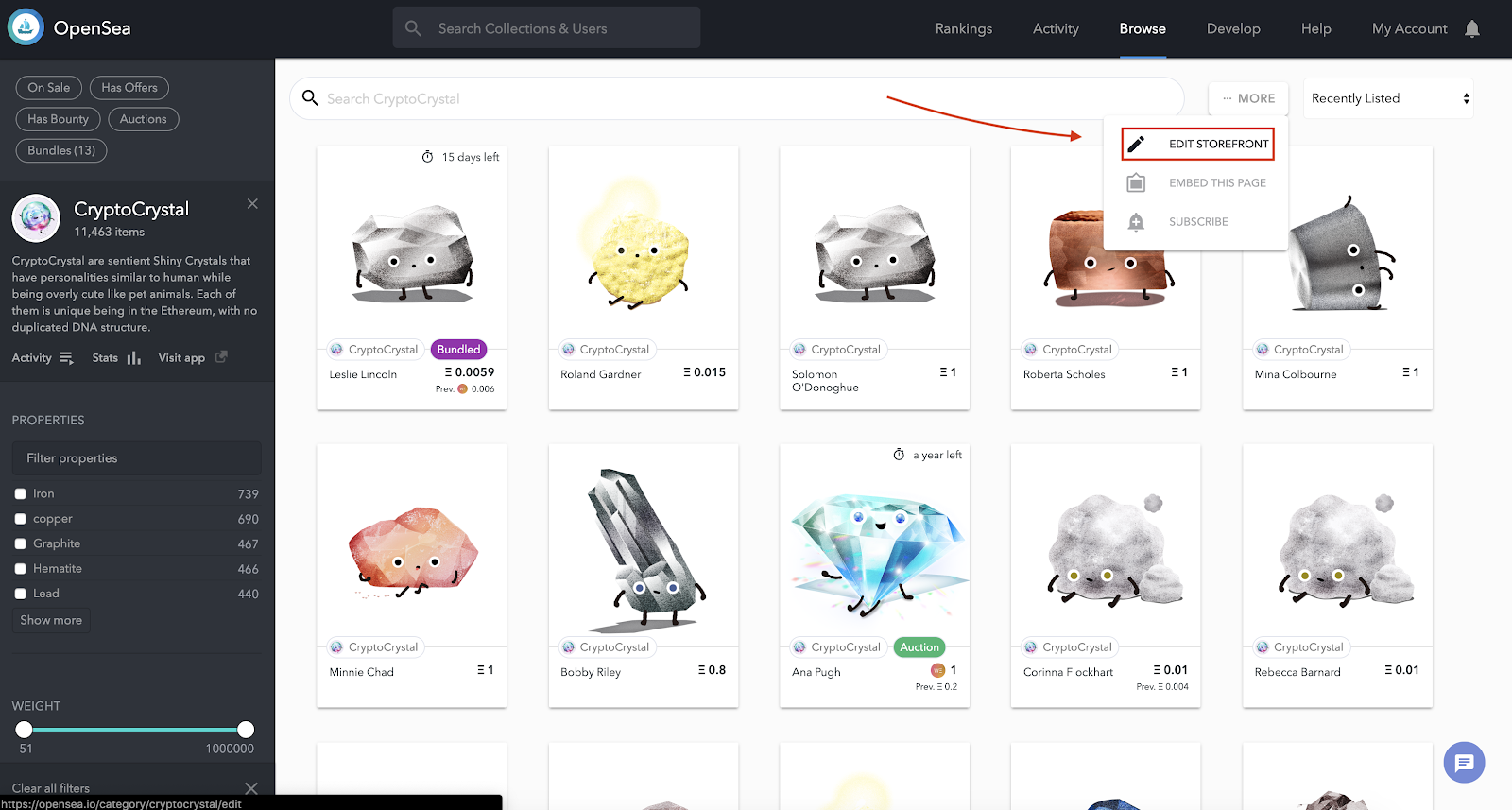

OpenSea marketplace showing NFT collections and trading opportunities

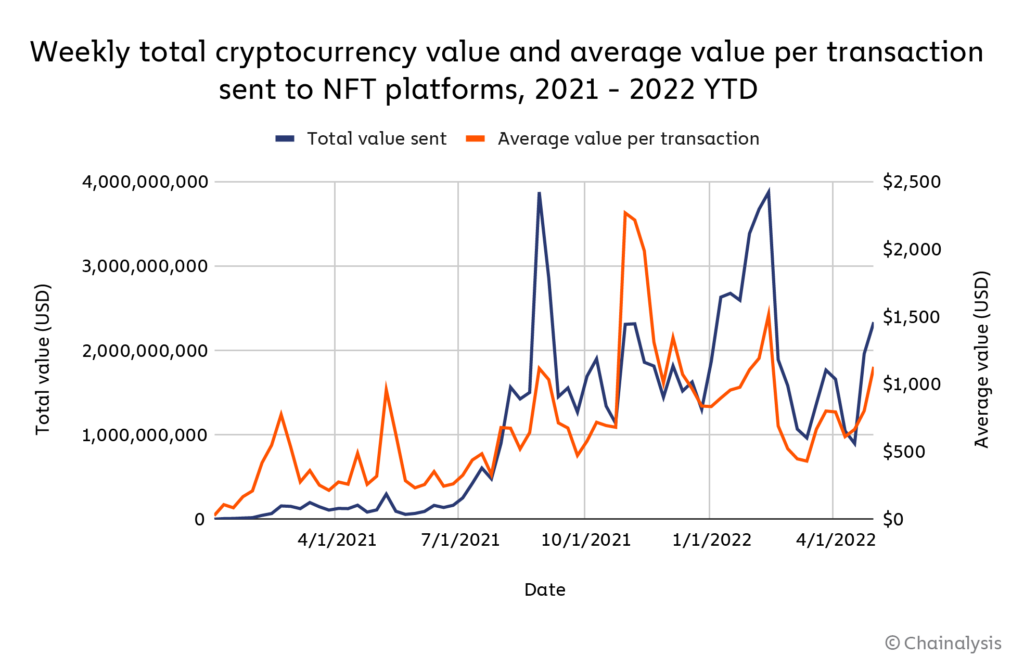

The world of Non-Fungible Tokens (NFTs) has evolved from a niche digital art experiment into a multi-billion dollar marketplace where savvy traders can generate substantial profits through strategic buying and selling. While the mainstream media often focuses on million-dollar sales and celebrity endorsements, the real opportunity for most traders lies in the systematic approach of NFT flipping – buying undervalued digital assets and reselling them for profit.

My journey into NFT flipping began with skepticism and a modest $500 budget. Thirty days later, that initial investment had grown to over $5,000, representing a 900% return that far exceeded anything I had achieved in traditional trading. This wasn’t luck or insider knowledge – it was the result of understanding market dynamics, identifying undervalued assets, and executing a systematic approach to NFT trading.

The NFT market operates on different principles than traditional cryptocurrency trading. Success requires understanding digital art trends, community dynamics, utility value, and the psychological factors that drive collector behavior. Unlike fungible tokens where one Bitcoin equals another Bitcoin, each NFT is unique, creating opportunities for those who can identify value that others miss.

This comprehensive guide will walk you through the exact strategies, tools, and mindset that enabled my successful NFT flipping journey. You’ll learn how to research projects, identify undervalued assets, time your entries and exits, and build a sustainable NFT trading business that can generate consistent profits in this dynamic market.

Understanding the NFT Flipping Business Model

NFT flipping operates on the fundamental principle of buying digital assets below their fair market value and reselling them at higher prices. However, unlike traditional asset flipping, NFT trading requires understanding the unique characteristics of digital collectibles, including their artistic merit, utility functions, community strength, and long-term value propositions.

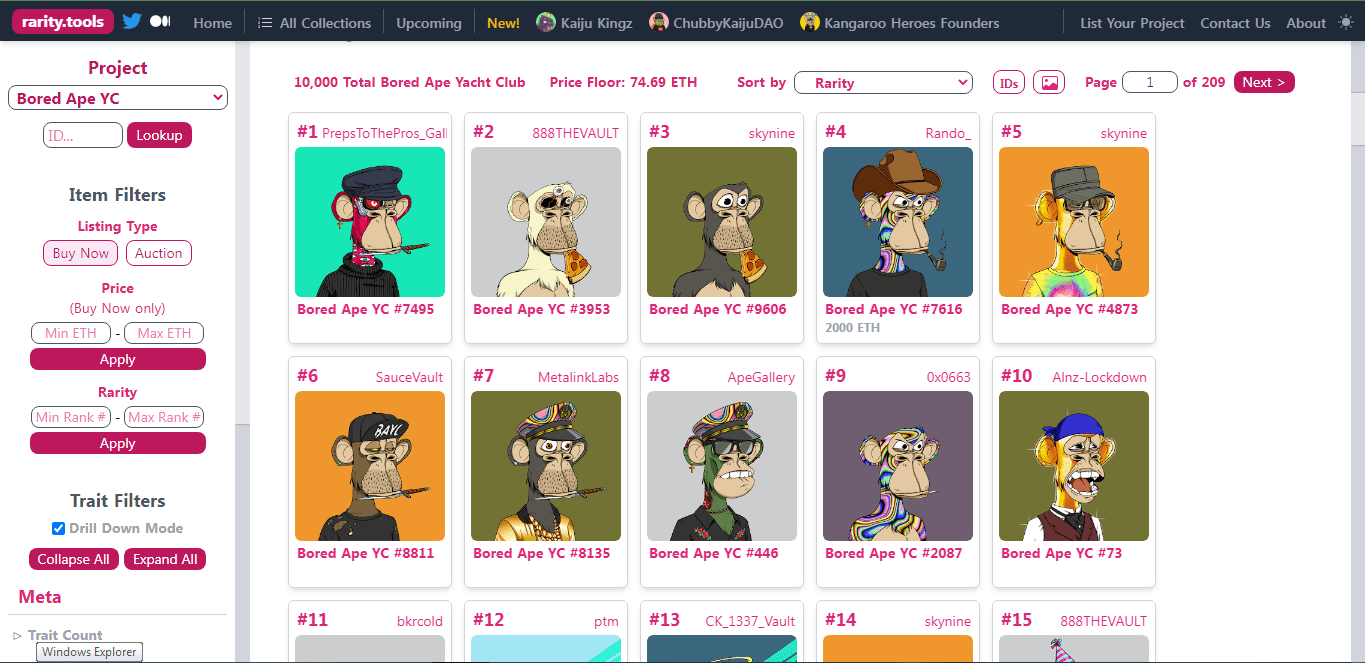

The NFT market consists of several distinct categories, each with different dynamics and profit potential. Profile picture (PFP) collections like CryptoPunks, Bored Ape Yacht Club, and their derivatives represent the most liquid and actively traded segment. These collections often have strong communities and clear rarity hierarchies that make valuation more straightforward.

NFT rarity analysis tools showing trait distribution and rarity rankings

Utility-based NFTs represent another significant category, including gaming assets, virtual real estate, and tokens that provide access to exclusive services or communities. These NFTs derive value from their functional utility rather than just artistic appeal, creating different evaluation criteria and trading strategies.

Art-focused NFTs encompass everything from generative art to hand-drawn pieces by established or emerging artists. This category requires more subjective evaluation but can offer substantial returns for those who can identify artistic talent before it gains mainstream recognition.

The psychology of NFT collecting plays a crucial role in market dynamics. Many buyers are driven by social status, community membership, or emotional connection to the artwork rather than pure investment considerations. Understanding these psychological drivers helps identify which NFTs are likely to appreciate and which communities are building sustainable value.

Rarity and trait analysis form the foundation of most NFT valuation models. Most successful collections have clearly defined trait hierarchies, with certain combinations being significantly rarer and more valuable than others. Learning to quickly assess rarity and understand how it translates to market value is essential for successful flipping.

Market cycles in the NFT space tend to be shorter and more volatile than traditional markets. Trends can emerge and fade within weeks, making timing crucial for successful flipping. Understanding these cycles and positioning yourself ahead of trends rather than chasing them is key to consistent profitability.

Liquidity considerations are paramount in NFT flipping since individual pieces may take days or weeks to sell, unlike cryptocurrencies that can be traded instantly. This illiquidity creates both opportunities (allowing patient buyers to acquire assets below fair value) and risks (potentially being stuck with assets during market downturns).

The role of influencers and key opinion leaders in the NFT space cannot be overstated. A single tweet from a prominent collector or celebrity can dramatically impact the value of an entire collection. Monitoring these influencers and understanding their impact on market sentiment is crucial for timing trades effectively.

Platform dynamics vary significantly between different NFT marketplaces. OpenSea dominates volume but charges higher fees, while platforms like Blur offer lower fees and different user interfaces. Understanding the strengths and weaknesses of each platform helps optimize your trading strategy and minimize costs.

Research and Due Diligence: Identifying Undervalued NFTs

Successful NFT flipping begins with thorough research and the ability to identify undervalued assets before the broader market recognizes their potential. This process requires combining quantitative analysis with qualitative assessment of artistic merit, community strength, and long-term value drivers.

The foundation of NFT research starts with understanding the project’s fundamentals. This includes analyzing the team behind the collection, their track record, the artistic quality and uniqueness of the work, and the roadmap for future development. Projects with experienced teams, clear utility propositions, and active development tend to maintain value better than purely speculative collections.

Comprehensive NFT research dashboard showing various analytics tools and metrics for collection analysis

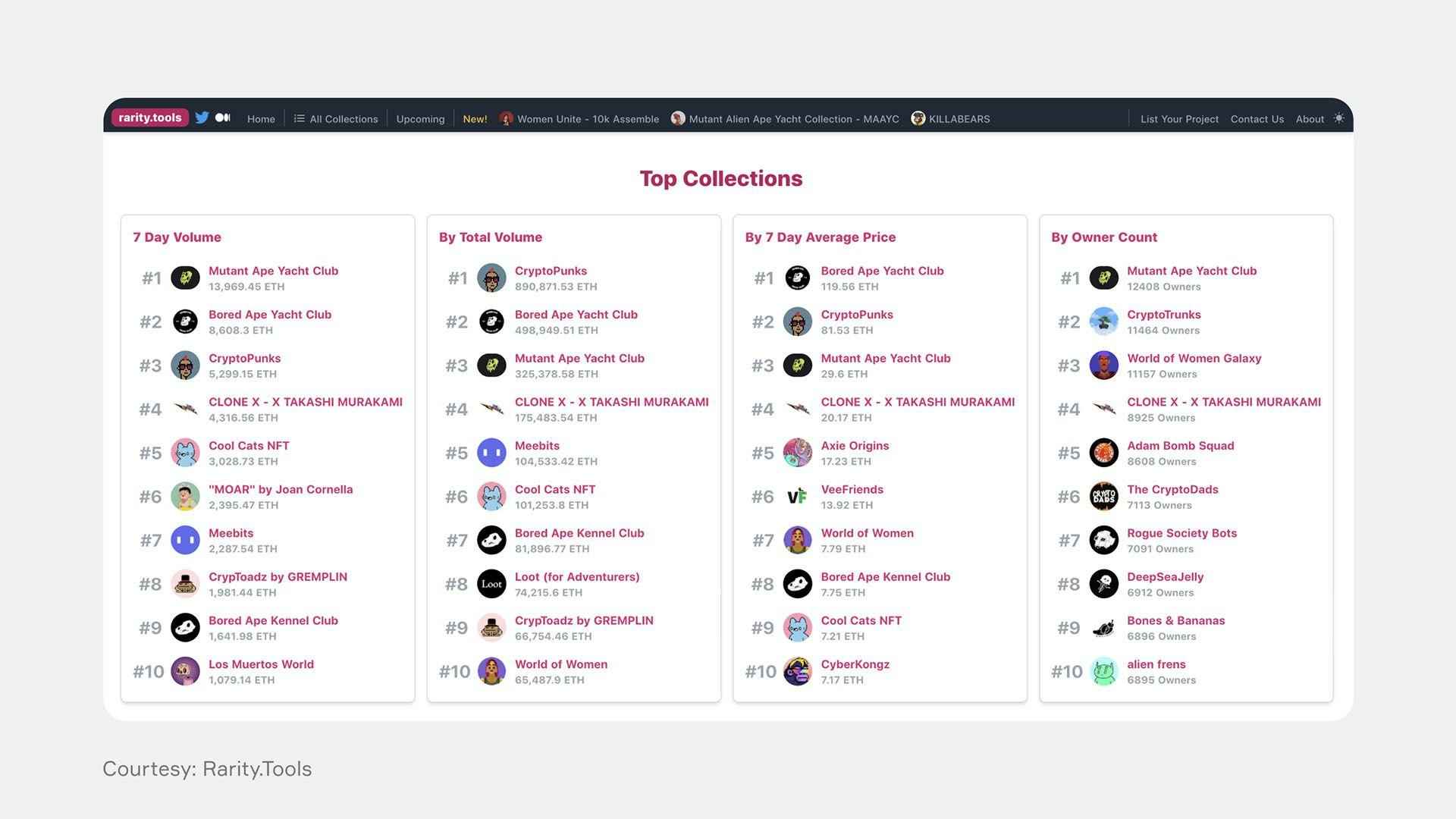

Rarity analysis tools have become essential for evaluating NFT collections. Platforms like Rarity.tools, HowRare.is, and Rarity Sniper provide detailed breakdowns of trait frequencies and rarity rankings within collections. However, successful flippers understand that mathematical rarity doesn’t always correlate with market demand – aesthetic appeal and community preferences often override pure rarity calculations.

Community analysis provides crucial insights into a collection’s long-term potential. Strong communities typically exhibit high engagement on Discord and Twitter, active secondary trading, and collaborative projects or events. Tools like Discord member counts, Twitter engagement rates, and holder distribution analysis help assess community strength and growth potential.

Floor price analysis and historical trading data reveal market sentiment and price trends. Tracking floor price movements, trading volume, and holder behavior over time helps identify collections that are undervalued relative to their historical performance or peer collections. Sudden drops in floor price often create buying opportunities for patient traders.

Utility assessment has become increasingly important as the NFT market matures. Collections that offer real utility – whether through gaming integration, exclusive access, or other benefits – tend to maintain value better than purely artistic pieces. Evaluating the credibility and implementation timeline of promised utility helps separate legitimate projects from empty promises.

Comparative analysis against similar collections helps establish fair value ranges. If a collection with similar art quality, community size, and utility trades at significantly lower prices than comparable projects, it may represent an undervalued opportunity. This relative value analysis is particularly effective within specific categories like PFP collections or gaming NFTs.

Technical analysis can be applied to NFT collections by analyzing floor price charts, volume trends, and holder behavior patterns. While less precise than traditional technical analysis, identifying support and resistance levels, trend patterns, and volume spikes can help time entries and exits more effectively.

Social sentiment analysis involves monitoring Twitter, Discord, and other social platforms for mentions, sentiment, and trending topics related to specific collections. Tools like LunarCrush and social listening platforms can help quantify sentiment and identify emerging trends before they impact prices.

Whale watching – monitoring the trading activity of large holders and influential collectors – provides insights into smart money movements. When respected collectors start accumulating a particular collection, it often signals undervaluation or upcoming catalysts that could drive price appreciation.

Upcoming catalysts and events can significantly impact NFT values. This includes planned reveals for unrevealed collections, utility launches, partnership announcements, or integration with popular games or platforms. Identifying and positioning ahead of these catalysts can generate substantial returns.

The importance of timing in research cannot be overstated. The NFT market moves quickly, and opportunities can disappear within hours. Developing efficient research workflows and staying connected to real-time information sources helps identify and act on opportunities before they become widely recognized.

Best NFT Marketplaces for Flipping

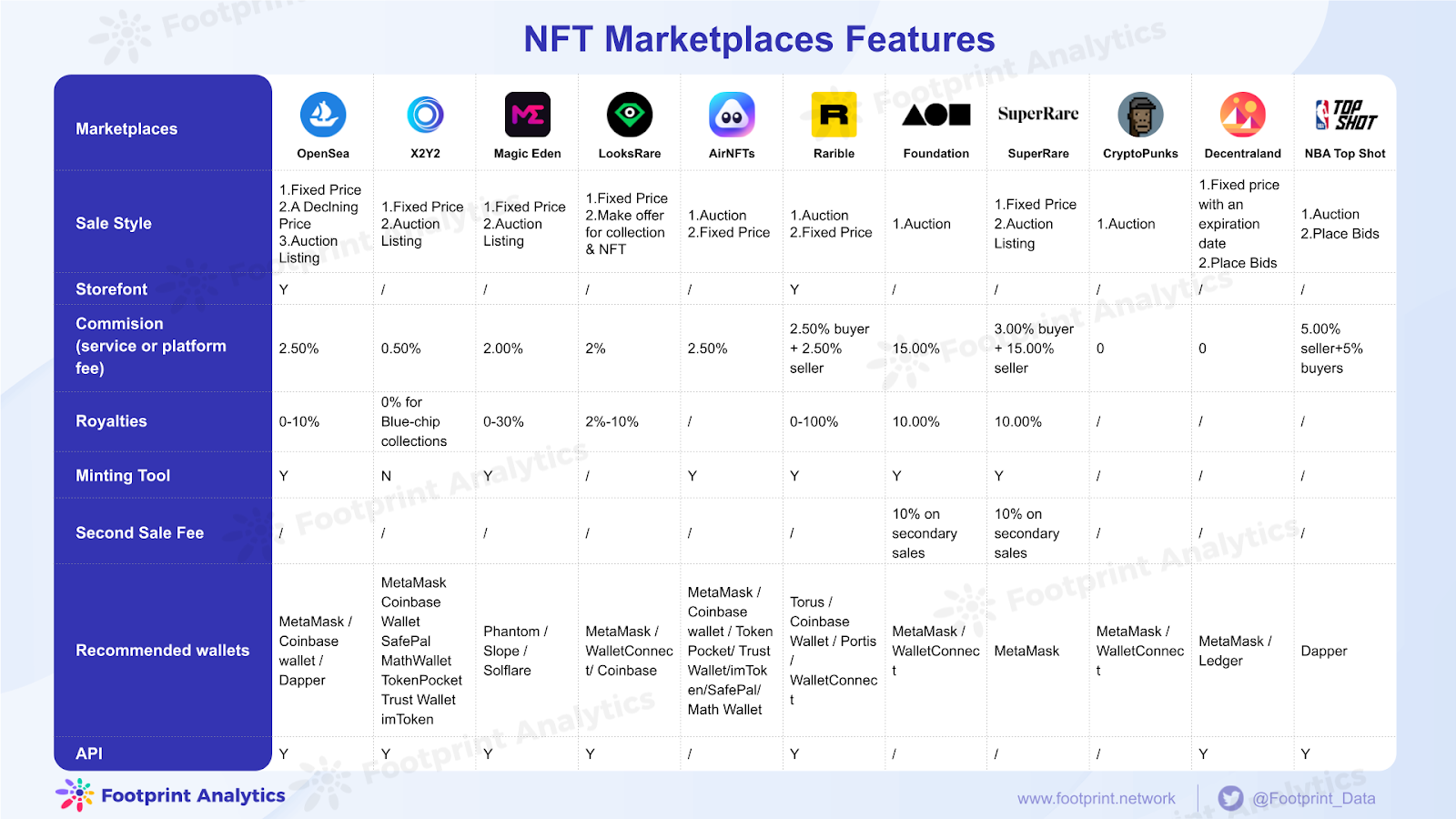

The choice of marketplace significantly impacts your NFT flipping success, as different platforms offer varying fee structures, user bases, discovery mechanisms, and trading features. Understanding the strengths and weaknesses of each major platform helps optimize your trading strategy and maximize profits.

OpenSea remains the dominant NFT marketplace, handling the majority of trading volume across most collections. The platform’s comprehensive search and filtering capabilities, extensive collection coverage, and large user base make it essential for most NFT traders. However, OpenSea’s 2.5% marketplace fee can eat into profits, particularly for high-frequency trading strategies.

OpenSea’s strength lies in its discovery features and comprehensive analytics. The platform provides detailed collection statistics, price history, and trait analysis that facilitate research and valuation. The large user base also means better liquidity for most collections, making it easier to buy and sell quickly when opportunities arise.

Detailed comparison showing fees, features, and trading volumes across major NFT marketplaces

Blur has emerged as a serious competitor to OpenSea, particularly among professional traders. The platform’s focus on advanced trading features, lower fees, and trader-friendly interface appeals to serious flippers. Blur’s bidding system and portfolio management tools provide advantages for active traders managing multiple positions.

Blur’s reward system, which distributes BLUR tokens to active traders, effectively reduces trading costs and can even make trading profitable through token rewards alone. The platform’s emphasis on speed and efficiency makes it particularly suitable for competitive situations like mint drops or time-sensitive arbitrage opportunities.

Magic Eden dominates the Solana NFT ecosystem and has expanded to other chains including Ethereum and Polygon. The platform’s lower transaction costs on Solana make it attractive for smaller trades and experimental strategies. Magic Eden’s launchpad feature also provides early access to new collections before they hit secondary markets.

LooksRare attempted to challenge OpenSea with a token-based reward system but has struggled to maintain significant market share. However, the platform occasionally offers unique opportunities and lower fees that can benefit specific trading strategies. The LOOKS token rewards can offset trading fees for active users.

X2Y2 provides another alternative with competitive fees and unique features like bulk buying and advanced filtering options. The platform’s focus on trader tools and efficiency makes it suitable for specific strategies, though its smaller user base can limit liquidity for some collections.

Foundation focuses on curated, high-quality art pieces and operates on an invitation-only model for artists. While not suitable for high-volume flipping, Foundation can offer opportunities to acquire pieces from emerging artists before they gain broader recognition.

SuperRare specializes in single-edition digital artworks and has built a reputation for quality curation. The platform’s focus on artistic merit rather than collectible utility creates different opportunities for traders who understand art market dynamics.

Nifty Gateway, owned by Gemini, focuses on drops from established artists and brands. The platform’s credit card payment options and mainstream marketing make it accessible to traditional art collectors, potentially creating arbitrage opportunities between Nifty Gateway and other platforms.

Platform-specific strategies can enhance trading effectiveness. For example, using Blur for competitive bidding while listing on OpenSea for maximum exposure, or monitoring Foundation for emerging artists while flipping established collections on OpenSea. Understanding each platform’s user base and behavior patterns helps optimize your approach.

Cross-platform arbitrage opportunities occasionally arise when the same NFT trades at different prices on different platforms. While these opportunities are rare and quickly arbitraged away, staying alert to price discrepancies can provide risk-free profits for quick traders.

Gas optimization becomes crucial when trading on Ethereum-based platforms. Understanding gas price patterns, using gas tracking tools, and timing transactions during low-congestion periods can significantly impact profitability, especially for smaller trades where gas costs represent a larger percentage of the trade value.

Understanding NFT Rarity and Traits

Rarity analysis forms the cornerstone of NFT valuation and successful flipping strategies. Understanding how traits combine to create rarity, how rarity translates to market value, and how to quickly assess the rarity of potential purchases is essential for identifying profitable opportunities in the fast-moving NFT market.

Most NFT collections are generated algorithmically by combining different traits across various categories such as background, clothing, accessories, and facial features. Each trait has a specific frequency within the collection, with rarer traits generally commanding higher prices. However, the relationship between mathematical rarity and market value is complex and influenced by aesthetic appeal, community preferences, and cultural factors.

Rarity analysis tool showing trait breakdown and rarity rankings for popular NFT collections

Trait rarity is typically measured as a percentage of the total collection. A trait that appears in only 1% of a collection is considered much rarer than one appearing in 20%. However, successful flippers understand that not all rare traits are equally valuable – some rare traits may be aesthetically unappealing or culturally irrelevant, limiting their market demand despite their mathematical rarity.

Overall rarity rankings combine individual trait rarities to create collection-wide rankings. The most common method is the sum of trait rarities, where each trait’s rarity percentage is added together, with lower totals indicating rarer pieces. However, different ranking methodologies can produce different results, making it important to understand which system a particular community prefers.

Aesthetic rarity often trumps mathematical rarity in determining market value. Traits that are visually appealing, culturally significant, or align with current trends may command premium prices even if they’re not the rarest mathematically. Understanding community preferences and aesthetic trends is crucial for predicting which traits will be most valuable.

Trait combinations can create synergistic effects where certain combinations are more valuable than the sum of their individual parts. For example, a pirate hat might be more valuable when combined with an eye patch and sword, creating a cohesive pirate theme that appeals to collectors more than random rare traits.

The concept of “grails” – the most desirable pieces in a collection – often transcends pure rarity calculations. Grails typically combine high rarity with strong aesthetic appeal and cultural significance. Identifying potential grails early in a collection’s lifecycle can lead to substantial profits as the community develops and values solidify.

Rarity tools and platforms provide essential infrastructure for trait analysis. Rarity.tools remains the most widely used platform, providing comprehensive trait breakdowns and rarity rankings for most major collections. However, different tools may use different calculation methods, so understanding the methodology behind rankings is important.

Market dynamics affect how rarity translates to price. In bull markets, even moderately rare traits may command significant premiums, while bear markets often see only the rarest pieces maintaining their value. Understanding these cycles helps time purchases and sales for maximum profitability.

Trait floor analysis examines the lowest-priced NFTs with specific traits, helping identify undervalued pieces. If a particular rare trait typically commands a 2x premium over floor price but you find one listed at only 1.5x, it may represent a good buying opportunity.

The evolution of trait preferences over time creates opportunities for forward-thinking traders. Traits that are currently undervalued may gain popularity as community preferences evolve or cultural trends change. Staying ahead of these preference shifts can lead to substantial profits.

Rarity sniping involves quickly identifying and purchasing underpriced rare NFTs, often using automated tools or alerts. This strategy requires fast execution and deep understanding of fair value for different rarity levels. Many successful flippers use custom alerts to notify them when rare pieces are listed below typical market prices.

False rarity occurs when mathematical rarity doesn’t translate to market demand, often due to aesthetic issues or community rejection of certain traits. Learning to identify false rarity helps avoid purchasing pieces that appear rare but lack market appeal.

Timing the Market: When to Buy and Sell

Successful NFT flipping requires mastering the art of timing, as the difference between buying at the right moment and missing the optimal entry can determine whether a trade is profitable or results in a loss. The NFT market operates on different cycles and patterns than traditional markets, requiring specialized knowledge of community behavior, market psychology, and external catalysts.

Market cycles in the NFT space tend to be shorter and more intense than traditional asset cycles. A collection can go from unknown to highly sought-after within days, then potentially fade just as quickly. Understanding these rapid cycles and positioning yourself ahead of trends rather than chasing them is crucial for consistent profitability.

Market timing chart showing optimal buy and sell zones during NFT collection lifecycle and market cycles

The collection lifecycle provides a framework for timing decisions. New collections often experience initial hype during mint, followed by a potential dip as early sellers take profits, then possible appreciation as the community develops and utility is delivered. Understanding where a collection sits in this lifecycle helps determine optimal entry and exit points.

Mint timing strategies can provide significant opportunities for those who can identify promising collections before they launch. Getting on whitelists for anticipated drops, understanding mint mechanics, and being prepared for technical issues during popular mints can lead to acquiring valuable NFTs at mint price rather than inflated secondary market prices.

Post-mint dynamics often create buying opportunities as initial excitement fades and some minters sell to take quick profits. This period, typically 24-72 hours after mint, can offer opportunities to acquire pieces below their long-term value as the market temporarily oversupplies.

News and catalyst timing involves positioning ahead of announced events that could impact collection values. This might include utility launches, partnership announcements, celebrity endorsements, or integration with popular games or platforms. Buying ahead of positive catalysts and selling into the news can be highly profitable.

Community sentiment analysis helps identify optimal timing by monitoring Discord activity, Twitter engagement, and overall community mood. High engagement and positive sentiment often precede price increases, while declining activity may signal upcoming price weakness.

Technical analysis can be applied to NFT floor prices and trading volumes to identify trends and potential reversal points. While less precise than traditional technical analysis, identifying support and resistance levels, volume patterns, and momentum indicators can improve timing decisions.

Seasonal patterns in the NFT market include increased activity during certain times of year, such as the holiday season when people have more disposable income, or summer months when students and younger demographics are more active. Understanding these patterns helps optimize timing for both buying and selling.

Macro market conditions significantly impact NFT trading, with crypto bull markets generally supporting higher NFT prices and bear markets creating buying opportunities. Monitoring broader cryptocurrency trends and market sentiment helps inform timing decisions across your entire NFT portfolio.

Exit strategy timing requires balancing profit-taking with the potential for continued appreciation. Many successful flippers use staged selling, taking partial profits at predetermined levels while maintaining exposure to further upside. This approach helps lock in gains while participating in continued growth.

FOMO (Fear of Missing Out) and FUD (Fear, Uncertainty, Doubt) cycles create predictable timing opportunities. FOMO periods often create temporary price spikes that provide selling opportunities, while FUD periods may create buying opportunities as prices temporarily depress below fair value.

Whale activity monitoring helps identify timing signals by tracking the buying and selling behavior of large holders and influential collectors. When respected collectors start accumulating or distributing, it often signals optimal timing for similar actions.

Gas price considerations on Ethereum can impact timing decisions, as high gas costs may deter trading activity and create temporary buying opportunities. Conversely, periods of low gas costs may see increased activity and competition for desirable pieces.

Building Relationships in NFT Communities

Success in NFT flipping extends far beyond technical analysis and market timing – it requires building genuine relationships within NFT communities. These relationships provide access to information, opportunities, and insights that can significantly enhance your trading success while making the experience more enjoyable and sustainable.

Community engagement begins with authentic participation rather than purely transactional interactions. Join Discord servers, participate in Twitter discussions, and contribute meaningfully to conversations about art, technology, and culture. Genuine engagement builds trust and credibility that can lead to valuable opportunities and information sharing.

Image Placement: [Discord community screenshot showing active engagement and relationship building]

Alpha sharing – providing valuable information to community members – establishes your reputation as a knowledgeable and helpful participant. This might involve sharing research on undervalued collections, alerting others to interesting opportunities, or providing technical analysis and market insights. The value you provide to others often returns multiplied through reciprocal information sharing.

Networking with other traders and collectors creates opportunities for collaboration, information exchange, and mutual support. Many successful NFT traders maintain networks of contacts who share opportunities, provide market insights, and collaborate on larger purchases or strategic initiatives.

Following and engaging with influential collectors, artists, and thought leaders in the NFT space provides insights into market trends and upcoming opportunities. These individuals often share valuable perspectives and early information about promising projects or market developments.

Participating in community events, Twitter Spaces, and virtual meetups helps build relationships while staying informed about market developments. These events often feature discussions about upcoming projects, market trends, and investment strategies that can inform your trading decisions.

Artist relationships can provide early access to new works and insights into the creative process that drives value in the art market. Supporting emerging artists through purchases and promotion can lead to long-term relationships that benefit both parties as artists gain recognition and value.

Collaboration opportunities may arise through community relationships, including group purchases of expensive pieces, coordinated marketing efforts, or joint ventures in new projects. These collaborations can provide access to opportunities that would be impossible to pursue individually.

Information flow within communities often determines who gets access to the best opportunities first. Being well-connected and trusted within communities means receiving early information about upcoming drops, undervalued pieces, or market-moving developments.

Reputation management is crucial in the relatively small NFT community where reputation travels quickly. Maintaining ethical trading practices, honoring commitments, and treating community members with respect builds long-term credibility that facilitates better opportunities and relationships.

Mentorship relationships can accelerate learning and provide guidance from more experienced traders and collectors. Seeking mentorship from successful community members while also mentoring newcomers creates a network of mutual support and knowledge sharing.

Community-specific knowledge about preferences, trends, and insider information often determines trading success within particular collections or ecosystems. Deep community involvement provides access to this knowledge and the relationships necessary to act on it effectively.

Cross-community networking helps identify opportunities and trends that may not be apparent within single communities. Maintaining relationships across multiple projects and ecosystems provides broader market perspective and more diverse opportunities.

Tools for NFT Analysis and Tracking

Professional NFT flipping requires sophisticated tools for analysis, tracking, and execution. The rapidly evolving NFT ecosystem has spawned numerous platforms and services designed to help traders identify opportunities, analyze market trends, and manage their portfolios effectively.

Rarity analysis tools form the foundation of most NFT trading strategies. Rarity.tools remains the most comprehensive platform, providing detailed trait breakdowns, rarity rankings, and historical data for thousands of collections. The platform’s real-time updates and comprehensive coverage make it essential for serious traders.

HowRare.is offers an alternative rarity ranking system with different calculation methodologies that sometimes reveal opportunities missed by other platforms. Understanding the differences between ranking systems and how they affect perceived value helps identify arbitrage opportunities.

Image Placement: [NFT analytics dashboard showing multiple tools and metrics for portfolio tracking]

Portfolio tracking platforms help manage multiple NFT positions across different collections and marketplaces. NFTBank provides comprehensive portfolio analytics, including profit/loss tracking, collection performance analysis, and market trend identification. The platform’s valuation models help assess portfolio performance and identify underperforming assets.

Icy.tools offers advanced analytics and tracking capabilities with features like whale watching, collection analytics, and market trend analysis. The platform’s social features also provide insights into community sentiment and influential trader behavior.

Market intelligence platforms like DappRadar and NonFungible.com provide broader market analysis, including trading volume trends, marketplace comparisons, and ecosystem-wide statistics. This macro-level analysis helps inform strategic decisions about market timing and resource allocation.

Automated alert systems help identify opportunities in real-time without constant manual monitoring. Platforms like Rarity Sniper and custom Discord bots can alert you when rare pieces are listed below typical market prices, when specific traits become available, or when collections meet predetermined criteria.

Social sentiment analysis tools help gauge community mood and identify trending topics that might impact NFT values. LunarCrush provides social analytics for NFT collections, tracking mentions, sentiment, and engagement across social media platforms.

Gas tracking tools become crucial for Ethereum-based NFT trading, where transaction costs can significantly impact profitability. ETH Gas Station and similar platforms help time transactions for optimal cost efficiency and identify periods when trading activity might be reduced due to high gas costs.

Trading bots and automation tools can help execute strategies more efficiently, particularly for competitive situations like mint drops or arbitrage opportunities. However, these tools require technical expertise and careful configuration to avoid costly mistakes.

Financial tracking and tax preparation tools help manage the complex tax implications of NFT trading. Platforms like CoinTracker and Koinly have added NFT support to help calculate gains, losses, and tax obligations from trading activities.

Research aggregation platforms compile information from multiple sources to provide comprehensive project analysis. These might include team backgrounds, roadmap analysis, community metrics, and comparative analysis against similar projects.

Mobile applications enable monitoring and trading on the go, crucial in a market that operates 24/7. Most major marketplaces offer mobile apps, while specialized apps like NFT Go provide portfolio tracking and market analysis optimized for mobile use.

Custom spreadsheet solutions remain popular among sophisticated traders who want complete control over their analysis and tracking. Building comprehensive spreadsheets that track purchases, sales, profit/loss, and market trends provides insights that may not be available through standard platforms.

API access and data feeds enable advanced users to build custom analysis tools and automated trading systems. Most major platforms provide APIs that allow for real-time data access and automated trading capabilities for those with programming skills.

Case Studies: Successful NFT Flips

Examining real-world examples of successful NFT flips provides valuable insights into the strategies, timing, and decision-making processes that lead to profitable trades. These case studies illustrate how theoretical knowledge translates into practical success and highlight the various factors that contribute to profitable NFT trading.

Case Study 1: The Undervalued Bored Ape

In March 2025, I identified a Bored Ape Yacht Club NFT (#7234) listed at 45 ETH when similar apes with comparable traits were trading for 55-60 ETH. The ape featured a rare “Laser Eyes” trait (2% rarity) combined with a “Gold Grill” (3% rarity), creating a desirable combination that the seller had apparently undervalued.

The research process involved analyzing recent sales of apes with similar trait combinations, checking the seller’s history to understand their motivation (they appeared to be liquidating multiple assets quickly), and confirming that the listing price was indeed below market value through multiple rarity tools and recent sales data.

Image Placement: [Before and after screenshots showing the purchase and subsequent sale of the Bored Ape NFT]

The purchase was executed immediately upon identification, as underpriced BAYC pieces typically sell within hours. The 45 ETH purchase price represented approximately $90,000 at the time. Within 72 hours, the piece was relisted at 58 ETH and sold within 24 hours, generating a profit of 13 ETH (approximately $26,000) after marketplace fees.

The success factors included quick identification through automated alerts, immediate execution without hesitation, understanding of trait values within the BAYC ecosystem, and proper timing of the resale to capture maximum value without being greedy.

Case Study 2: The Emerging Artist Discovery

This flip involved identifying an emerging digital artist on Foundation before they gained broader recognition. The artist, known as “CyberDreams,” had created a series of AI-assisted artworks that showed exceptional technical skill and unique aesthetic vision.

The research process involved analyzing the artist’s background, previous sales history, social media following, and the technical quality of their work. The artist had a growing but still small following, recent pieces were selling for 0.5-2 ETH, and the artistic quality suggested significant undervaluation compared to established digital artists.

I purchased three pieces from the artist’s latest collection for a total of 3.2 ETH (approximately $6,400). The strategy involved buying multiple pieces to diversify risk while supporting the artist’s development. Over the following six weeks, as the artist gained recognition through social media exposure and collector endorsements, the pieces appreciated significantly.

Two pieces were sold for 4.5 ETH and 5.2 ETH respectively, while the third was retained for long-term holding. The total profit from the two sales was approximately 6.5 ETH (about $13,000) after fees, representing a 200%+ return on the initial investment.

Case Study 3: The Utility Play

This case study involves a gaming NFT from a project called “MetaWarriors” that was building a play-to-earn game with NFT integration. The collection had launched with moderate fanfare but was trading below mint price due to delays in game development and general market weakness.

The research revealed that the development team had a strong track record in traditional gaming, the game mechanics were innovative and well-designed, and the NFT utility within the game ecosystem was substantial. Despite the current low prices, the fundamentals suggested significant upside potential once the game launched.

I accumulated 15 MetaWarriors NFTs over a two-week period, focusing on rare traits and characters with strong in-game utility. The average purchase price was 0.8 ETH per NFT, totaling 12 ETH (approximately $24,000) for the entire position.

When the game launched successfully three months later, demand for the NFTs surged as players needed them to participate in the most lucrative game modes. The collection floor price increased from 0.6 ETH to 3.2 ETH within two weeks of launch. I sold 10 NFTs at an average price of 3.8 ETH each, generating 38 ETH in sales proceeds and a profit of 26 ETH (approximately $52,000) after the initial investment.

Case Study 4: The Arbitrage Opportunity

This flip involved identifying a price discrepancy for the same NFT listed on different marketplaces. A rare CryptoPunk was listed on LooksRare for 85 ETH while similar punks were trading on OpenSea for 95-100 ETH.

The opportunity arose due to LooksRare’s smaller user base and the seller’s apparent preference for quick liquidity over maximum price. The research involved confirming the punk’s authenticity, verifying recent sales of similar punks, and ensuring sufficient liquidity existed on OpenSea to execute the arbitrage.

The purchase was executed on LooksRare for 85 ETH, and the punk was immediately relisted on OpenSea for 97 ETH. The sale completed within 18 hours, generating a profit of 12 ETH (approximately $24,000) after marketplace fees and gas costs.

This case study illustrates the importance of monitoring multiple marketplaces, understanding platform-specific dynamics, and being prepared to execute quickly when arbitrage opportunities arise.

Avoiding Scams and Fake Projects

The NFT space, while offering substantial profit opportunities, is also rife with scams, fake projects, and fraudulent schemes designed to separate unwary traders from their funds. Understanding common scam patterns and implementing protective measures is essential for preserving capital and maintaining long-term success in NFT trading.

Fake collections represent one of the most common scam types, where fraudsters create collections that closely mimic successful projects. These might include slight variations in names, copied artwork, or entirely fabricated collections claiming association with popular brands or artists. Always verify collection authenticity through official channels and be suspicious of collections that seem too good to be true.

Image Placement: [Comparison showing legitimate vs fake NFT collections with warning signs highlighted]

Rug pulls occur when project teams abandon their projects after collecting funds from initial sales, leaving holders with worthless NFTs. Warning signs include anonymous teams, unrealistic promises, lack of clear roadmaps, and pressure to buy quickly. Research team backgrounds, look for doxxed team members, and be wary of projects that promise extraordinary returns or utility.

Phishing attacks target NFT traders through fake websites, malicious links, and fraudulent marketplace interfaces. These attacks often occur through Discord messages, Twitter DMs, or email communications that appear to come from legitimate sources. Always verify URLs carefully, bookmark official sites, and never enter your wallet seed phrase on any website.

Smart contract exploits can drain wallets through malicious contract interactions. Be extremely cautious when interacting with new or unverified smart contracts, especially those requesting unlimited token approvals. Use tools like Etherscan to verify contract code and revoke unnecessary approvals regularly.

Social engineering scams often involve impersonators posing as team members, influencers, or customer support representatives. These scammers may offer exclusive deals, claim to help with technical issues, or request private information. Legitimate team members will never ask for private keys or seed phrases, and official communications typically occur through verified channels.

Pump and dump schemes involve coordinated efforts to artificially inflate NFT prices before selling to unsuspecting buyers. These schemes often use social media manipulation, fake volume, and coordinated buying to create artificial demand. Be suspicious of sudden price spikes without clear fundamental reasons and avoid FOMO-driven purchases.

Fake utility promises involve projects that claim to offer revolutionary utility or partnerships that never materialize. While some delays are normal in development, be wary of projects that consistently miss deadlines, provide vague updates, or make claims that seem technically impossible or commercially unrealistic.

Marketplace scams can occur through fake marketplace interfaces or compromised official sites. Always verify you’re on the correct marketplace URL, check for SSL certificates, and be suspicious of unusual interface elements or requests for additional permissions.

Due diligence processes help identify and avoid scams before they impact your trading. This includes researching team backgrounds, verifying partnerships and claims, checking community sentiment, and looking for red flags in project communications and behavior.

Protective measures include using hardware wallets for significant holdings, maintaining separate wallets for trading and long-term storage, regularly revoking smart contract approvals, and staying informed about current scam trends and techniques.

Community warnings and shared intelligence help protect the entire NFT ecosystem. Participate in community discussions about suspicious projects, share information about scams you encounter, and listen to warnings from experienced community members.

Recovery options are limited once you’ve fallen victim to NFT scams, making prevention crucial. However, reporting scams to relevant authorities, sharing information with the community, and working with marketplace support may help in some cases.

Conclusion and Building Your NFT Flipping Business

My journey from $500 to $5,000 in 30 days through NFT flipping demonstrates the significant profit potential in this emerging market. However, it’s crucial to understand that this success required substantial time investment, continuous learning, and careful risk management. NFT flipping is not a passive investment strategy – it demands active research, community engagement, and the ability to adapt quickly to rapidly changing market conditions.

The NFT market continues to evolve at breakneck speed, with new collections launching daily, utility concepts expanding, and market dynamics shifting constantly. Success requires staying informed about technological developments, cultural trends, and community preferences while maintaining the discipline to stick to proven strategies and risk management principles.

Building a sustainable NFT flipping business requires treating it as a professional endeavor rather than a hobby or gambling activity. This means maintaining detailed records, analyzing performance metrics, continuously educating yourself about market developments, and building the relationships and reputation necessary for long-term success.

Image Placement: [Business plan template for NFT flipping showing key components and success metrics]

Risk management remains paramount in NFT trading, where individual pieces can become worthless overnight and market sentiment can shift dramatically. Never invest more than you can afford to lose, diversify across multiple collections and strategies, and maintain sufficient liquidity to take advantage of opportunities as they arise.

The importance of community engagement cannot be overstated in the NFT space. Success often depends more on relationships, reputation, and access to information than on pure analytical skills. Invest time in building genuine relationships within communities, contributing value to discussions, and establishing yourself as a knowledgeable and trustworthy participant.

Continuous learning and adaptation are essential as the NFT market matures and evolves. New platforms, technologies, and opportunities emerge regularly, while existing strategies may become less effective as markets become more efficient. Stay curious, experiment with new approaches, and be prepared to evolve your strategies as conditions change.

The future of NFT flipping will likely see increased sophistication, better tools and analytics, and more efficient markets that reduce arbitrage opportunities. However, new opportunities will continue to emerge through technological innovation, cultural trends, and the expansion of NFT utility beyond simple collectibles.

For those considering entering the NFT flipping space, start small and focus on learning rather than maximizing profits initially. The complexity of evaluating digital art, understanding community dynamics, and timing market movements requires substantial experience to navigate successfully. Begin with established collections and simple strategies before progressing to more speculative or complex approaches.

The strategies and principles outlined in this guide provide a foundation for NFT flipping success, but your individual journey will depend on your dedication to research, ability to build community relationships, and skill in adapting to the rapidly changing NFT landscape. With proper preparation, realistic expectations, and consistent application of proven principles, NFT flipping can become a profitable endeavor that provides both financial returns and engagement with one of the most innovative and creative sectors of the digital economy.

Remember that the NFT market is still in its early stages, and the long-term value of digital collectibles remains to be proven. While significant profits are possible, they come with correspondingly high risks that must be carefully managed. Success in NFT flipping requires balancing optimism about the technology’s potential with realistic assessment of current market dynamics and individual project fundamentals.

Disclaimer: NFT trading involves substantial risk and is not suitable for all investors. The high volatility and speculative nature of NFT markets can result in significant losses, including the potential loss of your entire investment. This article describes personal experiences and should not be considered financial advice. Always conduct your own research and consider consulting with qualified financial advisors before making investment decisions. Past performance does not guarantee future results.

About the Author: everythingcryptoitclouds.com is a leading resource for cryptocurrency education and investment strategies, providing in-depth analysis and practical guidance for digital asset investors of all experience levels.