Published by everythingcryptoitclouds.com | August 22, 2025

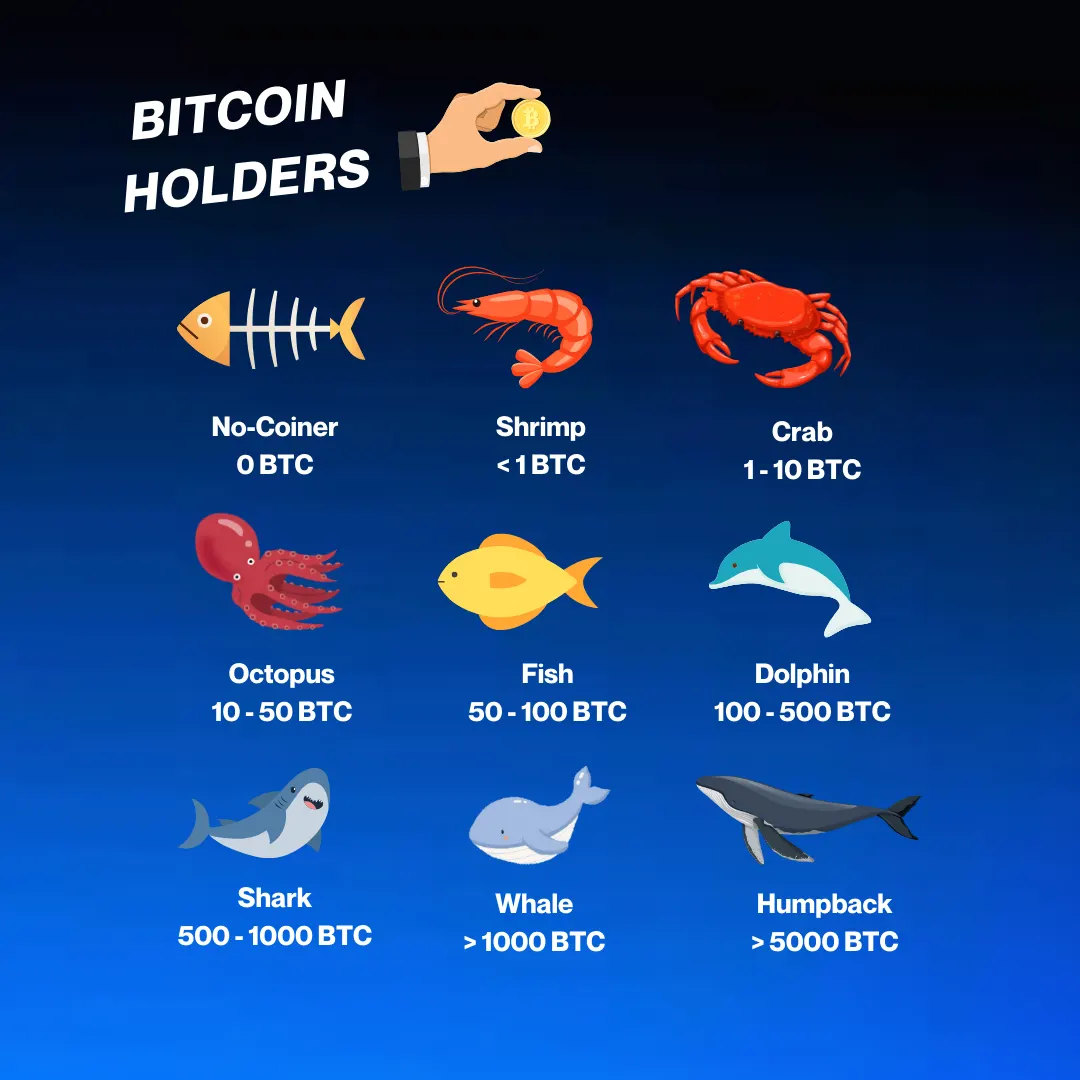

In one of the most dramatic moves witnessed in the cryptocurrency space this year, a Bitcoin whale that had remained dormant for seven years suddenly awakened on August 21, 2025, and immediately began rotating millions of dollars worth of Bitcoin into leveraged Ethereum positions. This wasn’t just any ordinary whale—this was an original gangster (OG) Bitcoin holder sitting on a staggering 14,837 BTC worth over $1.6 billion, who had diamond-handed their position through multiple market cycles without a single transaction.

The magnitude of this move sent shockwaves through the cryptocurrency community. In a matter of hours, this mysterious whale sold 670 Bitcoin worth approximately $76 million and used those funds to open massive leveraged long positions totaling 68,130 ETH valued at $295 million. But this was just the beginning. Over the following days, the whale continued their rotation strategy, ultimately selling over 3,142 BTC worth $356 million and accumulating a combined Ethereum position exceeding $577 million.

What makes this story particularly compelling is not just the scale of the transaction, but the timing and methodology behind it. This whale had weathered the crypto winter of 2018, the COVID-19 crash of 2020, the bull run of 2021, and the bear market of 2022-2023, never once moving their Bitcoin. Yet, just one week after Bitcoin reached a new all-time high of $124,128, they chose to break their seven-year silence and make one of the most aggressive rotations from Bitcoin to Ethereum ever recorded.

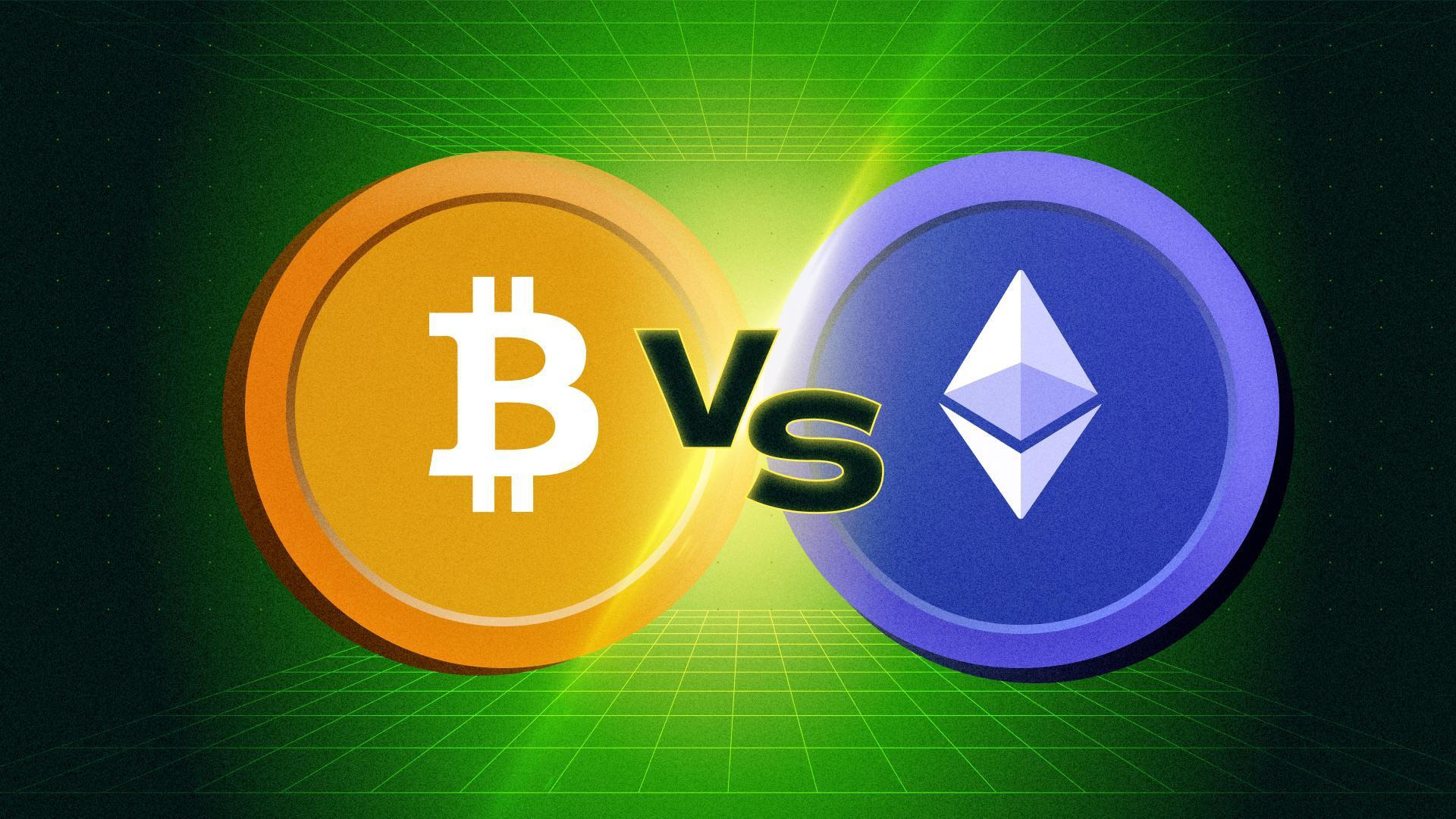

The question that has captivated the cryptocurrency community is simple yet profound: what drove this whale to abandon their Bitcoin maximalist position and bet big on Ethereum? The answer reveals deeper currents in the cryptocurrency market that could signal a fundamental shift in how institutional and sophisticated investors view the relative value proposition of Bitcoin versus Ethereum.

The Anatomy of a Whale: Understanding the Player Behind the Move

To understand the significance of this rotation, we must first examine the profile of the whale in question. This is not a newcomer to the cryptocurrency space or a speculative trader looking for quick gains. The on-chain data reveals a sophisticated investor who originally accumulated 100,784 BTC worth $642 million approximately seven years ago, primarily through purchases on major exchanges including Binance and HTX.

The whale’s acquisition timeline places their initial purchases around 2017-2018, during a period when Bitcoin was trading between $6,000 and $20,000. This timing suggests they were either early institutional adopters or high-net-worth individuals who recognized Bitcoin’s potential during its first major mainstream adoption cycle. The fact that they held through the subsequent bear market, when Bitcoin fell to as low as $3,200 in late 2018, demonstrates the kind of conviction and risk tolerance that characterizes true long-term believers.

What makes this whale particularly interesting is their complete dormancy over the seven-year period. Unlike many large Bitcoin holders who periodically move funds for security reasons, rebalancing, or partial profit-taking, this whale’s addresses showed zero activity. This pattern is characteristic of what the cryptocurrency community calls “diamond hands”—investors who refuse to sell regardless of market conditions, viewing their holdings as a long-term store of value rather than a trading instrument.

The whale’s holdings of 14,837 BTC at the time of the rotation represented approximately 0.07% of Bitcoin’s total supply, placing them among the top 100 Bitcoin addresses globally. At current prices, this position would rank them alongside some of the largest institutional Bitcoin holders, including publicly traded companies and investment funds. The decision to break such a significant accumulation pattern after seven years of unwavering commitment suggests that something fundamental had changed in their investment thesis.

The methodology of the rotation also reveals sophisticated trading knowledge. Rather than dumping their entire Bitcoin position at once, which could have caused significant market impact, the whale executed their strategy in measured tranches. They utilized Hyperliquid, a decentralized exchange known for its advanced derivatives trading capabilities, suggesting familiarity with cutting-edge DeFi protocols and sophisticated trading strategies.

The Transaction Breakdown: A Masterclass in Strategic Rotation

The whale’s rotation strategy unfolded over several days and demonstrated a level of sophistication that goes far beyond simple panic selling. The initial transaction on August 21 saw the whale sell 670.1 BTC for approximately $76 million, but this was just the opening move in a carefully orchestrated strategy that would ultimately involve hundreds of millions of dollars.

The proceeds from the Bitcoin sale were immediately deployed into Ethereum positions, but not through simple spot purchases. Instead, the whale opened leveraged long positions totaling 68,130 ETH with a notional value of $295 million. The leverage structure was particularly revealing: the majority of the position was opened with 10x leverage, while a smaller portion of 2,449 ETH was opened with 3x leverage. This suggests a high-conviction bet on Ethereum’s near-term price appreciation, with the whale willing to accept significant liquidation risk in exchange for amplified returns.

The timing of the initial rotation was strategically significant. The whale executed their first major transaction just as Bitcoin was experiencing a correction from its recent all-time high, selling at approximately $113,000 per Bitcoin. This timing suggests either exceptional market timing ability or access to information that suggested Bitcoin’s momentum was waning relative to Ethereum’s prospects.

Over the subsequent days, the whale continued their rotation strategy with additional transactions. According to blockchain analytics firm Lookonchain, the whale ultimately sold 3,142 BTC worth $356.47 million over a two-day period. The Ethereum accumulation was equally impressive, with the whale acquiring 55,039 ETH worth $237 million through spot trading and an additional 62,914 ETH worth $267 million through additional spot purchases.

The final position structure reveals the whale’s ultimate strategy: a combination of spot Ethereum holdings and leveraged long positions totaling 135,265 ETH with a notional value of approximately $577 million. This represents a complete transformation from a conservative, long-term Bitcoin holding strategy to an aggressive, leveraged bet on Ethereum’s outperformance.

The execution of these trades also demonstrates sophisticated understanding of market microstructure. By spreading the transactions across multiple days and utilizing both spot and derivatives markets, the whale minimized market impact while maximizing their ability to accumulate large positions. The use of Hyperliquid, a relatively new but technologically advanced decentralized exchange, suggests the whale was not only sophisticated in their market analysis but also technically proficient in navigating the latest DeFi infrastructure.

Market Context: The Perfect Storm for Rotation

Understanding the whale’s decision requires examining the broader market context in which this rotation occurred. The timing was not coincidental—it came at a moment when multiple factors were aligning to create what many analysts viewed as a potential inflection point between Bitcoin and Ethereum’s relative performance.

Bitcoin had just reached a new all-time high of $124,128 on August 14, 2025, representing a significant milestone that many long-term holders had been waiting for. However, the celebration was short-lived, as Bitcoin quickly entered a correction phase, falling to around $112,460 by the time the whale executed their first major transaction. This correction occurred against a backdrop of uncertainty surrounding Federal Reserve policy, with traders nervously awaiting Chairman Jerome Powell’s remarks at the Jackson Hole Symposium.

Ethereum, meanwhile, was displaying relative strength during the same period. While Bitcoin was correcting from its all-time high, Ethereum was approaching its own 2021 record of $4,878, showing resilience that caught the attention of institutional investors. The ETH/BTC ratio had been steadily improving, suggesting that capital was already beginning to rotate from Bitcoin to Ethereum even before the whale’s dramatic move.

The institutional landscape was also shifting in Ethereum’s favor. August 2025 had seen massive inflows into spot Ethereum ETFs, with institutional investors increasingly viewing Ethereum as a complementary or alternative allocation to Bitcoin. Companies like BitMine Immersion Technologies had been aggressively accumulating Ethereum, adding 52,475 ETH to bring their total holdings to 1.52 million tokens worth $6.6 billion. Other publicly traded companies, including SharpLink Gaming, BitDigital, The Ether Machine, and GameSquare, were also adding Ethereum to their corporate treasuries.

The derivatives market was providing additional signals of shifting sentiment. Ethereum futures on the Chicago Mercantile Exchange (CME) had reached record open interest of over $8.3 billion, marking the highest level ever recorded for ETH derivatives on the exchange. This institutional interest in Ethereum derivatives suggested that sophisticated investors were increasingly viewing Ethereum as a mature asset class worthy of significant allocation.

The broader cryptocurrency market was also showing signs of what many analysts termed “altcoin season”—a period when alternative cryptocurrencies outperform Bitcoin. Historical patterns suggest that such rotations often begin with large holders and institutional investors before trickling down to retail participants. The whale’s move could be seen as either a catalyst for or a confirmation of this broader trend.

The Psychology of Panic: Why Diamond Hands Finally Let Go

The characterization of the whale’s move as a “panic sell” might seem counterintuitive given the sophisticated execution and strategic timing. However, the decision to break a seven-year holding pattern and immediately rotate into leveraged positions suggests a fundamental shift in conviction that goes beyond normal portfolio rebalancing.

Several psychological factors likely contributed to the whale’s decision. First, the concept of opportunity cost had likely been weighing heavily on their mind. While Bitcoin had performed exceptionally well over the seven-year holding period, Ethereum had actually outperformed Bitcoin during several key periods, particularly during the DeFi summer of 2020 and the NFT boom of 2021. The whale may have been watching Ethereum’s ecosystem development with growing interest, finally reaching a tipping point where the potential for future outperformance outweighed their Bitcoin maximalist convictions.

The timing of the rotation, coming just after Bitcoin’s new all-time high, suggests that the whale may have been waiting for a psychological milestone before making their move. Reaching new highs often serves as a validation of long-term investment theses, providing the confidence needed to make major portfolio changes. The whale may have viewed Bitcoin’s new all-time high as the perfect exit opportunity, allowing them to realize the success of their seven-year bet while positioning for what they perceived as the next phase of cryptocurrency market evolution.

The choice to use leverage in the Ethereum positions reveals another psychological dimension: urgency. The whale wasn’t content to simply rotate from Bitcoin to Ethereum on a one-to-one basis. Instead, they chose to amplify their exposure through 10x leverage, suggesting they believed time was of the essence in capturing Ethereum’s potential outperformance. This urgency could stem from several factors, including upcoming Ethereum network upgrades, anticipated regulatory developments, or simply a belief that the market was on the verge of recognizing Ethereum’s superior fundamentals.

The whale’s complete dormancy over seven years also suggests a personality type that makes decisions infrequently but with high conviction. When such investors finally move, it often represents a fundamental shift in their worldview rather than tactical trading. The whale’s decision to not only sell Bitcoin but to immediately rotate into leveraged Ethereum positions suggests they had been contemplating this move for some time, waiting for the right moment to execute a complete strategic pivot.

Ethereum’s Compelling Value Proposition: What the Whale Saw

To understand why the whale chose Ethereum as their rotation target, we must examine the fundamental value proposition that Ethereum offers compared to Bitcoin. While Bitcoin has established itself as digital gold and a store of value, Ethereum has evolved into something far more complex and potentially valuable: a global computing platform that enables an entire ecosystem of decentralized applications, financial services, and digital assets.

The whale’s decision likely reflected a growing recognition that Ethereum’s utility extends far beyond simple value storage. The Ethereum network hosts the majority of decentralized finance (DeFi) protocols, which have grown to manage hundreds of billions of dollars in total value locked (TVL). This ecosystem includes lending protocols, decentralized exchanges, yield farming opportunities, and synthetic asset platforms that generate real economic activity and fees for the network.

Ethereum’s transition to proof-of-stake through “The Merge” in 2022 had also fundamentally altered its economic model. Unlike Bitcoin, which requires continuous energy expenditure for mining, Ethereum now operates on a more energy-efficient consensus mechanism that allows ETH holders to earn staking rewards. This creates a yield-bearing component to Ethereum ownership that Bitcoin lacks, potentially making it more attractive to institutional investors seeking income-generating assets.

The network’s upcoming upgrades and scaling solutions also present significant growth potential. Layer 2 solutions like Arbitrum, Optimism, and Polygon have been gaining traction, allowing Ethereum to process more transactions at lower costs while maintaining security. These developments address one of Ethereum’s primary limitations—scalability—while preserving its decentralized nature and security guarantees.

From an institutional adoption perspective, Ethereum offers several advantages over Bitcoin. The programmable nature of Ethereum allows for more sophisticated financial products and services, making it attractive to traditional financial institutions looking to build blockchain-based solutions. The success of Ethereum-based stablecoins, which represent the majority of stablecoin market capitalization, demonstrates the network’s utility for real-world financial applications.

The whale may have also been influenced by Ethereum’s superior developer activity and ecosystem growth. Ethereum consistently ranks at the top of developer activity metrics, with thousands of developers building applications on the platform. This developer mindshare often translates into innovation and network effects that can drive long-term value appreciation.

Institutional Validation: The Ethereum Treasury Trend

The whale’s rotation into Ethereum coincided with a broader trend of institutional Ethereum adoption that has been gaining momentum throughout 2025. This institutional validation likely played a significant role in the whale’s decision-making process, as it reduces the perceived risk of being an early adopter while confirming the investment thesis through the actions of other sophisticated investors.

BitMine Immersion Technologies has emerged as the most prominent example of corporate Ethereum adoption, building a treasury strategy focused specifically on Ethereum rather than Bitcoin. The company’s recent addition of 52,475 ETH brought their total holdings to 1.52 million tokens worth $6.6 billion, making them one of the largest corporate holders of Ethereum globally. This strategy represents a significant departure from the Bitcoin-focused treasury strategies popularized by companies like MicroStrategy, suggesting that institutional investors are increasingly viewing Ethereum as a legitimate treasury asset.

The success of spot Ethereum ETFs has provided another avenue for institutional adoption. August 2025 saw massive inflows into these products, with institutional investors increasingly viewing Ethereum as a complementary or alternative allocation to Bitcoin. The ETF structure allows traditional investors to gain Ethereum exposure through familiar investment vehicles, creating a steady stream of demand that wasn’t present in previous market cycles.

Other publicly traded companies have also begun adding Ethereum to their balance sheets. SharpLink Gaming made headlines with their acquisition of over $667 million in ETH, while companies like BitDigital, The Ether Machine, and GameSquare have also announced Ethereum treasury strategies. This trend suggests that corporate adoption of Ethereum is moving beyond early adopters to become a more mainstream corporate finance strategy.

The institutional derivatives market has also shown strong growth, with Ethereum futures on the Chicago Mercantile Exchange reaching record open interest levels. This institutional interest in Ethereum derivatives suggests that sophisticated investors are increasingly viewing Ethereum as a mature asset class worthy of significant allocation and risk management strategies.

The Leverage Gambit: High Risk, High Reward Strategy

One of the most striking aspects of the whale’s rotation was the decision to use significant leverage in their Ethereum positions. Rather than simply swapping Bitcoin for Ethereum on a one-to-one basis, the whale chose to amplify their exposure through 10x leverage on the majority of their position, with a smaller portion using 3x leverage. This decision reveals both the whale’s high conviction in Ethereum’s near-term prospects and their willingness to accept substantial liquidation risk.

The use of 10x leverage means that a 10% decline in Ethereum’s price would completely wipe out the leveraged portion of the whale’s position. Given Ethereum’s historical volatility, this represents a significant risk that only the most confident investors would be willing to accept. The whale’s decision to use such high leverage suggests they believed Ethereum was poised for significant near-term appreciation that would more than compensate for the additional risk.

The immediate aftermath of the whale’s position opening provided a stark reminder of these risks. Ethereum’s price dropped to $4,080 shortly after the positions were established, putting three of the whale’s positions within $300 of their liquidation prices of $3,699, $3,700, and $3,732. This near-miss with liquidation demonstrated both the risks inherent in leveraged trading and the whale’s willingness to accept such risks in pursuit of amplified returns.

The choice of Hyperliquid as the trading platform for these leveraged positions also reveals sophisticated understanding of the DeFi ecosystem. Hyperliquid is a relatively new but technologically advanced decentralized exchange that offers sophisticated derivatives trading capabilities. The platform’s use of an on-chain order book and advanced risk management features makes it attractive to institutional traders seeking to execute large, complex trades without the counterparty risk associated with centralized exchanges.

The leverage strategy also reflects a broader trend in institutional cryptocurrency trading toward more sophisticated risk management and return enhancement strategies. Rather than simply buying and holding cryptocurrencies, institutional investors are increasingly using derivatives, leverage, and complex trading strategies to optimize their risk-adjusted returns. The whale’s approach represents an evolution from the simple “HODL” strategy that characterized early Bitcoin adoption to a more nuanced approach that seeks to maximize returns while managing downside risk.

Market Impact and Immediate Consequences

The whale’s massive rotation had immediate and significant impacts on both Bitcoin and Ethereum markets, demonstrating the outsized influence that large holders can have on cryptocurrency price discovery and market sentiment. The $76 million Bitcoin sale, while representing only a small fraction of daily Bitcoin trading volume, occurred during a period of market uncertainty and likely contributed to additional selling pressure.

Bitcoin’s price action around the time of the whale’s initial transaction showed increased volatility, with the cryptocurrency struggling to maintain support above the $113,000 level. While it’s impossible to attribute Bitcoin’s weakness solely to the whale’s selling, the timing and scale of the transaction likely contributed to negative sentiment among other market participants. The psychological impact of seeing a seven-year holder finally capitulate may have been more significant than the actual selling pressure.

Ethereum, conversely, showed relative strength during the same period, with the whale’s massive accumulation providing significant buying pressure. The combination of spot purchases and leveraged long positions created substantial demand for Ethereum, helping to support the price even as broader cryptocurrency markets experienced volatility. Ethereum’s ability to maintain its price level despite the broader market uncertainty likely reinforced the whale’s conviction in their rotation strategy.

The derivatives markets also showed immediate reactions to the whale’s activity. Ethereum funding rates increased as the whale’s leveraged long positions contributed to overall long interest in the market. This increase in funding rates made it more expensive for other traders to maintain leveraged long positions, potentially discouraging additional speculative buying while rewarding those willing to take the other side of the trade.

The whale’s near-liquidation experience also provided a real-time demonstration of the risks associated with high-leverage trading in volatile markets. The fact that Ethereum’s price dropped to within $300 of the whale’s liquidation levels shortly after position establishment served as a reminder that even sophisticated investors with strong convictions can face significant losses when using leverage in volatile markets.

Broader Implications: A Signal of Market Evolution

The whale’s dramatic rotation from Bitcoin to Ethereum represents more than just an individual investment decision—it signals a potential evolution in how sophisticated investors view the cryptocurrency market and the relative value propositions of different digital assets. This move could mark the beginning of a broader rotation from Bitcoin to Ethereum among institutional and high-net-worth investors.

The timing of the rotation, coming just after Bitcoin reached new all-time highs, suggests that some long-term holders may view current levels as an opportune time to diversify into other cryptocurrency assets. This pattern of profit-taking from Bitcoin and rotation into alternative cryptocurrencies has historically marked the beginning of “altcoin seasons,” periods when alternative cryptocurrencies outperform Bitcoin.

The whale’s choice of Ethereum as their rotation target also validates the growing institutional narrative around Ethereum as a complementary or alternative investment to Bitcoin. While Bitcoin has established itself as digital gold and a store of value, Ethereum’s utility as a platform for decentralized applications and financial services offers a different value proposition that may be more attractive to investors seeking exposure to the broader cryptocurrency ecosystem.

The use of leverage in the rotation strategy also reflects the increasing sophistication of cryptocurrency markets and the availability of advanced trading tools and strategies. The whale’s ability to execute complex leveraged trades on decentralized exchanges demonstrates the maturation of DeFi infrastructure and its growing appeal to institutional investors.

From a market structure perspective, the whale’s move highlights the continued importance of large holders in cryptocurrency price discovery. Despite the growth of institutional adoption and retail participation, individual whales still possess the ability to significantly impact market dynamics through their trading decisions. This concentration of holdings remains a unique characteristic of cryptocurrency markets compared to traditional financial markets.

Risk Assessment: The Perils of Leveraged Conviction

While the whale’s rotation strategy demonstrates sophisticated market analysis and strong conviction, it also exposes them to significant risks that could result in substantial losses. The use of 10x leverage means that relatively small adverse price movements could result in complete loss of the leveraged portion of their position, representing hundreds of millions of dollars in potential losses.

The immediate aftermath of the position opening provided a stark reminder of these risks. Ethereum’s decline to $4,080 brought the whale’s positions dangerously close to liquidation, with three positions coming within $300 of their liquidation prices. This near-miss demonstrates that even sophisticated investors with strong fundamental convictions can face significant losses when market volatility exceeds expectations.

The correlation between Bitcoin and Ethereum during periods of market stress also presents additional risks to the whale’s strategy. While Ethereum has shown relative strength during normal market conditions, both assets tend to move in the same direction during periods of significant market stress or macroeconomic uncertainty. This correlation could limit the diversification benefits of the rotation and expose the whale to similar risks they faced with their Bitcoin holdings.

Regulatory risks also present potential challenges to the whale’s strategy. Changes in cryptocurrency regulation, particularly those affecting Ethereum’s status as a security or the operation of DeFi protocols, could significantly impact Ethereum’s price and the whale’s ability to maintain their leveraged positions. The whale’s use of decentralized exchanges and DeFi protocols also exposes them to smart contract risks and potential protocol failures.

The liquidity risks associated with such large positions also deserve consideration. While the whale was able to accumulate their Ethereum positions during a period of normal market conditions, unwinding such large leveraged positions during periods of market stress could prove challenging and potentially result in significant slippage and market impact.

The Ripple Effect: Inspiring Institutional Rotation

The whale’s dramatic rotation has already begun to inspire similar moves among other institutional and high-net-worth investors, creating a potential ripple effect that could accelerate the trend of Bitcoin-to-Ethereum rotation. The visibility of the whale’s move, combined with its sophisticated execution and strong conviction, has provided a template for other large holders considering similar strategies.

Several other whales have been observed making similar moves in the days following the initial rotation. Blockchain analytics firms have identified additional large Bitcoin holders moving funds to exchanges and accumulating Ethereum positions, suggesting that the original whale’s move may have catalyzed broader rotation activity. This copycat behavior is common in cryptocurrency markets, where the actions of sophisticated investors are closely watched and often emulated by others.

The institutional response has also been notable, with several cryptocurrency investment funds and family offices reportedly increasing their Ethereum allocations relative to Bitcoin. The whale’s move has provided additional validation for investment committees and risk management teams that may have been considering similar allocation changes but needed additional confirmation of the strategy’s viability.

The media attention surrounding the whale’s move has also contributed to broader awareness of Ethereum’s investment merits among institutional investors who may have previously focused primarily on Bitcoin. The narrative of a sophisticated, long-term Bitcoin holder choosing to rotate into Ethereum has resonated with institutional investors seeking to understand the evolving cryptocurrency landscape.

Future Implications: What This Means for Crypto Markets

The whale’s rotation from Bitcoin to Ethereum could mark the beginning of a significant shift in cryptocurrency market dynamics, with implications that extend far beyond the immediate price impacts on both assets. This move represents a potential inflection point in how institutional and sophisticated investors view the relative merits of different cryptocurrency investments.

If the whale’s strategy proves successful and Ethereum outperforms Bitcoin over the coming months, it could accelerate the trend of institutional rotation from Bitcoin to Ethereum. This could lead to a sustained period of Ethereum outperformance, similar to previous “altcoin seasons” but driven by institutional rather than retail demand. Such a rotation could fundamentally alter the market capitalization rankings and relative valuations of major cryptocurrencies.

The success of leveraged Ethereum strategies could also encourage the development of more sophisticated cryptocurrency investment products and strategies. Traditional financial institutions may begin offering leveraged Ethereum exposure through structured products, ETFs, or other investment vehicles, making such strategies accessible to a broader range of institutional investors.

The whale’s use of decentralized exchanges and DeFi protocols for their rotation also highlights the growing institutional adoption of decentralized finance. As more institutional investors become comfortable with DeFi protocols, it could drive significant additional capital into the Ethereum ecosystem and further validate Ethereum’s utility as a platform for financial innovation.

From a technological perspective, the whale’s move could accelerate development and adoption of Ethereum scaling solutions and infrastructure improvements. The attention and capital flowing into the Ethereum ecosystem could fund additional research and development, potentially solving some of the network’s current limitations and further enhancing its value proposition.

Conclusion: The Dawn of a New Era

The awakening of a $1.6 billion Bitcoin whale after seven years of dormancy and their immediate rotation into leveraged Ethereum positions represents one of the most significant individual investment moves in cryptocurrency history. This dramatic shift from diamond-handed Bitcoin maximalism to aggressive Ethereum speculation signals a potential evolution in how sophisticated investors view the cryptocurrency landscape.

The whale’s decision was not made in isolation but reflects broader trends in institutional cryptocurrency adoption, Ethereum ecosystem development, and the maturation of DeFi infrastructure. The timing of the move, coming just after Bitcoin reached new all-time highs and as Ethereum approaches its own records, suggests a sophisticated understanding of market cycles and relative value opportunities.

While the whale’s use of significant leverage introduces substantial risks, their willingness to accept such risks demonstrates extraordinary conviction in Ethereum’s near-term prospects. The near-liquidation experience shortly after position establishment serves as a reminder of the volatility and risks inherent in cryptocurrency markets, even for the most sophisticated investors.

The broader implications of this move extend far beyond the immediate market impacts. The whale’s rotation could catalyze similar moves among other institutional investors, potentially marking the beginning of a sustained period of capital rotation from Bitcoin to Ethereum. This shift could fundamentally alter the cryptocurrency market landscape and accelerate the adoption of more sophisticated investment strategies and products.

As the cryptocurrency market continues to mature and evolve, the actions of sophisticated investors like this whale provide valuable insights into the changing dynamics and emerging opportunities within the space. Whether this rotation proves to be a prescient move or a costly mistake will likely be determined over the coming months, but its impact on market sentiment and institutional behavior has already begun to reshape the cryptocurrency investment landscape.

The great awakening of this Bitcoin whale may well mark the dawn of a new era in cryptocurrency investing, where utility and ecosystem development begin to matter as much as, or more than, simple store-of-value narratives. For investors and market participants, the whale’s bold move serves as both inspiration and warning—a reminder of the potential rewards and risks that define the ever-evolving world of cryptocurrency investment.

References

[1] Cointelegraph. “Bitcoin whale who held for 7 years sells $76M to go long on Ether.” Cointelegraph, August 21, 2025. https://cointelegraph.com/news/bitcoin-whale-dumps-btc-for-295m-eth-long-position

[2] U.Today. “Bitcoin Whale Suddenly Pivots to Ethereum After Exiting 7 Years of Dormancy.” U.Today, August 22, 2025. https://u.today/bitcoin-whale-suddenly-pivots-to-ethereum-after-exiting-7-years-of-dormancy

[3] ZyCrypto. “Bitcoin OG Dumps $76 Million BTC After 7 Years Of HODLing To Go Long On Ether.” ZyCrypto, August 21, 2025. https://zycrypto.com/bitcoin-og-dumps-76-million-btc-after-7-years-of-hodling-to-go-long-on-ether/