Author: everythingcryptoitclouds.com

Introduction: The Convergence of Crypto and Traditional Finance

The narrative surrounding cryptocurrency is rapidly evolving. While the early years were dominated by speculative trading and decentralized finance (DeFi) experiments, 2026 is poised to be the year of Real-World Asset (RWA) Tokenization. This is the process of issuing blockchain-based tokens that represent ownership claims on tangible assets—from real estate and fine art to corporate bonds and private equity. This movement is not just a crypto trend; it is a fundamental restructuring of global finance, creating a seamless bridge between the multi-trillion-dollar traditional economy and the efficiency of decentralized ledgers [1].

The Tokenization Imperative: Unlocking Illiquid Value

Tokenization is the mechanism that unlocks value previously trapped in illiquid markets. By converting assets into digital tokens, it solves critical problems that have plagued traditional finance for decades: lack of liquidity, high transaction costs, and limited accessibility.

The process typically involves:

- Legal Structuring: Ensuring the token legally represents the underlying asset.

- Token Issuance: Minting the digital tokens on a blockchain (often Ethereum or a Layer 2 solution).

- On-Chain Management: Using smart contracts to automate governance, dividend payouts, and compliance [2].

The Institutional Floodgate: BlackRock and Regulatory Clarity

The explosive growth forecast for RWA tokenization is being driven primarily by institutional adoption and a rapidly clarifying regulatory environment.

Major financial players, including BlackRock, are not just observing this trend—they are actively leading it. BlackRock is advancing tokenized Exchange-Traded Funds (ETFs), with the first generation of these on-chain products expected to appear by late 2025 or early 2026 [3]. When the world’s largest asset manager embraces a technology, it signals a profound shift in market confidence.

Furthermore, the outlook for regulatory clarity in the U.S. is highly optimistic for 2026. As the Grayscale 2026 Digital Asset Outlook suggests, bipartisan crypto market structure legislation is expected to cement blockchain-based finance in U.S. capital markets, facilitating continued institutional investment [4]. This clarity is the key that unlocks the massive pools of institutional capital waiting on the sidelines.

Market Potential: From Billions to Trillions

The current tokenized asset market is small, representing only about 0.01% of the global equity and bond market capitalization. However, the growth trajectory is steep. While some conservative forecasts place the market at over $612 billion by the end of 2026, more aggressive estimates suggest the total value of tokenized assets could soar to $10 trillion in the coming years [5] [6].

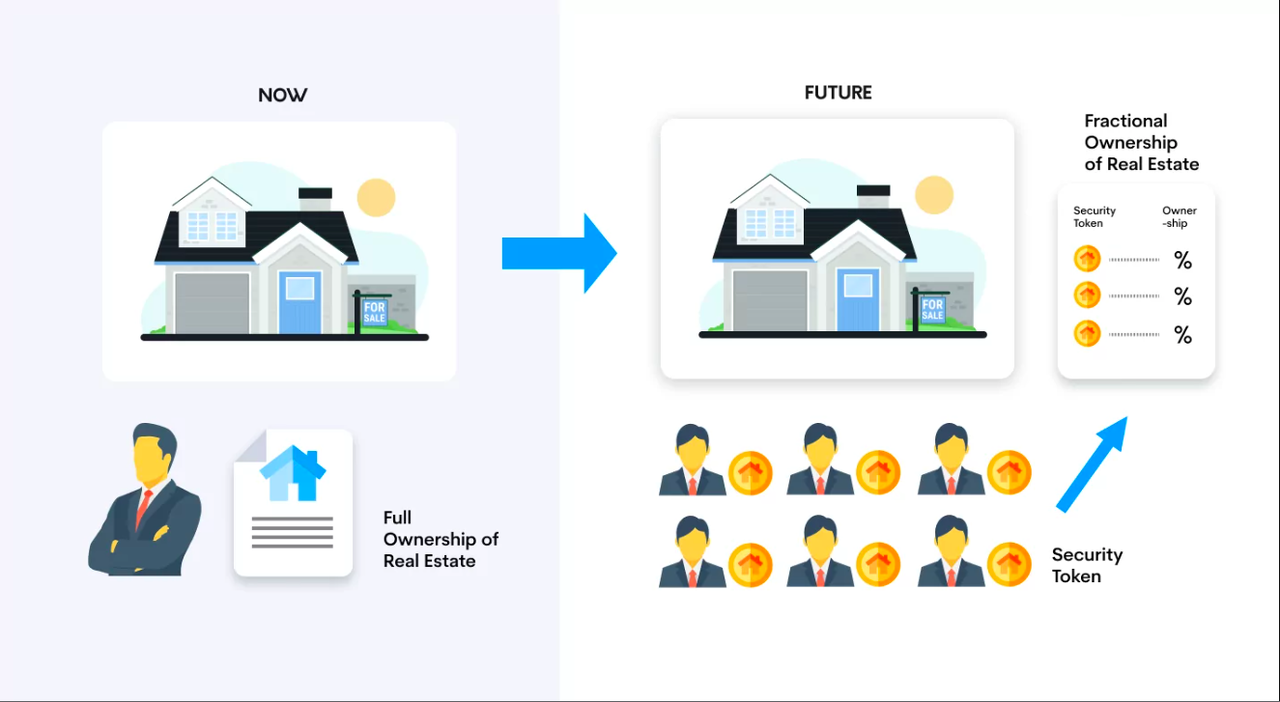

The Power of Fractional Ownership

One of the most transformative aspects of RWA tokenization is the democratization of investment through fractional ownership. Historically, high-value assets like commercial real estate or rare art were only accessible to wealthy individuals or large institutions. Tokenization breaks these assets into thousands of digital pieces, allowing anyone to participate with a small investment [7]. This not only broadens the investor base but also provides the original asset owner with a much wider pool of capital for faster fundraising.

Conclusion: The Future of Finance is On-Chain

The year 2026 will solidify RWA tokenization as the most significant crypto trend for institutional and retail investors alike. It represents the maturation of blockchain technology, moving beyond purely digital assets to fundamentally improve the efficiency, liquidity, and accessibility of the world’s most valuable assets. The convergence of institutional demand, regulatory progress, and the superior technology of decentralized ledgers is building a $10 trillion bridge between traditional finance and the crypto economy. For those looking for the next major wave in crypto, the tokenization of the real world is it.

References

[1] RWA.io. Tokenized Assets Opportunities for 2026. [URL: https://www.rwa.io/post/tokenized-assets-opportunities-for-2026%5D

[2] Medium. A Comprehensive Guide to Real-World Asset Tokenization. [URL: https://medium.com/@wisewaytec/why-real-world-asset-tokenization-are-the-future-of-finance-in-2026-cb5672f5a6cc%5D

[3] FinTech Weekly. BlackRock Advances Tokenized ETFs Amid Push for Regulation Clarity. [URL: https://www.fintechweekly.com/magazine/articles/blackrock-tokenized-etfs-regulation-clarity%5D

[4] Grayscale. 2026 Digital Asset Outlook: Dawn of the Institutional Era. [URL: https://research.grayscale.com/reports/2026-digital-asset-outlook-dawn-of-the-institutional-era%5D

[5] Medium. Why Real-World Asset Tokenization Are the Future of Finance in 2026. [URL: https://medium.com/@wisewaytec/why-real-world-asset-tokenization-are-the-future-of-finance-in-2026-cb5672f5a6cc%5D

[6] RWA.io. RWA Tokenization Investment for 2026. [URL: https://www.rwa.io/post/rwa-tokenization-investment-for-2026%5D

[7] Forbes. How Real-World Asset Tokenization Is Reshaping Modern Industries. [URL: https://www.forbes.com/councils/forbestechcouncil/2025/12/04/how-real-world-asset-tokenization-is-reshaping-modern-industries/%5D