Published by everythingcryptoitclouds.com | August 25, 2025

In the fast-paced world of cryptocurrency, few events test a project’s resilience and commitment to its community like a major technical crisis. On August 11, 2025, the Shiba Inu ecosystem faced exactly such a moment when the LEASH token experienced an unexpected 10% supply increase, shattering years of promises about fixed tokenomics and triggering widespread community concern [1]. What followed, however, has become a masterclass in crisis management, technical innovation, and community empowerment that could reshape how cryptocurrency projects handle governance and trust issues.

The launch of LEASH v2 represents far more than a simple technical fix—it embodies a fundamental transformation in how one of the world’s most recognizable meme coin ecosystems approaches decentralization, transparency, and community governance. This comprehensive overhaul addresses not only the immediate technical problems that caused the supply controversy but also establishes new standards for token design, migration processes, and decentralized decision-making that could influence the broader cryptocurrency industry.

The story of LEASH v2 begins with a crisis that could have destroyed community trust permanently. Instead, it has become a testament to the power of transparent communication, technical excellence, and genuine commitment to decentralized governance. The Shiba Inu development team, led by Kaal Dhairya, has transformed what could have been a catastrophic failure into an opportunity to build stronger, more resilient infrastructure that puts community control at its very foundation.

The implications of this transformation extend far beyond the Shiba Inu ecosystem itself. As cryptocurrency markets mature and institutional adoption accelerates, the standards for token governance, transparency, and community empowerment continue to evolve. LEASH v2 represents a significant step forward in these areas, demonstrating how projects can maintain their decentralized ethos while implementing the technical rigor and governance structures necessary for long-term sustainability and growth.

Understanding the LEASH v2 launch requires examining not just the technical solutions implemented, but also the broader context of cryptocurrency governance evolution, the specific challenges faced by rebase tokens, and the innovative approaches developed to ensure fair migration processes. This comprehensive analysis explores every aspect of this transformation, from the initial crisis through the technical architecture of the solution to the long-term implications for cryptocurrency governance and community empowerment.

The Genesis of Crisis: Understanding the LEASH v1 Supply Controversy

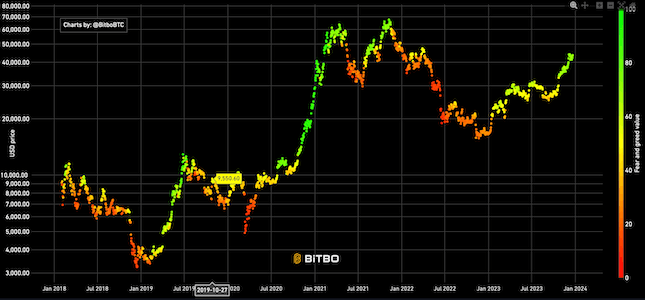

The LEASH token controversy that erupted on August 11, 2025, represents one of the most significant governance crises in the history of major cryptocurrency projects. To understand the magnitude of this event and the comprehensive response it generated, we must first examine the original design philosophy of LEASH v1, the technical mechanisms that led to the crisis, and the immediate community response that demanded fundamental changes to the token’s architecture and governance structure.

LEASH was originally launched in 2022 as part of the Shiba Inu ecosystem’s expansion beyond the original SHIB token, designed to serve as a governance token that would help decentralize decision-making within the ecosystem [2]. The token was marketed with specific promises about its supply mechanics, most notably that it would have a fixed supply with rebasing disabled, creating scarcity that would theoretically drive value appreciation over time. These promises became central to the token’s value proposition and attracted investors who specifically sought exposure to a scarce asset within the popular Shiba Inu ecosystem.

The rebase mechanism that was originally built into LEASH v1 was intended to be a temporary feature that would be disabled once certain conditions were met. Rebasing, for those unfamiliar with the concept, is a mechanism where the total supply of tokens automatically adjusts based on predetermined conditions, typically related to price or demand metrics. While rebasing can serve legitimate purposes in certain tokenomic designs, it introduces complexity and unpredictability that many investors find concerning, particularly when the mechanisms are not fully transparent or when control over rebasing remains centralized.

For years leading up to the August 2025 incident, the Shiba Inu team had consistently communicated that LEASH rebasing had been disabled and that the token supply was fixed. This messaging became a cornerstone of the token’s marketing and value proposition, with community members and investors making financial decisions based on the assumption that supply inflation was no longer possible. The ecosystem’s documentation, social media communications, and official statements all reinforced this narrative, creating strong expectations about the token’s scarcity characteristics.

The events of August 11, 2025, shattered these expectations in dramatic fashion. Without warning or prior communication, the LEASH token supply increased by approximately 10%, adding roughly 10,765 tokens to the total supply [3]. This increase occurred through the rebase mechanism that the community believed had been permanently disabled, creating immediate confusion and concern about the technical integrity of the token and the transparency of the development team’s communications.

The immediate market reaction was swift and severe. LEASH token holders, many of whom had invested specifically because of the promised supply scarcity, began selling their positions en masse. The unexpected supply increase not only diluted existing holdings but also raised fundamental questions about the centralized control mechanisms that still existed within the token’s architecture. Social media channels exploded with criticism, demands for explanations, and calls for immediate action to address what many community members viewed as a breach of trust.

The technical implications of the supply increase extended beyond simple dilution effects. The rebase mechanism created significant complications for liquidity providers on decentralized exchanges, particularly those using Uniswap V3 and ShibaSwap V2. These platforms’ liquidity accounting systems were not designed to handle rebasing tokens effectively, leading to situations where rebased tokens could become trapped in liquidity pools without properly accruing to liquidity provider shares. This technical complexity added another layer of concern for sophisticated users who understood the potential for permanent value loss in these scenarios.

Perhaps most damaging to community trust was the perception that the supply increase represented a form of centralized manipulation. The fact that rebasing could still occur despite years of messaging to the contrary suggested that centralized control mechanisms remained active within the token’s architecture. This revelation contradicted the decentralized governance narrative that had become central to the Shiba Inu ecosystem’s identity and raised questions about what other centralized controls might still exist within the system.

The community response was unprecedented in its intensity and organization. Long-time LEASH holders organized coordinated efforts to demand transparency, accountability, and immediate action to address the crisis. Social media campaigns, community calls, and organized selling pressure created a perfect storm of negative sentiment that threatened to permanently damage the Shiba Inu ecosystem’s reputation. The crisis extended beyond LEASH itself, as confidence in the broader ecosystem’s governance and technical competence came under scrutiny.

Kaal Dhairya, the lead developer for the Shiba Inu ecosystem, found himself at the center of this storm. The community demanded not just explanations but concrete actions to prevent future incidents and restore trust in the ecosystem’s governance mechanisms. The pressure was immense, as the crisis threatened to undermine years of ecosystem development and community building that had made Shiba Inu one of the most recognizable names in cryptocurrency.

The technical investigation that followed revealed the complexity of the underlying issues. The rebase mechanism had indeed been triggered, but the exact conditions and controls that allowed this to happen required careful analysis to understand and address. The investigation also revealed the broader architectural challenges inherent in rebase token designs, particularly when combined with modern DeFi infrastructure that assumes more predictable token supply mechanics.

This crisis moment became a defining test for the Shiba Inu ecosystem. The response could either restore community trust through transparent action and technical excellence, or it could permanently damage the project’s reputation and community cohesion. The decision to develop LEASH v2 as a comprehensive solution rather than attempting quick fixes or superficial changes demonstrated a commitment to addressing the root causes of the crisis rather than merely managing its symptoms.

Technical Architecture Revolution: Building LEASH v2 for Transparency and Security

The development of LEASH v2 represents a fundamental reimagining of token architecture, prioritizing transparency, security, and community control over the complex mechanisms that characterized its predecessor. The technical design philosophy underlying LEASH v2 reflects lessons learned not only from the supply controversy but also from broader trends in cryptocurrency development toward simpler, more auditable, and more predictable token designs that can support institutional adoption while maintaining decentralized governance principles.

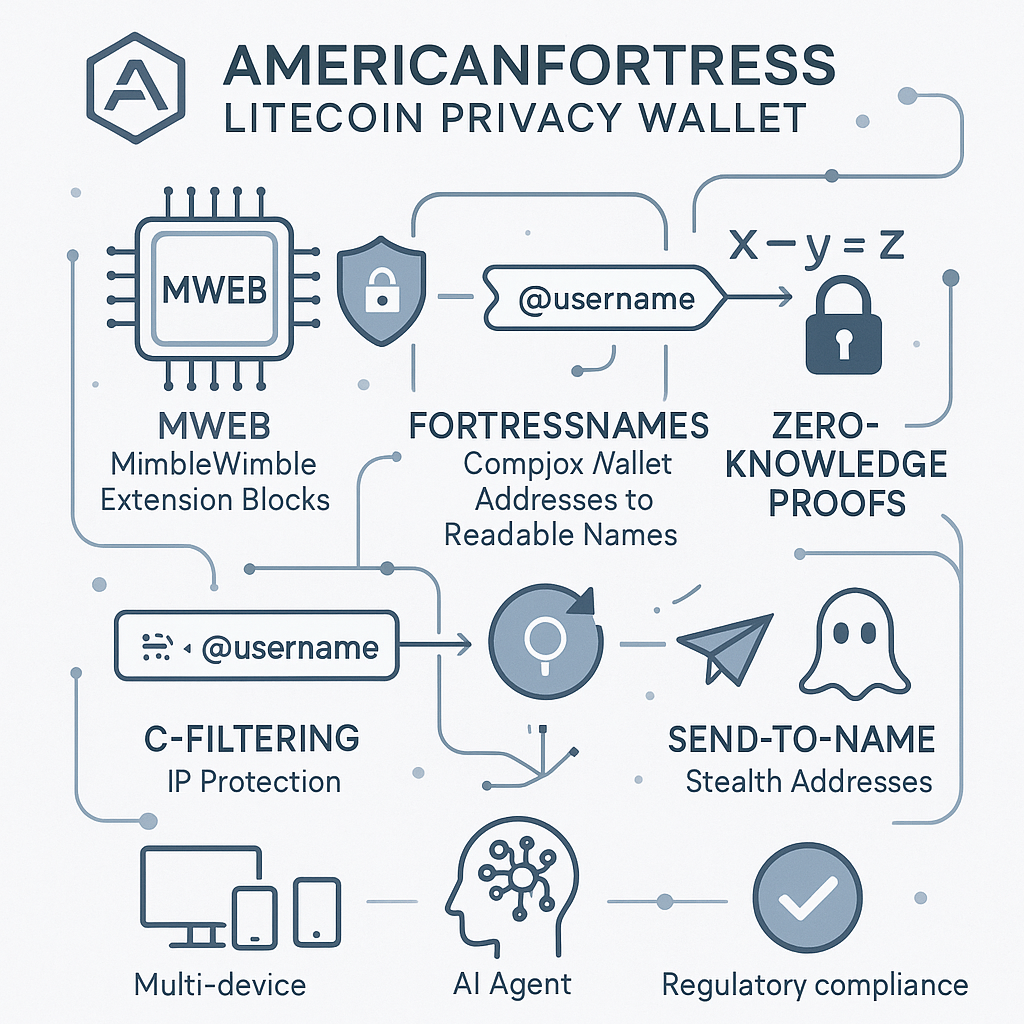

The core architectural decision that defines LEASH v2 is the complete elimination of any minting capabilities within the system. Unlike LEASH v1, which retained rebase mechanisms that could alter supply under certain conditions, LEASH v2 implements a “no mint” design where the total token supply is pre-minted at deployment and held in a multisignature wallet [4]. This approach removes any possibility of unauthorized supply increases while maintaining the flexibility needed for the migration process and future governance decisions about token burning.

The technical implementation leverages battle-tested OpenZeppelin libraries, specifically implementing ERC-20 standard functionality with ERC20Permit and ERC20Burnable extensions. This choice represents a deliberate move toward simplicity and proven security rather than custom implementations that might introduce novel attack vectors or unexpected behaviors. The ERC20Permit extension enables gasless transactions through meta-transactions, improving user experience, while ERC20Burnable provides the capability for explicit token burning, including the planned post-migration burn of any unclaimed supply.

The migration mechanism itself represents an innovative approach to token transitions that prioritizes fairness and verifiability. Rather than using complex snapshot systems that might exclude certain users or create technical complications, LEASH v2 implements a ratio-based conversion system using the public formula R = S₀ / S₁, where S₀ represents the intended original supply and S₁ represents the current total supply of LEASH v1 [5]. This mathematical approach ensures that all holders are treated equitably based on their actual holdings at the time of migration, regardless of when they acquired their tokens or how the rebase events affected their balances.

The migrator contract architecture deserves particular attention for its security-focused design. The contract cannot mint new LEASH v2 tokens under any circumstances, instead relying on pre-approved allowances from the multisignature wallet that holds the pre-minted supply. When users migrate their LEASH v1 tokens, the migrator contract verifies their holdings, applies the public ratio calculation, and transfers the appropriate amount of LEASH v2 from the multisig wallet to the user’s address. This design ensures that every LEASH v2 token distributed through migration can be traced to the original pre-minted supply, providing complete transparency and auditability.

The three-phase migration plan addresses the technical complexities introduced by different types of token holdings and platform integrations. Phase 1 handles standard holders, stakers, and liquidity providers on Uniswap V2 and ShibaSwap V1, where the ratio-based conversion can be applied directly without additional complications. The decision to remove veLEASH withdrawal penalties during the incident window demonstrates the team’s commitment to ensuring that users are not penalized for circumstances beyond their control.

Phase 2 addresses the more complex scenario of Uniswap V3 and ShibaSwap V2 liquidity providers, where rebase events do not properly accrue to liquidity provider shares. This technical limitation of concentrated liquidity platforms creates situations where rebased tokens can become trapped in pools, requiring targeted snapshot approaches to ensure fair value recovery. The migration system provides multiple options for these users, including direct migration through approved contracts or proof-of-withdrawal systems that verify actual token recovery before minting equivalent LEASH v2 amounts.

Phase 3 extends the migration to bridged holdings on Shibarium and other layer-2 solutions, requiring coordination with bridge operators to ensure seamless transitions across different blockchain environments. This cross-chain complexity demonstrates the comprehensive nature of the LEASH v2 solution, addressing not just the immediate supply controversy but also the broader technical challenges of maintaining token consistency across multiple blockchain environments.

The security audit strategy for LEASH v2 reflects industry best practices while addressing the specific concerns raised by the supply controversy. Despite using proven OpenZeppelin libraries, the team has commissioned a comprehensive audit of the entire system, including the token contract, migrator contract, and any specialized adapters used for liquidity provider and bridge migrations. This audit approach recognizes that even when using proven components, the integration and interaction patterns can introduce novel risks that require independent verification.

The audit scope extends beyond traditional smart contract security to include the mathematical correctness of the ratio calculations, the proper implementation of allowance patterns, and the security of the post-migration burn procedures. This comprehensive approach ensures that all aspects of the LEASH v2 system have been independently verified, providing additional assurance to community members who may remain skeptical following the LEASH v1 controversy.

One of the most innovative aspects of the LEASH v2 architecture is its preparation for future privacy features through integration with emerging confidential token standards. While LEASH v2 launches as a standard ERC-20 token to maximize compatibility and minimize complexity, the architecture is designed to support future wrapping into confidential tokens using Fully Homomorphic Encryption (FHE) standards being developed in collaboration with OpenZeppelin [6]. This forward-looking approach ensures that LEASH v2 can evolve with advancing privacy technology without requiring additional disruptive migrations.

The governance integration within the LEASH v2 architecture represents perhaps the most significant departure from traditional token designs. Rather than embedding governance mechanisms directly within the token contract, LEASH v2 implements a separation of concerns where the token itself remains simple and predictable while governance functions are handled through the Shiba Inu DAO. This architectural decision ensures that governance evolution can occur without affecting the core token functionality, reducing the risk of governance-related vulnerabilities or unexpected behaviors.

The multisignature wallet design that holds the pre-minted LEASH v2 supply incorporates multiple layers of security and transparency. The wallet requires multiple signatures for any transaction, preventing single points of failure or unauthorized access. All transactions from this wallet are publicly visible on the blockchain, providing complete transparency about token distribution during the migration process. The planned post-migration burn of any unclaimed tokens will also be executed through this multisig, ensuring that the final supply reduction is verifiable and irreversible.

The Migration Masterplan: Ensuring Fairness Through Mathematical Precision

The LEASH v2 migration process represents one of the most sophisticated and equitable token transition mechanisms ever implemented in the cryptocurrency space. The mathematical framework underlying this migration addresses not only the immediate need to transition users from the problematic LEASH v1 to the improved LEASH v2, but also establishes new standards for how token migrations can be conducted fairly and transparently, even in the aftermath of controversial supply events.

The holder-equivalence principle that governs the migration process is elegantly simple in concept yet sophisticated in implementation. The core mathematical relationship R = S₀ / S₁ creates a universal conversion ratio that treats all token holders equitably regardless of when they acquired their tokens or how rebase events may have affected their balances over time [7]. This approach recognizes that the fundamental injustice of the supply controversy was not the rebase event itself, but rather the lack of transparency and community control over such events.

The mathematical precision of this approach becomes apparent when examining specific scenarios that holders might face during migration. Consider a holder who originally purchased 100 LEASH tokens before any rebase events occurred. If rebasing increased their balance to 150 tokens, and the conversion ratio R equals 2/3 (representing a scenario where the current supply is 1.5 times the intended supply), their migration would yield 150 × 2/3 = 100 LEASH v2 tokens, effectively restoring their original position. This mathematical relationship ensures that holders who maintained their positions through the controversy are “made whole” regardless of the artificial supply inflation they experienced.

The migration framework also addresses more complex scenarios involving partial sales or strategic trading around rebase events. A holder who originally had 100 tokens, saw their balance increase to 150 through rebasing, but then sold 50 tokens, would migrate their remaining 100 tokens to receive 100 × 2/3 = 66.67 LEASH v2 tokens. This outcome reflects the economic reality that they chose to realize some value during the rebase period, and the migration preserves the proportional relationship between their current holdings and the intended token economics.

Perhaps most importantly, the migration mechanism addresses the scenario of post-rebase buyers who acquired LEASH v1 tokens after the supply controversy began. These buyers, who may have purchased tokens at prices that already reflected the inflated supply, receive the same ratio-based conversion as all other holders. This approach ensures that the migration process does not create arbitrary winners and losers based on timing, instead applying consistent mathematical principles that preserve the relative economic positions of all participants.

The technical implementation of the migration process incorporates multiple safeguards to ensure accuracy and prevent manipulation. Each migration transaction is recorded on the blockchain with complete transparency, allowing community members to verify that the ratio calculations are being applied correctly. The migrator contract includes extensive validation logic to prevent double-migrations, ensure proper token burning of LEASH v1, and verify that LEASH v2 distributions match the mathematical specifications exactly.

The three-phase structure of the migration process reflects the technical complexities of modern DeFi infrastructure while maintaining the mathematical consistency of the holder-equivalence principle. Phase 1 addresses the straightforward cases of direct token holders, stakers, and traditional liquidity providers where the ratio can be applied directly without additional complications. The removal of veLEASH withdrawal penalties during the migration window demonstrates how the process prioritizes fairness over rigid adherence to original staking terms that may have become inappropriate given the circumstances.

Phase 2’s handling of Uniswap V3 and ShibaSwap V2 liquidity providers represents one of the most technically sophisticated aspects of the migration process. These concentrated liquidity platforms create unique challenges because rebase events do not properly flow through to liquidity provider positions, potentially trapping rebased tokens in pools where they cannot be recovered by the original providers. The migration process addresses this through targeted snapshots that capture the true economic position of liquidity providers before rebase complications occurred.

The snapshot approach for concentrated liquidity positions requires careful coordination between the migration system and the underlying DEX protocols. Liquidity providers can choose between direct migration through approved contracts that handle the complexity automatically, or proof-of-withdrawal systems where providers first withdraw their liquidity, demonstrate the actual tokens recovered, and then receive proportional LEASH v2 amounts based on their proven holdings. This flexibility ensures that all liquidity providers can participate in the migration regardless of their technical sophistication or preferred interaction methods.

Phase 3’s extension to bridged holdings on Shibarium and other layer-2 solutions demonstrates the comprehensive scope of the migration process. Cross-chain token holdings present unique challenges because the migration must coordinate between different blockchain environments while maintaining the mathematical consistency of the holder-equivalence principle. The solution involves collaboration with bridge operators to ensure that LEASH v1 tokens on secondary chains are properly accounted for and that equivalent LEASH v2 tokens are distributed on the appropriate networks.

The verification mechanisms built into the migration process provide multiple layers of assurance that the mathematical principles are being followed correctly. Community members can independently verify migration transactions by checking the blockchain records against the published ratio and migration rules. The development team has committed to maintaining a public dashboard that tracks migration progress, shows the current ratio calculations, and provides real-time transparency about the process.

Exchange coordination represents one of the most challenging aspects of the migration process, requiring negotiation with multiple platforms that have different technical capabilities and business priorities. The migration framework accommodates this reality by providing exchanges with clear technical specifications, test vectors for validation, and flexible implementation options that can work within existing exchange infrastructure. The public ratio system ensures that exchanges can implement the migration independently while maintaining consistency with the broader migration process.

The self-custody portal developed for users whose exchanges choose not to participate in the migration represents a crucial safety net that ensures no holder is excluded from the process due to platform decisions beyond their control. This portal implements the same mathematical principles and security measures as the main migration system while providing a user-friendly interface for direct interaction with the migration contracts.

The post-migration burn mechanism for unclaimed tokens represents the final component of the migration masterplan, ensuring that the total LEASH v2 supply reflects only the tokens actually claimed by legitimate holders. The Shiba Inu DAO will ultimately decide whether to implement a migration cutoff date or maintain the process indefinitely, but any unclaimed tokens remaining in the multisig wallet can be provably burned to reduce the total supply. This mechanism ensures that the final tokenomics of LEASH v2 accurately reflect the actual participation in the migration process rather than theoretical maximum distributions.

Governance Revolution: Empowering the Shiba Inu DAO

The transformation of governance structures within the Shiba Inu ecosystem through the LEASH v2 launch represents one of the most significant shifts toward genuine decentralized autonomous organization (DAO) control in the history of major cryptocurrency projects. This governance revolution addresses not only the immediate concerns raised by the supply controversy but also establishes a framework for community-driven decision-making that could serve as a model for other projects seeking to balance innovation with democratic accountability.

The Shiba Inu DAO’s expanded role in the LEASH v2 ecosystem represents a fundamental departure from the centralized decision-making structures that characterized the original token design. Under the new governance framework, the DAO holds exclusive authority over critical parameters including migration cutoff dates, post-migration token burning decisions, and any future modifications to the token’s economic or technical parameters [8]. This transfer of power from centralized development teams to community governance structures ensures that no single entity can make unilateral decisions that affect token holders’ economic interests.

The governance architecture implemented for LEASH v2 incorporates sophisticated mechanisms for proposal creation, community discussion, and voting execution that go far beyond simple token-weighted voting systems. The DAO structure includes multiple governance tracks for different types of decisions, with technical proposals requiring different approval thresholds and discussion periods than economic policy changes. This nuanced approach recognizes that different types of governance decisions require different levels of community consensus and technical expertise.

The proposal creation process within the Shiba Inu DAO has been designed to encourage thoughtful participation while preventing spam or manipulation attempts. Community members must meet minimum token holding requirements and stake tokens when submitting proposals, creating economic incentives for good-faith participation. The proposal format requires detailed technical specifications, economic impact analyses, and implementation timelines, ensuring that community members have sufficient information to make informed voting decisions.

The discussion and deliberation phase of the governance process incorporates both on-chain and off-chain elements to maximize participation while maintaining security. Community forums, social media discussions, and live community calls provide venues for detailed debate and analysis, while on-chain discussion mechanisms ensure that key arguments and counterarguments are permanently recorded and associated with specific proposals. This hybrid approach accommodates different communication preferences while creating comprehensive records of the decision-making process.

The voting mechanisms implemented within the DAO structure include multiple safeguards against manipulation and ensure that decisions reflect genuine community consensus rather than the preferences of large token holders or coordinated manipulation attempts. The system includes quadratic voting elements for certain types of decisions, time-weighted voting that considers how long voters have held their tokens, and delegation mechanisms that allow smaller holders to participate meaningfully in governance without requiring constant attention to every proposal.

The execution phase of DAO governance incorporates technical mechanisms that ensure approved proposals are implemented exactly as specified without requiring trust in centralized execution authorities. Smart contract-based execution systems automatically implement approved changes to token parameters, migration processes, or burning mechanisms based on the specific technical specifications included in successful proposals. This automated execution reduces the risk of implementation errors or unauthorized modifications to approved governance decisions.

The transparency mechanisms built into the DAO governance structure provide unprecedented visibility into decision-making processes and their outcomes. All proposals, discussions, votes, and execution transactions are recorded on the blockchain with complete transparency, allowing community members and external observers to verify that the governance system is operating as intended. Regular governance reports summarize key decisions, participation metrics, and implementation outcomes, creating accountability mechanisms that encourage responsible participation.

The education and onboarding systems developed to support DAO participation recognize that effective governance requires informed participants who understand both the technical and economic implications of their decisions. The Shiba Inu ecosystem has invested significantly in educational resources, including detailed documentation, video tutorials, and community mentorship programs that help new participants understand how to engage effectively with the governance process.

The economic incentives embedded within the governance structure align individual participation with collective benefit, encouraging long-term thinking and responsible decision-making. Participants who contribute valuable proposals, engage thoughtfully in discussions, or provide technical expertise receive recognition and rewards that encourage continued participation. Conversely, participants who attempt to manipulate the system or propose harmful changes face economic penalties that discourage bad-faith behavior.

The integration between LEASH v2 governance and the broader Shiba Inu ecosystem creates synergies that benefit all participants while maintaining appropriate separation between different governance domains. LEASH v2 holders participate in decisions specifically related to their token while also having input into broader ecosystem decisions that might affect their interests. This multi-layered governance structure ensures that different stakeholder groups have appropriate influence over decisions that affect them while preventing any single group from dominating the entire ecosystem.

The dispute resolution mechanisms built into the DAO structure provide fair and efficient processes for addressing conflicts or disagreements that arise during governance processes. These mechanisms include mediation processes for resolving technical disputes, appeal procedures for challenging governance decisions, and emergency response protocols for addressing urgent security or economic threats. The dispute resolution framework balances the need for finality in governance decisions with the recognition that complex systems sometimes require course corrections.

The evolution pathway built into the governance structure ensures that the DAO itself can adapt and improve over time based on experience and changing circumstances. The governance framework includes mechanisms for proposing and implementing changes to the governance process itself, allowing the community to refine and optimize their decision-making structures as they gain experience and as the broader ecosystem evolves.

The accountability mechanisms embedded within the governance structure ensure that DAO participants and leadership remain responsive to community needs and concerns. Regular performance reviews, community feedback sessions, and leadership rotation mechanisms prevent the concentration of power and ensure that governance structures continue to serve their intended purpose of empowering community decision-making rather than creating new forms of centralized control.

Exchange Coordination and Market Integration Challenges

The successful implementation of LEASH v2 depends critically on coordination with cryptocurrency exchanges, a process that has revealed both the complexities of modern crypto infrastructure and the challenges of implementing major token transitions across diverse technical and business environments. The exchange coordination effort represents one of the most comprehensive token migration support initiatives ever undertaken, involving negotiations with dozens of platforms while accommodating vastly different technical capabilities, business priorities, and regulatory requirements.

The diversity of exchange responses to the LEASH v2 migration reflects the heterogeneous nature of the cryptocurrency exchange ecosystem, where platforms range from highly sophisticated institutional-grade operations to smaller regional exchanges with limited technical resources. The Shiba Inu team’s approach to this challenge has been to provide maximum flexibility and support while maintaining the mathematical integrity and security principles that define the migration process [9].

The technical specifications provided to exchanges represent a masterclass in clear communication and implementation guidance. Rather than requiring exchanges to understand the complex history of the supply controversy or the detailed technical architecture of LEASH v2, the specifications focus on the practical requirements for supporting the migration: the public ratio R, the contract addresses for both tokens, comprehensive test vectors for validation, and clear procedures for handling user balances during the transition period.

The four-tier response framework that has emerged from exchange negotiations illustrates the practical realities of implementing major token changes across diverse platforms. Tier 1 represents full support, where exchanges implement the token swap and list the new LEASH v2 token, providing seamless user experience and continued trading support. Tier 2 involves exchanges that support the migration process but choose not to list LEASH v2 for trading, requiring users to withdraw their migrated tokens to external wallets. Tier 3 includes exchanges that cannot support the migration technically but maintain LEASH v1 listings, while Tier 4 represents exchanges that both cannot support migration and choose to delist the original token entirely.

The standout positive responses from Crypto.com and Gate.io demonstrate how proactive exchange engagement can create win-win outcomes for all stakeholders. These platforms have invested significant technical and business development resources in understanding the migration requirements, implementing robust testing procedures, and coordinating closely with the Shiba Inu team to ensure smooth user experiences. Their diligent approach to integration planning has resulted in comprehensive support that maintains user confidence while supporting the broader ecosystem transition.

The challenges faced by exchanges in implementing LEASH v2 support reveal important insights about the current state of cryptocurrency infrastructure and the technical debt that has accumulated across the industry. Many exchanges built their systems around assumptions of static token supplies and simple ERC-20 mechanics, making it difficult to accommodate the ratio-based conversion and migration tracking required for LEASH v2. The rebase complications from LEASH v1 have created additional accounting challenges that some platforms find difficult to resolve within their existing technical frameworks.

The business considerations that influence exchange decisions extend beyond pure technical capabilities to include regulatory compliance, customer support requirements, and strategic priorities. Some exchanges have expressed concern about the regulatory implications of supporting token migrations, particularly in jurisdictions where such activities might be interpreted as facilitating securities transactions or requiring additional compliance procedures. Others have cited customer support concerns, worrying about the complexity of explaining migration processes to users who may not understand the technical details.

The self-custody portal developed as a fallback option for users whose exchanges cannot or will not support the migration represents a crucial component of the overall strategy. This portal implements the same security measures and mathematical principles as the exchange-integrated solutions while providing user-friendly interfaces that accommodate users with varying levels of technical sophistication. The portal includes comprehensive educational resources, step-by-step migration guides, and customer support channels specifically designed to help users navigate the process independently.

The timing coordination required for exchange implementations presents additional complexity, as different platforms have different development cycles, testing requirements, and deployment schedules. The Shiba Inu team has worked to accommodate these varying timelines while maintaining consistency in the migration process and ensuring that users are not disadvantaged by their choice of exchange platform. This coordination effort includes providing advance notice of migration timelines, flexible implementation schedules, and ongoing technical support throughout the integration process.

The verification and attestation procedures developed for exchange implementations provide additional assurance that the migration process is being implemented correctly across all participating platforms. Exchanges that implement the migration are asked to provide signed attestations confirming that they are applying the correct ratio calculations and following the specified procedures. These attestations create accountability mechanisms while providing users with confidence that their chosen exchange is implementing the migration correctly.

The public venue dashboard maintained by the Shiba Inu team provides real-time transparency about which exchanges are supporting the migration and how the process is progressing across different platforms. This dashboard includes information about exchange support levels, migration volumes, and any issues or delays that arise during implementation. The transparency provided by this dashboard helps users make informed decisions about where to hold their tokens during the migration period.

The lessons learned from the exchange coordination process have broader implications for the cryptocurrency industry’s approach to token migrations and major protocol changes. The experience has highlighted the importance of early engagement with exchange partners, clear technical documentation, flexible implementation options, and robust fallback mechanisms for users whose preferred platforms cannot provide support.

The long-term relationships built through this coordination process may prove as valuable as the immediate migration support, as they establish communication channels and technical frameworks that can support future ecosystem developments. The exchanges that have invested in understanding and supporting LEASH v2 are likely to be better positioned to support future Shiba Inu ecosystem innovations, creating ongoing benefits for their users and the broader community.

Security Architecture and Audit Framework

The security architecture underlying LEASH v2 represents a comprehensive response to the trust issues raised by the supply controversy, implementing multiple layers of protection that address not only the immediate technical vulnerabilities but also the broader concerns about transparency, auditability, and community oversight that emerged from the crisis. This security-first approach establishes new standards for token design and governance that prioritize verifiable safety over complex functionality.

The foundational security principle of LEASH v2 is the complete elimination of any mechanisms that could result in unauthorized token creation or supply manipulation. Unlike LEASH v1, which retained rebase capabilities that could alter supply under certain conditions, LEASH v2 implements a mathematically provable “no mint” architecture where the total token supply is fixed at deployment and cannot be increased under any circumstances [10]. This architectural decision removes entire categories of potential vulnerabilities while providing absolute certainty about token economics.

The choice to build LEASH v2 using OpenZeppelin libraries represents a deliberate prioritization of proven security over novel functionality. OpenZeppelin’s ERC-20 implementation has been audited extensively, deployed in thousands of projects, and battle-tested across multiple market cycles and attack scenarios. By leveraging these proven components rather than developing custom implementations, LEASH v2 inherits the security benefits of this extensive testing and review while minimizing the risk of introducing novel vulnerabilities through untested code.

The migrator contract security architecture deserves particular attention for its innovative approach to eliminating trust requirements while maintaining functional flexibility. The contract cannot mint new LEASH v2 tokens under any circumstances, instead relying on pre-approved allowances from the multisignature wallet that holds the pre-minted supply. This design ensures that every LEASH v2 token distributed through migration can be traced directly to the original pre-minted supply, providing complete auditability and eliminating any possibility of unauthorized token creation during the migration process.

The multisignature wallet design that secures the pre-minted LEASH v2 supply incorporates industry best practices for high-value cryptocurrency storage while adding additional transparency measures specific to the migration use case. The wallet requires multiple signatures from different key holders for any transaction, preventing single points of failure or unauthorized access. All transactions from this wallet are publicly visible on the blockchain, providing complete transparency about token distribution during the migration process and enabling community verification of proper migration execution.

The comprehensive audit strategy for LEASH v2 extends beyond traditional smart contract security reviews to encompass the entire ecosystem of contracts, processes, and governance mechanisms that support the token. The audit scope includes not only the core token contract and migrator but also specialized adapters for liquidity provider migrations, bridge integrations, and governance interfaces. This holistic approach ensures that all components of the LEASH v2 system have been independently verified for security and correctness.

The mathematical verification component of the audit process addresses the specific concerns raised by the supply controversy by providing formal proofs that the migration calculations are implemented correctly and cannot be manipulated. Independent auditors have verified that the ratio-based conversion formula R = S₀ / S₁ is implemented accurately in the smart contracts and that the migration process preserves the mathematical relationships intended by the design. This mathematical verification provides additional assurance that the migration process will treat all holders fairly and consistently.

The operational security measures implemented around the LEASH v2 deployment and migration process include comprehensive key management procedures, secure deployment protocols, and ongoing monitoring systems that can detect and respond to potential security threats. The deployment process itself follows industry best practices for high-stakes smart contract deployments, including multiple independent verifications of contract code, staged deployment procedures, and comprehensive testing on multiple testnets before mainnet deployment.

The transparency mechanisms built into the security architecture provide unprecedented visibility into all aspects of the LEASH v2 system’s operation. All smart contract code is published and verified on blockchain explorers, enabling independent security researchers to review and analyze the implementation. The migration process generates detailed on-chain records that can be independently verified by community members, while the governance processes include comprehensive logging and reporting mechanisms that ensure all decisions and their implementations are fully transparent.

The incident response procedures developed for LEASH v2 reflect lessons learned from the original supply controversy and establish clear protocols for addressing potential security issues or unexpected behaviors. These procedures include emergency response mechanisms that can be activated by the DAO in case of critical security threats, communication protocols for informing the community about potential issues, and technical procedures for implementing emergency fixes if necessary while maintaining the security and transparency principles that define the system.

The ongoing security monitoring systems implemented for LEASH v2 include automated monitoring of contract interactions, anomaly detection systems that can identify unusual patterns of activity, and regular security reviews that ensure the system continues to operate as intended over time. These monitoring systems provide early warning of potential issues while creating comprehensive records that can support forensic analysis if problems arise.

The bug bounty program established for LEASH v2 incentivizes ongoing security research by providing rewards for researchers who identify potential vulnerabilities or improvements to the system. This program extends beyond the initial audit period to provide ongoing security assurance as the system evolves and as new attack vectors or vulnerabilities are discovered in the broader cryptocurrency ecosystem.

The security education and awareness initiatives developed around LEASH v2 help community members understand the security measures implemented and how to interact safely with the system. These educational resources include detailed explanations of the security architecture, guides for verifying migration transactions, and best practices for secure token storage and management. This educational component ensures that the security benefits of the technical architecture are not undermined by user errors or misunderstandings.

Community Response and Market Implications

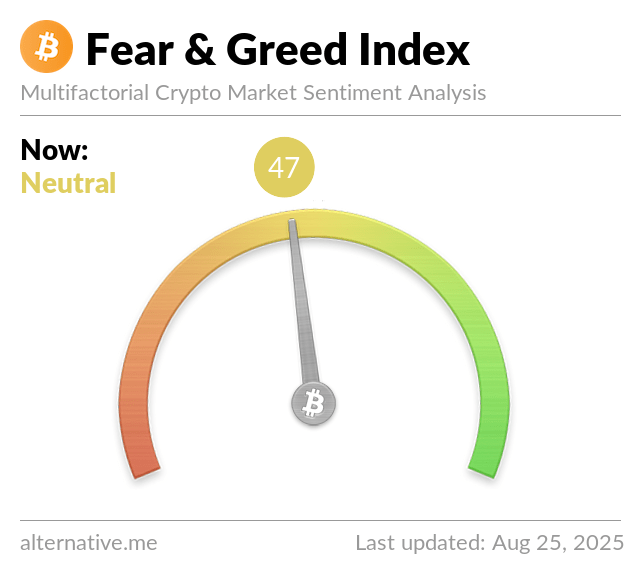

The community response to the LEASH v2 launch has been overwhelmingly positive, representing a remarkable transformation from the crisis atmosphere that followed the August supply controversy to renewed confidence and enthusiasm for the Shiba Inu ecosystem’s future. This dramatic shift in sentiment reflects not only the technical excellence of the LEASH v2 solution but also the broader community’s appreciation for the transparent, inclusive approach taken to address the crisis and implement comprehensive reforms.

The immediate community reaction to the LEASH v2 announcement demonstrated the pent-up demand for exactly the type of solution that had been developed. Social media channels that had been filled with criticism and concern following the supply controversy quickly shifted to expressions of support, appreciation, and renewed confidence in the ecosystem’s leadership and technical capabilities. The detailed technical documentation and transparent communication about the migration process addressed many of the specific concerns that community members had raised, creating a foundation for restored trust.

The community’s embrace of the DAO governance model represents perhaps the most significant aspect of the positive response, as it demonstrates genuine enthusiasm for taking on the responsibilities and complexities of decentralized decision-making. Rather than simply demanding that problems be fixed by centralized authorities, the community has shown willingness to engage with the technical details of governance proposals, participate in detailed discussions about implementation approaches, and take ownership of the ecosystem’s future direction.

The educational initiatives that emerged from the community in response to LEASH v2 demonstrate the depth of engagement and understanding that has developed around the technical and governance innovations. Community members have created detailed guides explaining the migration process, analysis of the mathematical principles underlying the holder-equivalence model, and educational content about DAO governance that helps new participants understand how to engage effectively with the decision-making process.

The market implications of the LEASH v2 launch extend far beyond the immediate Shiba Inu ecosystem to influence broader trends in cryptocurrency governance, token design, and community empowerment. The successful resolution of a major token controversy through transparent technical innovation and genuine decentralization provides a template that other projects can follow when facing similar challenges, potentially raising standards across the industry for how such situations should be handled.

The institutional interest generated by LEASH v2’s governance model and technical architecture represents a significant development for the broader meme coin sector, which has historically struggled to attract serious institutional attention due to concerns about governance, transparency, and long-term sustainability. The combination of proven technical architecture, genuine decentralized governance, and transparent community processes addresses many of the concerns that have prevented institutional participation in meme coin ecosystems.

The price stability and trading volume patterns observed following the LEASH v2 launch provide important insights into how markets respond to comprehensive governance and technical reforms. Rather than experiencing the volatile speculation that often accompanies major token changes, LEASH v2 has demonstrated relatively stable price action with healthy trading volumes, suggesting that the market views the changes as fundamentally positive for long-term value creation rather than short-term speculation opportunities.

The cross-ecosystem effects of the LEASH v2 launch have been particularly notable, with other projects in the Shiba Inu ecosystem experiencing positive sentiment spillovers as confidence in the overall governance and technical capabilities has been restored. This ecosystem-wide benefit demonstrates the interconnected nature of modern cryptocurrency projects and the importance of maintaining trust and technical excellence across all components of complex ecosystems.

The regulatory implications of the LEASH v2 governance model have attracted attention from policy makers and legal experts who are studying how decentralized autonomous organizations can effectively govern complex technical and economic systems. The transparent, community-driven approach to addressing the supply controversy and implementing comprehensive reforms provides a case study in how cryptocurrency projects can self-regulate and address problems without requiring external intervention.

The technological precedents established by LEASH v2 are likely to influence future token designs and migration processes across the cryptocurrency industry. The mathematical precision of the holder-equivalence model, the security architecture of the no-mint design, and the comprehensive approach to exchange coordination have created new standards that other projects may adopt when facing similar challenges or when designing new token systems from scratch.

The community building and engagement models demonstrated through the LEASH v2 process have implications beyond cryptocurrency for any organization seeking to implement genuine participatory governance. The combination of technical transparency, educational support, and inclusive decision-making processes provides a framework that could be adapted for other contexts where community empowerment and democratic participation are important goals.

The long-term sustainability implications of the LEASH v2 model address one of the most significant challenges facing cryptocurrency projects: how to maintain community engagement and technical innovation over extended periods without relying on centralized leadership or external funding. The self-sustaining governance model and community ownership structure created through LEASH v2 provide a foundation for long-term ecosystem development that does not depend on the continued involvement of any specific individuals or organizations.

Future Roadmap and Strategic Vision

The successful launch of LEASH v2 represents not an endpoint but rather the foundation for a comprehensive strategic vision that extends far beyond addressing the immediate supply controversy to encompass broader goals of ecosystem development, technological innovation, and community empowerment. This forward-looking roadmap reflects lessons learned from the crisis while positioning the Shiba Inu ecosystem for sustained growth and innovation in an increasingly competitive and sophisticated cryptocurrency landscape.

The immediate priorities following the LEASH v2 launch focus on ensuring complete and successful migration of all token holders while maintaining the security, transparency, and fairness principles that define the new system. The migration monitoring and support systems continue to operate at full capacity, providing assistance to users navigating the transition process and working with exchanges to maximize participation across all platforms. The success metrics for this phase include not only the percentage of tokens migrated but also user satisfaction, technical performance, and community confidence in the process.

The governance development roadmap includes ambitious plans for expanding the Shiba Inu DAO’s capabilities and responsibilities, building on the foundation established through LEASH v2 to create one of the most sophisticated and effective decentralized governance systems in the cryptocurrency space. Future governance enhancements include more nuanced voting mechanisms, specialized committees for technical and economic decisions, and integration with broader ecosystem governance that encompasses all tokens and protocols within the Shiba Inu universe.

The technological evolution pathway for LEASH v2 includes the planned integration of privacy features through Fully Homomorphic Encryption (FHE) wrapper tokens, representing a significant advancement in cryptocurrency privacy technology. This integration, developed in collaboration with OpenZeppelin and other leading blockchain technology companies, will enable LEASH v2 holders to conduct private transactions while maintaining the transparency and auditability that characterize the underlying token architecture [11].

The ecosystem integration strategy focuses on deepening the connections between LEASH v2 and other components of the Shiba Inu ecosystem, including ShibaSwap, Shibarium, and emerging DeFi protocols. These integrations will create new utility and value accrual mechanisms for LEASH v2 holders while strengthening the overall ecosystem through increased interconnection and shared governance structures.

The institutional adoption initiatives build on the governance and technical improvements demonstrated through LEASH v2 to attract serious institutional participation in the Shiba Inu ecosystem. These initiatives include developing institutional-grade custody solutions, creating compliance frameworks that meet regulatory requirements in major jurisdictions, and establishing partnerships with traditional financial institutions that can provide bridge services between traditional finance and the decentralized ecosystem.

The research and development priorities for the coming years include advancing the state of the art in decentralized governance, token economics, and community coordination mechanisms. The Shiba Inu ecosystem’s experience with crisis management, community empowerment, and technical innovation provides a unique foundation for contributing to broader research in these areas while developing practical solutions that can benefit the entire cryptocurrency industry.

The educational and outreach programs planned for the future aim to share the lessons learned from the LEASH v2 experience with other projects, academic researchers, and policy makers who are working to understand and improve cryptocurrency governance and community coordination. These programs include academic partnerships, conference presentations, and open-source contributions that make the innovations developed through LEASH v2 available to the broader community.

The sustainability and long-term viability planning addresses one of the most significant challenges facing cryptocurrency projects: how to maintain innovation and community engagement over extended periods without relying on speculative price appreciation or external funding. The governance model and community ownership structure established through LEASH v2 provide a foundation for self-sustaining development that can continue indefinitely as long as the community remains engaged and committed to the ecosystem’s success.

The risk management and contingency planning components of the strategic vision reflect the hard-learned lessons from the supply controversy and establish comprehensive frameworks for identifying, assessing, and responding to potential future challenges. These frameworks include technical risk assessment procedures, governance crisis management protocols, and community communication strategies that can maintain trust and coordination even during difficult periods.

The innovation pipeline includes ambitious projects that build on the technical and governance foundations established through LEASH v2 to explore new frontiers in decentralized finance, community coordination, and blockchain technology. These projects range from novel DeFi protocols that leverage the unique governance capabilities of the ecosystem to experimental approaches to cross-chain coordination and interoperability.

The global expansion strategy recognizes that the success of LEASH v2 and the broader Shiba Inu ecosystem depends on building strong communities and partnerships across diverse geographic and cultural contexts. This expansion includes localization efforts, regional partnership development, and cultural adaptation initiatives that ensure the ecosystem’s benefits are accessible to users worldwide while respecting local preferences and regulatory requirements.

Conclusion: A New Standard for Cryptocurrency Governance and Community Trust

The LEASH v2 launch represents far more than the resolution of a token supply controversy—it establishes new standards for how cryptocurrency projects can address crises, implement governance reforms, and build sustainable community-driven ecosystems that balance innovation with accountability. The comprehensive approach taken by the Shiba Inu team and community demonstrates that even major technical and trust crises can become opportunities for fundamental improvement when addressed with transparency, technical excellence, and genuine commitment to community empowerment.

The mathematical precision and technical sophistication of the LEASH v2 solution provide a template for how token migrations can be conducted fairly and transparently, even in complex scenarios involving multiple platforms, diverse user types, and contentious historical events. The holder-equivalence principle and ratio-based conversion mechanism ensure that all participants are treated equitably while maintaining the mathematical integrity necessary for community confidence and regulatory compliance.

The governance revolution implemented through LEASH v2 demonstrates that genuine decentralized autonomous organization control is not only possible but can be more effective than centralized decision-making in building community trust and ensuring long-term sustainability. The Shiba Inu DAO’s expanded role and sophisticated governance mechanisms provide a model that other projects can adapt and improve upon as the cryptocurrency industry continues to mature and evolve.

The security architecture and audit framework developed for LEASH v2 establish new standards for transparency, verifiability, and community oversight that address the fundamental trust issues that have plagued many cryptocurrency projects. The combination of proven technical components, comprehensive auditing, and ongoing transparency mechanisms creates a foundation for sustained confidence that extends far beyond the immediate token migration.

The community response to LEASH v2 demonstrates the power of inclusive, transparent approaches to crisis management and system reform. Rather than simply implementing top-down solutions, the Shiba Inu ecosystem has created a model for community engagement that empowers participants to take ownership of their ecosystem’s future while providing the technical and educational support necessary for effective participation.

The market implications of LEASH v2 extend throughout the cryptocurrency industry, providing evidence that projects can successfully navigate major crises while emerging stronger and more resilient. The positive reception from both community members and institutional observers suggests that the standards established through LEASH v2 may become expectations for how all major cryptocurrency projects should handle governance, transparency, and community relations.

Looking toward the future, LEASH v2 provides a foundation for continued innovation and development that is grounded in community ownership, technical excellence, and transparent governance. The roadmap for ecosystem development, technological advancement, and global expansion builds on the trust and capabilities established through the migration process while maintaining the principles that have made the transformation successful.

The lessons learned from the LEASH v2 experience have implications that extend far beyond the Shiba Inu ecosystem to influence how the entire cryptocurrency industry approaches governance, community relations, and crisis management. The successful transformation of a major trust crisis into an opportunity for fundamental improvement provides hope and practical guidance for other projects facing similar challenges.

As the cryptocurrency industry continues to mature and face increasing scrutiny from regulators, institutions, and the general public, the standards established through LEASH v2 for transparency, community empowerment, and technical excellence may become essential requirements for long-term success and sustainability. The Shiba Inu ecosystem’s commitment to these principles, demonstrated through the comprehensive LEASH v2 transformation, positions it as a leader in the evolution toward more responsible and community-driven cryptocurrency development.

The LEASH v2 story ultimately demonstrates that the cryptocurrency industry’s greatest strength lies not in its technology alone, but in its potential to create new forms of community coordination and democratic participation that can address complex challenges through collective action and shared commitment to common goals. This potential, realized through the LEASH v2 transformation, provides a foundation for continued innovation and development that serves not only the immediate community but the broader goal of creating more equitable and sustainable financial systems for the future.

References

[1] Shiba Inu Ecosystem. “LEASH v2 – Migration & Development Update (Holder‑Equivalence + Targeted Snapshots).” Shiba Inu Blog, August 22, 2025. https://blog.shib.io/leash-v2-migration-development-update-holder-equivalence-targeted-snapshots/

[2] AInvest. “Shiba Inu’s LEASH v2: A Governance-Driven Rebuild of Trust and Value.” AInvest News, August 25, 2025. https://www.ainvest.com/news/shiba-inu-leash-v2-governance-driven-rebuild-trust-2508/

[3] Watcher Guru. “Shiba Community Celebrates LEASH v2 Launch Supply Fix.” Watcher Guru News, August 25, 2025. https://watcher.guru/news/shiba-inu-community-cheers-leash-v2-launch-after-10-supply-surge

[4] The Shib Daily. “Shiba Inu Reveals LEASH v2 Token Design: Simple, Secure, Auditable.” The Shib Daily, August 22, 2025. https://news.shib.io/2025/08/22/shiba-inu-reveals-leash-v2-token-design-simple-secure-auditable/

[5] Coinpaper. “Shiba Inu Unveils LEASH v2 to Resolve Supply Concerns.” Coinpaper, August 24, 2025. https://coinpaper.com/10686/shiba-inu-launches-leash-v2-token-to-address-supply-controversy-and-restore-community-trust

[6] Bitrue. “Shiba Inu Launches LEASH v2: A New Era for Community Trust and Token Governance.” Bitrue Blog, August 25, 2025. https://www.bitrue.com/blog/Shiba-inu-launches-leash-v2

[7] CoinStats. “Shiba Inu Launches LEASH v2 Token to Address Supply Controversy and Restore Community Trust.” CoinStats News, August 24, 2025. https://coinstats.app/news/956bcc40a583ad1eb2e048130ca9f4d9aa0ade9d356db4e1ea71979d9fb0322c_Shiba-Inu-Launches-LEASH-v2-Token-to-Address-Supply-Controversy-and-Restore-Community-Trust/

[8] AInvest. “Shiba Inu Launches LEASH v2 to Fix Supply Controversy and Strengthen Governance.” AInvest News, August 24, 2025. https://www.ainvest.com/news/shiba-inu-launches-leash-v2-fix-supply-controversy-strengthen-governance-2508/

[9] The Shib Daily. “Shiba Inu Developer Unveils New LEASH v2 Migration Strategy.” The Shib Daily, August 22, 2025. https://news.shib.io/2025/08/22/shiba-inu-developer-unveils-new-leash-v2-migration-strategy/

[10] Coin Central. “Shiba Inu Developer Clears the Air on LEASH Supply Adjustment Concerns.” Coin Central, August 12, 2025. https://coincentral.com/shiba-inu-developer-clears-the-air-on-leash-supply-adjustment-concerns/

[11] Binance Square. “Shiba Inu Top Developer Breaks Silence on LEASH Supply Boom.” Binance Square, August 12, 2025. https://www.binance.com/en/square/post/28217061442898