Published by everythingcryptoitclouds.com | August 27, 2025

In a move that has sent shockwaves through the financial technology and blockchain industries, Google Cloud announced today the launch of its own Layer-1 blockchain platform, the Google Cloud Universal Ledger (GCUL), marking the tech giant’s most aggressive entry yet into the rapidly evolving world of enterprise blockchain infrastructure. This groundbreaking development represents far more than another corporate blockchain initiative; it signals a fundamental shift in how global financial institutions will approach cross-border payments, asset tokenization, and digital finance infrastructure in the coming decade [1].

The timing of Google Cloud’s blockchain launch could not be more strategic, coming at a moment when the global stablecoin market has reached unprecedented scale, with transaction volumes hitting $30 trillion in 2024—a figure that surpasses Visa’s entire annual payment volume. This massive market opportunity, combined with the growing institutional demand for programmable money and automated financial workflows, has created the perfect conditions for a technology giant with Google’s infrastructure capabilities and enterprise relationships to make a decisive move into blockchain-based financial services [2].

What makes GCUL particularly significant is not just Google’s entry into the blockchain space, but the company’s strategic positioning of the platform as “credibly neutral” infrastructure that can serve any financial institution, regardless of their existing partnerships or competitive relationships. This approach directly addresses one of the most significant barriers to enterprise blockchain adoption: the reluctance of financial institutions to build on platforms controlled by their direct competitors. By offering a neutral foundation that doesn’t favor any particular ecosystem or stablecoin issuer, Google Cloud has created a compelling value proposition that could accelerate institutional blockchain adoption across the entire financial services industry.

The technical architecture of GCUL represents a sophisticated approach to enterprise blockchain design, featuring Python-based smart contracts that make the platform more accessible to traditional financial engineers and developers who may not be familiar with blockchain-specific programming languages like Solidity. This developer-friendly approach, combined with Google Cloud’s proven ability to scale infrastructure for billions of users, positions GCUL as a potentially transformative platform that could bridge the gap between traditional finance and blockchain-based financial services.

The competitive implications of Google’s blockchain launch extend far beyond the immediate impact on existing blockchain platforms, creating new dynamics in the rapidly evolving landscape of enterprise financial infrastructure. With major technology companies like Stripe and Circle also developing their own blockchain platforms, the race to define the next generation of financial settlement rails has intensified dramatically, with each platform offering distinct advantages and targeting different segments of the massive global payments market.

The partnership between Google Cloud and CME Group, one of the world’s largest derivatives exchanges, provides immediate validation of GCUL’s enterprise capabilities and demonstrates the platform’s potential to transform traditional capital markets infrastructure. The successful completion of initial integration and testing phases with CME Group signals that GCUL is not merely a conceptual project but a production-ready platform that can handle the demanding requirements of institutional financial markets, including 24/7 trading, complex asset tokenization, and sophisticated risk management workflows.

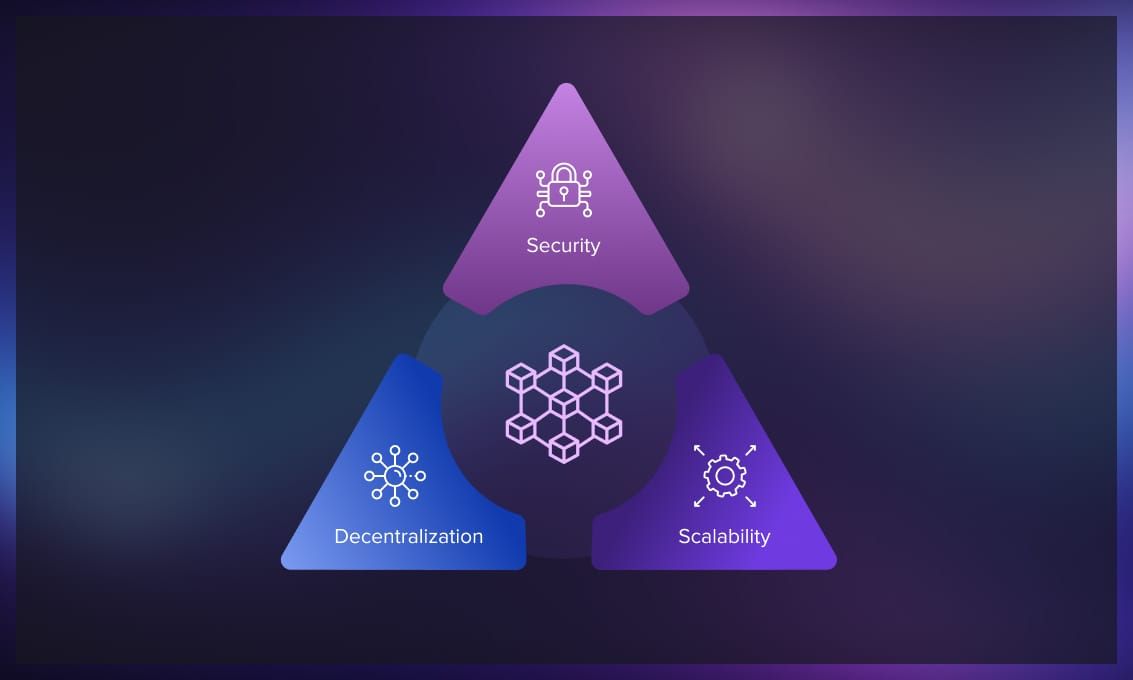

Understanding the full implications of Google Cloud’s blockchain launch requires examining not only the technical capabilities and competitive positioning of GCUL but also the broader market forces that are driving the transformation of global financial infrastructure. The convergence of regulatory clarity, institutional adoption, and technological maturity has created conditions that favor the development of enterprise-grade blockchain platforms that can provide the security, scalability, and compliance features required by traditional financial institutions while offering the programmability and efficiency advantages that make blockchain technology compelling for financial applications.

The Technical Revolution: GCUL’s Architecture and Innovation

The Google Cloud Universal Ledger represents a masterful synthesis of enterprise-grade infrastructure design and cutting-edge blockchain technology, creating a platform that addresses the specific needs of institutional financial markets while maintaining the programmability and transparency advantages that make blockchain technology valuable for financial applications. The technical architecture of GCUL demonstrates Google’s deep understanding of both the requirements of traditional financial institutions and the potential of blockchain technology to transform financial infrastructure.

The most immediately striking aspect of GCUL’s technical design is its use of Python-based smart contracts, a decision that represents a significant departure from the Solidity-based smart contract platforms that dominate the current blockchain landscape. This choice reflects Google’s recognition that widespread institutional adoption of blockchain technology requires platforms that are accessible to the existing developer talent pool within financial institutions, rather than requiring organizations to hire specialized blockchain developers or retrain their existing engineering teams. Python’s widespread adoption in financial engineering, data science, and quantitative analysis makes it the natural choice for a platform targeting institutional financial markets [1].

The implications of Python-based smart contracts extend far beyond developer convenience, enabling financial institutions to leverage their existing codebases, libraries, and analytical tools when building blockchain-based financial applications. This compatibility with existing financial technology stacks significantly reduces the barriers to adoption and enables institutions to implement blockchain solutions more rapidly and cost-effectively than would be possible with platforms requiring entirely new development approaches. The decision to support Python also positions GCUL to benefit from the extensive ecosystem of financial and analytical libraries that have been developed for Python, enabling sophisticated financial modeling and risk management capabilities to be integrated directly into blockchain-based workflows.

The architectural design of GCUL emphasizes scalability and performance characteristics that are essential for institutional financial applications, with Google leveraging its proven ability to operate infrastructure that serves billions of users worldwide. The platform is designed to support hundreds of financial institutions simultaneously while maintaining the performance and reliability standards required for mission-critical financial operations. This scalability advantage represents a significant competitive differentiator, as many existing blockchain platforms struggle to provide the throughput and reliability required for large-scale institutional adoption.

The API-first design philosophy underlying GCUL reflects Google’s understanding that enterprise adoption requires integration approaches that align with existing enterprise software development practices. Rather than requiring institutions to interact directly with blockchain infrastructure, GCUL provides a single, comprehensive API that abstracts the complexity of blockchain operations while providing access to all the platform’s capabilities. This approach enables financial institutions to integrate blockchain functionality into their existing systems using familiar development patterns and tools, significantly reducing the technical complexity and risk associated with blockchain adoption.

The billing model implemented by GCUL addresses one of the most significant concerns that financial institutions have expressed regarding blockchain adoption: the unpredictability of transaction costs associated with volatile gas fees. By implementing a fixed monthly billing structure, GCUL provides the cost predictability that is essential for institutional financial planning and budgeting processes. This approach eliminates the risk of unexpected cost spikes during periods of high network congestion and enables institutions to accurately forecast their blockchain infrastructure costs as part of their overall technology budgets.

The private and permissioned nature of GCUL’s current implementation reflects the regulatory realities facing institutional financial markets, where compliance requirements and risk management considerations necessitate controlled access and comprehensive oversight capabilities. However, Google has indicated that the platform is designed to evolve toward more open access models as regulatory frameworks develop and mature, providing a migration path that enables institutions to benefit from blockchain technology within current regulatory constraints while positioning them to take advantage of future regulatory developments.

Competitive Landscape: GCUL vs. Stripe Tempo and Circle Arc

The launch of Google Cloud Universal Ledger occurs within a rapidly evolving competitive landscape where major technology and financial services companies are racing to define the next generation of financial infrastructure. The emergence of Stripe’s Tempo platform and Circle’s Arc blockchain as direct competitors to GCUL creates a fascinating three-way competition that highlights different strategic approaches to enterprise blockchain adoption and reveals the various paths that the industry might take as it evolves toward blockchain-based financial infrastructure.

Stripe’s Tempo platform represents a natural extension of the company’s existing payments empire, leveraging Stripe’s established relationships with millions of merchants and its proven ability to process over a trillion dollars in annual payment volume. The Tempo platform is designed as a vertically integrated solution that extends Stripe’s existing merchant payment rails into a blockchain-based infrastructure, enabling merchants to benefit from blockchain capabilities while remaining within Stripe’s controlled ecosystem. This approach provides significant advantages in terms of merchant adoption and integration, as existing Stripe customers can access blockchain functionality without changing their existing payment processing relationships or technical integrations [1].

The strategic positioning of Tempo reflects Stripe’s focus on merchant-centric use cases and its goal of maintaining control over the entire payment processing value chain. By building a blockchain platform that is tightly integrated with its existing payment infrastructure, Stripe can offer merchants seamless access to blockchain capabilities while ensuring that transaction volume and revenue remain within the Stripe ecosystem. This approach is particularly compelling for merchants who are already heavily invested in Stripe’s payment processing infrastructure and want to explore blockchain capabilities without the complexity of integrating with external blockchain platforms.

Circle’s Arc platform takes a fundamentally different approach, positioning USDC stablecoin as the central component of a blockchain ecosystem designed to optimize cross-border payments and currency exchange. Arc is built around the premise that stablecoins represent the future of digital money and that blockchain platforms should be optimized specifically for stablecoin-based transactions and settlements. The platform promises lightning-fast settlement capabilities with built-in foreign exchange functionality, enabling seamless conversion between different currencies and payment methods within a single transaction [2].

The competitive advantage of Circle’s Arc lies in USDC’s established position as one of the world’s most widely adopted stablecoins, with extensive liquidity integrations and regulatory compliance across multiple jurisdictions. Circle can leverage USDC’s existing adoption and liquidity to provide immediate utility for Arc users, while the platform’s focus on stablecoin optimization enables performance and functionality advantages that are specifically tailored to digital currency use cases. The Arc platform is already in pilot testing with select partners, giving Circle a potential first-mover advantage in bringing enterprise blockchain capabilities to market.

Google Cloud’s GCUL platform differentiates itself through its commitment to credible neutrality, a strategic positioning that addresses one of the most significant barriers to enterprise blockchain adoption: the reluctance of financial institutions to build on platforms controlled by their direct competitors. As Rich Widmann, Google’s head of Web3 strategy, explained in his recent LinkedIn post, “Tether won’t use Circle’s blockchain – and Adyen probably won’t use Stripe’s blockchain. But any financial institution can build with GCUL” [1]. This neutral positioning enables GCUL to serve as shared infrastructure that can be adopted by competing financial institutions without concerns about strengthening rivals or creating strategic dependencies.

The neutrality advantage of GCUL extends beyond competitive considerations to include technical and operational benefits that result from serving a diverse ecosystem of financial institutions. By designing the platform to serve any stablecoin issuer, payment processor, or financial institution, Google can create network effects that benefit all participants while avoiding the limitations that result from optimizing for specific use cases or ecosystems. This approach enables GCUL to serve as a foundation for innovation across the entire financial services industry rather than being limited to specific market segments or use cases.

The timeline differences between the three platforms reveal different strategic priorities and development approaches. Circle’s Arc is already in pilot testing and appears closest to full commercial availability, reflecting the company’s focus on leveraging existing USDC adoption to accelerate platform development. Stripe’s Tempo is targeting a 2026 launch, aligning with the company’s methodical approach to product development and its focus on ensuring seamless integration with existing merchant infrastructure. Google’s GCUL is also targeting 2026 for full commercial availability, but the company has already completed initial integration testing with CME Group and plans to begin broader institutional testing later in 2025.

The distribution strategies employed by each platform reflect their different competitive advantages and target markets. Stripe can leverage its existing relationships with millions of merchants and its proven ability to drive adoption through its established sales and marketing channels. Circle can build on USDC’s global adoption and the extensive ecosystem of exchanges, wallets, and financial services that already support USDC transactions. Google brings the reach and credibility of Google Cloud’s enterprise relationships, along with the company’s proven ability to scale infrastructure for global adoption.

The feature differentiation between the platforms reveals their different strategic focuses and target use cases. Arc emphasizes speed and seamless foreign exchange capabilities, making it particularly attractive for cross-border payment use cases and international commerce. Tempo focuses on merchant integration and payment processing optimization, leveraging Stripe’s deep understanding of merchant needs and payment processing workflows. GCUL emphasizes programmability through Python-based smart contracts and institutional-grade tokenization capabilities, positioning it as a foundation for sophisticated financial engineering and capital markets applications.

Market Implications and Industry Transformation

The launch of Google Cloud Universal Ledger represents far more than the introduction of another blockchain platform; it signals a fundamental transformation in how the global financial services industry will approach digital infrastructure, cross-border payments, and programmable money in the coming decade. The entry of a technology giant with Google’s scale, infrastructure capabilities, and enterprise relationships into the blockchain space validates the technology’s potential to transform financial services while creating new competitive dynamics that will reshape the entire industry.

The most immediate market implication of GCUL’s launch is the validation it provides for enterprise blockchain adoption among traditional financial institutions. Google’s decision to invest significant resources in developing a blockchain platform specifically for financial services sends a powerful signal to conservative financial institutions that may have been hesitant to embrace blockchain technology. The credibility and technical expertise that Google brings to the blockchain space can help overcome the skepticism and risk aversion that have historically limited institutional blockchain adoption, potentially accelerating the transition toward blockchain-based financial infrastructure across the entire industry.

The threat that GCUL poses to traditional financial infrastructure providers, particularly SWIFT and other cross-border payment networks, cannot be understated. The current global financial infrastructure relies heavily on correspondent banking relationships and legacy messaging systems that were designed decades ago and struggle to provide the speed, transparency, and cost-effectiveness that modern financial markets demand. GCUL’s ability to provide near-instantaneous settlement with programmable compliance and automated workflows represents a fundamental improvement over existing infrastructure that could drive widespread adoption among financial institutions seeking competitive advantages [3].

The implications for stablecoin issuers and digital asset infrastructure providers are particularly significant, as GCUL’s neutral positioning creates opportunities for any stablecoin issuer to build on the platform without concerns about competitive disadvantages or strategic dependencies. This neutrality could accelerate the development of a more diverse and competitive stablecoin ecosystem, as issuers gain access to enterprise-grade infrastructure without being forced to choose between competing platform ecosystems. The result could be increased innovation in stablecoin design and functionality, as issuers compete to provide the most compelling offerings on a shared infrastructure platform.

The impact on traditional payment processors and money transfer services represents another significant market implication, as GCUL enables financial institutions to bypass traditional payment processing intermediaries for many types of transactions. The platform’s ability to provide direct settlement between financial institutions, combined with its programmable compliance and automated workflow capabilities, could reduce the role of traditional payment processors in many types of financial transactions. However, the platform also creates opportunities for payment processors to enhance their offerings by integrating blockchain capabilities and providing value-added services on top of the GCUL infrastructure.

The competitive response from existing blockchain platforms and financial infrastructure providers will likely accelerate innovation across the entire industry, as companies seek to match or exceed the capabilities provided by GCUL. This competitive dynamic could drive improvements in scalability, user experience, and enterprise features across the blockchain industry, ultimately benefiting financial institutions and end users through better technology options and more competitive pricing. The entry of major technology companies into the blockchain space also validates the technology’s long-term potential and could attract additional investment and development resources to the industry.

The regulatory implications of GCUL’s launch are complex and multifaceted, as the platform’s design reflects Google’s understanding of current regulatory requirements while positioning for future regulatory developments. The private and permissioned nature of GCUL’s current implementation aligns with existing financial services regulations and compliance requirements, while the platform’s programmable compliance capabilities could help financial institutions meet evolving regulatory requirements more efficiently and effectively. The involvement of a major technology company like Google in blockchain-based financial services could also influence regulatory development by demonstrating the technology’s potential benefits and addressing regulatory concerns about security and compliance.

The international implications of GCUL’s launch extend beyond the immediate impact on financial institutions to include potential effects on monetary policy, financial sovereignty, and international economic relationships. The platform’s ability to facilitate cross-border payments and settlements could reduce the role of traditional correspondent banking relationships and potentially challenge the dominance of existing international payment systems. However, the platform’s design also enables central banks and regulatory authorities to maintain oversight and control over financial flows, potentially providing a path for blockchain adoption that preserves existing monetary policy tools and regulatory frameworks.

The long-term market implications of GCUL’s success could include fundamental changes in how financial institutions approach technology infrastructure, vendor relationships, and competitive strategy. The platform’s neutral positioning and comprehensive capabilities could enable financial institutions to reduce their dependence on multiple specialized vendors and instead build their digital infrastructure on a single, comprehensive platform. This consolidation could reduce costs and complexity while enabling more sophisticated financial products and services that leverage the programmability and automation capabilities of blockchain technology.

CME Group Partnership: Validating Enterprise Blockchain Capabilities

The strategic partnership between Google Cloud and CME Group represents one of the most significant validations of enterprise blockchain technology to date, demonstrating that GCUL can meet the demanding requirements of one of the world’s largest and most sophisticated derivatives exchanges. The successful completion of initial integration and testing phases between Google Cloud and CME Group provides concrete evidence that blockchain technology has matured to the point where it can support mission-critical financial market infrastructure, including the complex workflows, risk management requirements, and regulatory compliance needs that characterize modern capital markets.

CME Group’s decision to partner with Google Cloud on blockchain infrastructure development reflects the exchange’s recognition that traditional financial market infrastructure is increasingly inadequate for the demands of modern global finance. The current infrastructure supporting derivatives markets relies heavily on legacy systems and manual processes that create inefficiencies, increase operational risk, and limit the ability to provide 24/7 trading and settlement capabilities that global markets increasingly demand. The partnership with Google Cloud represents CME Group’s strategic investment in next-generation infrastructure that can support continuous trading, automated settlement, and sophisticated risk management capabilities.

The technical requirements that CME Group brings to the partnership are among the most demanding in the financial services industry, encompassing high-frequency trading, complex derivatives pricing, sophisticated risk management, and comprehensive regulatory reporting. The fact that GCUL has successfully completed initial integration testing with CME Group’s systems demonstrates the platform’s ability to handle enterprise-scale financial operations while maintaining the performance, reliability, and security standards required for derivatives trading. This validation is particularly significant because derivatives markets involve some of the most complex and risk-sensitive financial transactions in the global economy.

The use cases being explored through the CME Group partnership extend beyond simple payment processing to include sophisticated applications such as tokenized collateral management, automated margin calculations, and programmable settlement workflows. These applications demonstrate the potential for blockchain technology to transform not just how payments are processed but how financial risk is managed, how collateral is optimized, and how complex financial instruments are settled and cleared. The successful implementation of these use cases could provide a template for blockchain adoption across other segments of the financial services industry.

The timeline for the CME Group partnership provides insight into the development and deployment schedule for GCUL’s enterprise capabilities. The completion of initial integration and testing phases demonstrates that the platform has already achieved a significant level of technical maturity, while the planned expansion of testing to additional market participants later in 2025 indicates that Google Cloud is taking a methodical approach to scaling the platform’s capabilities. The target of full commercial availability in 2026 aligns with the broader industry timeline for enterprise blockchain adoption and provides financial institutions with a clear roadmap for planning their own blockchain initiatives.

The regulatory implications of the CME Group partnership are particularly significant, as derivatives markets are among the most heavily regulated segments of the financial services industry. The fact that CME Group is willing to explore blockchain-based infrastructure for derivatives trading suggests that regulatory authorities are becoming more comfortable with blockchain technology for mission-critical financial applications. The partnership also provides an opportunity for regulators to observe blockchain technology in operation within a controlled, well-regulated environment, potentially accelerating regulatory approval for broader blockchain adoption across financial markets.

The competitive implications of the CME Group partnership extend beyond the immediate benefits to Google Cloud and CME Group to include broader effects on the derivatives trading industry and financial market infrastructure providers. Other exchanges and financial market infrastructure providers will likely feel pressure to explore similar blockchain initiatives to remain competitive, potentially accelerating blockchain adoption across the entire derivatives trading ecosystem. The partnership also demonstrates the potential for blockchain technology to enable new types of financial products and services that were not possible with traditional infrastructure.

The international implications of the partnership are significant, as CME Group operates global markets that serve participants from around the world. The successful implementation of blockchain-based infrastructure for derivatives trading could influence regulatory approaches and market development in other jurisdictions, potentially accelerating global adoption of blockchain technology for financial market infrastructure. The partnership also demonstrates the potential for blockchain technology to enable more efficient cross-border trading and settlement, which could have significant implications for international financial markets and monetary policy.

Technical Innovation and Developer Experience

The technical innovation embodied in Google Cloud Universal Ledger extends far beyond the platform’s core blockchain capabilities to encompass a comprehensive approach to developer experience, enterprise integration, and operational efficiency that reflects Google’s deep understanding of what financial institutions need to successfully adopt blockchain technology. The platform’s design philosophy prioritizes accessibility, reliability, and scalability while maintaining the security and compliance features that are essential for financial applications.

The Python-based smart contract capability represents perhaps the most significant technical innovation in GCUL’s design, addressing one of the primary barriers to enterprise blockchain adoption: the scarcity of developers with blockchain-specific programming skills. By enabling smart contracts to be written in Python, GCUL allows financial institutions to leverage their existing developer talent and analytical capabilities rather than requiring them to hire specialized blockchain developers or invest in extensive retraining programs. This approach significantly reduces the time, cost, and risk associated with blockchain implementation while enabling institutions to build on their existing technical expertise and code libraries.

The implications of Python-based smart contracts extend beyond developer convenience to include significant advantages in terms of code quality, testing, and maintenance. Python’s extensive ecosystem of testing frameworks, debugging tools, and code analysis utilities enables financial institutions to apply the same quality assurance and risk management practices to blockchain-based applications that they use for traditional financial software. This capability is particularly important for financial institutions, where software reliability and security are paramount concerns that can have significant regulatory and financial implications.

The API-first design philosophy underlying GCUL reflects Google’s recognition that enterprise adoption requires integration approaches that align with existing enterprise software development practices and infrastructure. Rather than requiring financial institutions to learn blockchain-specific integration patterns and tools, GCUL provides a comprehensive REST API that enables institutions to integrate blockchain functionality using familiar web service integration approaches. This design choice significantly reduces the technical complexity and learning curve associated with blockchain adoption while enabling institutions to leverage their existing integration expertise and tools.

The single API approach also provides significant operational advantages by eliminating the need for institutions to manage multiple blockchain connections, wallet integrations, and protocol-specific interfaces. Instead of requiring separate integrations for different blockchain capabilities, GCUL provides a unified interface that enables institutions to access all platform capabilities through a single, well-documented API. This approach reduces operational complexity, simplifies security management, and enables institutions to build more robust and maintainable blockchain integrations.

The scalability architecture of GCUL leverages Google Cloud’s proven ability to operate infrastructure that serves billions of users worldwide, providing financial institutions with confidence that the platform can handle their current and future transaction volumes without performance degradation or reliability issues. The platform is designed to support hundreds of financial institutions simultaneously while maintaining sub-second transaction processing times and 99.99% uptime guarantees that are essential for mission-critical financial operations. This scalability advantage represents a significant competitive differentiator, as many existing blockchain platforms struggle to provide the performance characteristics required for large-scale institutional adoption.

The monitoring and observability capabilities built into GCUL reflect Google’s understanding that financial institutions require comprehensive visibility into their blockchain operations for risk management, compliance, and operational purposes. The platform provides real-time monitoring of transaction processing, smart contract execution, and system performance, along with comprehensive logging and audit trail capabilities that enable institutions to meet regulatory reporting requirements and internal risk management standards. These capabilities are essential for financial institutions that must demonstrate compliance with regulatory requirements and maintain detailed records of all financial transactions.

The security architecture of GCUL incorporates multiple layers of protection that address the specific security concerns of financial institutions, including encryption of data in transit and at rest, comprehensive access controls, and integration with enterprise identity management systems. The platform also provides advanced threat detection and response capabilities that leverage Google’s expertise in cybersecurity and threat intelligence to protect against sophisticated attacks that target financial infrastructure. These security capabilities are essential for financial institutions that face constant threats from cybercriminals and nation-state actors seeking to compromise financial systems.

The compliance and regulatory features built into GCUL demonstrate Google’s understanding of the complex regulatory environment that governs financial services and the need for blockchain platforms to provide built-in compliance capabilities rather than requiring institutions to build compliance features on top of basic blockchain functionality. The platform includes native support for know-your-customer (KYC) verification, anti-money laundering (AML) monitoring, and regulatory reporting, along with configurable compliance rules that can be adapted to different jurisdictional requirements and regulatory frameworks.

Future Roadmap and Industry Evolution

The development roadmap for Google Cloud Universal Ledger reflects a carefully planned approach to enterprise blockchain adoption that balances the need for rapid innovation with the stability and reliability requirements of financial institutions. The phased rollout strategy, beginning with private testnet operations and progressing through institutional pilot programs to full commercial availability, demonstrates Google’s understanding that financial institutions require extensive testing and validation before adopting new infrastructure for mission-critical operations.

The immediate focus on expanding institutional pilot programs during the second half of 2025 represents a critical phase in GCUL’s development, as these programs will provide real-world validation of the platform’s capabilities while enabling Google to refine the platform based on feedback from actual financial institution users. The selection of pilot participants will likely include a diverse range of financial institutions, from large multinational banks to specialized payment processors, enabling Google to validate the platform’s capabilities across different use cases and operational requirements.

The planned release of detailed technical documentation and specifications during the coming months represents another critical milestone in GCUL’s development, as financial institutions require comprehensive technical information to evaluate blockchain platforms and plan their implementation strategies. The documentation will likely include detailed API specifications, security architecture descriptions, compliance framework documentation, and integration guides that enable financial institutions to understand exactly how GCUL can be integrated into their existing infrastructure and operations.

The target of full commercial availability in 2026 aligns with broader industry expectations for enterprise blockchain adoption and provides financial institutions with a clear timeline for planning their blockchain initiatives. This timeline also allows sufficient time for regulatory frameworks to continue evolving and for financial institutions to complete the extensive planning, testing, and approval processes that are typically required for adopting new financial infrastructure. The 2026 timeline positions GCUL to benefit from the continued maturation of blockchain technology and regulatory frameworks while ensuring that the platform is thoroughly tested and validated before full commercial deployment.

The evolution of GCUL from its current private and permissioned model toward more open access models represents a significant long-term opportunity that could transform how financial institutions interact with blockchain technology. As regulatory frameworks continue to develop and mature, the platform’s ability to evolve toward more open models could enable new types of financial innovation and cross-institutional collaboration that are not possible with current infrastructure. This evolution could also enable smaller financial institutions and fintech companies to access enterprise-grade blockchain infrastructure that would otherwise be beyond their technical or financial capabilities.

The potential for GCUL to serve as a foundation for broader Web3 and decentralized finance innovation represents another significant long-term opportunity that could extend the platform’s impact beyond traditional financial services. As the platform matures and regulatory frameworks continue to develop, GCUL could potentially serve as a bridge between traditional finance and decentralized finance, enabling traditional financial institutions to participate in DeFi protocols and enabling DeFi applications to access traditional financial infrastructure and liquidity.

The competitive dynamics that will emerge as GCUL, Stripe’s Tempo, and Circle’s Arc all come to market will likely drive continued innovation and improvement across all three platforms, ultimately benefiting financial institutions through better technology options and more competitive pricing. The competition between these platforms will also likely accelerate the development of industry standards and best practices for enterprise blockchain adoption, making it easier for financial institutions to evaluate and adopt blockchain technology.

The international expansion opportunities for GCUL represent a significant long-term growth driver that could enable the platform to serve financial institutions around the world while adapting to different regulatory frameworks and market requirements. Google’s global infrastructure and regulatory expertise position the company well to navigate the complex international regulatory environment and provide localized versions of GCUL that meet the specific requirements of different jurisdictions and markets.

The potential for GCUL to enable new types of financial products and services that leverage the programmability and automation capabilities of blockchain technology represents perhaps the most significant long-term opportunity for the platform. As financial institutions become more comfortable with blockchain technology and regulatory frameworks continue to evolve, GCUL could enable innovations such as programmable money, automated compliance, real-time risk management, and sophisticated financial instruments that are not possible with traditional infrastructure.

Conclusion: The Dawn of Enterprise Blockchain Adoption

The launch of Google Cloud Universal Ledger represents a watershed moment in the evolution of enterprise blockchain technology, marking the transition from experimental pilot programs to production-ready infrastructure that can support the demanding requirements of global financial institutions. The combination of Google’s technical expertise, infrastructure capabilities, and enterprise relationships creates a compelling platform that addresses the primary barriers to blockchain adoption while providing the scalability, reliability, and compliance features that financial institutions require for mission-critical operations.

The strategic positioning of GCUL as credibly neutral infrastructure represents a breakthrough approach to enterprise blockchain adoption that could accelerate institutional adoption across the entire financial services industry. By providing a platform that can serve any financial institution without creating competitive disadvantages or strategic dependencies, Google has created a foundation for industry-wide blockchain adoption that could transform how financial institutions approach digital infrastructure, cross-border payments, and programmable money.

The technical innovations embodied in GCUL, particularly the Python-based smart contract capability and API-first design philosophy, demonstrate that blockchain technology has matured to the point where it can provide enterprise-grade capabilities while maintaining the accessibility and developer experience that financial institutions require. These innovations address fundamental barriers to blockchain adoption and provide a template for how blockchain platforms can be designed to serve enterprise users effectively.

The validation provided by the CME Group partnership demonstrates that GCUL can meet the demanding requirements of sophisticated financial market infrastructure while providing the performance, reliability, and compliance capabilities required for derivatives trading and capital markets operations. This validation is particularly significant because it demonstrates blockchain technology’s readiness for the most demanding financial applications and provides a model for how other financial institutions can approach blockchain adoption.

The competitive dynamics created by the emergence of GCUL, Stripe’s Tempo, and Circle’s Arc represent a new phase in the evolution of financial infrastructure, where major technology companies are competing to define the next generation of payment processing, settlement, and financial services infrastructure. This competition will likely drive continued innovation and improvement across all platforms while accelerating the overall pace of blockchain adoption in financial services.

The market implications of GCUL’s launch extend far beyond the immediate impact on Google Cloud’s business to include fundamental changes in how the global financial system operates, how cross-border payments are processed, and how financial institutions approach technology infrastructure and vendor relationships. The platform’s potential to challenge traditional financial infrastructure providers like SWIFT while enabling new types of financial innovation could reshape the entire financial services industry over the coming decade.

The future roadmap for GCUL, including the planned expansion of institutional pilot programs and the target of full commercial availability in 2026, provides financial institutions with a clear timeline for planning their blockchain initiatives while ensuring that the platform is thoroughly tested and validated before full commercial deployment. This methodical approach to platform development reflects Google’s understanding of the conservative nature of financial institutions and the importance of reliability and stability for financial infrastructure.

Looking toward the future, GCUL represents more than just another blockchain platform; it embodies the potential for blockchain technology to transform financial services while preserving the stability, security, and regulatory compliance that are essential for global financial markets. The success of GCUL could accelerate the transition toward a more efficient, transparent, and programmable financial system that serves the needs of financial institutions and their customers more effectively than current infrastructure.

The ultimate significance of Google Cloud Universal Ledger lies not in its immediate technical capabilities or competitive positioning, but in its demonstration that enterprise blockchain adoption is not only possible but inevitable. By providing a platform that addresses the real needs of financial institutions while leveraging the proven capabilities of blockchain technology, Google has created a foundation for the next generation of financial infrastructure that could transform how money moves around the world and how financial services are delivered to billions of people globally.

References

[1] CoinDesk. “Google Advances Its Layer-1 Blockchain; Here’s What We Know So Far.” August 27, 2025. https://www.coindesk.com/business/2025/08/27/google-advances-its-layer-1-blockchain-here-s-what-we-know-so-far

[2] AInvest. “Google’s Neutral Blockchain Aims to Redefine Global Finance.” August 27, 2025. https://www.ainvest.com/news/google-neutral-blockchain-aims-redefine-global-finance-2508/

[3] CryptoSlate. “Google Cloud builds neutral layer-1 blockchain in biggest threat to Swift yet.” August 27, 2025. https://cryptoslate.com/google-cloud-builds-neutral-layer-1-blockchain-in-biggest-threat-to-swift-yet/