Author: everythingcryptoitclouds.com

Introduction: From Windfall to Wipeout

In the high-stakes world of cryptocurrency, fortunes can be made and lost in the blink of an eye. Few stories illustrate this brutal reality as vividly as that of the “Hyperunit whale,” a prominent trader who, in a dramatic turn of events, saw a $200 million windfall transform into a $250 million Ether (ETH) loss in early February 2026. This epic collapse, which left the whale with a mere $53 in their Hyperliquid account, serves as a cautionary tale about the perils of extreme leverage and the unforgiving nature of crypto markets.

This blog post delves into the rise and fall of the Hyperunit whale, examining the market dynamics that led to this brutal liquidation and the critical lessons for all crypto investors.

The Rise: A Master of Market Timing

The Hyperunit whale first gained notoriety in October 2025. At a time of heightened geopolitical tension, specifically around former President Trump’s tariff announcements, the whale made a strategic move: shorting over $1 billion in Bitcoin (BTC) and Ether (ETH). This prescient bet paid off handsomely, reportedly netting the trader a staggering $200 million windfall as the market reacted sharply to the news.

Linked to Garrett Jin, co-founder of WaveLabs/GroupFi, the whale’s identity became a subject of intense speculation. While Jin claimed the funds belonged to clients, the market was captivated by the apparent genius of a trader who could so accurately time a major market downturn.

The Fall: When Conviction Meets Catastrophe

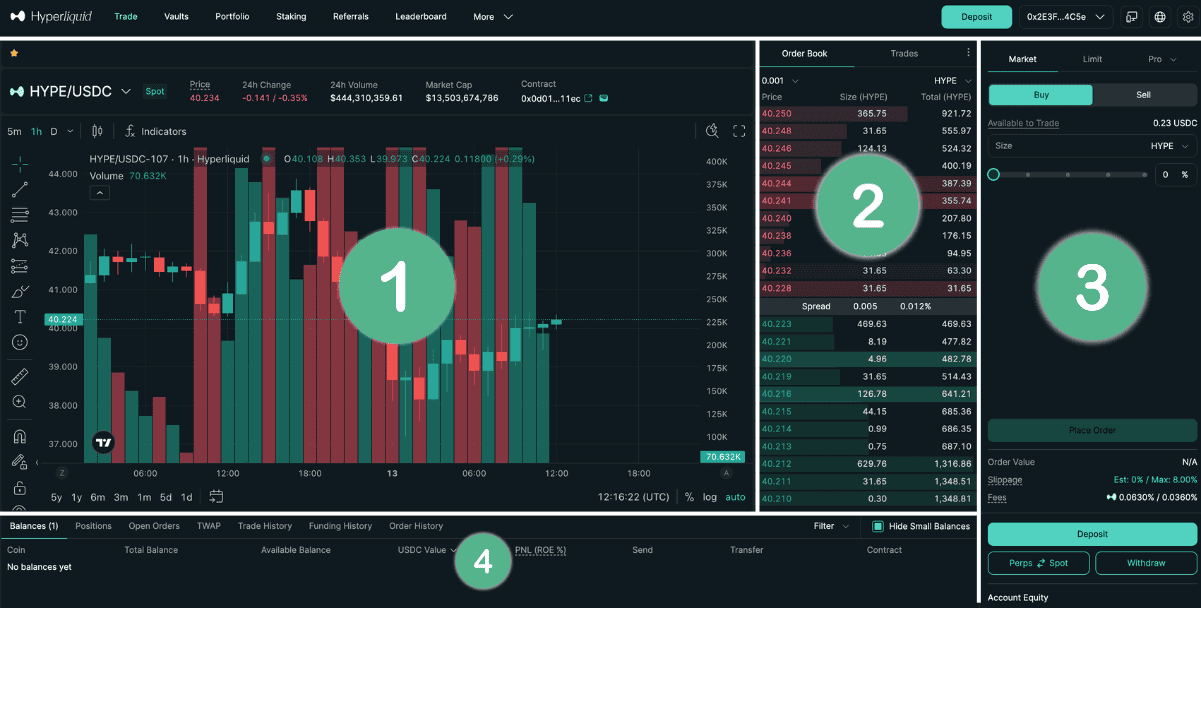

Flush with success, the Hyperunit whale shifted strategy in mid-January 2026, taking a massive long position on Ethereum. Their total long exposure, encompassing ETH, Solana (SOL), and Bitcoin, exceeded $900 million, with a significant portion dedicated to Ether, valued at over $730 million.

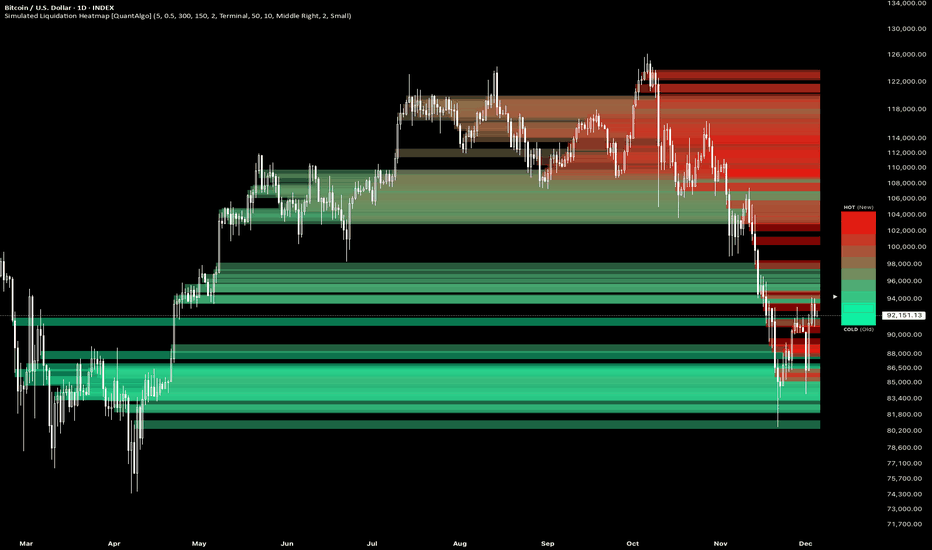

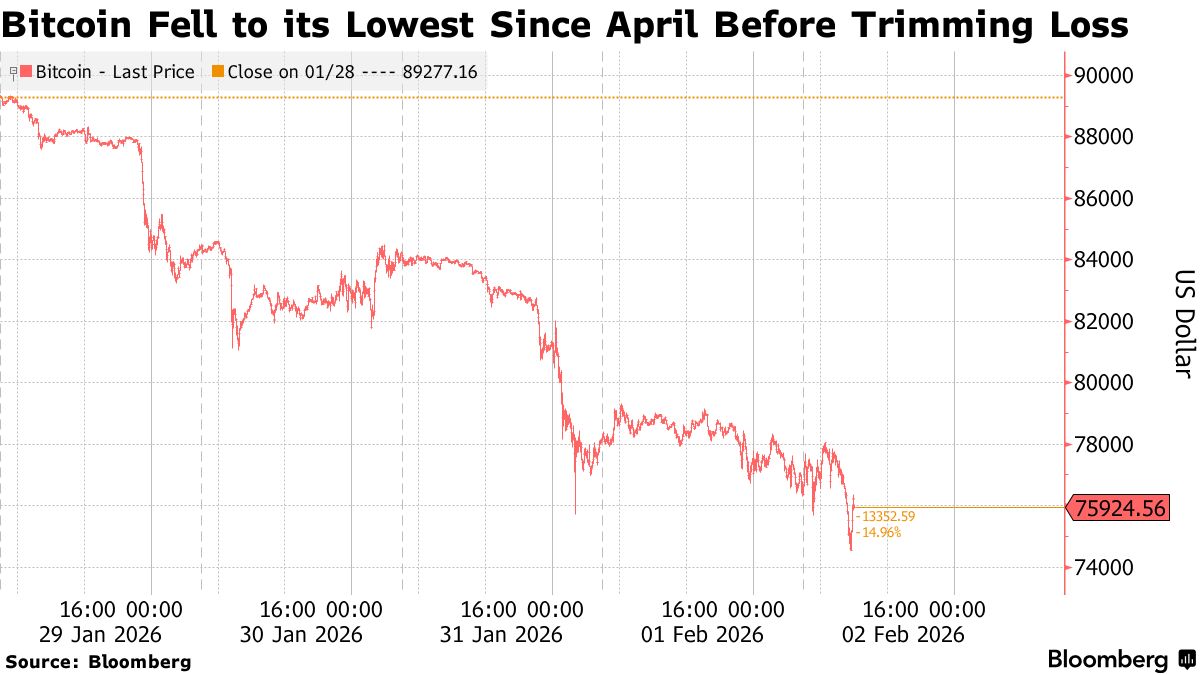

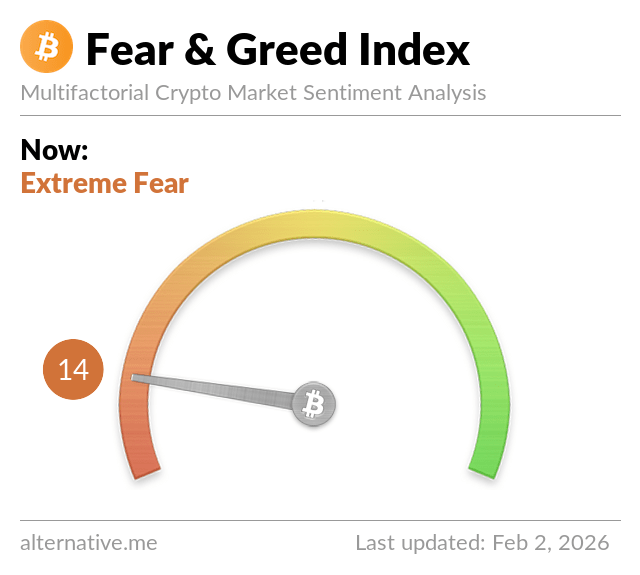

However, the market had other plans. As February dawned, a confluence of macroeconomic headwinds and a broader crypto market downturn—dubbed “Black Sunday II”—sent Ether spiraling. The price of ETH broke below a critical support level of $2,620, accelerating its descent towards the $2,247-$2,400 range. This rapid depreciation triggered a cascade of liquidations across the market, and the Hyperunit whale’s highly leveraged position became unsustainable.

In a brutal 24-hour period, the whale was forced to exit their entire ETH long position on Hyperliquid, realizing an estimated $250 million loss. The once-mighty account was reduced to a mere $53, a stark symbol of how quickly fortunes can reverse in the crypto space.

The Aftermath: Lessons from the Abyss

The Hyperunit whale’s collapse sent shockwaves through the crypto community, contributing to a broader market liquidation event that saw over $2.5 billion wiped out. This incident offers several critical lessons for both seasoned and novice investors:

1. The Double-Edged Sword of Leverage

Leverage amplifies both gains and losses. While it allowed the Hyperunit whale to achieve a $200 million windfall, it also led to a $250 million loss. Even with a massive capital base, excessive leverage can lead to total ruin when the market moves against a position. The lesson is clear: use leverage sparingly and with extreme caution.

2. Market Timing is a Fickle Friend

The whale’s initial success in timing the October 2025 crash was remarkable. However, the subsequent failure to anticipate or react to the February 2026 downturn highlights that consistent market timing is incredibly difficult, if not impossible. Relying solely on timing, especially with high leverage, is a recipe for disaster.

3. Risk Management is Paramount

Even for a trader with deep pockets, proper risk management is non-negotiable. The absence of adequate stop-losses or a sufficient margin buffer meant that a relatively modest percentage drop in Ether’s price led to a complete liquidation. Diversification, conservative position sizing, and strict stop-loss orders are essential safeguards against such catastrophic losses.

4. The Unforgiving Nature of Decentralized Finance

Platforms like Hyperliquid, while offering unprecedented access to leveraged trading, operate with automated liquidation mechanisms. There are no bailouts or second chances when margin requirements are breached. This transparent and unforgiving system ensures market integrity but demands extreme discipline from its participants.

Conclusion: A Cautionary Tale for All

The story of the Hyperunit whale is a powerful cautionary tale for anyone venturing into the volatile world of cryptocurrency. It underscores that even the most successful traders are not immune to the market’s brutal forces, especially when fueled by excessive leverage. While the allure of massive gains is undeniable, the potential for equally massive losses is ever-present.

For retail investors, the message is stark: learn from the mistakes of giants. Prioritize capital preservation, embrace conservative risk management, and never underestimate the market’s capacity for unexpected turns. In crypto, survival often means living to trade another day, even if it means missing out on some potential gains. The Hyperunit whale’s $53 balance is a sobering reminder of this fundamental truth.

References

[1] Cryptopolitan. Hyperunit whale’s $200M Trump-Tariff windfall turns into $250M Ether loss. [URL: https://www.cryptopolitan.com/hyperunit-whales-gain-turn-to-250m-loss/%5D

[2] Ainvest. ETH’s $2.6B Liquidation Wave: Flow-Driven Breakdown & Whale’s $250M Loss. [URL: https://www.ainvest.com/news/eth-2-6b-liquidation-wave-flow-driven-breakdown-whale-250m-loss-2602/%5D

[3] BingX. Hyperunit whale closes Ethereum long with $250M loss as ETH trades near $2,400. [URL: https://bingx.com/en/news/post/hyperunit-whale-closes-ethereum-long-with-m-loss-as-eth-trades-near%5D

[4] MEXC. Crypto Whale Suffers $250M Loss After Closing Massive Ethereum Long Position. [URL: https://www.mexc.com/en-GB/news/609282%5D

[5] CoinDesk. Single trader just lost $220 million as ether plunged 10%. [URL: https://www.coindesk.com/markets/2026/02/01/single-trader-just-lost-usd220-million-as-ether-plunged-10%5D

[6] Forklog. Hyperliquid Whale Loses $250 Million on Failed Ethereum Long, Leaving Just $53. [URL: https://forklog.com/en/hyperliquid-whale-loses-250-million-on-failed-ethereum-long-leaving-just-53/%5D