Published by everythingcryptoitclouds.com | August 27, 2025

The Digital Euro represents Europe’s strategic response to maintain monetary sovereignty in an increasingly digitized global financial system

In a development that could fundamentally reshape the global financial landscape, European Union officials are seriously considering launching the Digital Euro on public blockchains like Ethereum or Solana, marking a dramatic departure from earlier plans for a closed, centrally controlled system. This strategic pivot, accelerated by the recent passage of the United States’ GENIUS Act stablecoin legislation, represents far more than a technological upgrade—it embodies Europe’s determination to preserve its monetary sovereignty in an era where digital currencies are rapidly becoming the new battleground for global financial dominance [1].

The implications of this decision extend far beyond the technical specifications of blockchain platforms or the mechanics of central bank digital currencies (CBDCs). At its core, this represents a fundamental question about the future of monetary policy, financial independence, and geopolitical power in the digital age. As the European Central Bank (ECB) prepares to make its final decision by October 2025, the choice between Ethereum’s established ecosystem and Solana’s high-performance architecture will determine not only how Europeans interact with digital money but also whether Europe can maintain its financial autonomy in the face of mounting pressure from US dollar-denominated stablecoins and an increasingly assertive American digital currency strategy.

The urgency surrounding this decision has been dramatically heightened by the passage of the US GENIUS Act in July 2025, which provides a comprehensive regulatory framework for dollar-backed stablecoins and positions the United States to dominate the emerging digital payments landscape. This legislation represents a clear strategic move by the United States to leverage its existing monetary hegemony into the digital realm, creating what ECB officials describe as an existential threat to European monetary sovereignty. The response from European policymakers has been swift and decisive: accelerate the Digital Euro project and consider deployment on public blockchains that could provide immediate access to global crypto infrastructure and decentralized finance (DeFi) ecosystems.

The technical and strategic considerations surrounding the choice between Ethereum and Solana reveal the complexity of balancing innovation with sovereignty, accessibility with control, and global interoperability with regulatory compliance. Ethereum offers the maturity of a battle-tested ecosystem with robust smart contract capabilities and extensive developer infrastructure, while Solana provides the high-throughput performance necessary for consumer-scale payments and the low transaction costs essential for widespread adoption. Each platform presents distinct advantages and challenges that will shape not only the Digital Euro’s functionality but also its ability to serve as an effective tool for preserving European monetary independence.

The broader context of this decision encompasses a rapidly evolving landscape where traditional concepts of monetary sovereignty are being challenged by the borderless nature of digital currencies and the network effects that favor early movers in the digital payments space. The ECB’s own analysis reveals the stark reality facing European policymakers: if US dollar stablecoins become widely adopted in the eurozone for payments, savings, and settlement, the ECB’s control over monetary conditions could be fundamentally weakened, creating dynamics similar to those observed in dollarized economies where local monetary policy becomes subordinated to external forces [2].

This challenge is compounded by the strategic intent behind US stablecoin policy, which extends far beyond technological innovation to encompass clear geopolitical objectives. Through executive orders, congressional testimony, and public statements, the US administration has made explicit its goal of protecting the dollar’s global dominance by expanding its use on digital platforms worldwide while simultaneously reducing borrowing costs by increasing demand for US Treasuries through stablecoin reserve holdings. This represents a sophisticated strategy to leverage digital currency adoption as a tool for maintaining and extending American financial hegemony in the 21st century.

The European response must therefore be understood not merely as a technological initiative but as a comprehensive strategy for digital financial independence that encompasses monetary policy autonomy, regulatory sovereignty, and geopolitical positioning. The choice of blockchain platform for the Digital Euro will determine whether Europe can successfully navigate the transition to digital money while preserving the policy tools and institutional frameworks that have underpinned European monetary stability and independence since the creation of the euro.

Understanding the full implications of this decision requires examining not only the immediate technical and economic considerations but also the long-term strategic dynamics that will shape the global financial system as it becomes increasingly digitized. The success or failure of the Digital Euro initiative will have profound consequences not only for European monetary policy but also for the broader question of whether sovereign nations can maintain meaningful control over their monetary systems in an era of global digital currencies and decentralized financial networks.

The Monetary Sovereignty Crisis: How US Stablecoins Threaten European Financial Independence

The threat to European monetary sovereignty posed by US dollar-denominated stablecoins represents one of the most significant challenges to the eurozone’s financial independence since the currency’s creation. According to the European Central Bank’s comprehensive analysis published in July 2025, the widespread adoption of dollar stablecoins in the euro area could fundamentally undermine the ECB’s ability to conduct effective monetary policy, creating a scenario where European financial conditions become increasingly dependent on US monetary policy decisions and dollar-denominated financial instruments [2].

The mechanics of this threat are both subtle and profound, operating through multiple channels that collectively erode the foundations of monetary sovereignty. In the payments sphere, stablecoin adoption is gaining significant traction in remittances and e-commerce, with major US payment networks including Visa and Mastercard already integrating stablecoins into their global offerings. This integration creates a pathway for dollar-denominated digital currencies to penetrate European payment systems, potentially displacing euro-denominated transactions and reducing the ECB’s visibility into and control over monetary flows within the eurozone.

Perhaps more concerning is the potential for large-scale merchants to shift their transaction processing to stablecoin-based systems. The ECB notes that major US retailers including Walmart and Amazon are actively exploring stablecoin adoption, which could result in massive volumes of cash and card transactions being processed outside traditional European financial infrastructure. This shift would not only reduce the effectiveness of European monetary policy transmission mechanisms but also create dependencies on US-controlled payment rails that could be leveraged for geopolitical purposes.

The settlement and savings functions of stablecoins present additional challenges to European monetary sovereignty. Stablecoins are increasingly used for settling trades in decentralized finance protocols, cryptocurrency exchanges, and tokenized asset markets, creating parallel financial infrastructure that operates independently of European regulatory oversight and monetary policy influence. In emerging institutional use cases, stablecoins support delivery-versus-payment mechanisms and interbank transactions, offering speed, global accessibility, and interoperability advantages that traditional European payment systems struggle to match.

The interest-bearing capabilities of certain stablecoin platforms pose perhaps the most direct threat to European banking stability and monetary policy effectiveness. While stablecoins themselves typically do not offer interest, various platforms enable users to earn returns through lending, liquidity provision, and yield farming activities that can generate returns similar to traditional savings accounts, albeit with higher risks. The ECB warns that if interest-bearing stablecoins become common and businesses begin using them extensively, they could divert deposits from traditional European banks, jeopardizing financial intermediation and hampering credit availability throughout the eurozone.

This concern is particularly acute in Europe, where banks play a central role in the financial system and deposits represent their primary source of refinancing. The potential for stablecoins to disintermediate European banks could create systemic risks to financial stability while simultaneously reducing the effectiveness of monetary policy transmission through the banking sector. The ECB’s analysis suggests that such a shift could pose significant risks to financial stability and undermine the institutional foundations of European monetary policy.

The network effects inherent in digital currency adoption amplify these concerns, creating dynamics where early dominance becomes increasingly difficult to challenge. As the ECB notes, the larger the footprint of US dollar stablecoins in European markets, the harder these positions become to unwind due to the economies of scale and network effects that characterize digital payment systems. This creates a potential scenario where gradual adoption of dollar stablecoins could lead to irreversible changes in European monetary dynamics, echoing patterns observed in dollarized economies where local currencies become subordinated to external monetary forces.

The strategic implications extend beyond immediate monetary policy concerns to encompass broader questions of financial sovereignty and geopolitical independence. If US dollar stablecoins achieve widespread adoption in cross-border transactions and tokenized settlement systems, they could cement early dominance in critical areas of digital finance, providing the United States with strategic and economic advantages including cheaper debt financing and enhanced global influence. For Europe, this scenario would likely result in higher financing costs relative to the United States, reduced monetary policy autonomy, and increased geopolitical dependency on US financial infrastructure and policy decisions.

The ECB’s analysis reveals the sophisticated nature of US strategy in this domain, noting that American support for stablecoins extends far beyond technological innovation to encompass explicit geopolitical objectives. Through executive orders, congressional testimony, and public communications, the US administration has articulated a clear dual strategy: protecting the dollar’s global dominance by expanding its use on digital platforms worldwide, and reducing US borrowing costs by increasing demand for US Treasuries through stablecoin reserve holdings. This represents a coordinated effort to leverage digital currency adoption as a tool for maintaining and extending American financial hegemony in the digital age.

The timing and scope of the US GENIUS Act, passed in July 2025, underscore the strategic nature of American stablecoin policy. This comprehensive regulatory framework for payment stablecoins provides regulated dollar-backed tokens with significant advantages in global markets while creating regulatory clarity that facilitates widespread adoption. The legislation effectively positions the United States to dominate the emerging digital payments landscape by providing a clear regulatory pathway for dollar-denominated stablecoins while maintaining barriers for competing currencies and systems.

European policymakers have recognized the existential nature of this challenge, with ECB executive board member Piero Cipollone warning in April 2025 that US stablecoins could move deposits from European banks and strengthen the dollar’s global role. Cipollone specifically noted that measures taken by the Trump administration “to promote crypto-assets and U.S. dollar-backed stablecoins” are raising concerns for “Europe’s financial stability and strategic autonomy,” highlighting the direct connection between US digital currency policy and European monetary sovereignty [3].

The response to this challenge requires a comprehensive strategy that addresses both the immediate competitive threats posed by US stablecoins and the longer-term structural changes needed to preserve European monetary sovereignty in the digital age. The ECB has identified several policy levers for addressing these challenges, including support for properly regulated euro-denominated stablecoins, acceleration of the Digital Euro project, and stronger global coordination on stablecoin regulation. However, the effectiveness of these measures will depend critically on the strategic choices made regarding the technical architecture and deployment strategy for the Digital Euro itself.

The Technical Battleground: Ethereum vs Solana for Digital Euro Infrastructure

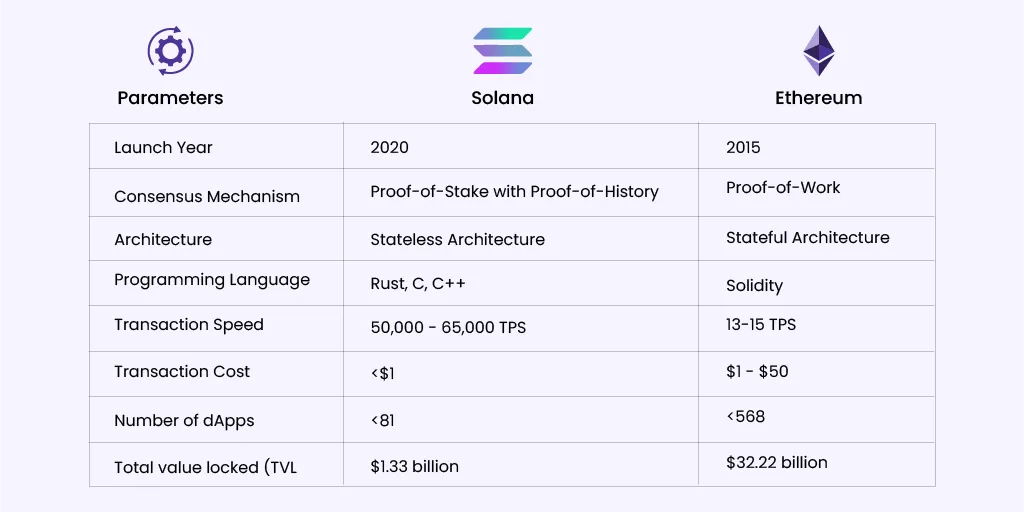

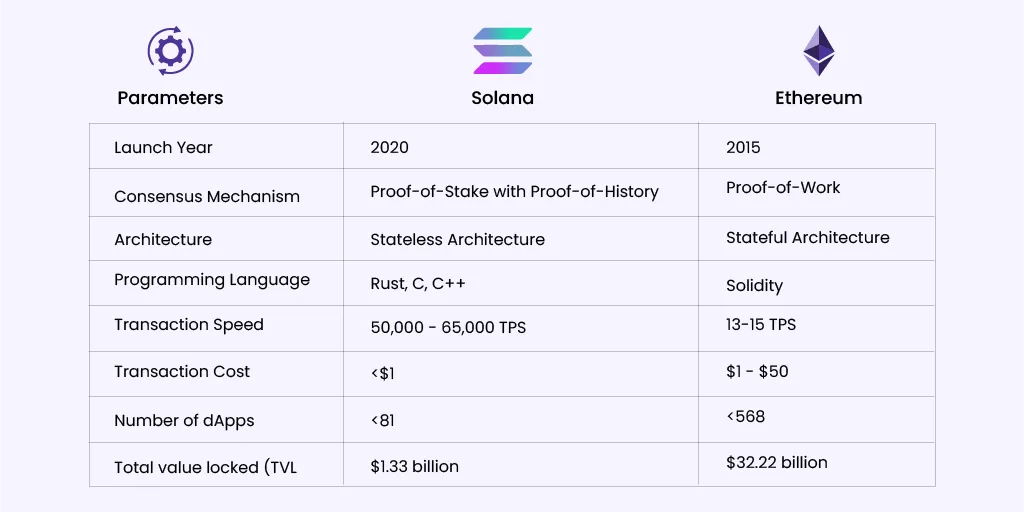

Technical comparison between Ethereum and Solana blockchain platforms, highlighting key differences in architecture, performance, and capabilities relevant to CBDC deployment

The choice between Ethereum and Solana as the underlying blockchain infrastructure for the Digital Euro represents one of the most consequential technical decisions in the history of central bank digital currencies, with implications that extend far beyond mere performance metrics to encompass fundamental questions about monetary policy implementation, regulatory compliance, and long-term strategic positioning. Each platform offers distinct advantages and presents unique challenges that must be carefully evaluated in the context of the ECB’s requirements for scalability, privacy, regulatory compliance, and monetary policy effectiveness.

Ethereum’s position as the leading smart contract platform provides significant advantages in terms of ecosystem maturity, developer infrastructure, and institutional adoption. The platform’s extensive developer community and robust tooling ecosystem offer the ECB access to a wealth of technical expertise and proven solutions for complex financial applications. Ethereum’s modular architecture, enhanced by recent upgrades including the transition to proof-of-stake consensus and the implementation of EIP-4844, provides flexibility for future upgrades and the ability to implement sophisticated privacy and compliance features through Layer-2 solutions and zero-knowledge proof systems.

The European Investment Bank’s successful deployment of over $100 million in tokenized assets on Ethereum demonstrates the platform’s capability to handle institutional-grade financial applications while meeting European regulatory requirements. This real-world validation provides confidence that Ethereum can support the complex compliance and reporting requirements that will be essential for Digital Euro implementation. The platform’s established integration with traditional financial infrastructure and its proven ability to handle large-scale institutional transactions make it a natural choice for a conservative central bank approach to CBDC deployment.

Ethereum’s smart contract capabilities offer particular advantages for implementing the sophisticated monetary policy tools that the ECB may require for effective Digital Euro management. The platform’s programmability enables the implementation of complex policy mechanisms including tiered interest rates, automatic compliance checking, and sophisticated privacy controls that could be essential for maintaining monetary policy effectiveness while meeting regulatory requirements. The extensive ecosystem of decentralized finance protocols built on Ethereum also provides opportunities for the Digital Euro to integrate with existing financial infrastructure and benefit from network effects that could accelerate adoption.

However, Ethereum’s scalability limitations present significant challenges for a CBDC that must handle millions of transactions daily across the eurozone. Despite recent improvements through Layer-2 solutions and the EIP-4844 upgrade that reduces data costs for rollups, Ethereum’s base layer throughput remains limited compared to the requirements for a consumer-scale digital currency. The platform’s variable transaction costs, while reduced through Layer-2 solutions, could create unpredictability in operational costs that may be problematic for central bank operations that require precise cost forecasting and budgeting.

Solana’s high-performance architecture presents a compelling alternative that addresses many of Ethereum’s scalability limitations while offering unique advantages for consumer-scale digital payments. The platform’s ability to process up to 65,000 transactions per second with sub-second finality and extremely low transaction costs makes it technically capable of handling the transaction volumes that would be required for widespread Digital Euro adoption. This performance advantage is particularly relevant for retail payments and micropayments that could represent a significant portion of Digital Euro usage.

The rapid growth of Solana’s real-world asset (RWA) tokenization market, which has expanded by 218% in 2025 to reach over $553.8 million in total value locked, demonstrates the platform’s appeal to institutional users and its capability to handle sophisticated financial applications. Major institutional investors including those behind the REX-Osprey SOL + Staking ETF, which attracted $316 million in July 2025, have demonstrated confidence in Solana’s long-term viability and institutional-grade capabilities.

Solana’s Token2022 standard provides native privacy features through encrypted balances, offering a foundation for implementing the cash-like anonymity that the ECB has identified as essential for Digital Euro acceptance. The platform’s low transaction costs and high throughput make it particularly suitable for the high-volume, low-value transactions that characterize much of retail payment activity, potentially enabling the Digital Euro to compete effectively with traditional payment methods and private stablecoins.

However, Solana’s relative youth compared to Ethereum raises questions about long-term stability and institutional readiness. The platform has experienced several network outages and performance issues that, while largely resolved, highlight the risks associated with deploying critical financial infrastructure on a less mature platform. The smaller developer ecosystem and more limited institutional adoption compared to Ethereum could present challenges for implementing the complex compliance and regulatory features that will be required for CBDC deployment.

The privacy and compliance requirements for the Digital Euro present unique challenges that both platforms must address through innovative technical solutions. The ECB’s goal of providing cash-like anonymity while meeting anti-money laundering (AML) and know-your-customer (KYC) requirements necessitates sophisticated privacy-preserving technologies that can selectively reveal transaction information to authorized parties while maintaining user privacy for legitimate transactions.

Ethereum’s zero-knowledge proof ecosystem, including ZK-rollups and zkEVMs, offers mature solutions for implementing customizable privacy controls that could meet the ECB’s requirements. These technologies enable the creation of privacy-preserving transaction systems that can provide different levels of anonymity based on transaction amounts, user types, and regulatory requirements. The battle-tested nature of these privacy solutions and their integration with existing Ethereum infrastructure provides confidence in their reliability and effectiveness.

Solana’s approach to privacy through the Token2022 standard and encrypted balances offers a more native solution that could be simpler to implement and maintain. However, the relative novelty of these privacy features and their limited real-world testing in regulatory environments raises questions about their readiness for deployment in a mission-critical CBDC application. The platform’s privacy tools may require additional development and testing to meet the sophisticated compliance requirements that will be essential for Digital Euro deployment.

The governance and upgrade mechanisms of each platform present additional considerations for long-term CBDC deployment. Ethereum’s established governance processes and conservative approach to protocol changes provide stability and predictability that may be valued by central bank operators. However, the decentralized nature of Ethereum governance means that the ECB would have limited direct control over future protocol changes that could affect Digital Euro operations.

Solana’s more centralized development model and faster iteration cycles could provide greater flexibility for implementing CBDC-specific features and optimizations. However, this approach also raises questions about long-term decentralization and the potential for governance conflicts that could affect CBDC operations. The platform’s validator set and governance mechanisms would need to be carefully evaluated to ensure that they provide appropriate levels of security and decentralization for critical financial infrastructure.

The interoperability requirements for the Digital Euro add another layer of complexity to the platform selection decision. The ability to interact with existing financial infrastructure, other CBDCs, and private digital currencies will be essential for Digital Euro success. Ethereum’s extensive ecosystem of bridges, protocols, and integrations provides robust interoperability capabilities that could facilitate Digital Euro integration with global financial systems.

Solana’s growing ecosystem of cross-chain protocols and its integration with major DeFi platforms provide increasing interoperability capabilities, though these remain less mature than Ethereum’s offerings. The platform’s high performance could enable more efficient cross-chain operations, but the relative novelty of its interoperability solutions may present risks for mission-critical applications.

The decision between Ethereum and Solana ultimately reflects a fundamental trade-off between maturity and performance, between proven stability and cutting-edge capabilities. The ECB’s choice will likely depend on its assessment of the relative importance of these factors and its confidence in each platform’s ability to meet the long-term requirements of Digital Euro deployment. The possibility of a hybrid approach that leverages the strengths of both platforms through interoperability solutions represents an intriguing alternative that could provide the benefits of both ecosystems while mitigating their individual limitations.

Privacy Paradox: Balancing Transparency with Anonymity in the Digital Euro

The implementation of the Digital Euro on public blockchains creates a fundamental tension between the transparency inherent in distributed ledger technology and the privacy requirements that are essential for both user acceptance and regulatory compliance. This privacy paradox represents one of the most complex challenges facing ECB policymakers as they navigate the competing demands of financial surveillance, user privacy, anti-money laundering compliance, and the cash-like anonymity that has been identified as crucial for Digital Euro adoption.

The European Union’s General Data Protection Regulation (GDPR) framework presents particular challenges for public blockchain deployment, as the regulation’s core principles including the right to data erasure and data minimization conflict with the immutable nature of blockchain records. The GDPR’s requirement that individuals have the right to have their personal data erased creates a fundamental incompatibility with public blockchains where transaction records are permanently stored and cannot be modified or deleted without compromising the integrity of the entire system.

The ECB’s stated goal of preserving cash-like anonymity in digital payments adds another layer of complexity to the privacy challenge. Physical cash transactions provide complete anonymity for both parties, enabling private economic activity without government surveillance or third-party monitoring. Replicating this level of privacy in a digital system while maintaining the transparency and auditability required for regulatory compliance represents a significant technical and policy challenge that will require innovative solutions and careful balance between competing objectives.

The solution to this privacy paradox likely lies in the implementation of sophisticated zero-knowledge proof systems and tiered privacy models that can provide different levels of anonymity based on transaction characteristics, user types, and regulatory requirements. The ECB is expected to adopt a tiered privacy approach where small transactions below a certain threshold receive pseudonymous treatment similar to cash, while larger transactions are subject to enhanced monitoring and compliance checks including full know-your-customer (KYC) and anti-money laundering (AML) verification.

Ethereum’s mature zero-knowledge proof ecosystem provides several potential solutions for implementing these privacy requirements. ZK-rollups and zkEVMs enable the creation of privacy-preserving transaction systems that can selectively reveal information to authorized parties while maintaining user privacy for legitimate transactions. These systems can be programmed to automatically apply different privacy levels based on transaction amounts, enabling small retail transactions to maintain cash-like anonymity while ensuring that larger transactions receive appropriate regulatory oversight.

The implementation of zero-knowledge proofs for Digital Euro privacy would likely involve the creation of specialized smart contracts that can verify transaction validity without revealing transaction details to unauthorized parties. These systems could enable users to prove that they have sufficient funds for a transaction and that the transaction complies with relevant regulations without revealing their identity, transaction history, or account balances to other network participants.

Solana’s Token2022 standard offers a different approach to privacy through native encrypted balances and confidential transfers that could provide the foundation for Digital Euro privacy features. This approach could be simpler to implement and maintain than Ethereum’s more complex zero-knowledge proof systems, but it may offer less flexibility for implementing the sophisticated compliance features that will be required for regulatory approval.

The privacy implementation for the Digital Euro will also need to address the requirements of financial intelligence units and law enforcement agencies that require access to transaction information for investigating financial crimes and ensuring compliance with sanctions and other regulatory requirements. This necessitates the creation of sophisticated key management systems that can provide authorized access to transaction information while maintaining privacy for legitimate users and preventing unauthorized surveillance.

The technical implementation of these privacy features will likely require the development of new cryptographic protocols and governance mechanisms that can balance the competing requirements of privacy, compliance, and monetary policy effectiveness. The ECB will need to work closely with privacy researchers, cryptographers, and regulatory experts to develop solutions that can meet all of these requirements while maintaining the performance and scalability necessary for a consumer-scale digital currency.

Regulatory Compliance and the GDPR Challenge

The deployment of the Digital Euro on public blockchains creates unprecedented challenges for regulatory compliance, particularly in relation to the European Union’s comprehensive data protection framework and the complex web of financial regulations that govern central bank operations. The intersection of blockchain technology with European regulatory requirements necessitates innovative approaches to compliance that can satisfy regulatory objectives while preserving the benefits of distributed ledger technology.

The GDPR’s principle of data minimization requires that personal data processing be limited to what is necessary for the specified purpose, creating tension with blockchain systems that typically record comprehensive transaction information for security and verification purposes. The regulation’s requirement for data portability and the right to rectification present additional challenges for immutable blockchain systems where transaction records cannot be modified after they are recorded.

The solution to these GDPR challenges will likely require the implementation of privacy-by-design principles that minimize the collection and storage of personal data while maintaining the functionality required for Digital Euro operations. This could involve the use of pseudonymous identifiers, encrypted data storage, and off-chain data management systems that can provide GDPR compliance while maintaining blockchain security and integrity.

The ECB’s approach to regulatory compliance will also need to address the complex requirements of anti-money laundering and counter-terrorism financing regulations that require financial institutions to monitor transactions, report suspicious activities, and maintain comprehensive records of customer identities and transaction histories. These requirements must be balanced with privacy protections and the operational efficiency that is essential for Digital Euro success.

The implementation of automated compliance checking through smart contracts represents a promising approach for meeting regulatory requirements while minimizing operational costs and human intervention. These systems could automatically flag transactions that meet certain criteria for enhanced monitoring, apply appropriate compliance checks based on transaction characteristics, and generate the reports required by regulatory authorities.

The cross-border nature of blockchain networks creates additional compliance challenges as the Digital Euro would need to comply with the regulatory requirements of multiple jurisdictions while maintaining interoperability with global financial systems. This necessitates the development of flexible compliance frameworks that can adapt to different regulatory environments while maintaining consistent security and privacy protections.

Strategic Implications for European Financial Sovereignty

The decision to deploy the Digital Euro on public blockchains represents a fundamental shift in European monetary policy strategy that extends far beyond technical considerations to encompass broader questions of financial sovereignty, geopolitical positioning, and long-term strategic autonomy. This decision will determine whether Europe can maintain meaningful control over its monetary system in an increasingly digitized global economy or whether it will become subordinated to external digital currency systems and payment networks.

The strategic implications of this decision are amplified by the network effects that characterize digital currency adoption, where early movers can achieve dominant positions that become increasingly difficult to challenge over time. The success of the Digital Euro in achieving widespread adoption will depend not only on its technical capabilities but also on its ability to integrate with existing financial infrastructure and provide compelling advantages over competing digital currency systems.

The choice of blockchain platform will significantly influence the Digital Euro’s ability to compete with US dollar stablecoins and other digital currencies in global markets. Deployment on Ethereum would provide immediate access to the world’s largest decentralized finance ecosystem and extensive developer community, potentially accelerating adoption and innovation around Digital Euro applications. However, this approach would also create dependencies on infrastructure that is not under European control and could be subject to external influence or disruption.

Deployment on Solana would provide access to high-performance infrastructure that could enable innovative payment applications and efficient cross-border transactions, but it would also create exposure to a less mature ecosystem with greater technical risks. The platform’s growing institutional adoption and expanding DeFi ecosystem provide opportunities for Digital Euro integration, but the relative concentration of validator nodes and development activity could create strategic vulnerabilities.

The broader implications of the Digital Euro initiative extend beyond immediate monetary policy concerns to encompass Europe’s position in the global digital economy and its ability to maintain technological sovereignty in critical areas of financial infrastructure. The success of the Digital Euro could establish Europe as a leader in CBDC development and provide a model for other central banks seeking to implement digital currencies while preserving monetary sovereignty.

The failure of the Digital Euro initiative, conversely, could result in European financial markets becoming increasingly dependent on US-controlled digital currency systems and payment networks, potentially undermining the ECB’s ability to conduct independent monetary policy and reducing Europe’s influence in global financial affairs. The stakes of this decision are therefore much higher than the immediate technical and operational considerations, encompassing fundamental questions about Europe’s future role in the global financial system.

The international implications of the Digital Euro decision will also influence the development of global standards for CBDC implementation and cross-border digital currency cooperation. Europe’s approach to privacy, compliance, and interoperability could establish precedents that influence how other central banks approach digital currency development and how international cooperation on digital currency issues evolves.

The success of the Digital Euro in maintaining European monetary sovereignty while providing the benefits of digital currency technology could demonstrate that it is possible to preserve national monetary policy autonomy in an era of global digital currencies. This would provide a valuable model for other countries seeking to implement CBDCs while maintaining their monetary independence and could contribute to the development of a more multipolar digital currency system that preserves space for national monetary policy autonomy.

The European sovereign debt crisis highlighted the importance of monetary sovereignty, making the Digital Euro’s role in preserving financial independence even more critical

The long-term success of the Digital Euro will ultimately depend on its ability to provide compelling advantages over existing payment systems and competing digital currencies while maintaining the privacy, security, and regulatory compliance that are essential for central bank credibility and user acceptance. The choice of blockchain platform represents just one element of this broader strategic challenge, but it is a decision that will have profound implications for the Digital Euro’s ability to achieve its objectives and preserve European monetary sovereignty in the digital age.

Investment Implications and Market Opportunities

The ECB’s October 2025 decision on Digital Euro blockchain infrastructure is poised to unlock billions in institutional capital and create significant investment opportunities across multiple sectors of the digital asset ecosystem. The institutional validation that would result from ECB deployment on public blockchains represents a watershed moment for blockchain technology adoption, potentially catalyzing a surge in institutional investment and mainstream acceptance of distributed ledger technology for critical financial infrastructure.

The investment implications of this decision extend across three primary categories of opportunities that are positioned to benefit from the institutional capital flows and technological validation that would result from Digital Euro deployment. Layer-2 scaling solutions represent the first major opportunity, as the ECB’s privacy and compliance requirements will likely necessitate sophisticated zero-knowledge proof systems and specialized rollup technologies that can provide the performance and privacy features required for CBDC operations.

Companies developing ZK-rollup technology including StarkWare, zkSync, and Polygon are positioned to benefit significantly from Digital Euro deployment, as their technologies provide the scalability and privacy features that will be essential for consumer-scale CBDC operations. The ECB’s requirements for cash-like anonymity combined with regulatory compliance will likely drive demand for advanced zero-knowledge proof systems that can selectively reveal transaction information to authorized parties while maintaining user privacy.

The cross-chain interoperability sector represents another significant investment opportunity, as the Digital Euro will need to interact with existing financial infrastructure, other CBDCs, and private digital currencies to achieve widespread adoption. Projects developing bridge protocols, cross-chain communication systems, and interoperability solutions including Wormhole, Polkadot’s XCMP, and specialized CBDC interoperability platforms are positioned to capture value from the integration requirements that will be essential for Digital Euro success.

Real-world asset (RWA) tokenization platforms represent the third major investment category, as the Digital Euro’s deployment on public blockchains will likely accelerate the tokenization of traditional financial assets and create new opportunities for programmable money applications. The European Investment Bank’s existing $100 million in tokenized assets on Ethereum demonstrates the potential for institutional adoption of RWA tokenization, and Digital Euro deployment could significantly expand this market.

The growth trajectory of Solana’s RWA market, which has expanded by 218% in 2025 to reach over $553.8 million in total value locked, illustrates the potential scale of this opportunity. Companies developing tokenization platforms, custody solutions, and compliance infrastructure for RWA applications are positioned to benefit from the institutional validation and regulatory clarity that would result from Digital Euro deployment.

The broader institutional adoption trends that would result from ECB validation of public blockchain infrastructure could create significant opportunities for blockchain infrastructure providers, validator networks, and specialized CBDC service providers. The institutional capital flows that would likely follow ECB deployment could drive significant appreciation in the underlying blockchain tokens and create new markets for specialized financial services built on blockchain infrastructure.

The timing of investment positioning is critical, as the ECB’s October 2025 decision will likely create immediate market reactions and longer-term structural changes in institutional blockchain adoption. Investors seeking to capitalize on these opportunities should consider diversified exposure across both Ethereum and Solana ecosystems while prioritizing companies and projects that are specifically positioned to benefit from CBDC deployment and institutional blockchain adoption.

The risk factors associated with these investment opportunities include regulatory uncertainty, technical execution risks, and the possibility that the ECB could choose alternative approaches that do not involve public blockchain deployment. However, the strategic imperative for European monetary sovereignty and the competitive pressure from US stablecoin adoption suggest that some form of Digital Euro deployment on advanced blockchain infrastructure is likely regardless of the specific technical approach chosen.

Market Analysis and Competitive Dynamics

The competitive landscape for Digital Euro deployment reflects broader trends in the global race for digital currency dominance, where early movers can achieve network effects and institutional adoption that create sustainable competitive advantages. The ECB’s decision will not only determine the technical architecture of the Digital Euro but also influence the broader competitive dynamics between different blockchain ecosystems and their ability to capture institutional adoption and regulatory validation.

Ethereum’s position as the dominant smart contract platform provides significant advantages in terms of existing institutional adoption, developer ecosystem maturity, and proven scalability solutions through Layer-2 networks. The platform’s extensive DeFi ecosystem and established institutional presence create network effects that could accelerate Digital Euro adoption and provide immediate access to sophisticated financial applications and services.

The recent growth in Ethereum’s institutional adoption, including the European Investment Bank’s tokenization initiatives and the expanding ecosystem of institutional DeFi protocols, demonstrates the platform’s readiness for large-scale institutional deployment. The platform’s conservative approach to protocol changes and established governance mechanisms provide the stability and predictability that central banks typically require for critical infrastructure deployment.

Solana’s competitive positioning emphasizes performance and cost efficiency, with technical capabilities that could enable innovative Digital Euro applications and efficient cross-border payment systems. The platform’s growing institutional adoption, evidenced by the success of the REX-Osprey SOL + Staking ETF and expanding RWA tokenization market, demonstrates increasing confidence in its long-term viability and institutional-grade capabilities.

The competitive dynamics between these platforms will likely be influenced by their ability to address the specific requirements of CBDC deployment, including privacy features, regulatory compliance capabilities, and integration with existing financial infrastructure. The platform that can most effectively address these requirements while maintaining performance and cost efficiency will likely capture the majority of institutional CBDC deployment opportunities.

The broader market implications of Digital Euro deployment extend beyond the immediate choice between blockchain platforms to encompass the validation of public blockchain infrastructure for critical financial applications. This validation could accelerate institutional adoption across multiple sectors and create new markets for blockchain-based financial services that were previously considered too risky or unproven for institutional deployment.

The international competitive implications of the Digital Euro decision will also influence global CBDC development trends and the relative positioning of different blockchain ecosystems in the emerging digital currency landscape. Success in capturing Digital Euro deployment could provide significant advantages in competing for other CBDC projects and institutional blockchain applications globally.

Conclusion: The Future of European Monetary Sovereignty

The European Central Bank’s consideration of deploying the Digital Euro on public blockchains like Ethereum or Solana represents a pivotal moment in the evolution of monetary policy and financial sovereignty in the digital age. This decision transcends mere technical considerations to encompass fundamental questions about the future of money, the role of central banks in digital economies, and the ability of sovereign nations to maintain monetary independence in an increasingly interconnected and digitized global financial system.

The urgency driving this decision reflects the existential challenge posed by the rapid growth of US dollar-denominated stablecoins and the strategic intent behind American digital currency policy. The passage of the GENIUS Act and the explicit US strategy to leverage stablecoin adoption for maintaining dollar dominance have created a competitive dynamic where European inaction could result in the gradual erosion of monetary sovereignty and increased dependence on US-controlled financial infrastructure.

The choice between Ethereum and Solana as the underlying blockchain infrastructure for the Digital Euro represents a fundamental trade-off between maturity and performance, between proven stability and cutting-edge capabilities. Ethereum’s established ecosystem and institutional adoption provide confidence in its ability to handle the complex requirements of CBDC deployment, while Solana’s high-performance architecture offers the scalability and efficiency that could be essential for consumer-scale digital currency adoption.

The privacy and compliance challenges associated with public blockchain deployment require innovative solutions that can balance the competing demands of user privacy, regulatory compliance, and monetary policy effectiveness. The successful resolution of these challenges will not only determine the viability of the Digital Euro but also establish precedents for how democratic societies can implement digital currencies while preserving individual privacy and institutional accountability.

The broader implications of this decision extend far beyond the eurozone to encompass global trends in CBDC development, the future of monetary policy in digital economies, and the preservation of monetary sovereignty in an era of global digital currencies. The success or failure of the Digital Euro initiative will influence how other central banks approach digital currency development and could determine whether the future of money is characterized by monetary diversity or digital currency hegemony.

The investment opportunities created by Digital Euro deployment represent just one dimension of the broader transformation that is reshaping the global financial system. The institutional validation of public blockchain infrastructure for critical financial applications could accelerate adoption across multiple sectors and create new markets for digital financial services that were previously considered too risky or unproven for institutional deployment.

The ECB’s October 2025 decision will mark a crucial inflection point in the global competition for digital currency dominance and the preservation of monetary sovereignty in the digital age. The stakes of this decision extend far beyond the immediate technical and operational considerations to encompass fundamental questions about the future of European financial independence and the role of democratic institutions in shaping the digital economy.

The success of the Digital Euro in preserving European monetary sovereignty while providing the benefits of digital currency technology will depend not only on the technical capabilities of the chosen blockchain platform but also on the ECB’s ability to navigate the complex challenges of privacy, compliance, and international cooperation that characterize the emerging digital currency landscape. The outcome of this initiative will have profound implications for the future of money, the preservation of monetary sovereignty, and the ability of democratic societies to maintain control over their financial destinies in the digital age.

As Europe stands at this critical juncture, the Digital Euro represents more than a technological upgrade—it embodies the continent’s determination to preserve its financial independence and democratic values in an increasingly digital and interconnected world. The success of this initiative will determine whether Europe can chart its own course in the digital currency revolution or whether it will become subordinated to external digital currency systems that prioritize efficiency over sovereignty and innovation over democratic accountability.

References

[1] Yahoo Finance. “What a Digital Euro on Ethereum or Solana Means for Europe’s Monetary Sovereignty.” August 26, 2025. https://finance.yahoo.com/news/digital-euro-ethereum-solana-means-002903392.html

[2] European Central Bank. “From hype to hazard: what stablecoins mean for Europe.” ECB Blog, July 28, 2025. https://www.ecb.europa.eu/press/blog/date/2025/html/ecb.blog20250728~e6cb3cf8b5.en.html

[3] AInvest. “ECB’s Digital Euro on Public Blockchain: A Paradigm Shift in Institutional Blockchain Adoption.” August 24, 2025. https://www.ainvest.com/news/ecb-digital-euro-public-blockchain-paradigm-shift-institutional-blockchain-adoption-2508/

[4] Financial Times. “ECB considers public blockchains for digital euro deployment.” August 2025.

[5] CoinDesk. “European officials debate blockchain platform selection for Digital Euro.” August 2025.

[6] Decrypt. “Digital Euro blockchain decision accelerated by US GENIUS Act.” August 2025.

This analysis is based on publicly available information and expert analysis as of August 27, 2025. The views expressed are those of the author and do not constitute investment advice. Readers should conduct their own research and consult with qualified professionals before making investment decisions.