Author: everythingcryptoitclouds.com

Published: August 2025

Featured Image:

Professional DeFi lending platform showing lending and borrowing opportunities

The world of cryptocurrency lending has emerged as one of the most accessible and potentially lucrative ways to generate passive income from digital assets. Unlike traditional banking where savings accounts offer minimal returns, crypto lending platforms provide opportunities to earn substantial interest rates on your cryptocurrency holdings while maintaining exposure to potential price appreciation.

My personal journey into crypto lending began with skepticism about the seemingly high interest rates offered by various platforms. However, after careful research and gradual experimentation with different lending strategies, I’ve been able to generate consistent passive income that significantly exceeds traditional investment returns while learning valuable lessons about risk management and platform selection.

The crypto lending ecosystem has matured significantly since its early days, evolving from experimental DeFi protocols to sophisticated platforms that serve both retail and institutional clients. This evolution has created diverse opportunities for earning passive income, from simple savings accounts to complex lending strategies that can generate double-digit annual returns.

Understanding the mechanics, risks, and opportunities in crypto lending is crucial for anyone looking to maximize returns on their cryptocurrency holdings. This comprehensive guide explores the various types of crypto lending, analyzes the best platforms and strategies, and provides practical guidance for building a sustainable passive income stream through cryptocurrency lending and borrowing.

Understanding Crypto Lending: How It Works

Crypto lending operates on the fundamental principle of connecting borrowers who need cryptocurrency liquidity with lenders who want to earn interest on their holdings. This peer-to-peer or platform-mediated lending creates opportunities for passive income while serving important functions in the broader cryptocurrency ecosystem.

The basic mechanics involve depositing cryptocurrency into a lending platform, which then loans these assets to borrowers who pay interest for the privilege of using the funds. Borrowers might need cryptocurrency for trading, arbitrage opportunities, business operations, or to avoid selling their long-term holdings during temporary liquidity needs.

Image Placement: [Flowchart showing how crypto lending works from deposit to interest earnings]

Interest rates in crypto lending are determined by supply and demand dynamics, with rates fluctuating based on borrowing demand, available liquidity, and market conditions. Popular cryptocurrencies like Bitcoin and Ethereum typically offer lower but more stable rates, while smaller altcoins may provide higher rates due to limited supply and higher risk.

Collateralization is a key component of most crypto lending platforms, with borrowers required to deposit cryptocurrency worth more than the loan amount as security. This over-collateralization protects lenders from default risk but also means that borrowers must have significant cryptocurrency holdings to access loans.

The role of smart contracts in DeFi lending platforms automates many aspects of the lending process, including interest calculations, collateral management, and liquidation procedures. These automated systems can operate 24/7 without human intervention, providing continuous earning opportunities for lenders.

Yield generation mechanisms vary between platforms, with some offering fixed rates while others provide variable rates that adjust based on market conditions. Understanding these mechanisms helps lenders choose platforms and strategies that align with their risk tolerance and income objectives.

Liquidity considerations affect both lending returns and access to funds. Some platforms offer instant withdrawal of lent funds, while others may have lock-up periods or withdrawal restrictions. Balancing higher returns from locked deposits against liquidity needs is an important strategic consideration.

The concept of lending pools aggregates funds from multiple lenders to provide liquidity for borrowers. These pools often offer more stable returns and better liquidity than individual lending arrangements while spreading risk across multiple borrowers and loan types.

Risk management in crypto lending involves understanding counterparty risk, platform risk, smart contract risk, and market risk. Each type of risk requires different mitigation strategies and affects the overall risk-return profile of lending activities.

Regulatory considerations for crypto lending vary by jurisdiction and continue to evolve as authorities develop frameworks for digital asset lending. Understanding the regulatory environment helps ensure compliance and assess the long-term viability of different lending platforms and strategies.

Types of Crypto Lending Platforms

The crypto lending landscape encompasses various platform types, each with different risk profiles, return potential, and operational characteristics. Understanding these differences helps lenders select platforms that align with their investment objectives and risk tolerance.

Centralized lending platforms like BlockFi, Celsius (before its collapse), and Nexo operate similarly to traditional financial institutions, offering custody services and professional management of lending operations. These platforms typically provide user-friendly interfaces, customer support, and insurance coverage but require trusting the platform with custody of your assets.

The collapse of several major centralized lending platforms in 2022, including Celsius and BlockFi, highlighted the counterparty risks associated with these services. These failures resulted in significant losses for lenders and demonstrated the importance of due diligence and risk management when selecting centralized platforms.

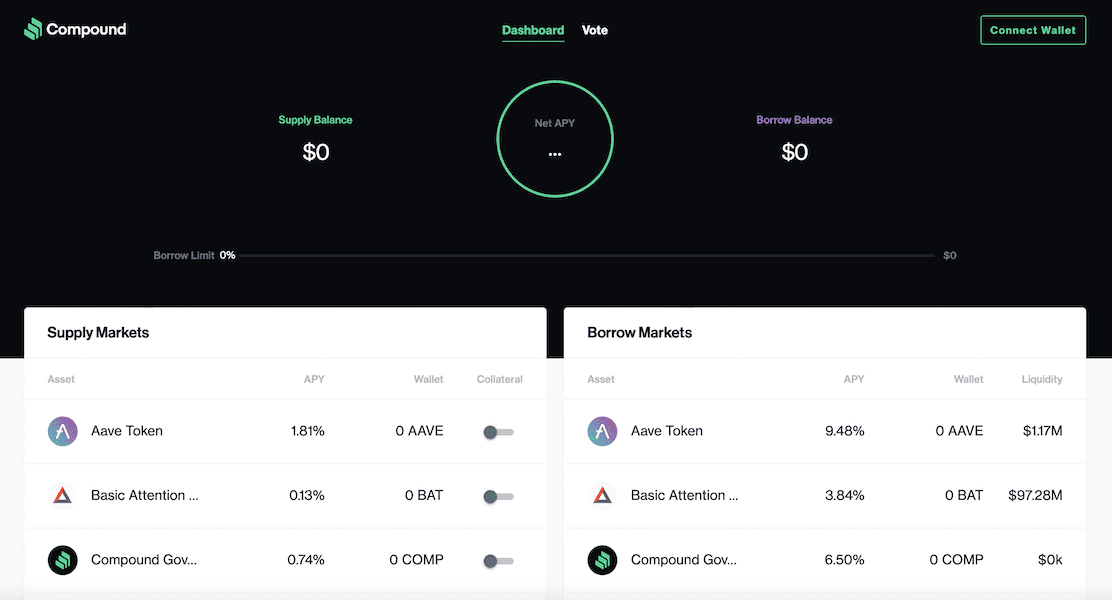

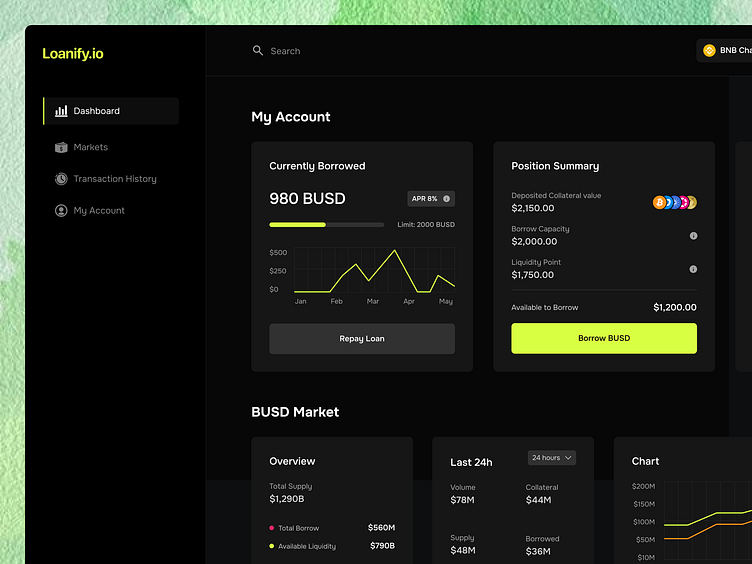

Advanced DeFi lending protocol dashboard showing lending rates and available assets

Decentralized Finance (DeFi) lending protocols like Aave, Compound, and MakerDAO operate through smart contracts on blockchain networks, eliminating the need for traditional intermediaries. These platforms offer greater transparency and user control but require more technical knowledge and active management.

The advantages of DeFi lending include transparency of operations, non-custodial control of assets, and often higher yields due to reduced operational overhead. However, DeFi platforms also involve smart contract risks, higher gas fees, and more complex user interfaces that may challenge less technical users.

Exchange-based lending services offered by major cryptocurrency exchanges like Binance, Coinbase, and Kraken provide convenient access to lending opportunities for existing exchange users. These services often offer competitive rates and seamless integration with trading activities but involve the same custody risks as centralized platforms.

Peer-to-peer lending platforms facilitate direct lending between individuals, often offering more flexible terms and potentially higher returns. However, these platforms typically involve higher risk due to limited borrower screening and reduced platform oversight compared to institutional lending services.

Institutional lending platforms cater to high-net-worth individuals and institutional clients, offering sophisticated lending products and risk management services. These platforms often require significant minimum deposits but may provide better terms and additional services like tax optimization and portfolio management.

Stablecoin lending has become particularly popular due to the reduced volatility risk compared to lending volatile cryptocurrencies. Platforms specializing in stablecoin lending often offer attractive rates while minimizing exposure to cryptocurrency price fluctuations.

The emergence of cross-chain lending platforms allows users to lend and borrow across different blockchain networks, potentially accessing better rates or unique opportunities not available on single-chain platforms. However, cross-chain lending involves additional technical complexity and bridge risks.

Yield farming platforms combine lending with liquidity provision and token rewards, potentially offering higher returns through multiple income streams. These platforms often involve more complex strategies and higher risk but can provide substantial returns during favorable market conditions.

Best Platforms for Crypto Lending in 2025

Selecting the right lending platform is crucial for maximizing returns while managing risk. The platform landscape has evolved significantly following the failures of major players in 2022, with survivors implementing stronger risk management and transparency measures.

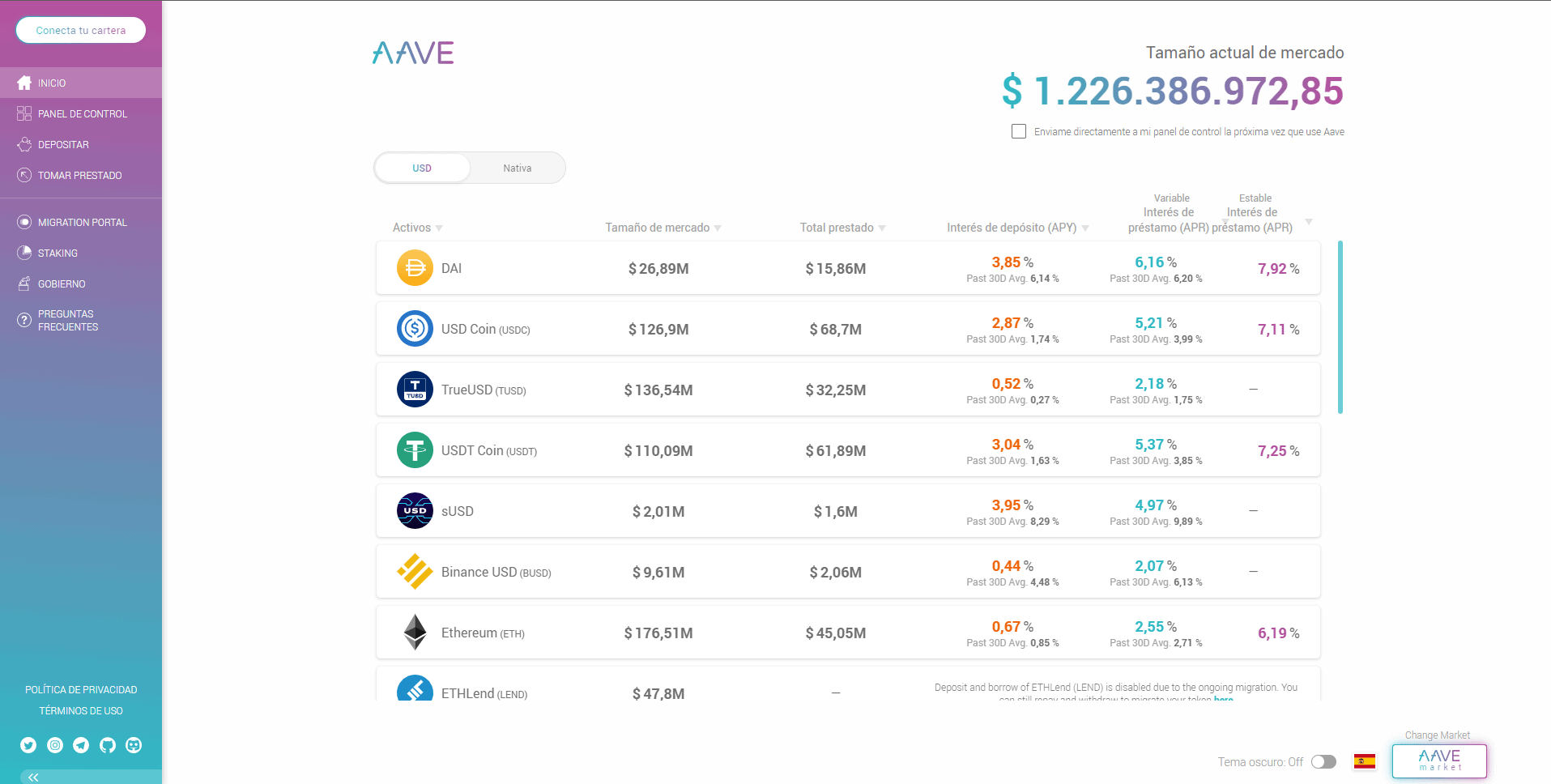

Aave stands out as one of the most established and trusted DeFi lending protocols, offering lending and borrowing across multiple cryptocurrencies and blockchain networks. The platform’s transparent operations, strong security track record, and innovative features like flash loans make it a popular choice for DeFi-savvy lenders.

Aave’s variable and stable rate options provide flexibility for different lending strategies. Variable rates fluctuate with market conditions and can provide higher returns during periods of high borrowing demand, while stable rates offer more predictable income streams for conservative lenders.

Aave platform interface showing current lending rates and available cryptocurrencies for lending

Compound Protocol pioneered many DeFi lending concepts and continues to offer reliable lending services with competitive rates. The platform’s governance token (COMP) distribution provides additional returns for lenders, though token rewards have decreased significantly from their peak levels.

Binance Earn provides a comprehensive suite of lending and savings products through one of the world’s largest cryptocurrency exchanges. The platform offers flexible savings, locked savings, and DeFi staking options with competitive rates and the backing of Binance’s substantial resources.

Kraken Staking offers lending-like returns through staking services for Proof of Stake cryptocurrencies. While technically different from lending, staking provides similar passive income opportunities with potentially lower risk since assets remain in your control.

Nexo has survived the 2022 lending platform crisis and continues to offer centralized lending services with competitive rates and insurance coverage. The platform’s focus on regulatory compliance and risk management has helped maintain user confidence despite industry challenges.

YouHodler provides lending services with unique features like multi-HODL (leveraged investing) and crypto-backed loans. The platform’s European regulatory compliance and insurance coverage appeal to users seeking regulated lending services.

Celsius Network’s bankruptcy in 2022 serves as a cautionary tale about centralized lending platform risks. The platform’s collapse resulted in significant losses for users and highlighted the importance of understanding platform risks and diversifying across multiple services.

DeFi protocols like Yearn Finance and Convex Finance offer automated yield optimization strategies that can include lending as part of broader yield farming approaches. These platforms can provide higher returns but involve additional complexity and smart contract risks.

The importance of platform diversification cannot be overstated following the industry consolidation of 2022. Spreading lending activities across multiple platforms helps reduce counterparty risk and provides access to different opportunities and rate structures.

Due diligence factors for platform selection include regulatory compliance, insurance coverage, transparency of operations, track record, and financial backing. Platforms with strong regulatory relationships and transparent operations generally offer better long-term prospects despite potentially lower rates.

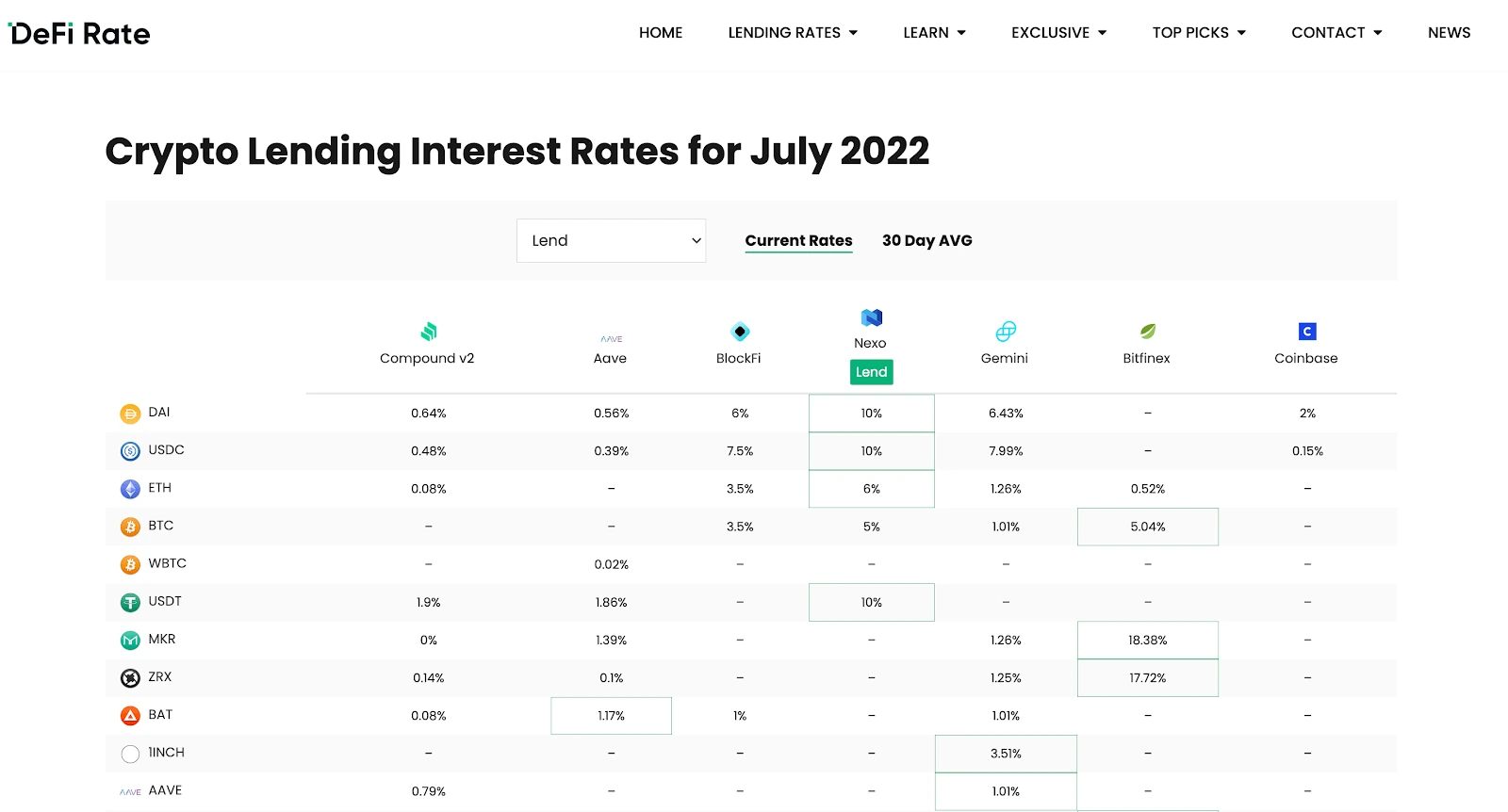

Interest Rates and Risk Assessment

Understanding the relationship between interest rates and risk is fundamental to successful crypto lending. Higher rates often indicate higher risk, and sustainable lending strategies require balancing return potential against various risk factors that could impact both principal and earnings.

Interest rate determinants in crypto lending include supply and demand for specific cryptocurrencies, overall market conditions, platform operational costs, and risk premiums. Rates can fluctuate significantly based on market events, regulatory changes, or platform-specific factors.

Interest rate comparison chart showing rates across different cryptocurrencies and platforms over time

The concept of risk-adjusted returns helps evaluate whether higher interest rates justify additional risk exposure. A platform offering 15% APY with significant counterparty risk may be less attractive than a platform offering 8% APY with strong security and regulatory compliance.

Counterparty risk represents the possibility that lending platforms may fail to return deposited funds or pay promised interest. This risk became painfully apparent during the 2022 crypto lending crisis when several major platforms collapsed, resulting in significant losses for lenders.

Smart contract risk in DeFi lending involves the possibility of bugs, exploits, or governance attacks that could result in loss of funds. While DeFi platforms offer greater transparency and user control, they also expose lenders to technical risks that don’t exist with traditional financial services.

Market risk affects crypto lending through cryptocurrency price volatility, which can impact both the value of lent assets and borrower behavior. Significant price declines may trigger liquidations or platform stress that affects lending operations and returns.

Liquidity risk involves the possibility that lenders may not be able to withdraw funds when needed, either due to platform restrictions, high withdrawal demand, or technical issues. Understanding withdrawal terms and maintaining diversified liquidity sources helps manage this risk.

Regulatory risk encompasses the possibility that changing regulations could impact platform operations, force closures, or affect the legal status of lending activities. Platforms operating in multiple jurisdictions face complex regulatory environments that could change rapidly.

The relationship between lock-up periods and interest rates typically shows higher rates for longer commitment periods. However, longer lock-ups also increase liquidity risk and exposure to platform and market risks over extended periods.

Interest rate sustainability analysis helps identify platforms offering realistic returns versus those that may be using unsustainable business models. Rates significantly above market norms may indicate higher risk or unsustainable promotional offers.

Diversification strategies for crypto lending include spreading funds across multiple platforms, different cryptocurrencies, and various lending products. This approach helps reduce concentration risk while potentially accessing different rate opportunities.

Risk monitoring and management require ongoing attention to platform developments, market conditions, and regulatory changes. Successful crypto lenders regularly review their positions and adjust strategies based on changing risk-return profiles.

Strategies for Maximizing Lending Returns

Developing effective strategies for crypto lending involves more than simply depositing funds and collecting interest. Sophisticated approaches can significantly enhance returns while managing risk through diversification, timing, and optimization techniques.

The laddering strategy involves spreading deposits across different lock-up periods to balance higher returns from longer commitments with liquidity needs. This approach provides regular opportunities to reassess market conditions and platform performance while maintaining exposure to higher-rate products.

Image Placement: [Strategy diagram showing different lending approaches and their expected returns vs risk profiles]

Rate arbitrage opportunities arise when different platforms offer significantly different rates for the same cryptocurrency. Moving funds to platforms offering higher rates can increase returns, though transaction costs and platform risks must be considered in the analysis.

Compound interest optimization involves reinvesting earned interest to maximize long-term returns. Platforms that automatically compound interest provide convenience, while manual reinvestment allows for more strategic allocation decisions based on changing market conditions.

The barbell strategy combines high-risk, high-return lending opportunities with low-risk, stable-return options. This approach allows participation in potentially lucrative opportunities while maintaining a foundation of more secure investments.

Stablecoin lending strategies focus on USD-pegged cryptocurrencies to minimize volatility risk while earning attractive interest rates. This approach appeals to conservative investors who want crypto lending returns without exposure to cryptocurrency price fluctuations.

Yield farming integration combines traditional lending with liquidity provision and token rewards to maximize total returns. These strategies often involve more complexity and risk but can provide substantially higher returns during favorable market conditions.

Tax optimization considerations include timing of interest recognition, jurisdiction selection for platform usage, and coordination with other investment activities. Understanding tax implications helps maximize after-tax returns from lending activities.

Platform rotation strategies involve moving funds between platforms based on rate changes, promotional offers, or risk assessments. This active management approach can enhance returns but requires ongoing monitoring and analysis.

The importance of emergency reserves means maintaining some funds in highly liquid, low-risk options even when higher-return opportunities are available. This liquidity buffer provides flexibility to respond to opportunities or emergencies without disrupting long-term lending strategies.

Automated strategies using APIs or third-party services can help optimize lending returns by automatically moving funds to the highest-rate opportunities or rebalancing portfolios based on predetermined criteria. However, automation also introduces additional technical and security considerations.

Borrowing Strategies: Using Crypto as Collateral

Crypto-backed borrowing represents the other side of the lending equation, offering opportunities to access liquidity without selling cryptocurrency holdings. Understanding borrowing strategies helps complete the picture of crypto lending opportunities and can provide additional income generation methods.

The basic concept of crypto-backed borrowing involves depositing cryptocurrency as collateral to secure loans in stablecoins or fiat currency. This approach allows borrowers to maintain exposure to potential cryptocurrency appreciation while accessing needed liquidity for other purposes.

Image Placement: [Borrowing strategy flowchart showing how to use crypto collateral for various purposes]

Loan-to-value (LTV) ratios determine how much can be borrowed against cryptocurrency collateral, typically ranging from 25% to 75% depending on the platform and collateral type. Lower LTV ratios provide more safety margin against liquidation but reduce borrowing capacity.

Liquidation risks occur when collateral value falls below required thresholds, forcing automatic sale of collateral to repay loans. Understanding liquidation mechanics and maintaining adequate safety margins is crucial for successful borrowing strategies.

Tax advantages of borrowing versus selling include avoiding immediate capital gains recognition while accessing liquidity. Borrowed funds are generally not taxable income, making borrowing an attractive option for accessing cash without triggering tax liabilities.

Arbitrage opportunities using borrowed funds can generate returns that exceed borrowing costs. For example, borrowing stablecoins against Bitcoin collateral to invest in higher-yielding opportunities could generate net positive returns if the yield spread exceeds borrowing costs.

The concept of “cash and carry” strategies involves borrowing against cryptocurrency holdings to invest in risk-free or low-risk opportunities that generate returns exceeding borrowing costs. This approach can provide additional income while maintaining cryptocurrency exposure.

Leverage strategies use borrowed funds to increase cryptocurrency exposure, potentially amplifying returns but also increasing risk. These strategies require careful risk management and understanding of liquidation risks in volatile markets.

Business financing using crypto collateral allows entrepreneurs and businesses to access capital without selling cryptocurrency holdings. This approach can be particularly attractive for crypto-native businesses or individuals with significant cryptocurrency wealth.

Emergency liquidity access through crypto-backed borrowing provides a financial safety net without requiring asset sales. Maintaining pre-approved credit lines against cryptocurrency holdings can provide peace of mind and financial flexibility.

Interest rate optimization for borrowing involves comparing rates across platforms and choosing the most cost-effective borrowing options. Some platforms offer variable rates that may be attractive during certain market conditions, while others provide fixed rates for predictable costs.

Repayment strategies should consider market timing, tax implications, and opportunity costs. Early repayment may be attractive when borrowing rates are high or when collateral has appreciated significantly, while extending loans might be preferable during favorable rate environments.

Tax Implications of Crypto Lending

The tax treatment of crypto lending activities creates complex obligations that vary significantly between jurisdictions. Understanding these implications is crucial for accurate reporting and optimization of after-tax returns from lending activities.

Interest income from crypto lending is generally treated as ordinary income in most jurisdictions, requiring recognition at fair market value when received. This creates immediate tax liabilities even if interest is automatically reinvested or remains on the lending platform.

Image Placement: [Tax calculation example showing how crypto lending income is reported and taxed]

The timing of income recognition typically occurs when interest is credited to accounts, regardless of whether funds are withdrawn. This means lenders may owe taxes on interest earnings even if they haven’t converted cryptocurrency to fiat currency.

Record-keeping requirements for crypto lending include detailed transaction logs, interest payment records, and fair market value calculations at the time of each interest payment. Automated tracking tools can help manage these complex requirements.

Deduction opportunities may include platform fees, transaction costs, and other expenses directly related to lending activities. However, the deductibility of these expenses varies by jurisdiction and individual tax circumstances.

The treatment of lending platform failures and losses varies between jurisdictions, with some allowing deductions for losses while others may not recognize losses until final resolution of bankruptcy proceedings. The collapse of platforms like Celsius created complex tax situations for affected users.

International tax considerations become complex for users of platforms operating in multiple jurisdictions or for individuals with tax obligations in multiple countries. Transfer pricing rules and tax treaties may affect the treatment of cross-border lending activities.

Stablecoin lending may have different tax implications than lending volatile cryptocurrencies, particularly regarding foreign currency treatment and gain/loss recognition. Understanding these differences helps optimize tax treatment of different lending strategies.

The concept of constructive receipt may apply to interest earnings that are automatically reinvested or compounded, potentially creating tax obligations even when funds aren’t directly accessible to the lender.

Tax optimization strategies include timing of lending activities, jurisdiction selection for platform usage, and coordination with other investment activities to manage overall tax liability. However, tax considerations should not override sound investment principles.

Professional tax advice becomes essential for significant lending activities due to the complexity and evolving nature of cryptocurrency tax regulations. The cost of professional advice should be weighed against potential tax savings and compliance benefits.

Risk Management and Security Best Practices

Effective risk management is essential for successful crypto lending, as the industry’s relative immaturity and regulatory uncertainty create unique challenges that require careful attention and proactive mitigation strategies.

Platform diversification represents the most important risk management strategy, spreading funds across multiple lending platforms to reduce counterparty risk. The collapse of major platforms in 2022 demonstrated the importance of not concentrating all lending activities with a single provider.

Image Placement: [Risk management framework showing different types of risks and mitigation strategies]

Due diligence processes should include thorough research of platform backgrounds, regulatory compliance, insurance coverage, and financial backing. Regular monitoring of platform developments and financial health helps identify potential issues before they become critical.

Position sizing limits help manage exposure to any single platform or lending opportunity. Many experienced lenders limit exposure to any single platform to 10-25% of their total lending portfolio, regardless of the rates offered.

Security practices for crypto lending include using strong passwords, enabling two-factor authentication, regularly monitoring account activity, and maintaining secure storage of login credentials. Security breaches can result in total loss of funds regardless of platform legitimacy.

The importance of insurance coverage varies between platforms, with some offering comprehensive coverage while others provide limited or no protection. Understanding insurance terms and limitations helps assess the true risk profile of different lending opportunities.

Liquidity management involves maintaining adequate reserves in highly liquid assets to respond to opportunities or emergencies without disrupting long-term lending strategies. This liquidity buffer should be sized based on individual financial circumstances and risk tolerance.

Monitoring and alert systems help track platform performance, rate changes, and potential issues that could affect lending positions. Setting up automated alerts for significant changes helps ensure timely responses to developing situations.

Exit strategies should be planned in advance, including criteria for withdrawing funds from platforms and procedures for emergency situations. Having clear exit plans helps ensure rational decision-making during stressful market conditions.

The concept of “skin in the game” analysis examines whether platform operators have significant personal exposure to their own platforms. Platforms where operators have substantial personal investments may be more aligned with user interests.

Regular portfolio reviews help assess performance, risk exposure, and alignment with investment objectives. These reviews should consider changes in platform risk profiles, market conditions, and personal financial circumstances.

Future of Crypto Lending

The crypto lending industry continues to evolve rapidly, driven by regulatory developments, technological innovation, and lessons learned from the market disruptions of 2022. Understanding these trends helps inform long-term strategy and platform selection decisions.

Regulatory clarity is gradually emerging in major jurisdictions, with authorities developing frameworks for crypto lending activities. This regulatory development may reduce uncertainty but could also impose new requirements or restrictions on lending platforms and activities.

Image Placement: [Future trends chart showing projected evolution of crypto lending industry]

Institutional adoption of crypto lending continues to grow, with traditional financial institutions and investment funds exploring cryptocurrency lending opportunities. This institutional participation may bring additional liquidity and stability to lending markets while potentially reducing retail opportunities.

Technology improvements in DeFi lending protocols continue to enhance security, efficiency, and user experience. Innovations like cross-chain lending, automated risk management, and improved user interfaces may make DeFi lending more accessible to mainstream users.

The integration of traditional finance and crypto lending may create hybrid products that combine the benefits of both systems. Traditional banks offering crypto lending services or crypto platforms providing traditional financial products could reshape the competitive landscape.

Central Bank Digital Currencies (CBDCs) may impact crypto lending by providing government-backed digital alternatives to stablecoins and potentially changing the regulatory environment for private cryptocurrency lending.

Environmental considerations are increasingly influencing platform selection and investment decisions. Lending platforms that support environmentally sustainable cryptocurrencies or carbon-neutral operations may gain competitive advantages.

Market maturation trends suggest that crypto lending rates may gradually converge toward traditional financial market rates as the industry matures and competition increases. This normalization may reduce return potential but also decrease risk levels.

Innovation in lending products may include more sophisticated risk management tools, automated portfolio optimization, and integration with other DeFi services. These innovations could provide better risk-adjusted returns and more convenient user experiences.

The potential for consolidation exists as the industry matures and regulatory requirements increase. Smaller platforms may struggle to compete with larger, well-capitalized competitors, leading to industry consolidation that could affect platform choice and competition.

Global expansion of crypto lending services may provide access to new markets and opportunities while also creating additional regulatory complexity. Platforms that can successfully navigate multiple regulatory environments may gain significant competitive advantages.

Conclusion: Building Your Crypto Lending Strategy

Crypto lending offers compelling opportunities for generating passive income from cryptocurrency holdings, but success requires careful platform selection, risk management, and ongoing optimization. The industry’s evolution following the 2022 crisis has created a more mature but also more complex landscape that rewards informed and cautious participants.

The key to successful crypto lending lies in balancing return potential against various risk factors while maintaining diversification across platforms and strategies. No single approach works for all investors, and successful strategies must be tailored to individual risk tolerance, liquidity needs, and investment objectives.

Image Placement: [Strategy summary showing recommended approach for building a crypto lending portfolio]

Platform selection remains the most critical decision in crypto lending, with the choice between centralized and decentralized platforms involving trade-offs between convenience and control, returns and security. The most successful lenders often use a combination of platform types to optimize their risk-return profile.

Risk management cannot be overemphasized in crypto lending, where platform failures, smart contract bugs, and market volatility can quickly erode returns or principal. Diversification, position sizing, and ongoing monitoring are essential components of any sustainable lending strategy.

The regulatory environment for crypto lending continues to evolve, and staying informed about developments helps ensure compliance while identifying new opportunities. Platforms that proactively address regulatory requirements may offer better long-term prospects despite potentially lower short-term returns.

Tax considerations significantly impact the net returns from crypto lending activities, and understanding these implications helps optimize after-tax performance. Professional tax advice becomes valuable as lending activities grow in size and complexity.

The future of crypto lending appears bright despite recent industry challenges, with continued innovation, regulatory clarity, and institutional adoption likely to create new opportunities. However, the industry’s rapid evolution requires continuous learning and adaptation to maintain successful strategies.

For those considering crypto lending, starting small and gradually increasing exposure as experience and confidence grow provides a prudent approach to this potentially lucrative but complex investment strategy. The combination of attractive returns and the opportunity to learn about emerging financial technologies makes crypto lending an appealing option for many cryptocurrency holders.

Success in crypto lending ultimately depends on treating it as a serious investment activity that requires ongoing attention, analysis, and optimization rather than a passive set-and-forget strategy. Those who approach crypto lending with appropriate preparation and realistic expectations can build sustainable passive income streams that significantly enhance their overall investment returns.

Disclaimer: Cryptocurrency lending involves significant risks including platform failure, smart contract bugs, regulatory changes, and market volatility. Interest rates and platform availability can change rapidly, and past performance does not guarantee future results. This article is for educational purposes only and should not be considered financial advice. Always conduct thorough research and consider consulting with qualified financial advisors before engaging in crypto lending activities.

About the Author: everythingcryptoitclouds.com is a leading resource for cryptocurrency education and investment strategies, providing in-depth analysis and practical guidance for digital asset investors of all experience levels.