Author: everythingcryptoitclouds.com

Published: August 2025

Featured Image:

Professional crypto staking dashboard showing various cryptocurrencies and their annual percentage yields

In the rapidly evolving world of cryptocurrency, finding reliable ways to generate passive income has become a top priority for investors seeking to maximize their digital asset returns. Among the various strategies available, crypto staking has emerged as one of the most accessible and relatively low-risk methods for earning consistent rewards from your cryptocurrency holdings. Unlike the volatile nature of day trading or the complexity of yield farming, staking offers a straightforward approach that allows you to earn money while you sleep, quite literally.

The concept of staking has revolutionized how we think about cryptocurrency ownership. Rather than simply holding digital assets and hoping for price appreciation, staking enables you to actively participate in blockchain networks while earning rewards for your contribution. This comprehensive guide will walk you through everything you need to know about crypto staking, from the fundamental concepts to advanced strategies that can help you maximize your passive income potential.

Understanding the Fundamentals of Crypto Staking

Crypto staking is fundamentally different from traditional investment methods. When you stake cryptocurrency, you’re essentially locking up your digital assets to support the operations of a blockchain network. This process is integral to what’s known as a Proof of Stake (PoS) consensus mechanism, which has become increasingly popular as an energy-efficient alternative to Bitcoin’s Proof of Work system.

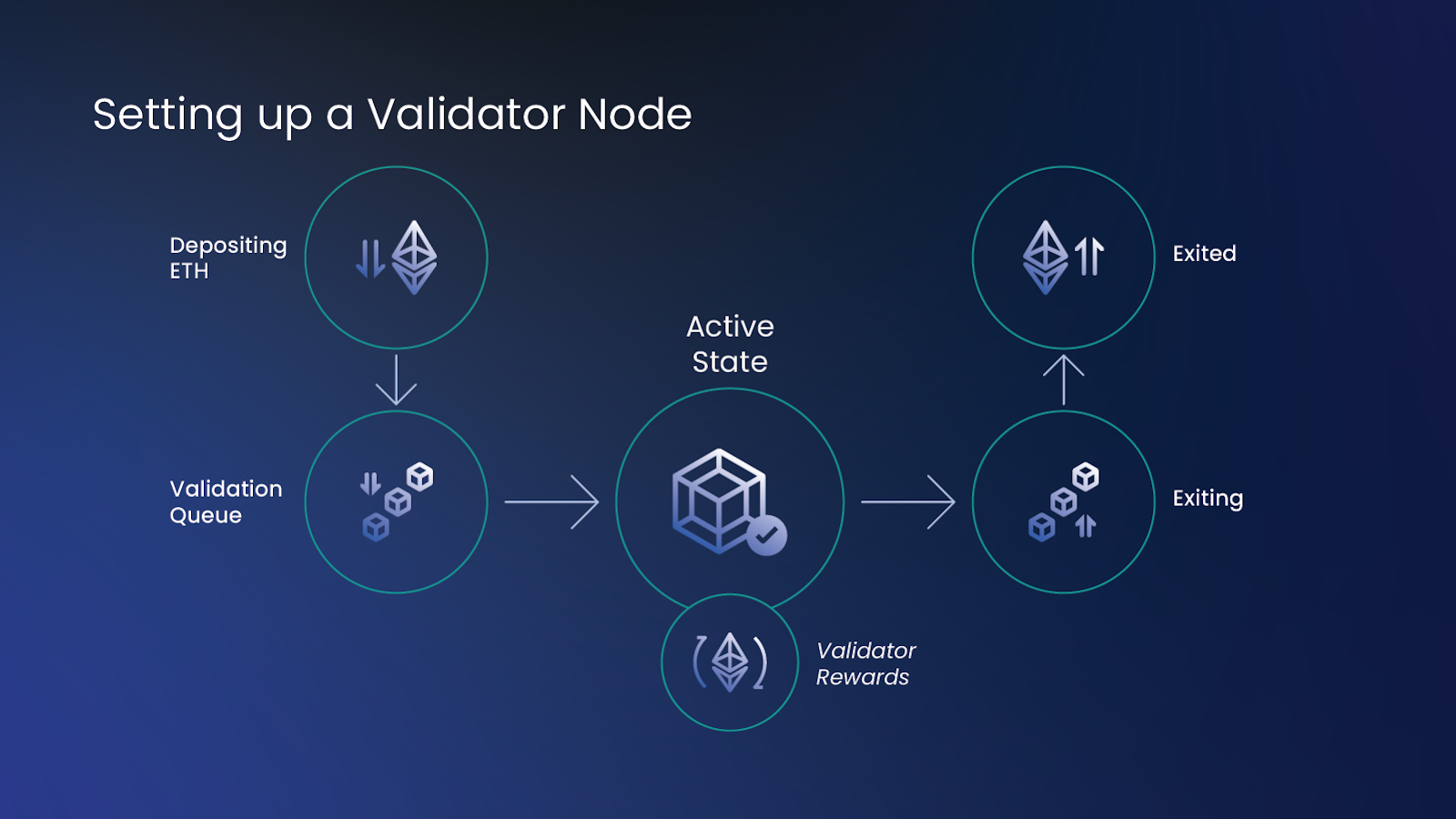

The beauty of staking lies in its simplicity and purpose. By staking your tokens, you become a validator or delegate your tokens to validators who help secure the network, process transactions, and maintain the blockchain’s integrity. In return for this service, the network rewards you with additional tokens, creating a passive income stream that compounds over time.

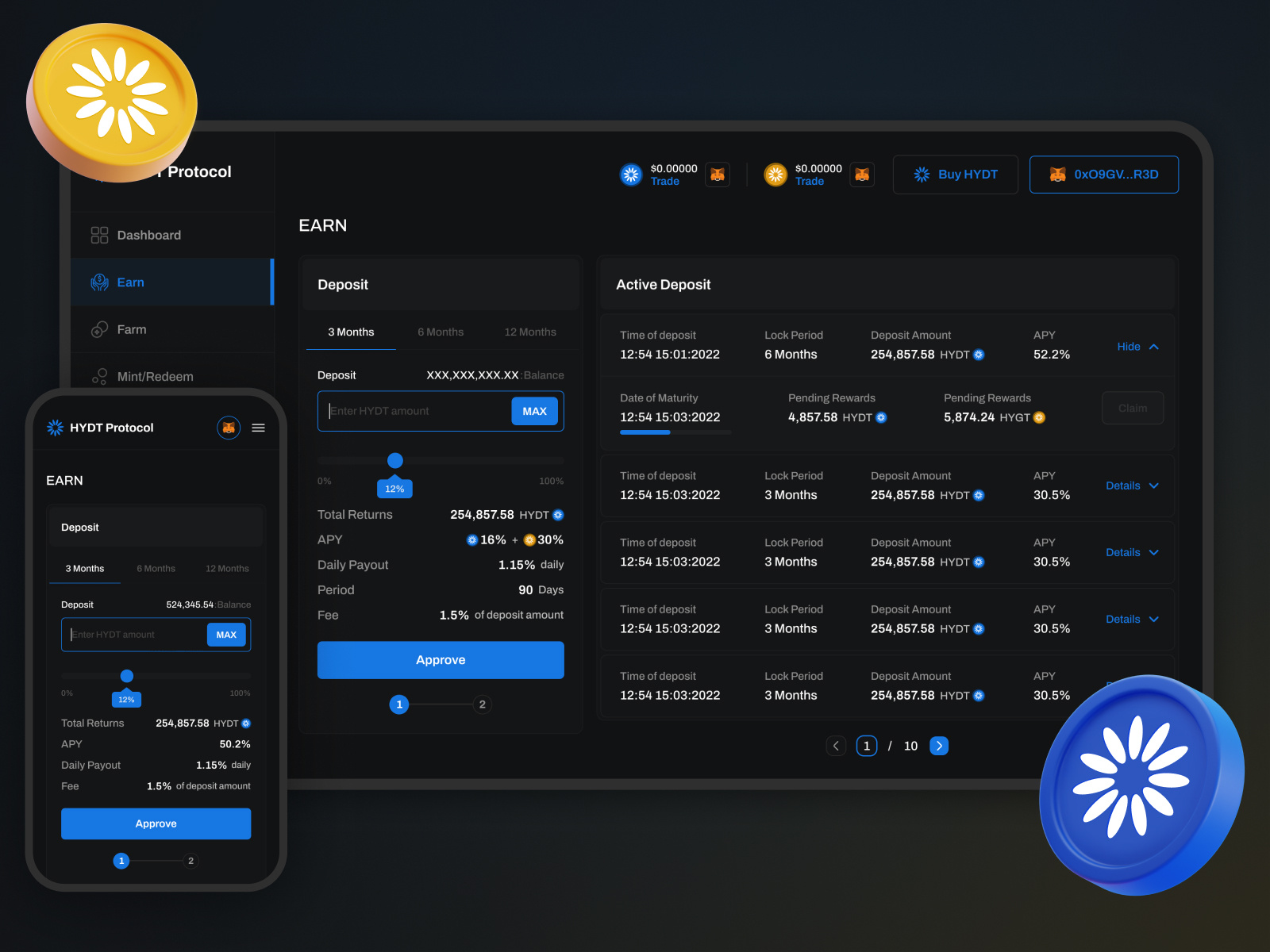

How Ethereum staking works: from validator setup to earning rewards

The rewards you earn from staking come from several sources. Transaction fees paid by users of the network form a significant portion of staking rewards. Additionally, many networks have built-in inflation mechanisms that mint new tokens specifically to reward stakers. Some networks also distribute a portion of their treasury or governance tokens to active participants in the staking ecosystem.

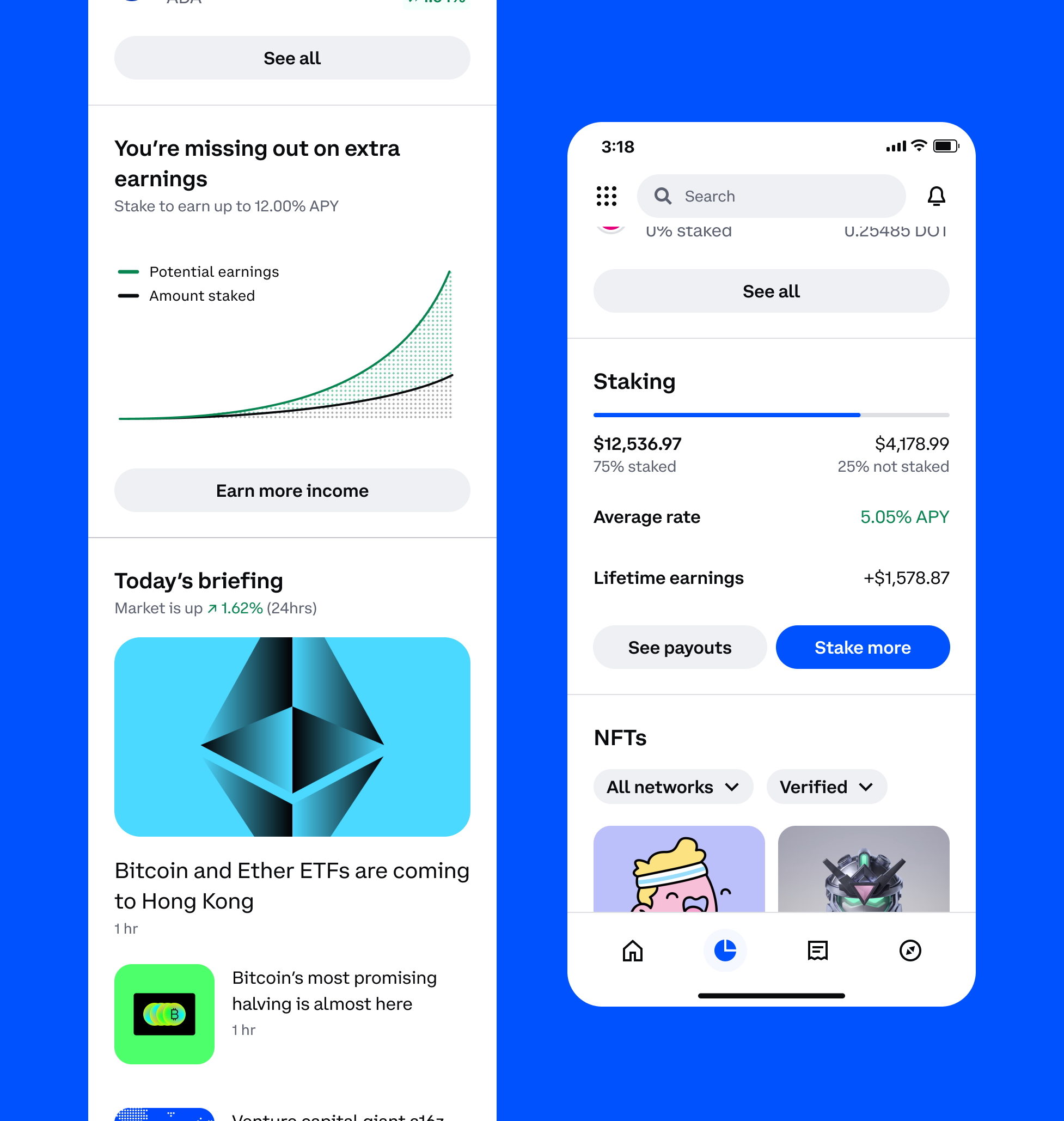

What makes staking particularly attractive is its predictable nature compared to other crypto earning methods. While trading requires constant market monitoring and yield farming involves complex strategies with impermanent loss risks, staking rewards are generally more stable and predictable. Most staking rewards are calculated as an Annual Percentage Yield (APY), giving you a clear expectation of your potential returns.

The entry barriers for staking are relatively low compared to other passive income strategies. Unlike running a masternode, which often requires significant technical knowledge and substantial initial investments, staking can be started with modest amounts of cryptocurrency. Many platforms now offer liquid staking options, allowing you to stake your assets while maintaining the flexibility to trade or use them in other DeFi protocols.

Top Cryptocurrencies for Staking in 2025

The staking landscape in 2025 offers numerous opportunities across different blockchain networks, each with unique characteristics, reward structures, and risk profiles. Understanding the top staking options available can help you make informed decisions about where to allocate your digital assets for maximum returns.

Ethereum stands as the most significant staking opportunity in the cryptocurrency space. Since the completion of The Merge in 2022, Ethereum transitioned from a Proof of Work to a Proof of Stake consensus mechanism, opening up staking opportunities for ETH holders. With Ethereum’s dominant position in the DeFi ecosystem and its role as the foundation for countless decentralized applications, staking ETH provides exposure to the network that processes the majority of cryptocurrency transactions globally.

The minimum requirement for running an Ethereum validator is 32 ETH, which represents a substantial investment. However, liquid staking protocols like Lido, Rocket Pool, and Coinbase have democratized Ethereum staking by allowing users to stake any amount of ETH. These platforms pool smaller amounts from multiple users to meet the 32 ETH requirement, distributing rewards proportionally to contributors. Current Ethereum staking yields typically range from 3% to 5% APY, with the exact rate depending on the total amount of ETH staked across the network.

Cardano (ADA) represents another compelling staking opportunity with its unique approach to delegation. The Cardano network allows ADA holders to delegate their stake to stake pools without actually transferring custody of their tokens. This means you retain full control of your ADA while earning staking rewards, typically ranging from 4% to 6% APY. The delegation process is straightforward and can be done directly through official wallets like Daedalus or Yoroi.

Solana (SOL) has gained significant attention for its high-performance blockchain and attractive staking rewards. SOL staking typically offers yields between 6% and 8% APY, making it one of the more lucrative staking options among major cryptocurrencies. The Solana network’s focus on speed and low transaction costs has attracted numerous DeFi projects and NFT marketplaces, potentially driving long-term value for SOL holders.

Polkadot (DOT) offers a unique staking mechanism called nominated proof-of-stake, where DOT holders can nominate validators to secure the network. The minimum staking amount varies based on network participation, but typically requires around 120 DOT tokens. Polkadot staking rewards generally range from 10% to 14% APY, making it one of the higher-yielding major cryptocurrencies for staking.

Comprehensive staking calculator showing potential returns across different cryptocurrencies

Cosmos (ATOM) provides another attractive staking opportunity with its focus on blockchain interoperability. ATOM staking typically yields between 8% and 12% APY, with a 21-day unbonding period. The Cosmos ecosystem’s growth and its role in connecting different blockchains make ATOM staking an interesting long-term proposition.

Avalanche (AVAX) offers staking opportunities with yields typically ranging from 8% to 11% APY. The platform’s focus on creating custom blockchain networks and its growing DeFi ecosystem provide additional utility beyond staking rewards. AVAX staking requires a minimum of 25 AVAX tokens and has a 2-week unbonding period.

Tezos (XTZ) pioneered many of the liquid staking concepts we see today, allowing XTZ holders to delegate their tokens to bakers (validators) while maintaining custody. Tezos staking typically yields around 5% to 6% APY with no minimum staking requirement and no lock-up period, making it one of the most flexible staking options available.

When selecting cryptocurrencies for staking, consider factors beyond just the APY. Network adoption, development activity, tokenomics, and the overall ecosystem health play crucial roles in determining the long-term viability of your staking strategy. Higher yields often come with higher risks, so it’s essential to balance potential returns with the stability and security of the underlying network.

Step-by-Step Guide to Start Staking

Getting started with crypto staking might seem daunting at first, but the process has become increasingly user-friendly as the ecosystem has matured. This comprehensive guide will walk you through each step of the staking process, from initial preparation to ongoing management of your staked assets.

The first step in your staking journey involves selecting the right cryptocurrency and platform for your needs. Consider your risk tolerance, investment timeline, and the amount of capital you’re willing to allocate to staking. Research the different staking options available, paying attention to factors such as minimum staking requirements, lock-up periods, reward rates, and the reputation of the network or platform.

Once you’ve decided on a cryptocurrency to stake, you’ll need to acquire the tokens through a reputable cryptocurrency exchange. Popular exchanges like Coinbase, Binance, Kraken, and Gemini offer direct purchasing options for most stakeable cryptocurrencies. Ensure you’re buying from a legitimate exchange with proper security measures and regulatory compliance in your jurisdiction.

Setting up a compatible wallet is crucial for most staking operations. While some exchanges offer staking services directly on their platforms, using a dedicated wallet often provides better security and more control over your assets. For Ethereum staking, wallets like MetaMask, Ledger, or Trezor work well with liquid staking protocols. For Cardano, the official Daedalus wallet or the lightweight Yoroi wallet are excellent choices.

Step-by-step wallet setup process for crypto staking showing user-friendly interface

The actual staking process varies depending on the cryptocurrency and method you choose. For liquid staking protocols like Lido for Ethereum, the process is remarkably simple. Connect your wallet to the Lido website, specify the amount of ETH you want to stake, and confirm the transaction. You’ll receive stETH tokens representing your staked ETH, which continue to earn rewards while remaining liquid and tradeable.

For native staking on networks like Cardano, the process involves delegating your ADA to a stake pool. Open your Cardano wallet, navigate to the delegation center, browse available stake pools, and select one based on factors like performance history, fees, and pool size. The delegation process typically requires a small transaction fee and takes effect after one or two epochs (approximately 5-10 days).

Security considerations are paramount when staking cryptocurrency. Never share your private keys or seed phrases with anyone, and be wary of phishing attempts that might try to steal your credentials. When using liquid staking protocols, ensure you’re interacting with the official websites and smart contracts. Bookmark official URLs and always verify you’re on the correct site before connecting your wallet.

Monitoring your staking rewards is an important ongoing responsibility. Most staking platforms provide dashboards where you can track your accumulated rewards, staking efficiency, and overall performance. Set up regular check-ins to ensure your staking setup is functioning correctly and that you’re receiving expected rewards.

Understanding the tax implications of staking is crucial for compliance and financial planning. In many jurisdictions, staking rewards are considered taxable income at the time they’re received, valued at their fair market value. Keep detailed records of your staking activities, including dates, amounts, and token values, to facilitate accurate tax reporting.

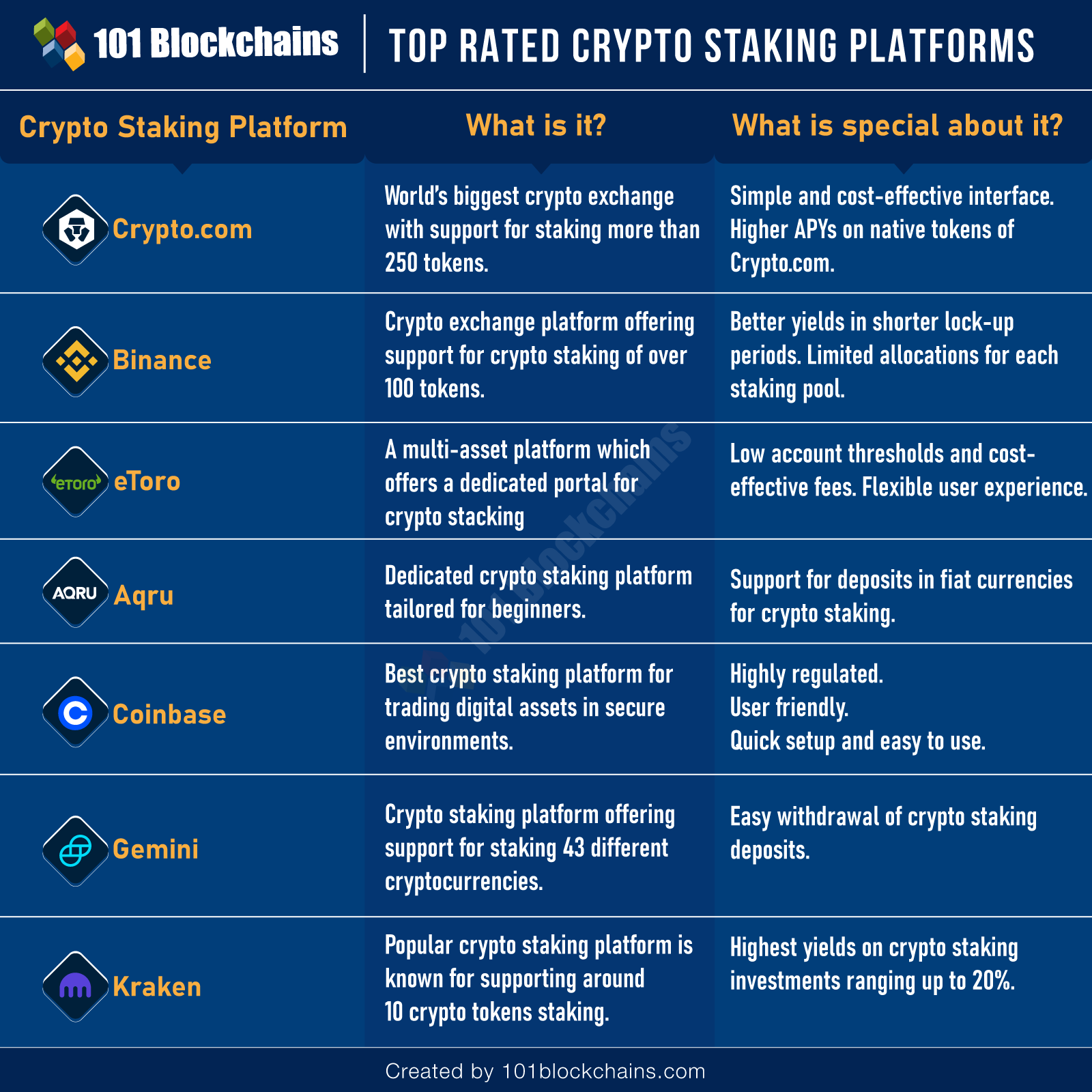

Comparing Staking Platforms and Services

The staking ecosystem has evolved to include numerous platforms and services, each offering different features, benefits, and trade-offs. Understanding these options will help you choose the most suitable platform for your staking strategy and risk profile.

Centralized exchanges have become popular entry points for staking due to their user-friendly interfaces and simplified processes. Coinbase offers staking services for multiple cryptocurrencies, handling all technical aspects while providing a familiar interface for users already comfortable with traditional exchange operations. The platform typically takes a commission from staking rewards (usually around 25%) but eliminates the complexity of managing validators or delegation processes.

Kraken provides another robust centralized staking option with competitive rates and a wide selection of stakeable cryptocurrencies. The platform offers both on-chain and off-chain staking options, with on-chain staking providing higher rewards but longer unbonding periods. Kraken’s transparent fee structure and detailed reward calculations make it easy to understand your potential returns.

Binance, as one of the largest cryptocurrency exchanges globally, offers extensive staking options through its Binance Earn program. The platform provides both flexible and locked staking products, allowing users to choose between liquidity and higher rewards. Binance’s large user base often enables them to negotiate better staking terms with various networks.

Comprehensive comparison of top crypto staking platforms showing features, yields, and ratings

Liquid staking protocols represent a significant innovation in the staking space, allowing users to stake their assets while maintaining liquidity. Lido Finance has become the dominant liquid staking provider for Ethereum, controlling a significant portion of all staked ETH. Users receive stETH tokens that represent their staked ETH and continue earning rewards while remaining tradeable on various DeFi platforms.

Rocket Pool offers a decentralized alternative to Lido for Ethereum staking, with a more distributed validator set and governance structure. The platform requires users to provide both ETH and RPL tokens for validation, creating additional complexity but potentially better decentralization. Rocket Pool’s rETH token provides similar liquidity benefits to Lido’s stETH.

Native staking through official wallets and protocols often provides the highest rewards but requires more technical knowledge and active management. Ethereum’s native staking through the Ethereum 2.0 deposit contract offers the full staking yield without platform fees, but requires running validator software and maintaining 99%+ uptime to avoid penalties.

For Cardano staking, the choice between different stake pools can significantly impact your rewards. Factors to consider include pool performance history, operator reputation, pool size (avoiding oversaturated pools), and fee structure. Tools like PoolTool and ADApools provide comprehensive data to help you make informed delegation decisions.

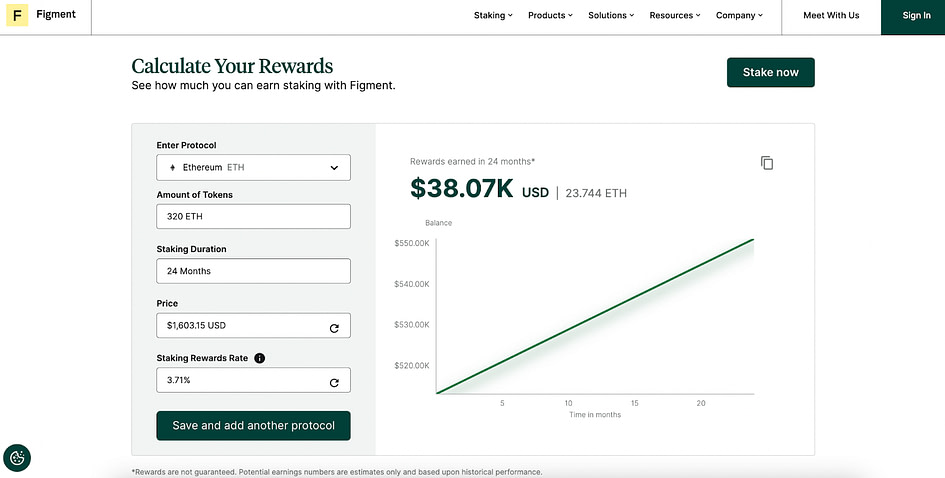

Staking-as-a-Service providers like Figment, Staked, and Chorus One cater to institutional investors and high-net-worth individuals who want professional management of their staking operations. These services typically charge higher fees but provide enterprise-grade security, compliance reporting, and dedicated support.

When comparing platforms, consider factors beyond just the advertised APY. Platform security, insurance coverage, fee transparency, customer support quality, and regulatory compliance all play important roles in the overall staking experience. Additionally, consider the platform’s track record during network upgrades, hard forks, and other technical events that might affect staking operations.

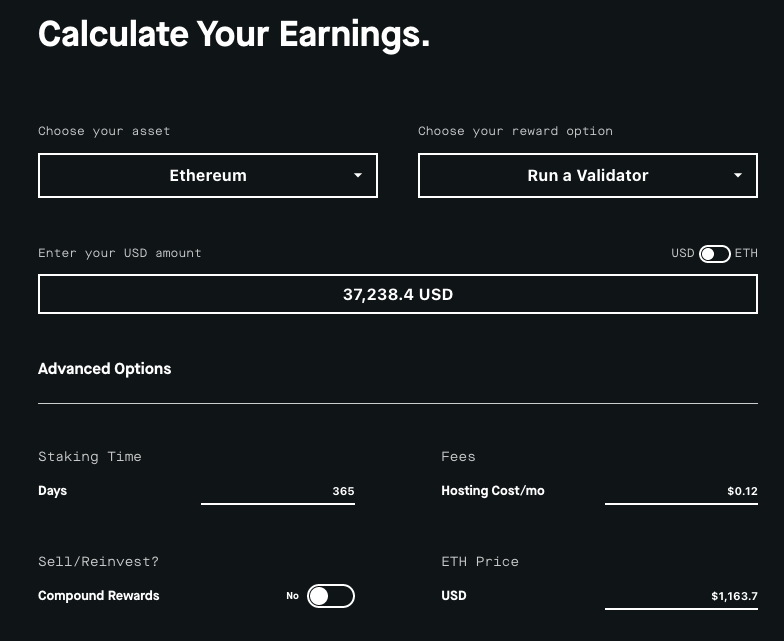

Calculating Expected Returns and Realistic Profit Projections

Understanding how to calculate and project staking returns is essential for making informed investment decisions and setting realistic expectations for your passive income strategy. Staking returns depend on multiple variables that can change over time, making accurate projections both important and challenging.

The foundation of staking return calculations begins with the Annual Percentage Yield (APY), which represents the total return you can expect over a year, including the effect of compounding. However, the advertised APY is often a theoretical maximum that assumes perfect conditions and doesn’t account for various factors that can reduce actual returns.

Network participation rates significantly impact staking rewards. Most Proof of Stake networks adjust rewards based on the total percentage of tokens being staked. When fewer tokens are staked, individual stakers earn higher rewards, and vice versa. For example, if a network targets 50% of tokens to be staked but only 30% are currently staked, early stakers might earn higher rewards until more participants join.

Platform fees represent another crucial factor in return calculations. Centralized exchanges typically charge 15-25% of staking rewards as fees, while liquid staking protocols usually charge 5-10%. These fees directly reduce your net returns and should be factored into all calculations. For a 10% gross APY with a 20% platform fee, your net APY would be 8%.

Advanced staking calculator showing profit scenarios with different fee structures and compounding

Compounding frequency affects long-term returns significantly. Some networks distribute rewards daily, while others do so weekly or monthly. More frequent compounding generally leads to higher effective yields due to the mathematical effect of compound interest. A 10% APY compounded daily yields approximately 10.52% effective annual return, while monthly compounding yields about 10.47%.

Let’s examine realistic profit projections with concrete examples. Suppose you stake $10,000 worth of Ethereum at a 4% net APY with daily compounding. After one year, assuming stable ETH prices, you would have approximately $10,408 worth of staked ETH. However, this calculation doesn’t account for ETH price volatility, which can significantly impact your total returns in dollar terms.

For a more comprehensive analysis, consider a scenario where you stake $10,000 worth of Cardano (ADA) at a 5% net APY. If ADA’s price remains stable, you’d earn about $500 in staking rewards over the first year. However, if ADA’s price increases by 20% during the year, your total return would include both the 5% staking yield and the 20% price appreciation, resulting in a combined return of approximately 26%.

Conversely, if the token price decreases, your staking rewards might not offset the capital loss. This scenario highlights the importance of considering both staking yields and potential price movements when evaluating staking opportunities. Staking works best as a long-term strategy where you believe in the fundamental value and growth potential of the underlying network.

Tax implications can significantly impact your net returns from staking. In many jurisdictions, staking rewards are taxed as ordinary income at the time they’re received, not when you sell them. This means you might owe taxes on rewards even if you haven’t converted them to fiat currency. Factor in your marginal tax rate when calculating net returns from staking activities.

Inflation and opportunity cost considerations are often overlooked in staking calculations. If inflation is running at 3% annually and your staking yields 5%, your real return is only about 2%. Additionally, consider what else you could do with the capital – if you could earn 8% in traditional investments with similar risk profiles, the 5% staking yield might not be optimal.

Risk-adjusted return calculations provide a more sophisticated approach to evaluating staking opportunities. Consider factors like network security, validator slashing risks, smart contract risks for liquid staking, and the overall maturity of the blockchain ecosystem. A 15% APY on a newer, less proven network might actually be riskier than a 5% APY on Ethereum.

Risk Management and Mitigation Strategies

While crypto staking is generally considered one of the safer ways to earn passive income in the cryptocurrency space, it’s not without risks. Understanding these risks and implementing appropriate mitigation strategies is crucial for protecting your capital and ensuring sustainable long-term returns.

Slashing represents one of the most significant technical risks in staking. This penalty mechanism is designed to discourage malicious behavior by validators, but it can also affect delegators in some networks. Slashing occurs when validators fail to maintain proper uptime, sign conflicting transactions, or engage in other behaviors that could compromise network security. While slashing events are relatively rare on well-established networks, they can result in the permanent loss of a portion of your staked tokens.

To mitigate slashing risks, carefully research validator performance history and reputation before delegating your tokens. Look for validators with consistent uptime records, transparent operations, and strong technical infrastructure. Diversifying your stake across multiple validators can also reduce the impact of any single validator being slashed. Many liquid staking protocols implement additional safeguards and insurance mechanisms to protect users from slashing events.

Smart contract risks are particularly relevant for liquid staking protocols and DeFi-integrated staking solutions. These platforms rely on complex smart contracts that, despite thorough auditing, may contain bugs or vulnerabilities that could be exploited by malicious actors. The collapse of several DeFi protocols in recent years has highlighted the importance of smart contract security in the cryptocurrency ecosystem.

Comprehensive risk assessment matrix showing different types of staking risks and considerations

Platform and counterparty risks arise when using centralized exchanges or third-party staking services. These platforms control your private keys and could potentially freeze your assets, suffer security breaches, or even become insolvent. The collapse of FTX in 2022 served as a stark reminder that even large, seemingly reputable platforms can fail catastrophically, taking user funds with them.

To minimize platform risks, consider using non-custodial staking methods where you maintain control of your private keys. If you do use centralized platforms, diversify across multiple providers and avoid keeping all your staked assets in one place. Research the platform’s security practices, insurance coverage, and regulatory compliance status before committing significant funds.

Liquidity risks can impact your ability to access your staked funds when needed. Many staking mechanisms include unbonding periods during which your tokens are locked and cannot be traded or transferred. These periods can range from a few days to several weeks, depending on the network. During market downturns, being unable to quickly exit positions can result in significant losses.

Liquid staking tokens provide one solution to liquidity risks by allowing you to trade your staked position while still earning rewards. However, these tokens may trade at a discount to the underlying asset during periods of market stress, creating additional complexity in your risk management strategy.

Regulatory risks represent an evolving challenge in the cryptocurrency space. Changes in government policies, tax treatments, or legal classifications of staking activities could impact the profitability or legality of your staking operations. Stay informed about regulatory developments in your jurisdiction and consider consulting with legal or tax professionals familiar with cryptocurrency regulations.

Network risks encompass various technical and governance challenges that could affect the long-term viability of your chosen blockchain. These include potential hard forks, governance disputes, technical vulnerabilities, or competition from other networks. While these risks are difficult to predict, diversifying your staking activities across multiple networks can help reduce concentration risk.

Inflation and tokenomics risks relate to the monetary policy of the staked cryptocurrency. Some networks have high inflation rates that could erode the real value of your holdings even while earning staking rewards. Understanding the tokenomics of your chosen cryptocurrency, including inflation schedules, token distribution mechanisms, and governance processes, is crucial for long-term success.

Implementing a comprehensive risk management strategy involves several key components. First, never stake more than you can afford to lose, and maintain adequate emergency funds in liquid assets. Second, diversify your staking activities across different cryptocurrencies, platforms, and strategies to reduce concentration risk. Third, stay informed about developments in the networks where you’re staking and be prepared to adjust your strategy as conditions change.

Regular monitoring and rebalancing of your staking portfolio can help optimize returns while managing risks. Set up alerts for significant changes in staking yields, validator performance, or network conditions. Consider taking profits periodically and reinvesting in different opportunities to maintain optimal diversification.

Advanced Staking Strategies for Maximum Returns

As the staking ecosystem has matured, sophisticated strategies have emerged that can help experienced users maximize their returns while managing risks effectively. These advanced techniques require deeper understanding of blockchain mechanics and DeFi protocols but can significantly enhance your passive income potential.

Liquid staking arbitrage represents one of the most sophisticated strategies available to advanced stakers. This approach involves taking advantage of price discrepancies between liquid staking tokens and their underlying assets. For example, stETH (Lido’s liquid staking token) sometimes trades at a slight discount to ETH during periods of market stress. Experienced traders can purchase stETH at a discount, earn staking rewards, and potentially profit from the convergence back to parity.

The strategy requires careful monitoring of market conditions and sufficient capital to weather potential periods where the discount persists or widens. Risk management is crucial, as the discount could theoretically persist indefinitely, though historical data suggests these discrepancies are typically temporary.

Cross-chain staking strategies involve leveraging staking opportunities across multiple blockchain networks to optimize returns and reduce correlation risks. This might involve staking ETH on Ethereum, ADA on Cardano, and SOL on Solana simultaneously, then using cross-chain bridges to move assets between networks as opportunities arise.

Image Placement: [Advanced strategy flowchart showing multi-chain staking approach]

Yield farming with staked assets has become increasingly popular as DeFi protocols integrate liquid staking tokens. You can stake ETH to receive stETH, then deposit the stETH into lending protocols like Aave or Compound to earn additional yield. This strategy compounds your returns but also increases complexity and risk, as you’re now exposed to smart contract risks from multiple protocols.

Some advanced users implement leveraged staking strategies using borrowed funds to increase their staking positions. This approach amplifies both potential returns and risks. For example, you might deposit ETH as collateral on a lending platform, borrow additional ETH, stake the borrowed ETH, and use the staking rewards to pay interest on the loan. This strategy only works when staking yields exceed borrowing costs and requires careful management to avoid liquidation.

Validator operation represents the most advanced form of staking, where you run your own validator node instead of delegating to others. This approach typically offers the highest returns but requires significant technical expertise, infrastructure investment, and ongoing maintenance. Ethereum validators, for example, need to maintain 99%+ uptime and properly configure their systems to avoid slashing penalties.

Running a validator involves setting up dedicated hardware or cloud infrastructure, installing and configuring validator software, and monitoring operations 24/7. The technical requirements vary by network, but generally include reliable internet connectivity, backup power systems, and security measures to protect validator keys.

Staking derivatives and structured products have emerged as sophisticated tools for advanced users. Some platforms offer options contracts on staking yields, allowing you to hedge against yield fluctuations or speculate on future staking rates. Others provide structured products that combine staking with other DeFi strategies to create more complex risk-return profiles.

MEV (Maximal Extractable Value) optimization has become an important consideration for advanced stakers, particularly on Ethereum. MEV refers to the additional value that validators can extract by optimally ordering transactions in blocks. Some liquid staking protocols now share MEV rewards with their users, providing an additional source of returns beyond standard staking yields.

Governance participation represents another advanced strategy that can enhance returns while contributing to network development. Many staked tokens provide voting rights in network governance decisions. Active participation in governance can sometimes result in additional rewards or airdrops, while also helping to shape the future direction of the network.

Tax optimization strategies become increasingly important as staking portfolios grow larger. Advanced techniques might include tax-loss harvesting with liquid staking tokens, strategic timing of reward claims to optimize tax brackets, or using retirement accounts for long-term staking positions where permitted.

Institutional-grade staking strategies often involve more sophisticated risk management and compliance procedures. This might include using multiple custody solutions, implementing detailed reporting and audit trails, or working with specialized service providers that offer institutional-grade security and compliance features.

When implementing advanced strategies, it’s crucial to thoroughly understand the risks involved and start with small positions while learning. Many advanced strategies that work well in bull markets can become problematic during bear markets or periods of high volatility. Continuous education and staying updated with the latest developments in the staking ecosystem are essential for long-term success.

Tax Implications and Compliance Considerations

The tax treatment of crypto staking varies significantly across jurisdictions and continues to evolve as regulators develop clearer guidance for cryptocurrency activities. Understanding your tax obligations is crucial for compliance and accurate financial planning, as the tax implications can significantly impact your net returns from staking activities.

In the United States, the Internal Revenue Service (IRS) generally treats staking rewards as taxable income at the time they are received, valued at their fair market value on the date of receipt. This means that even if you don’t sell your staking rewards, you may owe income tax on their dollar value when they were distributed to your wallet or account.

The income tax treatment applies regardless of whether you immediately sell the rewards or hold them for future appreciation. If you later sell the staking rewards, you may also be subject to capital gains tax on any appreciation (or can claim capital losses on any depreciation) from the time you received them until the time you sold them.

Record-keeping becomes particularly important for staking activities due to the frequent nature of reward distributions. Many networks distribute staking rewards daily or weekly, creating numerous taxable events throughout the year. You’ll need to track the date, amount, and fair market value of each reward distribution to accurately calculate your tax liability.

Image Placement: [Tax tracking spreadsheet example showing staking reward records]

Several tools and services have emerged to help crypto users track their staking activities for tax purposes. Platforms like CoinTracker, Koinly, and TaxBit can automatically import transaction data from major exchanges and wallets, calculate fair market values, and generate tax reports. However, you should verify the accuracy of automated calculations and maintain your own backup records.

The classification of staking activities can affect tax treatment in some jurisdictions. Some tax authorities may treat staking as a business activity if conducted at sufficient scale or with profit-making intent, potentially allowing for business expense deductions but also subjecting the activity to self-employment taxes.

International tax considerations become complex for users staking across multiple jurisdictions or using platforms based in different countries. Some countries have more favorable tax treatments for cryptocurrency activities, while others may impose additional reporting requirements or restrictions on crypto staking.

Estate planning considerations are important for significant staking positions. Staked assets may have different valuation considerations for estate tax purposes, particularly if they’re subject to lock-up periods or other restrictions. The ongoing nature of staking rewards also creates additional complexity in estate planning scenarios.

Some jurisdictions offer more favorable tax treatments for long-term cryptocurrency holdings. In countries with capital gains tax exemptions for assets held longer than a certain period, the timing of when you sell staked assets versus the rewards can significantly impact your tax liability.

Retirement account considerations vary by jurisdiction and account type. In some cases, it may be possible to conduct staking activities within tax-advantaged retirement accounts, potentially deferring or eliminating tax on staking rewards. However, this typically requires using specialized custodians and may have restrictions on the types of staking activities permitted.

Professional tax advice becomes increasingly valuable as staking portfolios grow larger or more complex. Tax professionals familiar with cryptocurrency can help optimize your staking strategy for tax efficiency, ensure compliance with reporting requirements, and navigate the evolving regulatory landscape.

Future regulatory developments may change the tax treatment of staking activities. Some jurisdictions are considering more favorable treatments for certain types of staking, while others may impose additional restrictions or reporting requirements. Staying informed about regulatory developments and being prepared to adjust your strategy accordingly is important for long-term success.

Conclusion and Future Outlook

Crypto staking has established itself as a cornerstone strategy for generating passive income in the digital asset ecosystem. As blockchain networks continue to mature and institutional adoption grows, staking opportunities are likely to become even more diverse and sophisticated. The transition of major networks like Ethereum to Proof of Stake consensus mechanisms has validated the long-term viability of staking as both a network security mechanism and an investment strategy.

The future of crypto staking looks promising, with several trends likely to shape the landscape in the coming years. Liquid staking protocols will continue to evolve, offering greater flexibility and integration with DeFi ecosystems. Cross-chain staking solutions may emerge, allowing users to stake assets from one network to secure another. Institutional-grade staking services will likely expand, bringing more traditional financial institutions into the staking ecosystem.

However, success in crypto staking requires more than simply locking up tokens and waiting for rewards. It demands ongoing education, careful risk management, and adaptation to changing market conditions and regulatory environments. The most successful stakers will be those who understand the underlying technology, stay informed about network developments, and implement comprehensive strategies that balance returns with risk management.

As you embark on or expand your crypto staking journey, remember that this is a long-term strategy that works best when aligned with your overall investment goals and risk tolerance. Start with small amounts, diversify across multiple networks and strategies, and gradually increase your exposure as you gain experience and confidence.

The passive income potential of crypto staking is real and significant, but it’s not a get-rich-quick scheme. Like any investment strategy, it requires patience, discipline, and continuous learning. By following the principles and strategies outlined in this guide, you’ll be well-positioned to build a sustainable passive income stream through crypto staking while contributing to the security and decentralization of blockchain networks.

Disclaimer: This article is for educational purposes only and does not constitute financial advice. Cryptocurrency investments carry significant risks, including the potential for total loss of capital. Always conduct your own research and consider consulting with qualified financial advisors before making investment decisions. Past performance does not guarantee future results, and staking rewards are not guaranteed.

About the Author: everythingcryptoitclouds.com is a leading resource for cryptocurrency education and investment strategies, providing in-depth analysis and practical guidance for digital asset investors of all experience levels.