Author: everythingcryptoitclouds.com

Introduction: The Jolt to the AI Trade

Last week, the seemingly unstoppable AI stock rally hit a major speed bump. A sharp selloff, triggered by disappointing news from key players, sent shockwaves through the market, raising the specter of an “AI bubble.” While the overall AI narrative remains robust, the correction served as a crucial reality check, reminding investors that even the most promising growth stories are subject to market scrutiny.

The focus of this correction centered on two major infrastructure providers: Broadcom (AVGO) and Oracle (ORCL). Their struggles quickly dragged down other AI-exposed giants, including Advanced Micro Devices (AMD) and Meta Platforms (META). This article breaks down the reasons behind the crash, analyzes the short-term outlook for the next four weeks, and provides a forecast for early 2026.

Anatomy of the Selloff: Broadcom and Oracle’s One-Two Punch

The market correction was primarily ignited by a one-two punch from two companies whose fortunes are deeply tied to the AI infrastructure buildout.

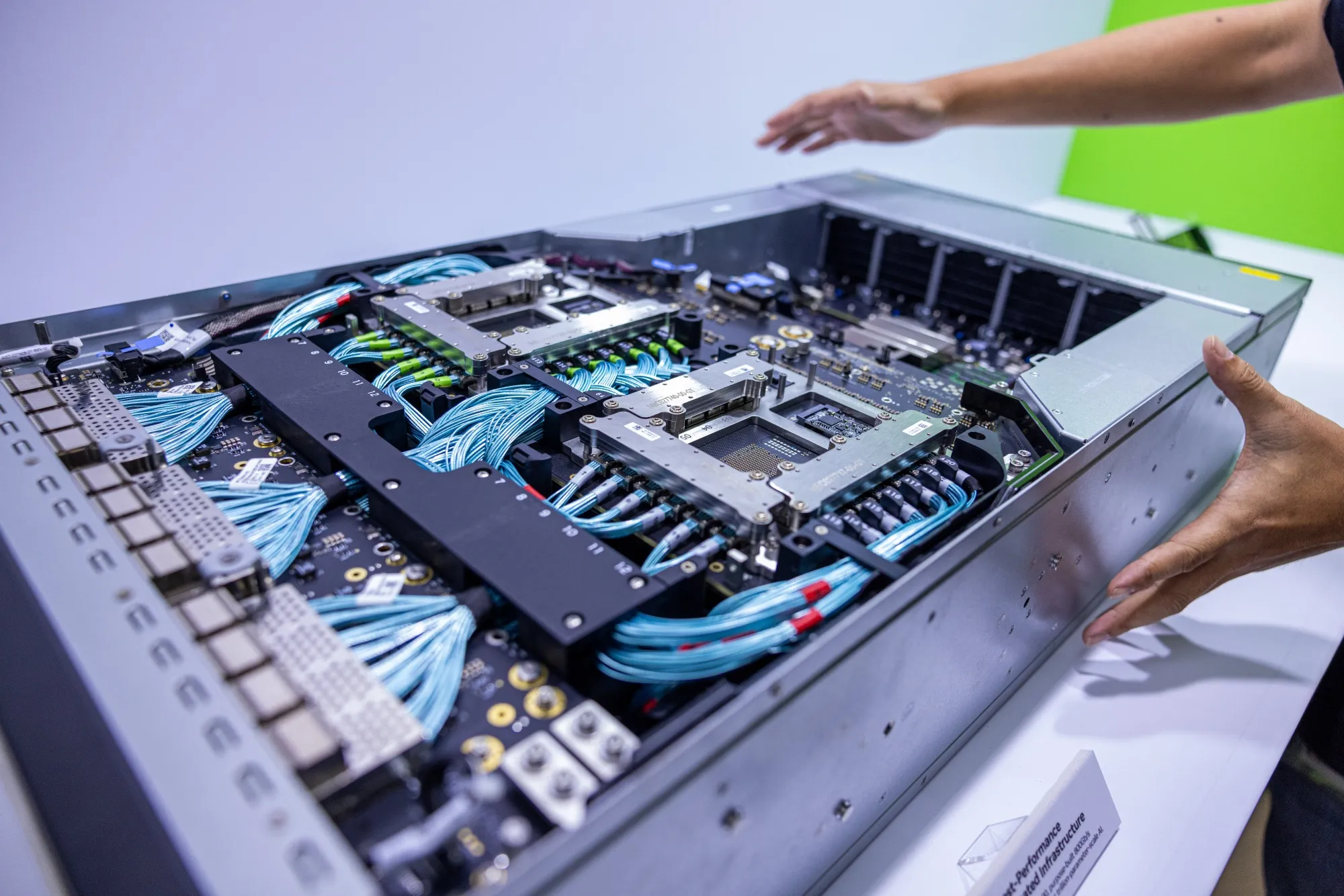

Broadcom’s Margin Scare: Despite reporting better-than-expected quarterly results and strong guidance, Broadcom’s stock plummeted by 11%. The core concern was a warning from management that gross margins would be lower in the short term. This is due to the higher up-front costs associated with producing complex custom AI chip systems and server racks. Furthermore, the CEO tempered expectations for a major deal with OpenAI in 2026, suggesting the immediate revenue boost might not be as explosive as investors had hoped.

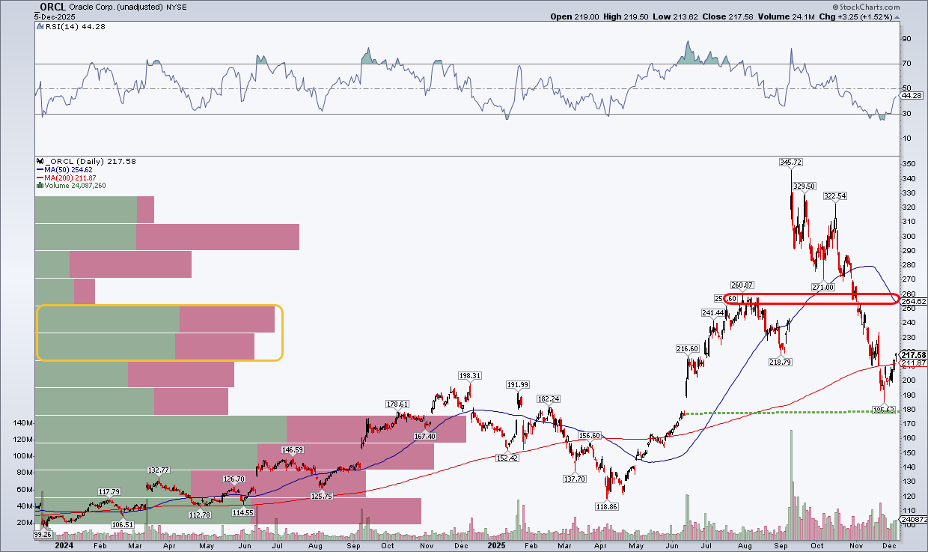

Oracle’s Financing Disappointment: Oracle’s stock had already plunged 10% before dropping another 4.5% in the wake of its mixed earnings report (beating on earnings per share but missing on revenue). Investors were particularly disappointed by the lack of detail on how the company plans to finance its massive, debt-fueled AI data center expansion. This raised questions about the sustainability and profitability of the aggressive infrastructure spending required to compete in the AI cloud space.

The combination of Broadcom’s margin concerns and Oracle’s financing uncertainty created a wave of “AI angst,” leading to a broader selloff in the sector.

Short-Term Outlook: The Next Four Weeks

The next four weeks, often characterized by holiday trading and year-end portfolio adjustments, will be crucial for these stocks.

| Company | Crash Reason | Short-Term Outlook (Next 4 Weeks) |

| :— | :— | :— |

| Broadcom (AVGO) | Margin contraction on custom AI chips. | Analysts are largely recommending to “buy the dip,” viewing the selloff as an overreaction to short-term margin pressure. The underlying demand for their custom chips from hyperscalers remains robust. |

| Oracle (ORCL) | Missed revenue and financing uncertainty. | Volatility is likely as the market digests the debt concerns. A clear communication from management regarding their CapEx financing strategy could stabilize the stock, but until then, it remains under pressure. |

| Advanced Micro Devices (AMD) | General AI trade selloff. | Expected to stabilize quickly. The drop was largely collateral damage from the Broadcom/Oracle news. Strong demand for its EPYC CPUs and Instinct GPUs in the data center market provides a solid floor. |

| Meta Platforms (META) | General AI trade selloff. | Strongly positioned for a rebound. News of trimming the metaverse budget to prioritize AI spending is a positive signal for investors. The stock is likely to benefit from the “flight to quality” within the AI sector. |

Early 2026 Forecast: The Infrastructure Boom Continues

Despite the recent correction, the long-term forecast for the AI infrastructure sector remains overwhelmingly bullish, especially as we head into early 2026. The fundamental driver is the massive, non-negotiable capital expenditure (CapEx) being committed by the world’s largest tech companies.

Meta’s AI Commitment: Meta Platforms is a prime example of this long-term commitment. The company is aggressively shifting resources away from its metaverse division to focus on building out its AI capabilities. Analysts project Meta’s 2026 CapEx to reach an astonishing $109 billion, more than triple its 2023 spending. This colossal investment is primarily directed at AI infrastructure, including the purchase of chips and the construction of data centers.

The Demand for Silicon: This spending spree directly benefits chipmakers like Broadcom and AMD. Broadcom’s custom chip business, despite the short-term margin hit, is poised for massive growth as it supplies hyperscalers like Meta and Google. Similarly, AMD is forecast to see a 20%+ increase in revenue in 2026, driven by the insatiable demand for its high-performance EPYC and Instinct GPUs in the data center. The AI arms race is far from over, and these companies are the essential suppliers.

Oracle’s Long Game: While Oracle faces short-term financing questions, its long-term strategy hinges on becoming a major player in the AI cloud. The massive data center buildout, while costly, is a necessary step to capture future AI-driven revenue. If the company can effectively communicate its financing plan and execute on its AI pipeline, the stock could see a significant recovery in 2026.

Conclusion: A Correction, Not a Collapse

The recent AI stock selloff was a healthy, albeit painful, market correction. It was driven by specific, company-level concerns about margins and financing, not a collapse in the underlying demand for artificial intelligence.

For investors, the message is clear: the AI revolution is still in its early stages, and the long-term trend of massive infrastructure spending is intact. The next four weeks may see continued volatility as the market finds its footing, but the outlook for early 2026 remains bright. The companies that are the essential building blocks of the AI future—Broadcom, AMD, Oracle, and Meta—are poised to be the biggest beneficiaries of this sustained, multi-year boom.