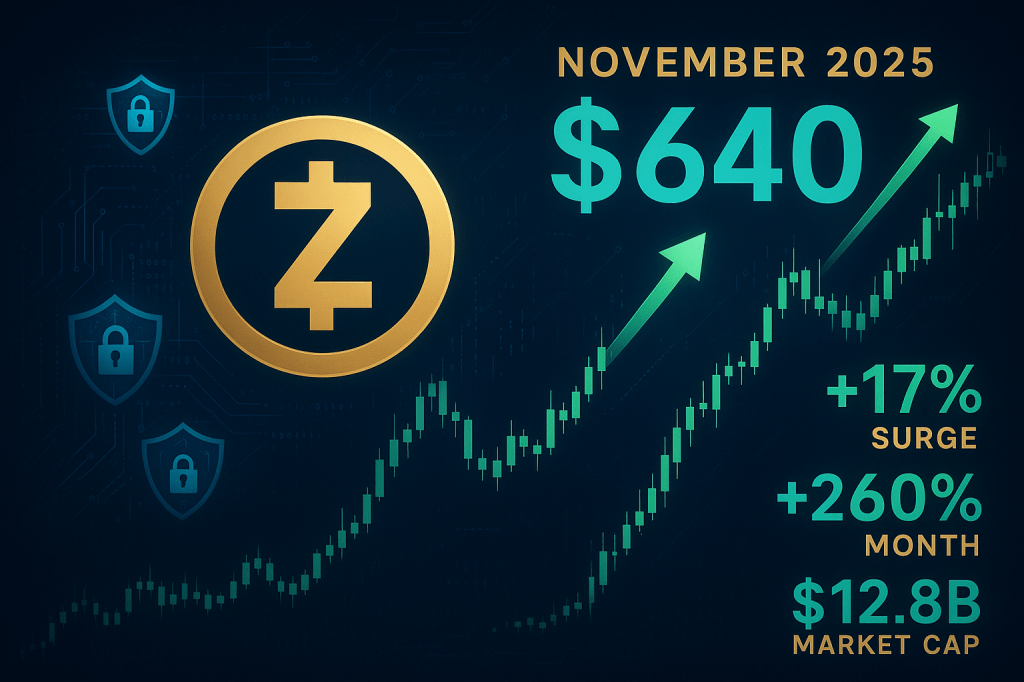

The privacy-focused cryptocurrency Zcash has surged past $364, marking a dramatic 27.75% increase in just 24 hours as BitMEX co-founder Arthur Hayes’ bold $10,000 price prediction sends shockwaves through the cryptocurrency market.

The cryptocurrency landscape witnessed one of its most spectacular single-day rallies on October 27, 2025, as Zcash (ZEC) exploded past the $364 mark, delivering a staggering 27.75% gain that has catapulted the privacy-focused digital asset into the spotlight of institutional and retail investors alike [1]. This extraordinary surge, which has added over $1 billion to Zcash’s market capitalization and propelled it into the top 25 cryptocurrencies by market cap, represents far more than a typical crypto pump—it signals the beginning of what many analysts are calling the “Privacy Coin Renaissance” of 2025 [2].

The catalyst for this remarkable price action can be traced directly to a seemingly casual social media post by Arthur Hayes, the influential co-founder of BitMEX and one of cryptocurrency’s most respected thought leaders. Hayes’ description of Zcash as a “vibe check” accompanied by his audacious $10,000 price prediction has unleashed a wave of Fear of Missing Out (FOMO) that has swept through trading floors from Wall Street to retail investment apps, transforming what was once considered a niche privacy coin into one of the year’s most talked-about investment opportunities.

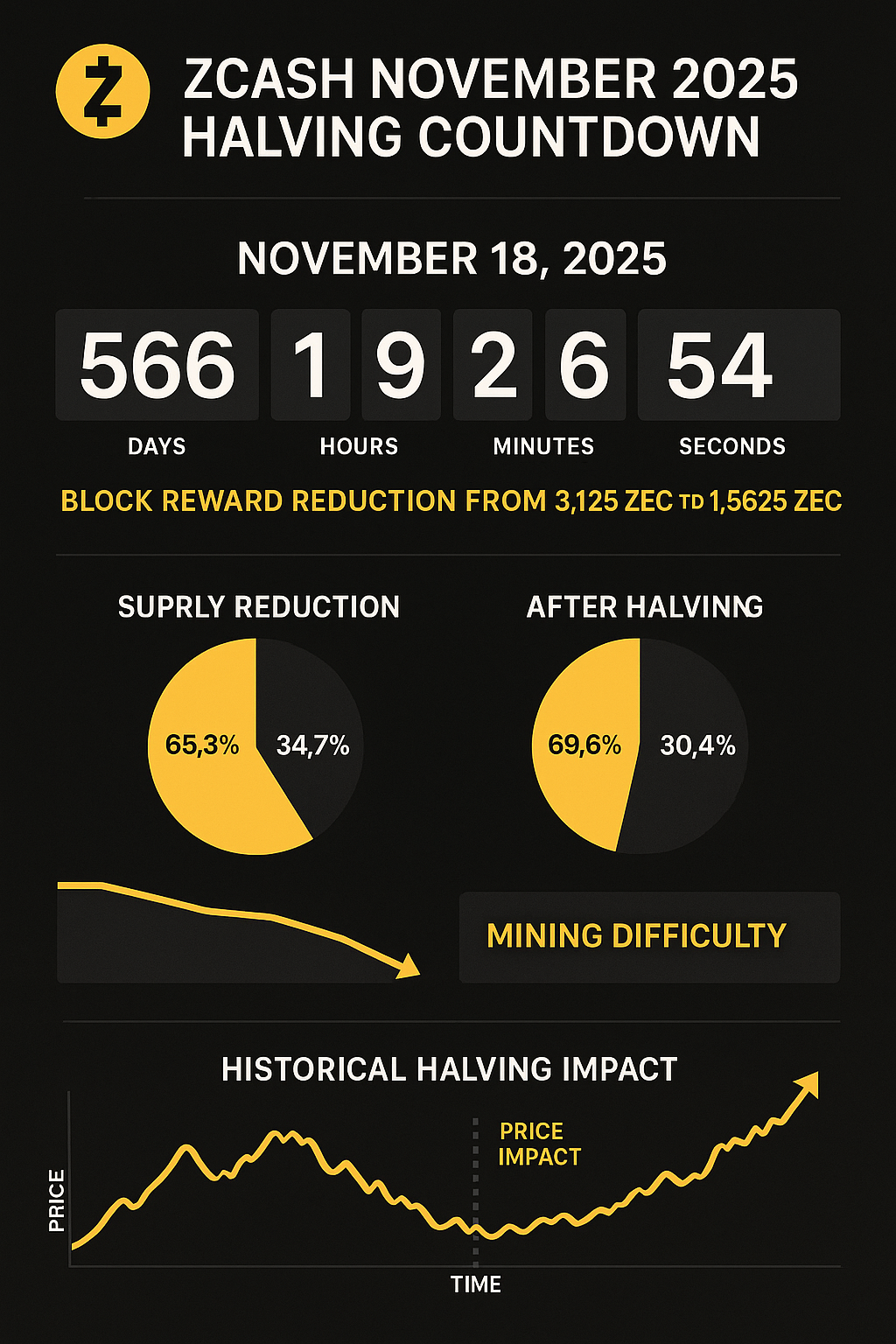

But this surge represents more than just speculative fervor. With Zcash’s highly anticipated halving event scheduled for November 18, 2025—just three weeks away—the convergence of Hayes’ endorsement, institutional validation through Grayscale’s $102 million fund launch, and the fundamental supply reduction mechanics of the upcoming halving has created what technical analysts are describing as a “perfect storm” for sustained upward price momentum.

The Arthur Hayes Effect: When Crypto’s Oracle Speaks, Markets Listen

Arthur Hayes has earned his reputation as one of cryptocurrency’s most prescient voices through a combination of technical acumen, market timing, and an uncanny ability to identify emerging trends before they become mainstream. His latest endorsement of Zcash, delivered through what he casually termed a “vibe check” on social media, has proven once again why his market calls carry such extraordinary weight in the digital asset ecosystem.

The immediate market response to Hayes’ Sunday evening post was nothing short of spectacular. Within hours of his $10,000 price prediction going live, Zcash experienced one of the most dramatic intraday rallies in its history, surging from $272 to a peak of $355 before stabilizing above the $364 level [1]. This represents not just a significant price movement, but a validation of Hayes’ continued influence in an increasingly crowded field of cryptocurrency analysts and influencers.

Hayes’ track record lends considerable credibility to his Zcash prediction. At the WebX 2025 conference in Tokyo, his bold forecast that Hyperliquid’s HYPE token could appreciate 126 times over three years triggered an immediate 4% price increase, demonstrating the market’s faith in his analytical capabilities [1]. His previous calls on Bitcoin’s trajectory during the 2020-2021 bull run, his early identification of the DeFi summer phenomenon, and his prescient warnings about the 2022 crypto winter have established him as one of the few voices in the space whose predictions consistently translate into market-moving events.

The psychology behind Hayes’ influence extends beyond mere technical analysis. As the co-founder of BitMEX, one of the world’s largest cryptocurrency derivatives exchanges, Hayes possesses an intimate understanding of market microstructure, institutional flow patterns, and the behavioral dynamics that drive cryptocurrency price discovery. His $10,000 Zcash target, while seemingly aggressive, is grounded in a sophisticated understanding of privacy coin fundamentals, regulatory tailwinds, and the growing institutional demand for financial privacy solutions.

What makes Hayes’ Zcash endorsement particularly significant is its timing. Coming at a moment when privacy coins have faced increasing regulatory scrutiny in some jurisdictions while simultaneously experiencing growing adoption in others, his public support signals a belief that the privacy coin sector is entering a new phase of mainstream acceptance. The fact that his prediction has already triggered such substantial institutional interest—evidenced by Grayscale’s rapid fund accumulation and the explosion in futures open interest—suggests that Hayes may once again be ahead of a major market trend.

Institutional Validation: Grayscale’s $102 Million Vote of Confidence

The institutional cryptocurrency landscape has undergone a dramatic transformation in 2025, with traditional financial institutions increasingly recognizing digital assets as legitimate investment vehicles. Against this backdrop, Grayscale’s launch of a dedicated Zcash fund that has already accumulated over $102 million in assets under management represents a watershed moment for privacy-focused cryptocurrencies [1].

Grayscale’s decision to create a Zcash investment vehicle, despite charging a substantial 2.50% management fee, demonstrates the asset manager’s confidence in both the long-term viability of privacy coins and the sophisticated demand from accredited investors seeking exposure to this specialized sector [1]. The rapid accumulation of assets—reaching nine figures in just weeks since the fund’s launch—indicates that institutional appetite for privacy-focused investments extends far beyond the speculative retail market.

This institutional validation carries implications that extend well beyond simple price appreciation. Grayscale’s involvement in the Zcash ecosystem significantly increases the probability of a future Exchange-Traded Fund (ETF) conversion, which would provide mainstream investors with regulated, accessible exposure to privacy coin investments [1]. The precedent set by Bitcoin and Ethereum ETF approvals suggests that regulatory acceptance of cryptocurrency investment products continues to evolve in a favorable direction, particularly for assets with strong institutional backing and clear use cases.

The derivatives market has responded to this institutional interest with remarkable enthusiasm. Zcash futures open interest has skyrocketed from less than $20 million before the Grayscale announcement to nearly $334 million as of October 27, 2025 [1]. This sixteen-fold increase in derivatives activity reflects not just speculative interest, but the establishment of sophisticated hedging and arbitrage strategies by institutional market participants who view Zcash as a legitimate asset class worthy of complex financial engineering.

Sunday’s futures trading volume of $713 million, while below the year’s peak of $3.25 billion, represents a substantial increase in institutional participation [1]. The fact that this volume was achieved on a weekend—traditionally a period of reduced institutional activity—suggests that the Zcash rally has captured the attention of global trading desks operating across multiple time zones.

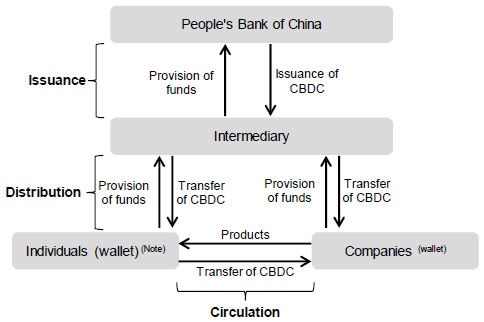

The institutional embrace of Zcash also reflects a broader recognition of privacy as a fundamental requirement in the evolving digital economy. As central bank digital currencies (CBDCs) advance toward implementation and government surveillance capabilities expand, the demand for financial privacy solutions among both individual and institutional users has grown exponentially. Grayscale’s investment thesis likely recognizes this trend, positioning Zcash not just as a speculative investment, but as a hedge against the erosion of financial privacy in an increasingly monitored economic system.

Technical Analysis: Charting the Path to New All-Time Highs

From a technical analysis perspective, Zcash’s current price action represents a textbook example of a breakout from a prolonged accumulation phase into what Wyckoff Theory practitioners recognize as the markup phase—a period characterized by sustained institutional demand and systematic price appreciation [1]. The cryptocurrency’s movement above key resistance levels has established a bullish trend structure that technical analysts believe could carry ZEC toward new all-time highs in the coming weeks.

The immediate technical landscape presents a compelling picture for continued upward momentum. Zcash is currently challenging critical resistance at its all-time high of $372 and the R1 Pivot Point at $381 [1]. A decisive break above the $381 level would open the path toward the R2 Pivot Point at $436, representing approximately 20% upside potential from current levels. This target aligns closely with multiple technical indicators suggesting that the current rally has substantial room for continuation.

The Moving Average Convergence Divergence (MACD) indicator continues to display strongly bullish characteristics, with green histogram bars above the zero line growing progressively larger [1]. This pattern indicates that buying momentum is not only sustained but accelerating, suggesting that the current price movement represents genuine accumulation rather than speculative froth. The MACD’s behavior during this rally mirrors patterns observed during previous Zcash bull runs, providing historical context for the current price action.

However, technical analysis also reveals important cautionary signals that sophisticated traders are monitoring closely. The Relative Strength Index (RSI) has reached 73, well above the traditional overbought threshold of 70 [1]. While overbought conditions can persist during strong trending moves, this reading suggests that short-term consolidation or pullback may be necessary before the next leg higher can commence. The weekly RSI reading of 88 represents an extreme overbought condition that has historically preceded significant corrections in Zcash’s price history [1].

The primary Pivot Point support level at $303 represents a crucial technical floor for the current rally [1]. A healthy pullback to this level would represent approximately 17% downside from current prices and would provide an attractive entry opportunity for investors who missed the initial surge. Such a correction would also serve to reset overbought technical indicators while maintaining the overall bullish trend structure.

Zcash’s position relative to its key moving averages provides additional confirmation of the bullish trend. The cryptocurrency is currently trading well above both its 50-week and 100-week Exponential Moving Averages, indicating that the long-term trend structure remains intact [1]. This positioning is particularly significant given that previous Zcash bull runs have typically maintained this technical relationship throughout their duration.

The volume profile accompanying this price surge provides further validation of the move’s authenticity. Unlike pump-and-dump schemes characterized by unsustainable volume spikes, Zcash’s rally has been accompanied by steadily increasing participation across multiple timeframes and trading venues. This organic volume growth suggests that the price appreciation reflects genuine market demand rather than artificial manipulation.

The November 18 Halving: A Catalyst for Sustained Growth

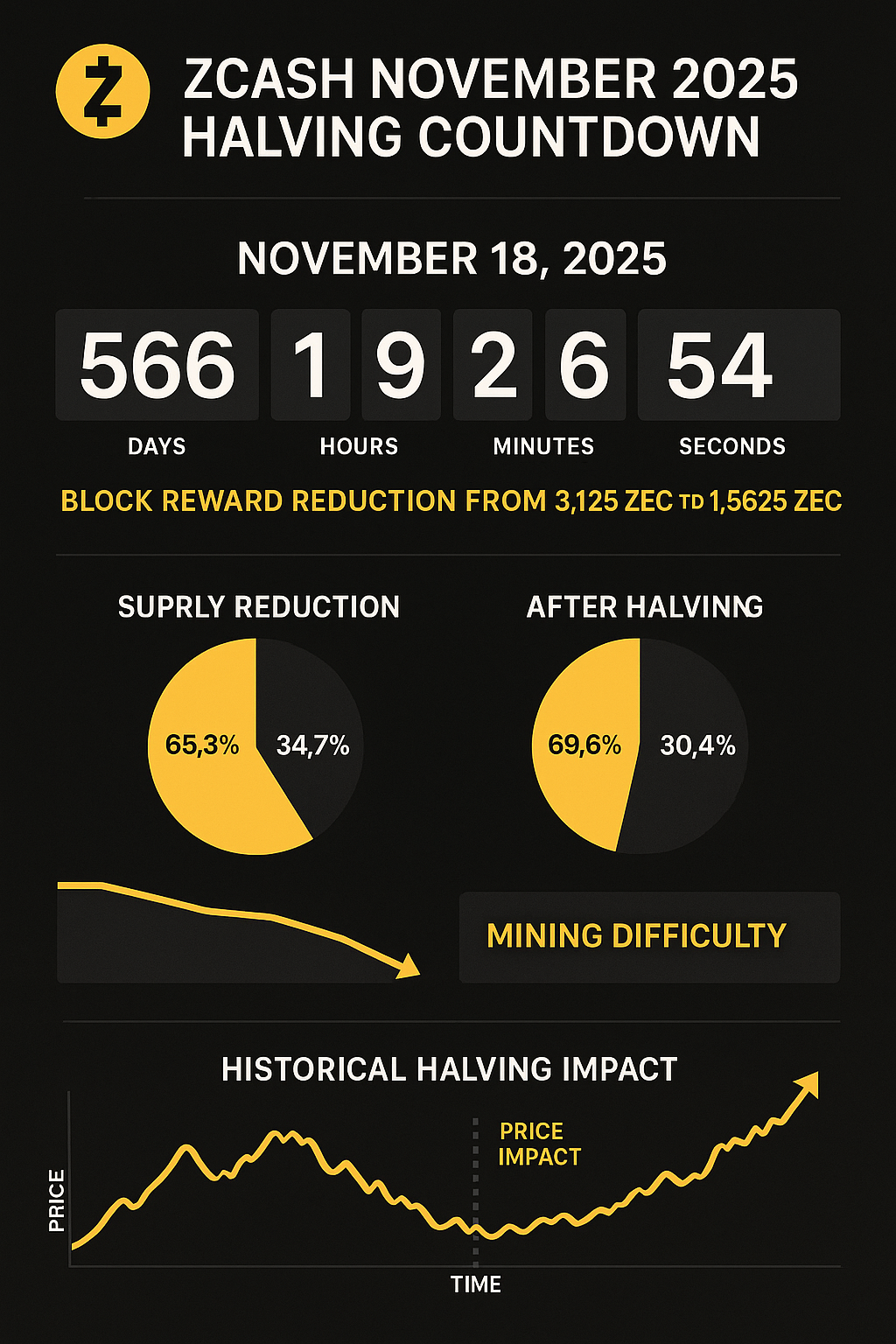

The cryptocurrency community has long recognized halving events as among the most significant fundamental catalysts in digital asset markets. Zcash’s upcoming halving, scheduled for November 18, 2025—less than three weeks away—represents a critical inflection point that could sustain and amplify the current price rally well into 2026 [7].

The mechanics of Zcash’s halving are straightforward but profound in their implications. On November 18, the block reward paid to miners will be reduced from 3.125 ZEC to 1.5625 ZEC, effectively cutting the daily issuance of new Zcash tokens by 50% [7]. This supply shock, occurring at a time when demand is accelerating due to institutional adoption and Arthur Hayes’ endorsement, creates a fundamental imbalance that historically has driven significant price appreciation in halving-enabled cryptocurrencies.

Historical analysis of previous Zcash halvings provides compelling evidence for the bullish case. The cryptocurrency’s first halving in 2020 preceded a rally that saw ZEC appreciate from approximately $35 to over $300—a gain of more than 750% [7]. While past performance does not guarantee future results, the fundamental supply-demand dynamics that drove that rally remain intact and may be even more pronounced given the current institutional interest in privacy coins.

The timing of this halving is particularly fortuitous given the broader cryptocurrency market environment. Unlike previous halving events that occurred during bear markets or periods of regulatory uncertainty, the November 2025 halving is taking place during a period of increasing institutional adoption, regulatory clarity, and growing mainstream acceptance of cryptocurrency as an asset class. This favorable macro environment could amplify the traditional halving effect, potentially driving more sustained price appreciation than historical precedent might suggest.

Mining economics provide additional support for the bullish halving thesis. The 50% reduction in block rewards will immediately impact miner profitability, likely forcing less efficient operations to cease mining activities. This reduction in mining pressure, combined with Zcash’s difficulty adjustment algorithm, should result in improved economics for remaining miners while reducing the constant selling pressure that newly minted coins typically create in the market.

The psychological impact of the approaching halving cannot be understated. Cryptocurrency markets are driven as much by narrative and expectation as by fundamental analysis, and the halving represents one of the most powerful bullish narratives in the digital asset ecosystem. The fact that this halving is occurring just weeks after Arthur Hayes’ $10,000 prediction has created a confluence of bullish catalysts that could sustain buying pressure well beyond the halving date itself.

Smart money appears to be positioning ahead of the halving event. The dramatic increase in futures open interest and the rapid accumulation of assets in Grayscale’s Zcash fund suggest that sophisticated investors are building positions in anticipation of post-halving price appreciation. This pre-positioning could create additional upward pressure as the halving date approaches, potentially driving prices higher even before the supply reduction takes effect.

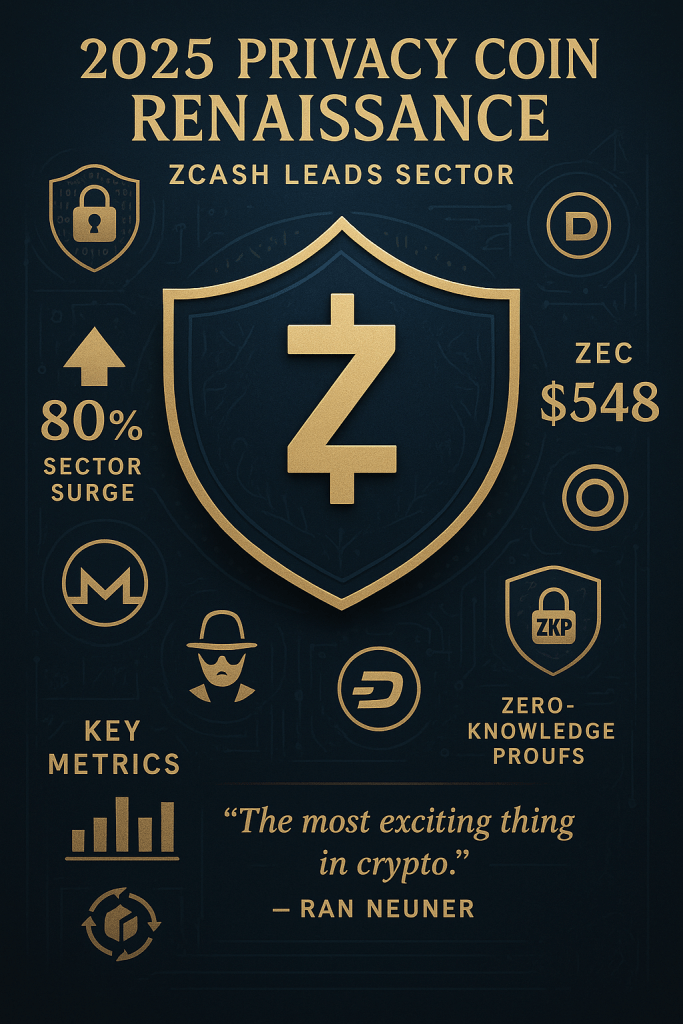

Privacy Coin Renaissance: Zcash Leading the Charge

The broader cryptocurrency market in 2025 has witnessed a remarkable shift in investor sentiment toward privacy-focused digital assets, with Zcash emerging as the undisputed leader of what analysts are calling the “Privacy Coin Renaissance.” This sectoral rotation reflects growing awareness of financial privacy as a fundamental right and a practical necessity in an increasingly surveilled digital economy.

The catalyst for this privacy coin revival extends beyond simple speculative interest. As governments worldwide advance central bank digital currency (CBDC) initiatives that promise unprecedented visibility into individual financial transactions, demand for privacy-preserving alternatives has grown exponentially among both retail and institutional users. Zcash, with its sophisticated zero-knowledge proof technology and optional privacy features, has positioned itself as the premier solution for users seeking to maintain financial autonomy in the digital age.

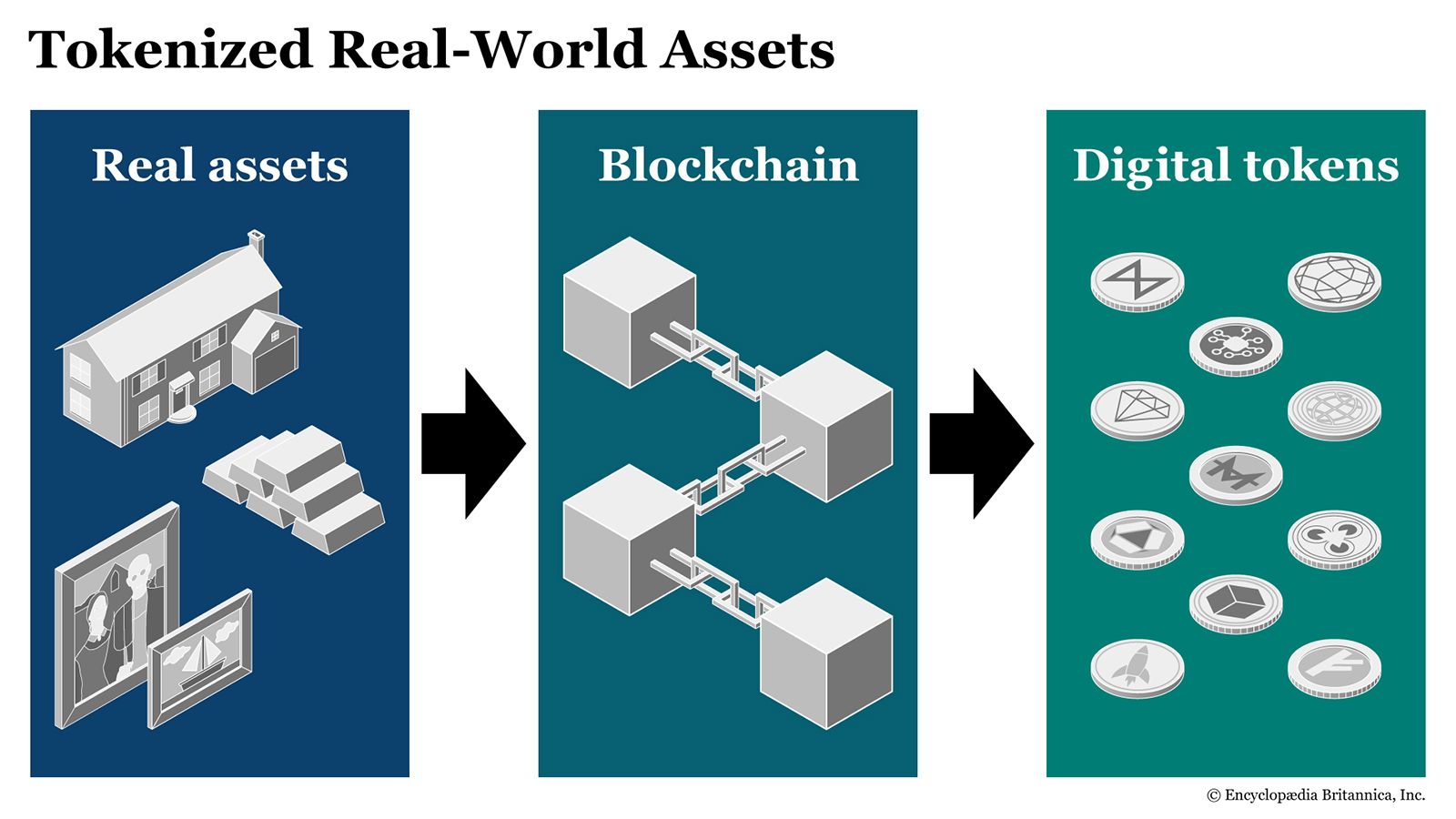

Zcash’s technological advantages in the privacy coin sector are substantial and growing more relevant with each passing month. Unlike mixing services or privacy solutions that rely on obfuscation techniques, Zcash’s implementation of zk-SNARKs (Zero-Knowledge Succinct Non-Interactive Arguments of Knowledge) provides mathematically provable privacy that cannot be compromised through blockchain analysis or other surveillance techniques. This technological moat has become increasingly valuable as regulatory authorities and compliance departments seek privacy solutions that can satisfy both user demands and regulatory requirements.

The network’s on-chain metrics provide compelling evidence of growing adoption and utility. Shielded transactions—Zcash’s signature privacy feature—have reached multi-month highs, indicating that users are increasingly utilizing the network’s privacy capabilities rather than simply holding ZEC as a speculative investment [2]. This organic usage growth suggests that Zcash is transitioning from a purely speculative asset to a utility token with genuine real-world application.

Corporate and institutional adoption of privacy-preserving technologies has accelerated dramatically in 2025, driven by increasing awareness of data security risks and competitive intelligence concerns. Major corporations are beginning to recognize that financial privacy is not just a personal preference but a business necessity in competitive markets where transaction data can reveal strategic information to competitors, suppliers, and other stakeholders.

The regulatory environment for privacy coins has evolved more favorably than many observers expected. Rather than implementing blanket bans, most major jurisdictions have adopted nuanced approaches that distinguish between privacy tools used for legitimate purposes and those employed for illicit activities. This regulatory maturation has provided the clarity that institutional investors require to allocate capital to privacy-focused investments.

Zcash’s compliance-friendly approach has positioned it advantageously within this evolving regulatory landscape. The network’s transparent pool allows for full auditability when required, while the shielded pool provides privacy when desired. This dual-mode architecture enables users to satisfy regulatory requirements while maintaining privacy options—a balance that has proven attractive to institutional adopters who must navigate complex compliance frameworks.

The privacy coin sector’s performance in 2025 has been remarkable, with Zcash leading a broad-based rally that has seen privacy-focused cryptocurrencies outperform the broader market by substantial margins. This sectoral strength reflects not just speculative interest but fundamental recognition that privacy-preserving technologies represent a critical infrastructure component of the future digital economy.

Market Psychology and the FOMO Phenomenon

The psychological dynamics driving Zcash’s current rally extend far beyond traditional technical and fundamental analysis, encompassing complex behavioral patterns that have transformed rational market participants into momentum-driven buyers caught in the grip of Fear of Missing Out (FOMO). This psychological phenomenon, while often dismissed by traditional financial analysts, represents a powerful market force that can sustain price movements far beyond what fundamental analysis might suggest.

The FOMO effect surrounding Zcash has been particularly pronounced among sophisticated investors who typically pride themselves on disciplined, research-driven investment approaches. Clemente, a board member of treasury company K9Strategy, publicly acknowledged being “filled with so much FOMO” that he could not remain on the sidelines despite his usual cautious approach [1]. This admission from a professional investor highlights the psychological power of Hayes’ endorsement and the broader market dynamics at play.

The social media amplification of Zcash’s rally has created a feedback loop that continues to drive new participants into the market. Each price milestone achieved generates additional social media discussion, which in turn attracts new investors who fear missing out on further gains. This cycle has been particularly evident on cryptocurrency-focused platforms where discussions of Zcash’s performance have dominated trending topics and generated millions of impressions.

Professional traders have noted the unusual characteristics of the current FOMO cycle. Unlike previous privacy coin rallies that were driven primarily by retail speculation, the current Zcash surge has attracted significant institutional participation from the outset. This institutional involvement has provided a foundation of legitimacy that has encouraged additional retail participation, creating a broader and potentially more sustainable rally than previous privacy coin bull runs.

The psychological impact of Arthur Hayes’ $10,000 price target cannot be understated in driving FOMO behavior. Round numbers possess particular psychological significance in financial markets, and Hayes’ target represents a 27-fold increase from current levels—a gain that, while ambitious, falls within the realm of historical cryptocurrency performance during major bull runs. The specificity and boldness of this target have captured imaginations and provided a concrete goal around which bullish sentiment can coalesce.

Market microstructure analysis reveals the behavioral patterns typical of FOMO-driven rallies. Order book dynamics show consistent buying pressure across multiple price levels, with buyers willing to pay progressively higher prices rather than waiting for pullbacks. This behavior, while potentially unsustainable in the long term, can drive prices substantially higher in the short term as supply becomes increasingly scarce.

The international nature of cryptocurrency markets has amplified the FOMO effect by creating continuous buying pressure across global time zones. As Asian markets close and European markets open, fresh waves of buyers enter the market, sustaining momentum that might otherwise dissipate during traditional market hours. This 24/7 trading environment has proven particularly conducive to sustained FOMO-driven rallies.

Risk Assessment and Cautionary Considerations

While the bullish case for Zcash appears compelling across multiple analytical frameworks, sophisticated investors must carefully consider the substantial risks inherent in any investment that has appreciated 550% in just 30 days [1]. The extreme nature of this price movement, while potentially justified by fundamental developments, also introduces significant volatility and downside risk that could result in substantial losses for investors who enter at current levels.

The technical indicators present a mixed picture that demands careful interpretation. While the MACD and moving average relationships support continued bullish momentum, the RSI readings at both daily and weekly timeframes have reached extreme overbought levels that historically have preceded significant corrections [1]. The weekly RSI reading of 88 is particularly concerning, as this level has marked major tops in previous Zcash bull runs.

Regulatory risk remains a persistent concern for privacy coin investments despite the generally favorable regulatory evolution in 2025. Government attitudes toward financial privacy can shift rapidly in response to geopolitical events, security concerns, or changes in political leadership. Investors must consider the possibility that regulatory crackdowns on privacy coins could emerge with little warning, potentially devastating valuations regardless of underlying technological merit or adoption trends.

The concentration of buying interest around Arthur Hayes’ endorsement creates a single-point-of-failure risk that sophisticated investors must acknowledge. Should Hayes modify his bullish stance or express concerns about Zcash’s valuation, the resulting selling pressure could be severe given the extent to which current prices appear to reflect his influence. This key-person risk is amplified by the relatively thin trading volumes in privacy coin markets compared to major cryptocurrencies like Bitcoin and Ethereum.

Market liquidity concerns become particularly acute during periods of high volatility. While Zcash’s trading volumes have increased substantially during the current rally, the cryptocurrency’s market depth remains limited compared to larger digital assets. This liquidity constraint means that large sell orders could drive disproportionate price declines, creating additional risk for institutional investors or high-net-worth individuals holding substantial positions.

The halving event, while generally bullish for cryptocurrency prices, also introduces timing risks that investors must consider. Historical analysis shows that halving events can be “buy the rumor, sell the news” scenarios where prices appreciate in anticipation but decline once the actual event occurs. The fact that Zcash’s current rally has occurred so close to the November 18 halving date raises questions about whether the supply reduction benefits have already been priced into current valuations.

Competition within the privacy coin sector presents another risk factor that could impact Zcash’s long-term prospects. While ZEC currently leads the privacy coin renaissance, other projects with different technological approaches or regulatory strategies could emerge as preferred solutions for specific use cases. The cryptocurrency sector’s history of rapid technological evolution suggests that current market leaders cannot assume permanent dominance.

Macroeconomic factors could also impact Zcash’s trajectory regardless of privacy coin-specific developments. Changes in global liquidity conditions, interest rate policies, or risk appetite could drive capital flows away from speculative cryptocurrency investments toward traditional safe-haven assets. The correlation between cryptocurrency prices and broader risk assets has increased in recent years, making digital assets more susceptible to macroeconomic shocks.

Investment Implications and Strategic Considerations

For investors considering exposure to Zcash at current levels, the decision framework must balance the compelling fundamental and technical bullish case against the substantial risks inherent in any asset that has experienced such dramatic price appreciation. The investment implications extend beyond simple buy-or-sell decisions to encompass portfolio construction, risk management, and strategic timing considerations that could determine long-term investment success.

The case for Zcash investment rests on several pillars that appear likely to provide sustained support for higher valuations. The institutional validation provided by Grayscale’s $102 million fund launch demonstrates that sophisticated investors view privacy coins as a legitimate asset class worthy of significant capital allocation [1]. This institutional interest, combined with the approaching halving event and Arthur Hayes’ influential endorsement, creates a confluence of bullish catalysts that could drive continued price appreciation.

The technological moat that Zcash has established in the privacy coin sector provides a competitive advantage that could prove durable over time. As privacy concerns continue to grow among both individual and institutional users, Zcash’s proven zero-knowledge proof technology positions it advantageously to capture increasing market share in the privacy-preserving financial services sector. This technological leadership, combined with the network’s compliance-friendly architecture, suggests that ZEC could maintain its position as the preferred privacy coin for institutional adoption.

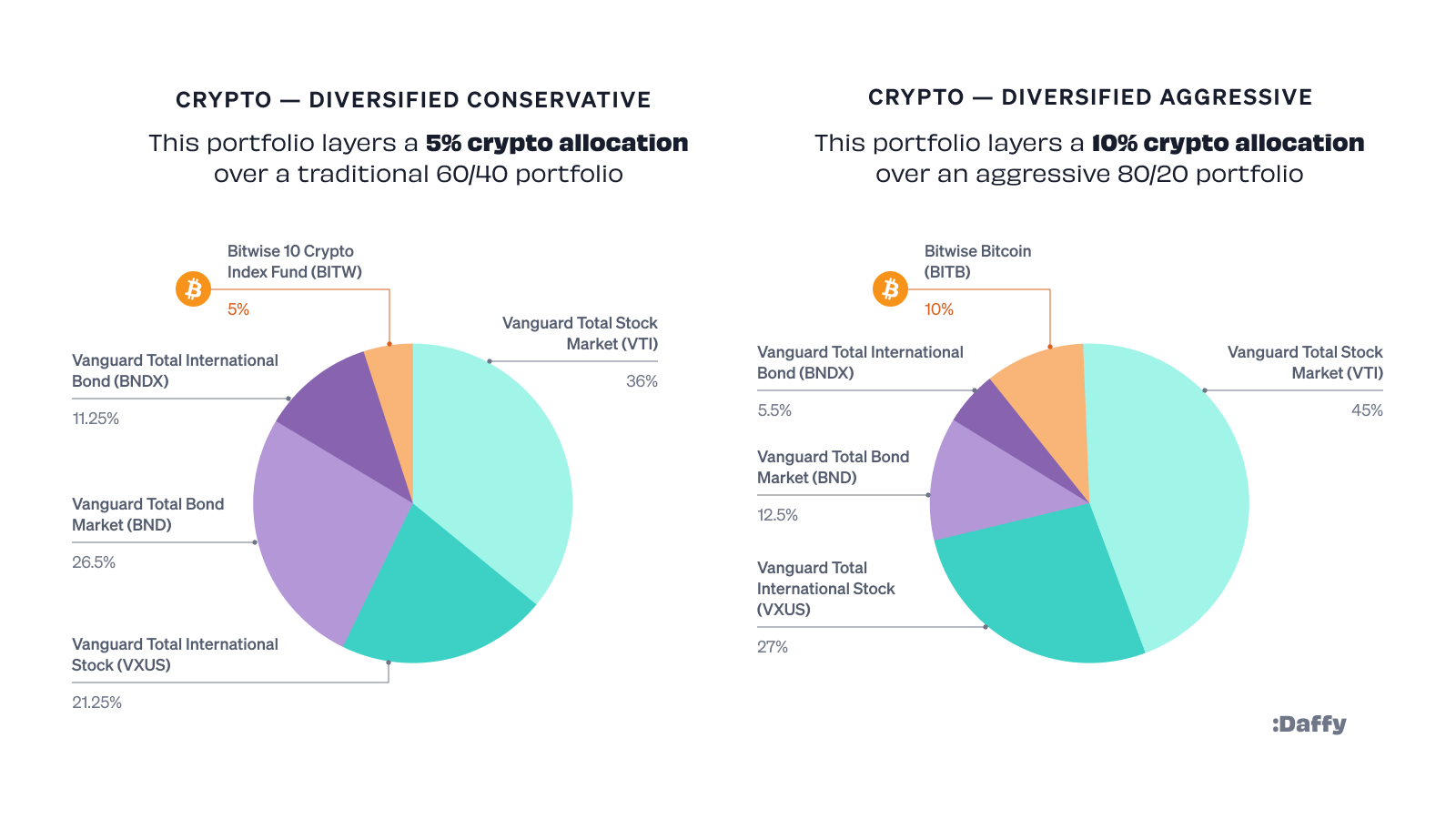

From a portfolio construction perspective, Zcash offers exposure to several investment themes that appear likely to drive returns in the coming years. The privacy coin thesis, the halving cycle dynamics, and the broader cryptocurrency adoption trend all support the inclusion of ZEC in diversified digital asset portfolios. However, the concentration risk associated with privacy coin investments suggests that position sizing should be carefully considered relative to overall portfolio risk tolerance.

The timing considerations for Zcash investment are particularly complex given the proximity of the November 18 halving event. Historical analysis suggests that halving-related price appreciation often begins months before the actual event and can continue for extended periods afterward. However, the fact that Zcash has already experienced substantial gains in anticipation of the halving raises questions about optimal entry timing for new investors.

Dollar-cost averaging strategies may be particularly appropriate for Zcash investment given the asset’s high volatility and the difficulty of timing optimal entry and exit points. This approach allows investors to build positions over time while reducing the impact of short-term price fluctuations on overall investment returns. The strategy is particularly relevant for investors who believe in the long-term privacy coin thesis but are concerned about current valuation levels.

Risk management considerations are paramount for any Zcash investment strategy. The use of stop-loss orders, position sizing limits, and profit-taking strategies can help investors participate in potential upside while limiting downside exposure. The extreme volatility that characterizes privacy coin markets makes these risk management tools essential for preserving capital during inevitable market corrections.

The international regulatory landscape for privacy coins continues to evolve, creating both opportunities and risks for investors. Jurisdictions that embrace privacy-preserving technologies may see increased adoption and investment flows, while those that implement restrictive policies could drive capital toward more favorable regulatory environments. Investors must monitor these regulatory developments closely and consider their potential impact on Zcash’s long-term prospects.

Future Outlook and Price Projections

Looking beyond the immediate excitement surrounding Arthur Hayes’ $10,000 price prediction and the approaching November halving, the long-term outlook for Zcash depends on several key factors that will determine whether the current rally represents the beginning of a sustained bull run or a speculative bubble destined for correction.

The most optimistic scenarios for Zcash’s future involve widespread adoption of privacy-preserving technologies across both retail and institutional markets. As governments worldwide implement increasingly sophisticated financial surveillance systems, demand for privacy coins could grow exponentially, driving Zcash toward or beyond Hayes’ ambitious $10,000 target. This scenario assumes continued technological leadership, favorable regulatory treatment, and successful execution of network upgrades that enhance both privacy and scalability.

More conservative projections focus on Zcash’s potential to capture a significant share of the growing cryptocurrency market while maintaining its position as the leading privacy coin. Under this scenario, ZEC could reasonably target the $1,000-$3,000 range over the next 12-24 months, representing substantial gains from current levels while remaining within historical cryptocurrency valuation frameworks. This projection assumes continued institutional adoption, successful navigation of regulatory challenges, and sustained interest in privacy-preserving technologies.

The technical analysis framework provides additional context for future price projections. The immediate targets of $420-$436 represent logical near-term objectives based on pivot point analysis and historical resistance levels [1][2]. Achievement of these targets would establish a foundation for further gains toward the $1,000 level, which represents a psychologically significant milestone that could attract additional institutional and retail investment.

The halving event scheduled for November 18 provides a fundamental catalyst that could drive price appreciation well into 2026. Historical analysis of cryptocurrency halving events suggests that the most significant price gains often occur 6-18 months after the actual supply reduction takes effect, as market dynamics adjust to the new supply-demand equilibrium. This timeline suggests that Zcash’s most substantial gains may still lie ahead, even after the current rally.

However, several risk factors could derail these optimistic projections. Regulatory crackdowns on privacy coins, technological challenges, increased competition, or broader cryptocurrency market corrections could all impact Zcash’s trajectory regardless of fundamental developments. The extreme nature of current valuations also suggests that any negative developments could result in severe price corrections that test investor resolve and confidence.

The institutional adoption trajectory will likely prove crucial in determining Zcash’s long-term success. If Grayscale’s fund continues to attract assets and additional institutional investment products emerge, the resulting legitimacy and accessibility could drive sustained demand growth. Conversely, if institutional interest wanes or regulatory concerns emerge, the lack of retail-driven demand could limit Zcash’s growth potential.

Global macroeconomic conditions will also influence Zcash’s future performance. Periods of economic uncertainty and currency debasement have historically driven interest in alternative monetary systems, potentially benefiting privacy coins like Zcash. However, economic stability and rising interest rates could reduce speculative demand for high-risk cryptocurrency investments.

The technological roadmap for Zcash includes several upgrades that could enhance the network’s capabilities and drive additional adoption. Improvements to transaction throughput, privacy features, and interoperability with other blockchain networks could expand Zcash’s addressable market and support higher valuations. The successful implementation of these upgrades will be crucial for maintaining technological leadership in the competitive privacy coin sector.

Conclusion: Navigating the Privacy Coin Revolution

Zcash’s extraordinary 27.75% surge following Arthur Hayes’ $10,000 price prediction represents far more than a typical cryptocurrency rally—it signals the emergence of privacy coins as a legitimate and increasingly essential component of the digital asset ecosystem. The confluence of institutional validation, approaching halving dynamics, and growing privacy awareness has created a perfect storm of bullish catalysts that could sustain Zcash’s momentum well beyond current levels.

The investment case for Zcash rests on solid fundamental foundations that extend beyond speculative enthusiasm. The cryptocurrency’s technological leadership in privacy-preserving technologies, combined with its compliance-friendly architecture and growing institutional adoption, positions it advantageously to capitalize on the increasing demand for financial privacy solutions. The approaching November 18 halving event provides an additional catalyst that could drive sustained price appreciation through 2026 and beyond.

However, investors must carefully balance these compelling opportunities against the substantial risks inherent in any asset that has experienced such dramatic price appreciation. The extreme overbought technical conditions, regulatory uncertainties, and concentration risks associated with privacy coin investments demand sophisticated risk management approaches and careful position sizing considerations.

For investors willing to navigate these challenges, Zcash offers exposure to several powerful investment themes that appear likely to drive returns in the coming years. The privacy coin revolution, institutional cryptocurrency adoption, and halving cycle dynamics all support the inclusion of ZEC in diversified digital asset portfolios, provided that investors maintain appropriate risk management disciplines and realistic expectations about volatility and potential drawdowns.

The ultimate success of Zcash’s current rally will depend on the cryptocurrency’s ability to transition from speculative momentum to sustainable adoption and utility. The early signs are encouraging, with institutional interest growing, network usage increasing, and regulatory clarity improving. However, the path forward will likely include significant volatility and periodic corrections that test investor resolve and confidence.

As the privacy coin renaissance continues to unfold, Zcash’s position as the sector leader provides both opportunities and responsibilities. The cryptocurrency’s ability to maintain technological leadership, navigate regulatory challenges, and deliver on the promises that have driven its current valuation will determine whether Arthur Hayes’ $10,000 prediction proves prescient or overly optimistic.

For now, Zcash stands at a critical juncture where fundamental developments, technical momentum, and market psychology have aligned to create one of 2025’s most compelling cryptocurrency investment opportunities. Whether this alignment proves sustainable will depend on the complex interplay of technological innovation, regulatory evolution, and market dynamics that will shape the future of privacy-preserving digital assets.

The privacy coin revolution is just beginning, and Zcash’s current rally may represent the opening chapter of a much larger story about financial privacy, technological innovation, and the evolution of money in the digital age. Investors who can successfully navigate the risks and opportunities ahead may find themselves well-positioned to benefit from one of the most significant trends in the cryptocurrency ecosystem.

References

[1] FX Leaders. “Zcash Surges Past $364 as Arthur Hayes’ $10K Prediction Ignites FOMO Rally.” October 27, 2025. https://www.fxleaders.com/news/2025/10/27/zcash-surges-past-364-as-arthur-hayes-10k-prediction-ignites-fomo-rally/

[2] AInvest. “ZCash Surges 20% in 24 Hours, Entering Top 25 Cryptocurrencies with Market Cap of Over $1 Billion.” October 27, 2025. https://www.ainvest.com/news/zcash-surges-20-24-hours-entering-top-25-cryptocurrencies-market-cap-1-billion-2510/

[3] Crypto News. “Zcash price jumps over 30% in a day as Arthur Hayes eyes $10k target.” October 27, 2025. https://crypto.news/zcash-price-jumps-over-30-in-a-day-as-arthur-hayes-eyes-10k-target/

[4] Coinpedia. “Arthur Hayes ZEC Coin Price Prediction Sends Zcash Soaring Past $350.” October 27, 2025. https://coinpedia.org/news/arthur-hayes-zec-coin-price-prediction-sends-zcash-soaring-past-350/

[5] Bitrue. “Arthur Hayes $10000 ZEC Prediction: A Realistic Analysis.” October 27, 2025. https://www.bitrue.com/blog/arthur-hayes-10000-zec-prediction-analysis

[6] CoinTribune. “Bitcoin starts a correction after its all-time high – Technical analysis of August 20, 2025.” August 20, 2025. https://www.cointribune.com/en/bitcoin-starts-a-correction-after-its-all-time-high-technical-analysis-of-august-20-2025/

[7] CoinMarketCap. “Zcash (ZEC) Price Prediction For 2025 & Beyond.” October 26, 2025. https://coinmarketcap.com/cmc-ai/zcash/price-prediction/

[8] Bitget News. “Zcash Halving to Take Place in November.” October 20, 2025. https://www.bitget.com/news/detail/12560605024109

[9] CoinDCX. “Zcash Price Prediction 2025–2030: Will ZEC Cross $350?” 2025. https://coindcx.com/blog/price-predictions/zcash-price/

[10] NiceHash. “Zcash halving countdown.” 2025. https://www.nicehash.com/countdown/zec-halving-2028-11-16-12-00

[11] YouTube. “Zcash’s Massive Surge: Arthur Hayes’ Prediction Sparks 30% Rally.” October 27, 2025. https://www.youtube.com/watch?v=BEapDprHHAw