Author: everythingcryptoitclouds.com

Introduction: When Leverage Turns Deadly

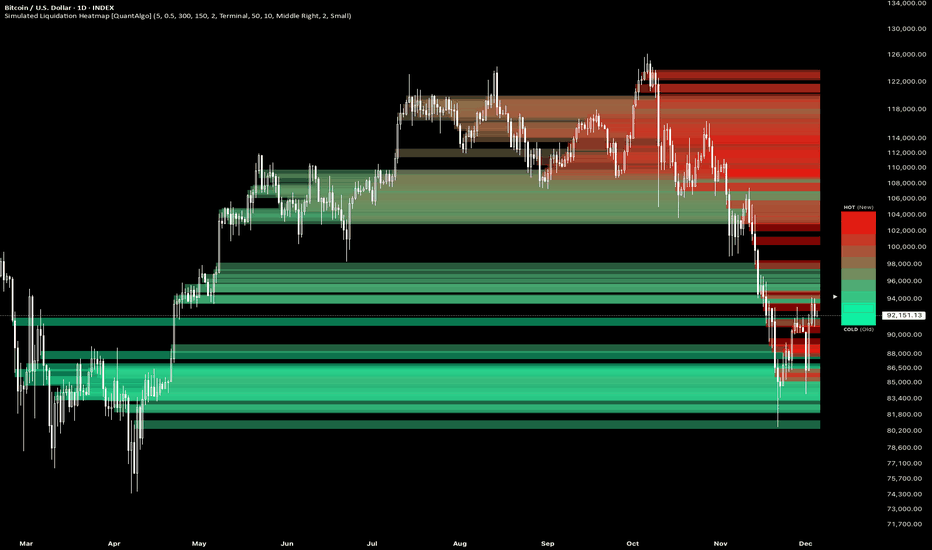

February 1, 2026, will be remembered as “Black Sunday II”—the day when cryptocurrency futures markets experienced one of the largest single-day liquidation events in history. In just 24 hours, $2.2 billion in leveraged positions were forcibly closed, wiping out over 335,000 traders. This catastrophic event serves as a stark reminder of the dangers inherent in margin trading and the cascading effects that can occur when market conditions turn against overleveraged positions.

This blog post examines what happened, why it happened, and the critical lessons traders must learn to avoid becoming another statistic in the next liquidation cascade.

The Perfect Storm: How $2.2 Billion Evaporated

The liquidation event on February 1, 2026, was not a random market fluctuation. Rather, it was the result of several converging factors that created a perfect storm of selling pressure and forced position closures.

The Timeline of Destruction

The most violent hour of the cascade occurred during the Asia/US session overlap, a classic window for liquidity vacuums and cascading stops. Bitcoin opened the day around $82,800 but rapidly descended to $77,400 during peak liquidation hours, eventually touching a low of $76,100. Ethereum, meanwhile, plummeted from $2,900 to below $2,800, with a low of $2,780. This rapid descent triggered a cascade of margin calls and forced liquidations across all major exchanges.

The timeline tells the story: between 06:00 and 12:00 UTC, approximately $1.18 billion in liquidations occurred, with peak-hour liquidations reaching $380 million. By the time the US session began, the damage was already catastrophic.

The Breakdown: Which Assets Suffered Most?

The liquidation event was not evenly distributed across the crypto market. Ethereum bore the brunt of the damage, with $961 million (44% of total liquidations) wiped out. Bitcoin followed with $679 million (31%), while Solana accounted for $168 million (8%). Smaller altcoins like XRP, DASH, and others collectively saw another $392 million in liquidations.

What’s particularly striking is the composition of these liquidations: approximately 80–85% were long positions. This reveals a critical insight into market sentiment at the time—traders had been overwhelmingly bullish, with the majority holding leveraged long positions. When the market turned against them, the cascade was inevitable.

The Root Causes: Why Did This Happen?

Understanding the causes of the February 1 liquidation event is essential for predicting and potentially avoiding similar events in the future.

Macroeconomic Headwinds

The primary catalyst was a shift in macroeconomic sentiment. The nomination of Kevin Warsh for Federal Reserve Chair was perceived by markets as a hawkish signal, suggesting a potential continuation of higher interest rates and tighter monetary policy. This triggered a broad retreat from risk assets, affecting not just cryptocurrencies but also traditional equities and commodities.

Technical Breakdown and Stop-Hunting

Bitcoin’s breach of the critical $84,000–$85,000 support cluster triggered a cascade of algorithmic stop-loss orders. In the crypto market, where many traders use automated stop-losses at round numbers or key technical levels, this technical breakdown can act as a trigger for a waterfall of selling. Algorithms designed to hunt for these stops exacerbated the move, pushing prices lower and triggering more stops in a vicious cycle.

Extreme Leverage and Euphoria Washout

The December 2025 and January 2026 rally had created a complacent market filled with overleveraged longs. Many traders had entered positions with leverage ratios of 10×, 20×, or even higher, betting that the bull market would continue indefinitely. When the market turned, these positions became liabilities. A mere 5% adverse move on a 20× leveraged position results in a complete wipeout—and the market moved far more than 5%.

Liquidity Vacuum

Weekend and early-week Asian trading sessions are notoriously thin in liquidity. With fewer market participants and lower trading volumes, even modest selling pressure can result in outsized price moves. The timing of this event—occurring during a low-liquidity period—meant that the cascade was far more severe than it might have been during a well-liquidity session.

The Human Cost: 335,000 Traders Wiped Out

Behind the numbers lies a human tragedy. Over 335,000 traders saw their accounts liquidated, many of them retail investors who had risked money they could not afford to lose. The average retail trader, lacking the risk management discipline of professional traders, often enters positions with inadequate stop-losses or margin buffers, making them particularly vulnerable to liquidation cascades.

The psychological impact of such events cannot be overstated. Many traders who were liquidated on February 1 will likely exit the crypto market entirely, having suffered devastating losses. Others may return with a healthier respect for risk management, but the damage to their financial and emotional well-being is real.

Lessons for the Future: How to Avoid Liquidation

The February 1 liquidation event, while catastrophic, offers valuable lessons for traders seeking to protect themselves in volatile markets.

1. Use Conservative Leverage

The most critical lesson is to use conservative leverage. Professional traders typically limit themselves to 3–5× leverage at most, and many use even lower ratios. A 3× leverage position requires only a 33% adverse move to result in liquidation, providing a substantial margin of safety. In contrast, a 20× position liquidates on a 5% move—and in crypto, 5% moves happen regularly.

2. Always Set Hard Stop-Losses

Every trader should establish hard stop-losses before entering a position. These should be placed at technical support levels or at a predetermined percentage below entry, whichever is more conservative. Without stop-losses, a trader is essentially gambling that the market will never move against them—a bet that will eventually lose.

3. Monitor Your Liquidation Price

Every major exchange displays the exact liquidation price for open positions. Traders should calculate this price before entering a trade and ensure that it provides an adequate buffer from current market price. If the liquidation price is too close to the current price, the position is too leveraged.

4. Maintain a Margin Buffer

During high-volatility periods, traders should maintain 20–50% excess collateral in their accounts. This buffer absorbs temporary price wicks and prevents forced liquidations during normal market fluctuations. Many traders who were liquidated on February 1 likely had minimal margin buffers and were liquidated on temporary price spikes rather than sustained moves.

5. Avoid Overexposure During Low-Liquidity Periods

Traders should reduce position sizes or flatten positions entirely during weekends, holidays, and Asian session gaps when liquidity is thin. The risk/reward profile is unfavorable during these periods, and the potential for extreme price moves is elevated.

The Bigger Picture: What This Means for Crypto Markets

The $2.2 billion liquidation event is not an isolated incident but rather a symptom of a broader market dynamic. The crypto market continues to attract overleveraged retail traders who lack the discipline and experience of professional traders. Until this changes—either through education, regulation, or natural selection—we can expect to see similar liquidation cascades in the future.

However, from a contrarian perspective, such extreme liquidation events often mark local bottoms. When the Fear & Greed Index hits “Extreme Fear” (as it did on February 1), and when over 80% of liquidations are longs (indicating capitulation), historical patterns suggest that a recovery is often near. Indeed, Bitcoin rebounded to $79,000–$80,500 within hours of the low, suggesting that many traders were quick to accumulate at the depressed prices.

Conclusion: A Cautionary Tale

The “Black Sunday II” liquidation event of February 1, 2026, is a cautionary tale for all traders. It demonstrates the dangers of excessive leverage, the importance of risk management, and the brutal efficiency of markets in punishing those who ignore these principles. While the event was devastating for those caught on the wrong side, it also presented opportunities for disciplined traders who had maintained cash reserves and were ready to accumulate at depressed prices.

As you navigate the crypto markets, remember: the goal is not to make the biggest gains, but to survive long enough to compound those gains over time. Conservative leverage, hard stop-losses, and adequate margin buffers are not exciting, but they are the tools that separate successful traders from those who become liquidation statistics.

References

[1] Tapbit Blog. Crypto Futures Liquidations Hit $2.2 Billion on February 1, 2026 – Full Breakdown & Lessons. [URL: https://blog.tapbit.com/crypto-futures-liquidations-hit-2-2-billion-on-february-1-2026-full-breakdown-lessons/%5D

[2] Yahoo Finance. Crypto Liquidations Surge to $1.7 Billion Amid Heightened Market Volatility. [URL: https://finance.yahoo.com/news/crypto-liquidations-surge-1-7-041531574.html%5D

[3] Coindesk. Bitcoin price moves end up liquidating $1.7 billion in bullish crypto bets. [URL: https://www.coindesk.com/markets/2026/01/30/rollercoaster-bitcoin-price-moves-end-up-liquidating-usd1-7-billion-in-bullish-crypto-bets%5D

[4] KuCoin News. Crypto Market Sees $2.2B in Liquidations as Bitcoin Drops Below $76K. [URL: https://www.kucoin.com/news/flash/crypto-market-sees-2-2b-in-liquidations-as-bitcoin-drops-below-76k%5D

[5] AMBCrypto. Ethereum slides to $2,300 – $1.16B liquidations trigger whale buying. [URL: https://ambcrypto.com/ethereum-slides-to-2300-1-16b-liquidations-trigger-whale-buying/%5D