Published by everythingcryptoitclouds.com | August 16, 2025

This week delivered a masterclass in market psychology and the fundamental differences between traditional finance and cryptocurrency markets. What started as a unified rally across both asset classes quickly transformed into a tale of two markets, with traditional equities demonstrating remarkable resilience while crypto assets experienced dramatic volatility. The catalyst? Two seemingly routine economic reports that revealed just how differently these markets interpret and react to inflationary pressures.

The S&P 500 climbed a solid 1.78% for the week, while the Nasdaq rose 1.60%, showcasing the steady confidence that has characterized traditional markets throughout 2025 [1]. Meanwhile, the cryptocurrency landscape painted a starkly different picture. Bitcoin managed only a modest 0.97% gain despite touching new record highs above $124,000, while Ethereum surged an impressive 17.18%, highlighting the growing divergence even within crypto markets themselves [2]. The total cryptocurrency market capitalization rose 3.13% to $4.084 trillion, but this headline figure masks the intense volatility that saw nearly $900 million in long positions liquidated in a single day [2].

The week’s events underscore a critical evolution in how different asset classes respond to economic data, revealing fault lines that could reshape investment strategies and risk management approaches for years to come. Understanding these dynamics isn’t just academic—it’s essential for anyone navigating the increasingly complex landscape where traditional finance and digital assets intersect.

The CPI Calm: When Good News Was Actually Good News

Tuesday, August 12th began with what markets had been eagerly anticipating: the July Consumer Price Index (CPI) report. In an environment where inflation data has become the primary driver of Federal Reserve policy and market sentiment, the numbers delivered exactly what investors wanted to hear [3].

The headline CPI rose 2.7% annually, coming in below the expected 2.8%, while the monthly increase of 0.2% met expectations precisely. More importantly, core CPI—which excludes volatile food and energy prices and is closely watched by Federal Reserve officials—increased 0.3% monthly and 3.1% annually, just slightly above the forecasted 3.0% [3]. These numbers represented a goldilocks scenario: inflation was cooling but not collapsing, providing the Federal Reserve with the flexibility to consider rate cuts without signaling economic distress.

The market reaction was swift and decisive. Stock market averages posted strong gains immediately following the release, while Treasury yields remained mixed as investors recalibrated their expectations for monetary policy [3]. The data reinforced growing confidence that the Federal Reserve would begin cutting interest rates at their September meeting, with traders ramping up bets on this outcome throughout the day.

What made this CPI report particularly significant was its treatment of tariff impacts. Despite widespread concerns that President Trump’s expanded tariff policies would drive inflation higher, the data showed only modest effects in tariff-sensitive categories. Household furnishings and supplies showed a 0.7% increase, but apparel prices rose just 0.1%, and core commodity prices increased only 0.2% [3]. This suggested that businesses were absorbing much of the tariff costs rather than immediately passing them through to consumers.

The benign inflation reading provided validation for the Federal Reserve’s patient approach to monetary policy. Fed officials had been expressing increasing concern about labor market weakness, and the CPI data gave them cover to shift focus from inflation fighting to economic support. Market-implied probabilities for a September rate cut jumped significantly, with traders also increasing bets on additional cuts later in the year.

For traditional equity markets, this represented an ideal scenario. Lower interest rates would reduce borrowing costs for corporations, potentially boosting earnings and making stocks more attractive relative to bonds. The technology-heavy Nasdaq was particularly responsive, as growth stocks tend to benefit disproportionately from lower discount rates applied to their future cash flows.

The PPI Shock: When Markets Chose Their Own Adventure

If Tuesday’s CPI report was a gentle breeze that lifted all boats, Thursday’s Producer Price Index (PPI) data was a hurricane that separated the wheat from the chaff. The numbers were nothing short of stunning in their deviation from expectations, and the divergent market reactions that followed would define the week’s narrative [4].

The PPI jumped 0.9% in July, compared to the Dow Jones estimate of just 0.2%—a massive miss that represented the biggest monthly increase since June 2022 [4]. Core PPI, excluding food and energy, rose 0.9% against forecasts of 0.3%, while the measure excluding food, energy, and trade services climbed 0.6%, the largest gain since March 2022 [4]. On an annual basis, headline PPI increased 3.3%, well above the Federal Reserve’s 2% inflation target and the biggest 12-month move since February.

The details behind these numbers were equally concerning. Services inflation provided much of the upward pressure, rising 1.1% for the largest gain since March 2022. Trade services margins climbed 2%, reflecting ongoing developments in tariff implementations. Machinery and equipment wholesaling surged 3.8%, while portfolio management fees jumped 5.4% and airline passenger services prices climbed 1% [4].

This is where the story becomes fascinating from a market structure perspective. Traditional equity markets, which had celebrated the benign CPI data just two days earlier, largely shrugged off the PPI surprise. Stock market futures fell initially following the release, and shorter-duration Treasury yields moved higher, but the reaction was measured and contained [4]. The S&P 500 and Nasdaq continued their weekly gains, demonstrating remarkable resilience in the face of what should have been concerning inflationary data.

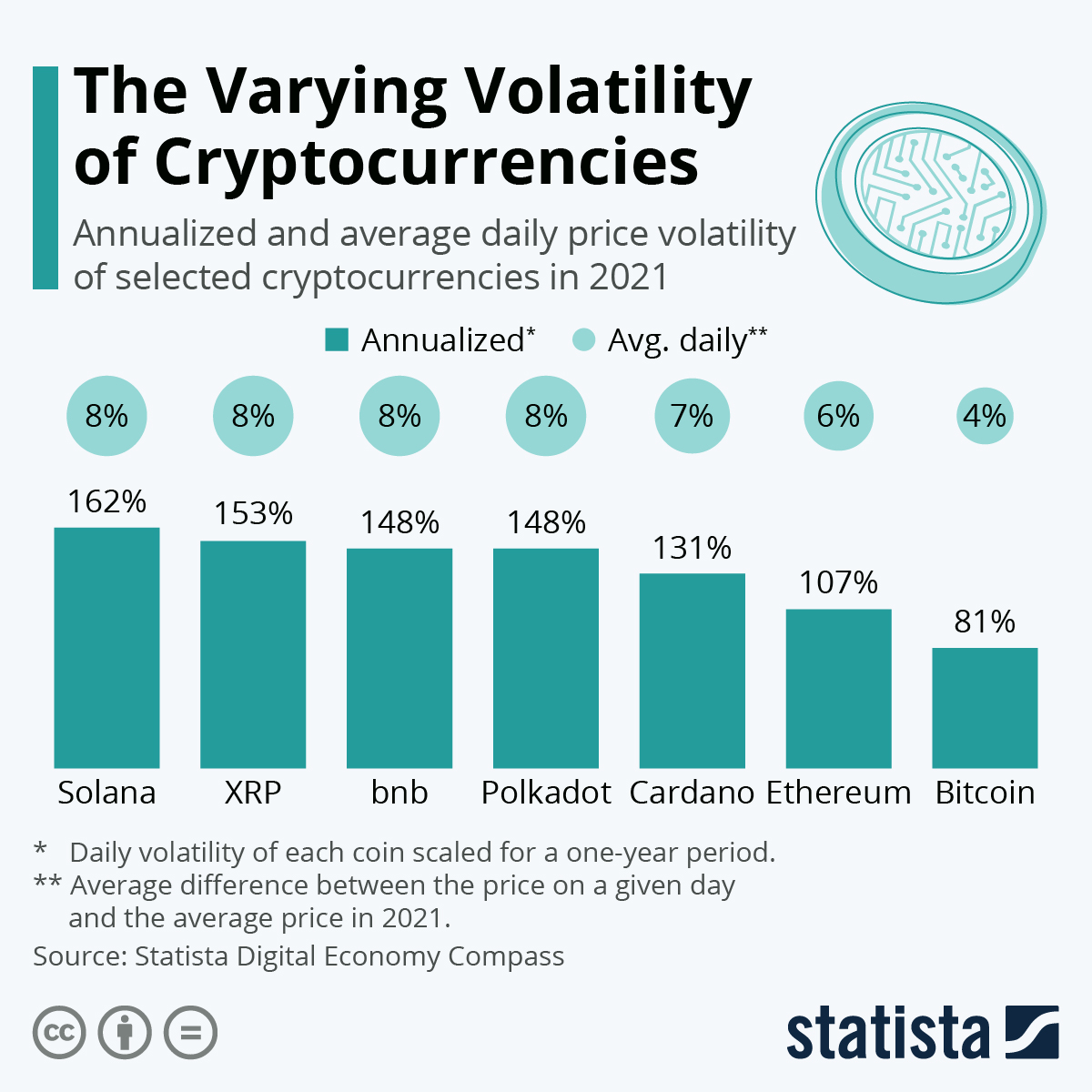

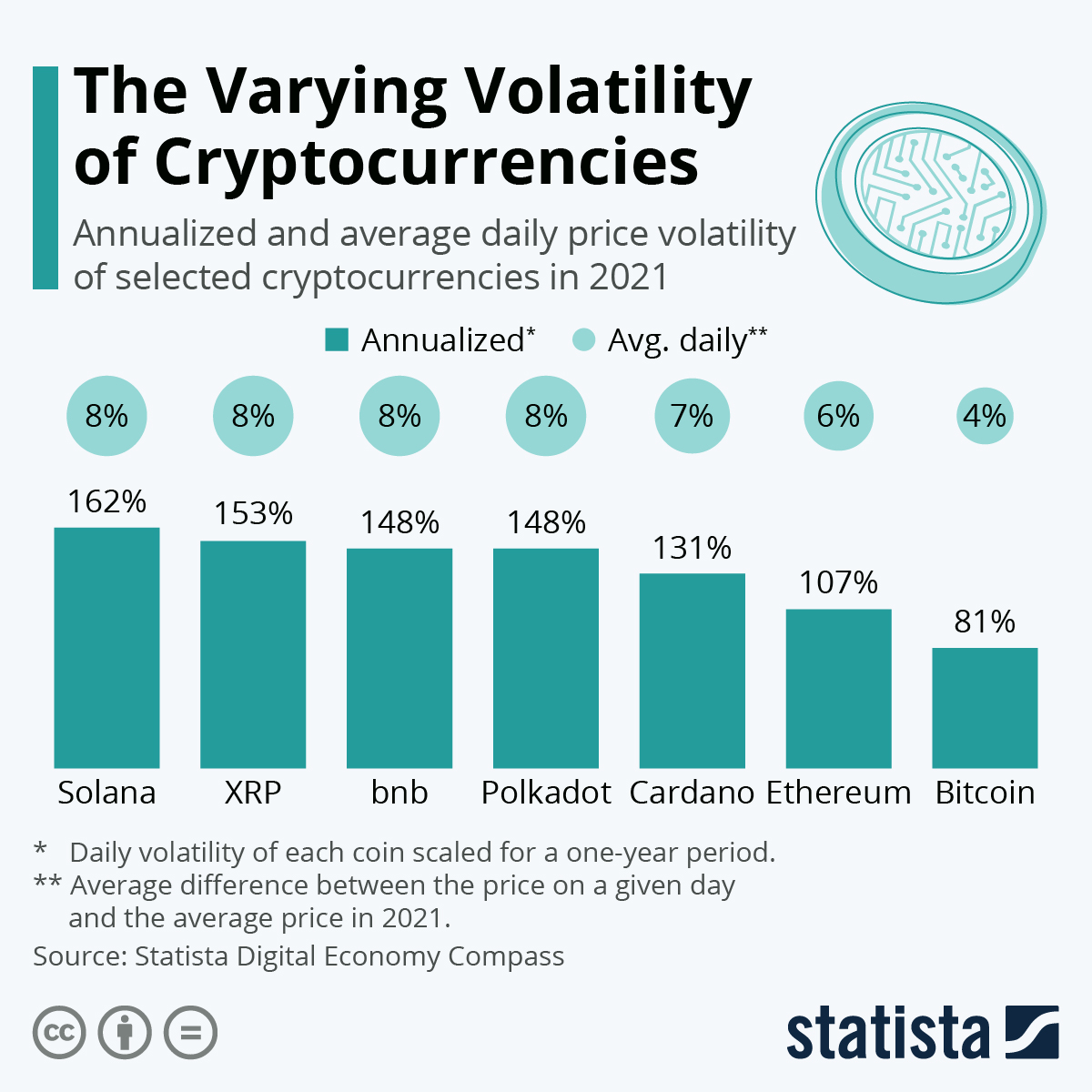

Cryptocurrency markets, however, told a completely different story. The PPI release triggered significant selling pressure across digital assets, with nearly $900 million in long positions liquidated as traders rushed for the exits [2]. The reaction was swift, brutal, and indiscriminate, affecting everything from Bitcoin to smaller altcoins. Funding rates, which had been falling generally across the crypto ecosystem, reflected the sudden shift in sentiment as leveraged positions were unwound.

This divergence reveals something profound about market structure and participant behavior. Traditional equity markets, dominated by institutional investors with longer time horizons and sophisticated risk management systems, were able to contextualize the PPI data within the broader economic picture. They recognized that producer prices often don’t translate directly to consumer prices, especially when businesses are absorbing costs to maintain market share.

Cryptocurrency markets, with their higher concentration of retail investors, algorithmic trading systems, and leveraged positions, reacted more viscerally to the inflation surprise. The 24/7 nature of crypto trading meant there was no circuit breaker, no closing bell to provide a pause for reflection. The result was a cascade of selling that fed on itself as stop-losses were triggered and margin calls forced additional liquidations.

Institutional Resilience vs. Retail Volatility

The contrasting reactions to the PPI data illuminate fundamental differences in market structure that extend far beyond simple asset class distinctions. Traditional equity markets have evolved over decades to incorporate sophisticated risk management systems, institutional oversight, and regulatory frameworks designed to prevent excessive volatility. When unexpected data emerges, there are mechanisms in place—both formal and informal—that encourage measured responses.

Institutional investors, who dominate traditional equity trading, typically operate with longer investment horizons and more comprehensive analytical frameworks. When the PPI data was released, these investors could quickly contextualize it within their existing economic models. They understood that producer price inflation doesn’t automatically translate to consumer price inflation, especially in an environment where businesses are facing competitive pressures and may choose to absorb costs rather than pass them through immediately.

The presence of professional risk managers, compliance departments, and fiduciary responsibilities also creates natural dampening effects on volatility. Institutional investors can’t simply panic-sell based on a single data point—they have processes, committees, and oversight mechanisms that encourage deliberate decision-making. This institutional infrastructure acts as a stabilizing force during periods of uncertainty.

Cryptocurrency markets, by contrast, operate in a fundamentally different ecosystem. While institutional participation has grown significantly over the past few years, the market structure remains heavily influenced by retail investors, algorithmic trading systems, and leveraged speculation. The absence of traditional market-making mechanisms and the 24/7 trading environment create conditions where volatility can amplify rapidly.

The role of leverage in cryptocurrency markets cannot be overstated. With many platforms offering 10x, 50x, or even 100x leverage, small price movements can trigger massive liquidation cascades. When the PPI data surprised to the upside, algorithmic systems programmed to respond to inflation concerns began selling, which triggered stop-losses and margin calls, which created additional selling pressure in a self-reinforcing cycle.

The psychological factors are equally important. Cryptocurrency investors, particularly retail participants, tend to be more sensitive to macroeconomic developments that could influence regulatory policy or institutional adoption. Inflation concerns raise the specter of more aggressive Federal Reserve action, which could reduce liquidity and risk appetite across all speculative assets. In a market where sentiment can shift rapidly, the PPI surprise was enough to trigger a broad reassessment of risk.

The Federal Reserve’s Delicate Balancing Act

The divergent market reactions to CPI and PPI data this week highlight the complex challenge facing Federal Reserve policymakers as they navigate between competing economic signals. The central bank finds itself in the unusual position of receiving mixed messages from different inflation measures, each telling a different story about underlying price pressures in the economy.

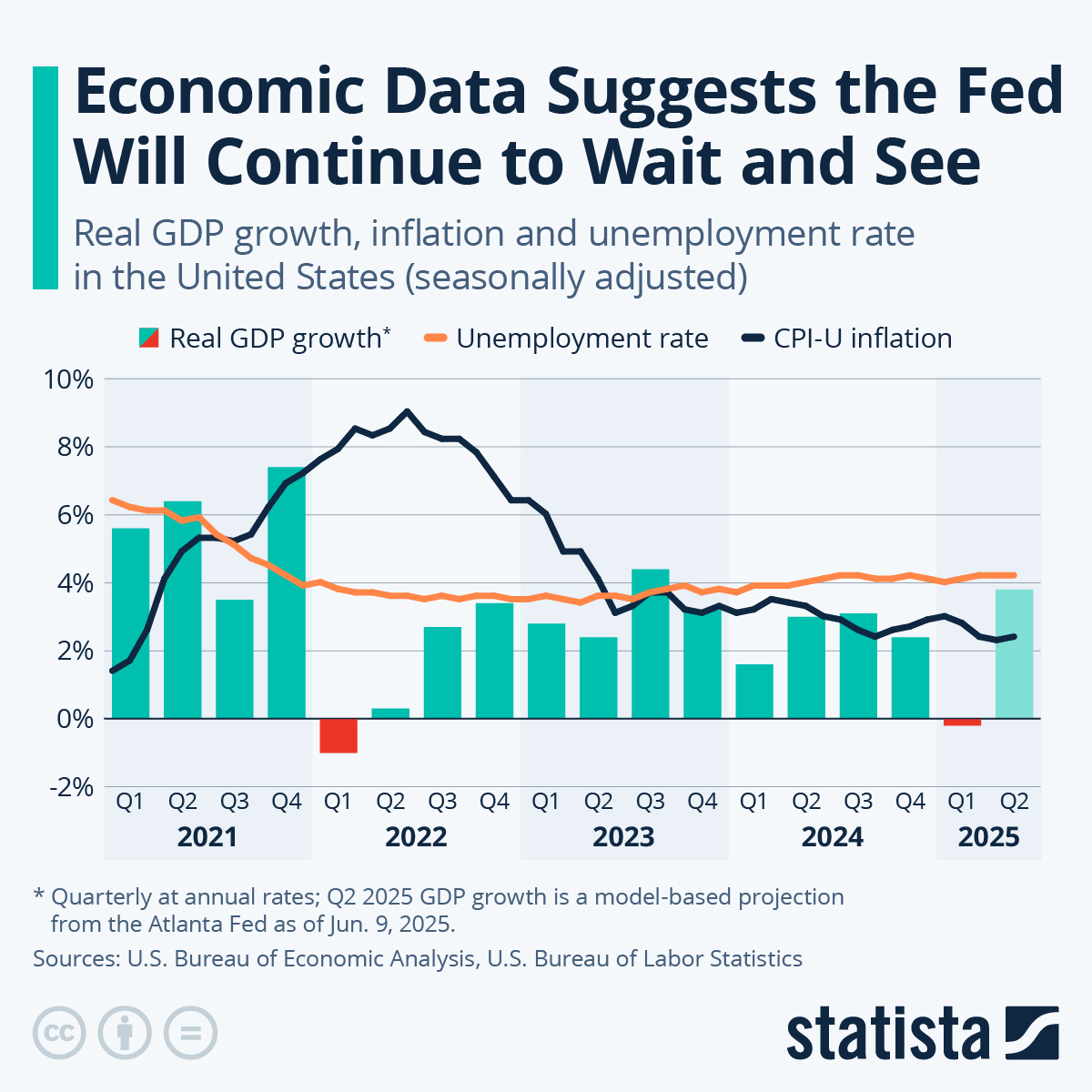

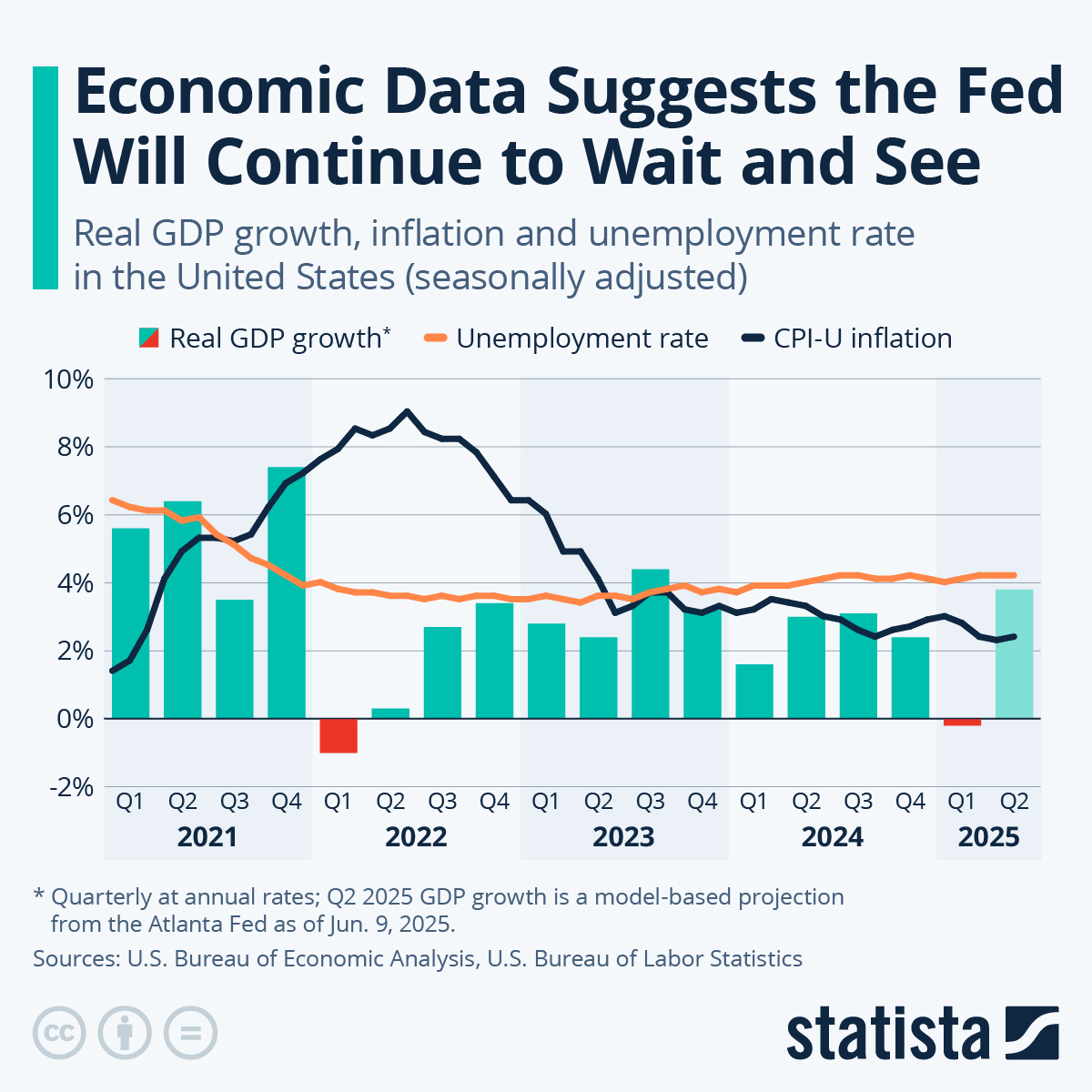

The benign CPI reading provided ammunition for Fed officials who have been advocating for rate cuts to support a weakening labor market. Consumer price inflation at 2.7% annually, while above the Fed’s 2% target, represents significant progress from the peaks reached in 2021 and 2022. The fact that core inflation came in only slightly above expectations, and that tariff impacts appeared contained, suggested that the disinflationary process remains intact.

However, the PPI surge complicates this narrative significantly. Producer prices are often considered a leading indicator of consumer price trends, as businesses eventually pass through higher input costs to customers. The 0.9% monthly jump in PPI, particularly the strength in services inflation, raises questions about whether the disinflationary trend is as durable as the CPI data suggests.

Fed officials now face the challenge of determining which measure provides a more accurate picture of underlying inflation dynamics. The divergence between CPI and PPI could reflect temporary factors—businesses absorbing tariff costs in the short term, seasonal adjustments, or measurement issues—or it could signal the beginning of a renewed inflationary cycle.

The market’s divergent reactions add another layer of complexity to the Fed’s decision-making process. Traditional equity markets are clearly pricing in rate cuts, with the expectation that the central bank will prioritize economic growth over inflation concerns. Cryptocurrency markets, however, are signaling greater concern about inflation persistence and the potential for more restrictive monetary policy.

This creates a communication challenge for Fed officials. Any signal that they’re taking the PPI data seriously could trigger broader market volatility, while dismissing producer price inflation could undermine their credibility if consumer prices begin accelerating later. The September Federal Open Market Committee meeting has become a critical inflection point where the Fed will need to balance these competing considerations.

Crypto’s Ethereum Outperformance: A Silver Lining in the Storm

While the broader cryptocurrency market struggled with the PPI-induced volatility, Ethereum’s remarkable 17.18% weekly gain stands out as a beacon of strength that deserves deeper analysis [2]. This outperformance occurred against a backdrop of significant market stress and provides important insights into the evolving dynamics within the cryptocurrency ecosystem.

Ethereum’s strength can be attributed to several converging factors that differentiate it from Bitcoin and other digital assets. The network’s transition to proof-of-stake consensus and the ongoing development of layer-2 scaling solutions have positioned it as the infrastructure backbone for decentralized finance (DeFi), non-fungible tokens (NFTs), and emerging Web3 applications. This utility-driven demand provides a different value proposition than Bitcoin’s store-of-value narrative.

The week’s news that BitMine Immersion Technologies, a leading Ethereum treasury company, filed for a $20 billion stock offering to accelerate their ETH purchases likely contributed to the positive sentiment [2]. This represents a significant institutional endorsement of Ethereum’s long-term prospects and demonstrates the growing trend of corporate treasury diversification into digital assets beyond Bitcoin.

Ethereum’s outperformance also reflects the network’s resilience during periods of market stress. While Bitcoin often trades more like a macro asset, correlating with traditional risk assets during periods of uncertainty, Ethereum’s price action is increasingly driven by network fundamentals and ecosystem development. The ongoing growth in DeFi total value locked, increasing transaction volumes, and expanding use cases provide fundamental support that can offset broader market concerns.

The technical infrastructure improvements continue to enhance Ethereum’s appeal to institutional investors. The successful implementation of EIP-1559, which introduced a fee-burning mechanism, has created deflationary pressure on ETH supply during periods of high network activity. Combined with the staking rewards available through proof-of-stake, Ethereum offers multiple sources of yield that are attractive in a low-interest-rate environment.

From a portfolio construction perspective, Ethereum’s outperformance during a week of crypto market stress demonstrates its potential role as a diversifier within digital asset allocations. While it remains correlated with broader crypto market movements, the magnitude and direction of its price action can differ significantly from Bitcoin and other cryptocurrencies, providing opportunities for active management and risk reduction.

The Liquidation Cascade: Anatomy of a Crypto Market Meltdown

The $900 million in long liquidations that occurred on Thursday represents one of the most significant single-day deleveraging events in recent cryptocurrency market history [2]. Understanding the mechanics of this cascade provides crucial insights into the structural vulnerabilities that continue to plague digital asset markets and the amplifying effects of excessive leverage.

The liquidation event began with the PPI data release at 8:30 AM Eastern Time on Thursday. Within minutes of the surprisingly high inflation reading, algorithmic trading systems began executing pre-programmed sell orders based on macroeconomic triggers. These initial sales created downward pressure on Bitcoin and other major cryptocurrencies, which in turn triggered the first wave of automated liquidations on leveraged positions.

Cryptocurrency derivatives markets, which have grown exponentially in recent years, played a central role in amplifying the selling pressure. Platforms offering perpetual futures contracts with high leverage ratios saw massive position closures as prices moved against highly leveraged long positions. The interconnected nature of these markets meant that liquidations on one platform quickly spread to others, creating a domino effect across the entire ecosystem.

The timing of the liquidations was particularly problematic from a market structure perspective. Thursday’s PPI release occurred during Asian trading hours for many cryptocurrency markets, when liquidity is typically lower than during U.S. or European sessions. This reduced liquidity environment meant that the same amount of selling pressure had a more pronounced impact on prices, accelerating the liquidation cascade.

Funding rates, which had been falling generally across the cryptocurrency ecosystem, provided an early warning signal of the stress building in the system [2]. As leveraged long positions accumulated throughout the week following the positive CPI data, funding rates began to normalize from previously negative levels. However, the rapid shift in sentiment following the PPI release caught many traders off-guard, particularly those who had increased their leverage based on the earlier positive inflation data.

The cascade also highlighted the role of cross-margining and portfolio-based risk management systems used by many cryptocurrency exchanges. When Bitcoin and Ethereum prices began falling rapidly, traders with diversified cryptocurrency portfolios found their entire positions at risk, not just their exposure to the specific assets that were declining. This forced additional selling across the entire cryptocurrency spectrum, including altcoins that had no direct relationship to the macroeconomic data that triggered the initial selling.

Traditional Markets: The Wisdom of Institutional Patience

The resilience demonstrated by traditional equity markets in the face of the PPI surprise offers valuable lessons about the benefits of institutional market structure and long-term investment approaches. While cryptocurrency markets were experiencing their liquidation cascade, the S&P 500 and Nasdaq continued their steady weekly gains, demonstrating a level of maturity and stability that comes from decades of institutional development.

Professional portfolio managers approached the PPI data with the context that comes from experience managing through multiple economic cycles. They understood that producer price inflation, while concerning, doesn’t automatically translate to consumer price inflation, especially in an environment where businesses are facing competitive pressures and may choose to absorb costs rather than pass them through immediately. This institutional knowledge prevented the kind of panic selling that characterized cryptocurrency markets.

The presence of sophisticated risk management systems also played a crucial role in maintaining stability. Institutional investors operate with position limits, diversification requirements, and oversight mechanisms that prevent excessive concentration in any single bet. When unexpected data emerges, these systems encourage measured responses rather than emotional reactions. Portfolio managers can’t simply liquidate entire positions based on a single data point—they have processes and procedures that encourage deliberate decision-making.

The longer investment horizons typical of institutional investors also contributed to market stability. While cryptocurrency traders often operate with daily or weekly time frames, institutional equity investors typically think in terms of quarters or years. From this perspective, a single month’s PPI reading, while noteworthy, doesn’t fundamentally alter long-term investment theses or require immediate portfolio adjustments.

Market-making mechanisms in traditional equity markets also provided crucial stability during the volatility. Designated market makers and high-frequency trading firms have obligations to provide liquidity even during periods of stress, which helps prevent the kind of air pockets that can develop in less mature markets. These mechanisms aren’t perfect, but they provide a foundation of liquidity that helps absorb selling pressure without causing excessive price dislocations.

The regulatory framework surrounding traditional equity markets also contributes to stability through transparency requirements, position reporting, and oversight mechanisms. While these regulations can sometimes be seen as burdensome, they create an environment where market participants have better information about underlying conditions and can make more informed decisions about risk management.

Looking Ahead: Implications for Multi-Asset Portfolios

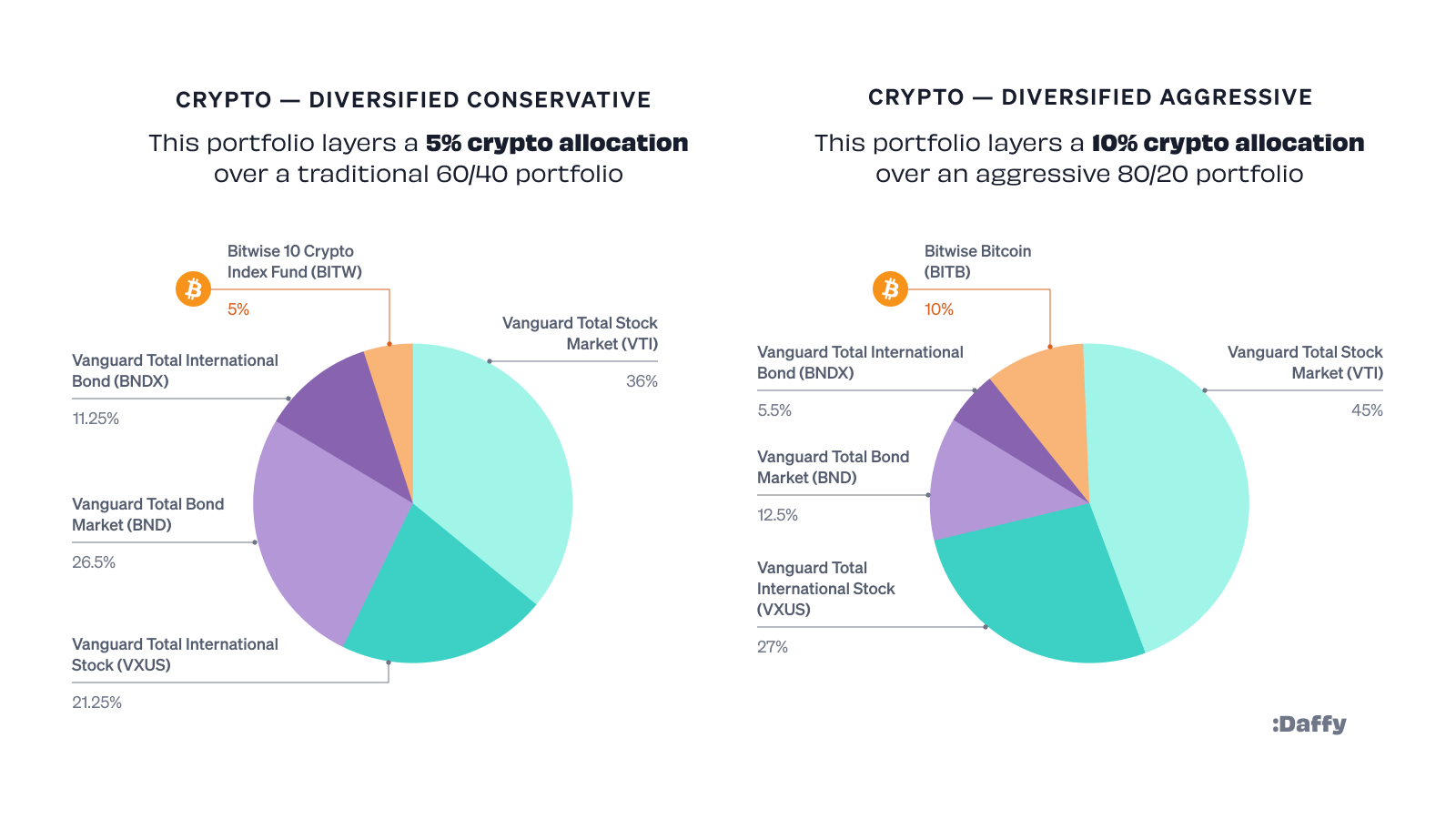

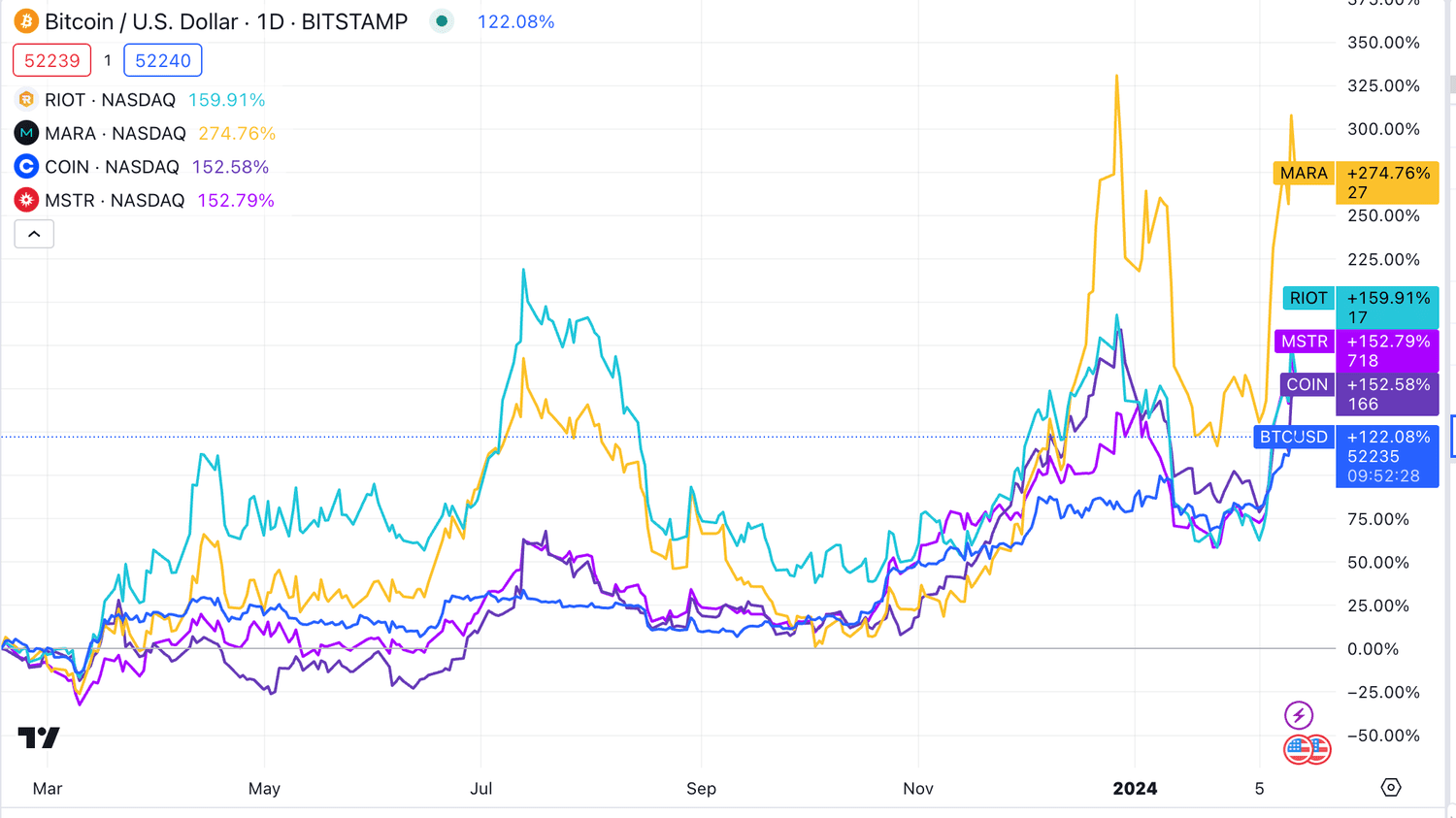

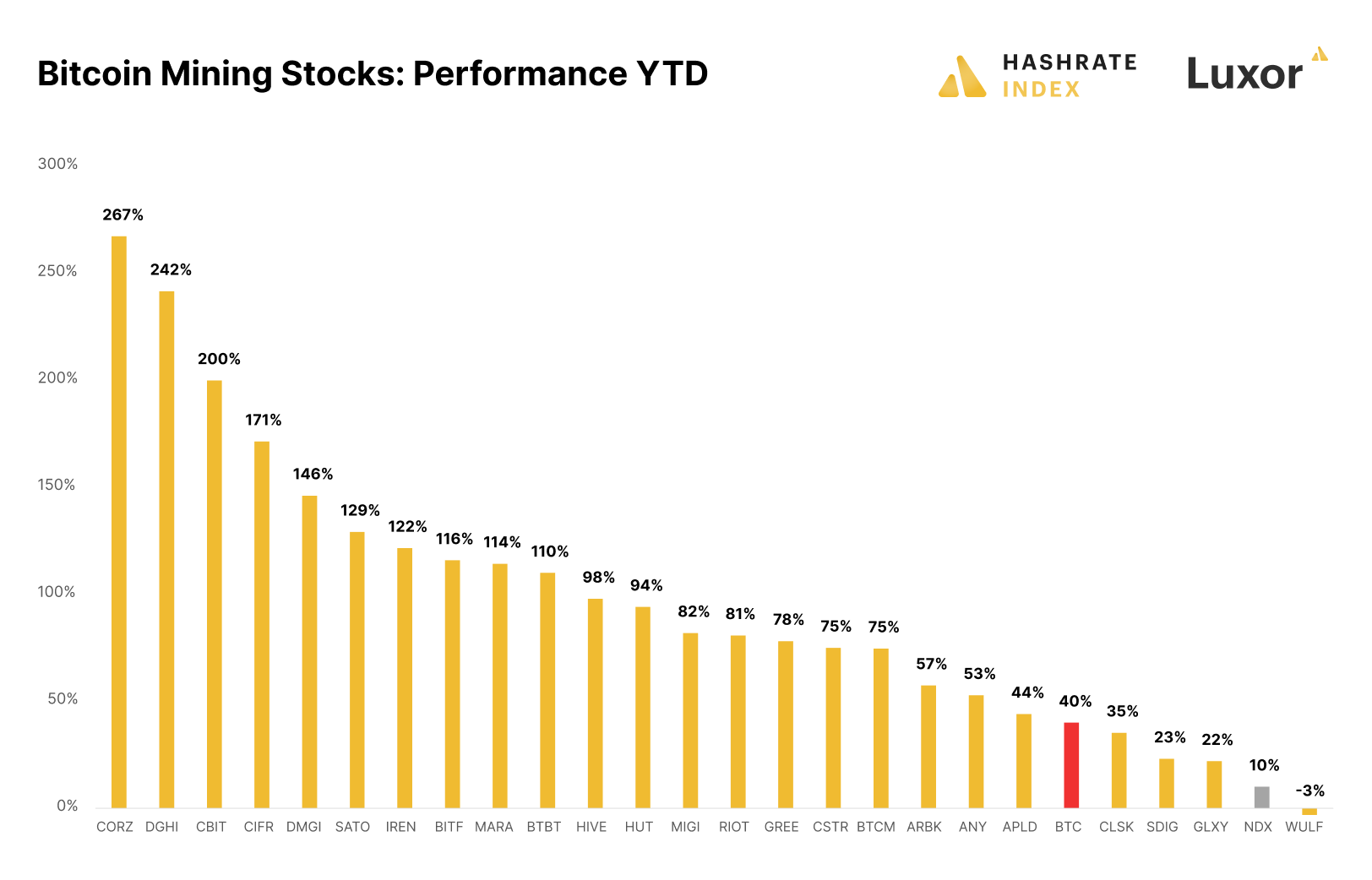

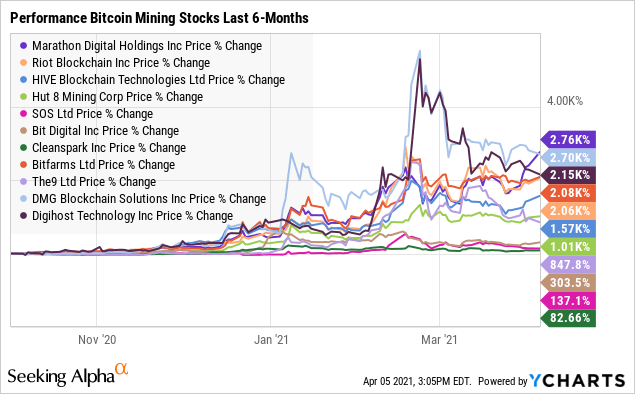

The events of this week provide important insights for investors constructing portfolios that span both traditional and digital assets. The divergent reactions to the same economic data highlight the importance of understanding correlation dynamics and the potential for diversification benefits, even as they also reveal new sources of risk that require careful management.

For investors who maintain exposure to both traditional equities and cryptocurrencies, this week demonstrated both the benefits and challenges of such diversification. On one hand, the resilience of traditional markets provided a stabilizing influence during cryptocurrency volatility. Investors with balanced allocations would have experienced less overall portfolio volatility than those concentrated exclusively in digital assets.

However, the week also highlighted that correlations between asset classes can shift rapidly during periods of stress. While cryptocurrencies and traditional equities often move together during broad risk-on or risk-off periods, they can diverge significantly when reacting to specific types of economic data. This creates both opportunities and risks that require active monitoring and potentially dynamic allocation adjustments.

The role of leverage in amplifying volatility across different asset classes also deserves careful consideration. While traditional equity markets generally operate with lower leverage ratios, the availability of margin trading and derivatives means that excessive leverage can create similar cascade effects. The cryptocurrency market’s experience this week serves as a cautionary tale about the systemic risks that can emerge when leverage becomes too concentrated.

From a risk management perspective, the week’s events underscore the importance of position sizing and diversification across different types of assets and investment strategies. Investors who had concentrated their cryptocurrency exposure in highly leveraged positions experienced disproportionate losses, while those who maintained more conservative position sizes were better able to weather the volatility.

The different time horizons and market structures that characterize traditional and digital asset markets also suggest the need for different approaches to portfolio management. Strategies that work well in traditional equity markets may not be appropriate for cryptocurrency investments, and vice versa. This requires investors to develop expertise across multiple asset classes and investment approaches.

The Broader Economic Context: Inflation, Policy, and Market Evolution

This week’s market divergence occurred against the backdrop of broader economic and policy developments that continue to shape the investment landscape. The mixed signals from CPI and PPI data reflect the complex inflationary dynamics that policymakers and investors are grappling with as the economy navigates the aftermath of pandemic-era fiscal and monetary stimulus.

The tariff policies implemented by the Trump administration add another layer of complexity to inflation dynamics. While the CPI data suggested that tariff impacts have been relatively contained so far, the PPI surge raises questions about whether businesses will be able to continue absorbing these costs indefinitely. The divergence between consumer and producer prices may represent a temporary phenomenon that eventually resolves through higher consumer prices, lower business margins, or some combination of both.

Federal Reserve policy remains the crucial variable that will determine how these inflationary pressures ultimately resolve. The central bank’s September meeting has taken on heightened importance as officials weigh the competing signals from different inflation measures. The market’s divergent reactions to CPI and PPI data provide additional complexity, as Fed officials must consider not just the economic data but also the financial stability implications of their policy decisions.

The international context also matters significantly for both traditional and digital asset markets. Central banks around the world are grappling with similar inflation challenges, and policy coordination—or the lack thereof—can have significant implications for capital flows and currency dynamics. Cryptocurrency markets, in particular, are sensitive to regulatory developments in major jurisdictions, which can create additional sources of volatility beyond purely economic factors.

The ongoing evolution of market structure in both traditional and digital asset markets continues to create new dynamics that investors must navigate. The growth of algorithmic trading, the expansion of derivatives markets, and the increasing interconnectedness of global financial systems all contribute to the complexity of modern portfolio management.

Conclusion: Navigating the New Reality of Multi-Asset Investing

This week’s divergent market reactions to CPI and PPI data provide a compelling case study in the evolving dynamics of modern financial markets. The resilience of traditional equities in the face of concerning producer price inflation, contrasted with the violent reaction in cryptocurrency markets, highlights fundamental differences in market structure, participant behavior, and risk management approaches that investors ignore at their peril.

The $900 million liquidation cascade in cryptocurrency markets serves as a stark reminder of the amplifying effects of excessive leverage and the importance of understanding the structural vulnerabilities that exist in less mature markets [2]. While Ethereum’s 17.18% weekly gain demonstrates that opportunities exist even during periods of broader market stress, the overall cryptocurrency market’s reaction to the PPI surprise underscores the continued importance of careful risk management and position sizing.

For traditional equity investors, the week provided validation of the benefits that come from institutional market structure and long-term investment approaches. The S&P 500’s 1.78% gain and the Nasdaq’s 1.60% advance occurred despite economic data that could have justified significant concern about inflation persistence [1]. This resilience reflects the maturity and stability that comes from decades of institutional development and regulatory oversight.

The Federal Reserve faces an increasingly complex challenge as it navigates between competing economic signals and divergent market reactions. The September FOMC meeting will provide crucial insights into how policymakers weigh the benign CPI data against the concerning PPI surge, and how they factor in the different messages being sent by traditional and digital asset markets.

Looking ahead, investors must prepare for a world where correlation dynamics can shift rapidly and where different asset classes may react very differently to the same economic developments. The events of this week demonstrate both the potential benefits of diversification across traditional and digital assets, as well as the new sources of risk that such diversification can create.

The key to successful navigation of this environment lies in understanding the fundamental differences between asset classes, maintaining appropriate position sizes and leverage levels, and developing the expertise necessary to manage across multiple types of markets and investment strategies. As the lines between traditional finance and digital assets continue to blur, the ability to understand and manage these dynamics will become increasingly important for investment success.

The great divergence of this week may be just the beginning of a new era in which traditional and digital asset markets increasingly march to the beat of different drummers. Investors who can understand and adapt to these evolving dynamics will be best positioned to capitalize on the opportunities while managing the risks that this new reality presents.

References

[1] User-provided market data for week ending August 15, 2025

[2] User-provided cryptocurrency market data and liquidation information

[3] CNBC. “CPI inflation report July 2025.” CNBC Economy, August 12, 2025. https://www.cnbc.com/2025/08/12/cpi-inflation-report-july-2025.html

[4] CNBC. “PPI inflation report July 2025: Wholesale prices rose 0.9% in July, much more than expected.” CNBC Economy, August 14, 2025. https://www.cnbc.com/2025/08/14/ppi-inflation-report-july-2025-.html