Published by everythingcryptoitclouds.com | August 25, 2025

In the volatile world of cryptocurrency trading, emotions often drive market movements more than fundamental analysis or technical indicators. Fear can trigger massive sell-offs that create exceptional buying opportunities, while greed can fuel unsustainable rallies that end in spectacular crashes. Understanding and quantifying these psychological forces has become crucial for successful crypto investing, which is where the Cryptocurrency Fear and Greed Index emerges as an indispensable tool for modern traders and investors.

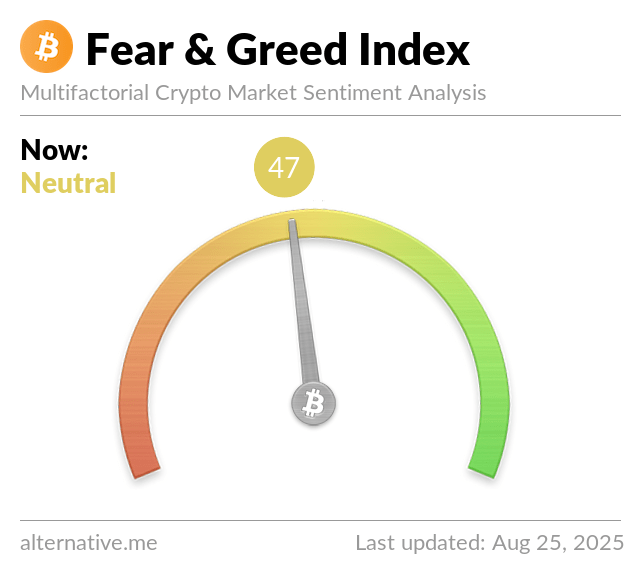

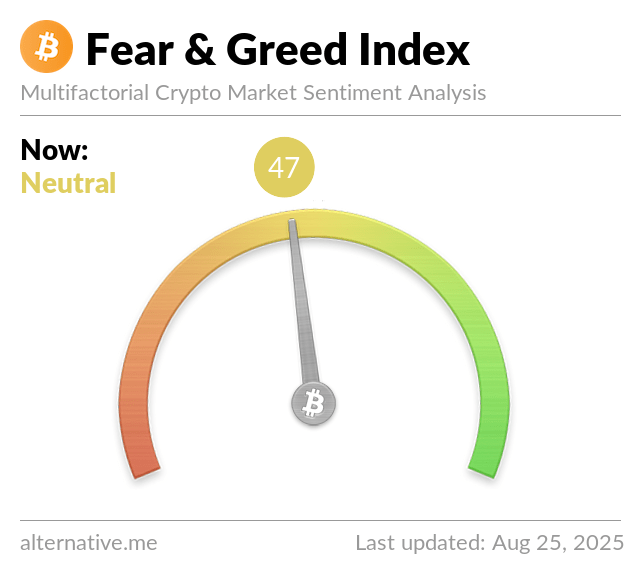

The Fear and Greed Index, currently reading 47 and sitting in neutral territory as of August 25, 2025, represents one of the most sophisticated attempts to measure market sentiment in the cryptocurrency space. This powerful indicator has evolved from a simple concept borrowed from traditional finance into a comprehensive analytical framework that processes multiple data streams to provide real-time insights into the collective psychology of crypto market participants.

What makes this index particularly fascinating is its ability to capture the emotional extremes that characterize cryptocurrency markets. Unlike traditional financial markets, where institutional participation and regulatory oversight tend to dampen emotional swings, crypto markets remain highly susceptible to sentiment-driven movements. The Fear and Greed Index serves as a psychological barometer, helping traders navigate these emotional currents and make more rational investment decisions.

The current neutral reading of 47 comes after a significant shift from greed territory just days ago, when the index reached 60 following Bitcoin’s historic climb to $124,128. This dramatic swing from greed to neutrality in such a short timeframe perfectly illustrates the rapid emotional shifts that characterize cryptocurrency markets and demonstrates why understanding sentiment analysis has become essential for anyone serious about crypto investing.

The index operates on a scale from 0 to 100, where extreme fear (0-24) often signals oversold conditions and potential buying opportunities, while extreme greed (75-100) frequently indicates overbought markets ripe for correction. The neutral zone (25-74) represents periods of balanced sentiment, though these can quickly shift as market conditions evolve. Understanding these ranges and their implications forms the foundation of sentiment-based trading strategies that have proven remarkably effective in cryptocurrency markets.

The Science Behind Market Sentiment: Understanding the Fear and Greed Index

The Cryptocurrency Fear and Greed Index represents a sophisticated fusion of quantitative analysis and behavioral psychology, designed to capture the complex emotional dynamics that drive cryptocurrency markets. Unlike simple price-based indicators, this index synthesizes multiple data sources to create a comprehensive picture of market sentiment, providing insights that go far beyond what traditional technical analysis can offer.

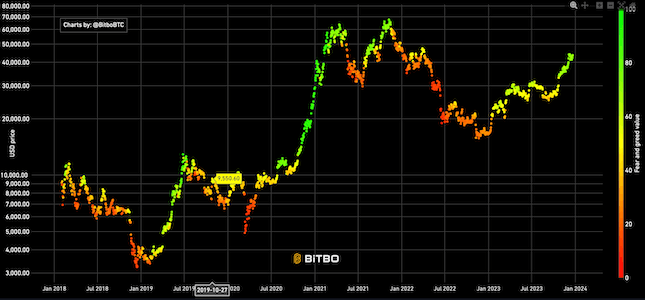

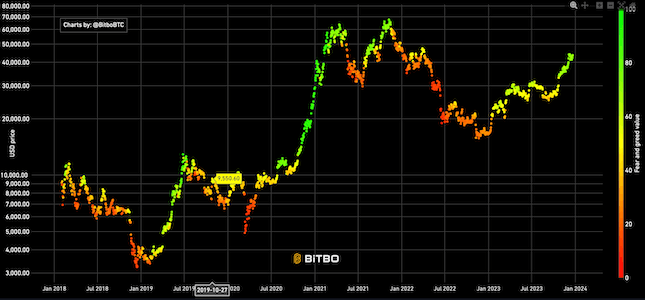

The index draws its conceptual foundation from Warren Buffett’s famous investment philosophy: “Be fearful when others are greedy, and greedy when others are fearful.” This contrarian approach recognizes that markets often move in cycles driven by collective emotions, creating opportunities for those who can identify and act against prevailing sentiment. In cryptocurrency markets, where emotional extremes tend to be more pronounced than in traditional finance, this principle becomes even more powerful.

The mathematical framework underlying the index involves weighted aggregation of six distinct components, each capturing different aspects of market psychology. This multi-dimensional approach ensures that the index reflects genuine sentiment shifts rather than temporary fluctuations in any single metric. The weighting system has been carefully calibrated based on historical analysis of how different factors correlate with actual market turning points, creating a robust indicator that has demonstrated remarkable predictive value over multiple market cycles.

What sets the cryptocurrency version apart from its traditional finance counterpart is its focus on the unique characteristics of digital asset markets. The inclusion of social media sentiment analysis, for instance, reflects the outsized role that platforms like Twitter play in shaping crypto market narratives. Similarly, the emphasis on Bitcoin dominance acknowledges the unique dynamics of the crypto ecosystem, where Bitcoin often serves as a safe haven during periods of uncertainty.

The index updates every twelve hours, providing traders with timely insights into evolving market sentiment. This frequency strikes an optimal balance between responsiveness to genuine sentiment shifts and stability that prevents overreaction to temporary noise. The regular update schedule also allows traders to incorporate sentiment analysis into their daily decision-making processes, whether they’re managing long-term portfolios or executing short-term trading strategies.

The psychological foundation of the index rests on well-established principles of behavioral finance, particularly the concepts of loss aversion and herd mentality. During periods of extreme fear, loss aversion causes investors to overreact to negative news and sell assets at prices below their intrinsic value. Conversely, during periods of extreme greed, herd mentality drives investors to chase rising prices without adequate consideration of risk, creating unsustainable bubbles that eventually burst.

Deconstructing the Components: The Six Pillars of Sentiment Analysis

The Fear and Greed Index derives its analytical power from six carefully selected components, each weighted according to its historical correlation with market turning points and its reliability as a sentiment indicator. Understanding these components and their individual contributions provides crucial insights into what drives the overall index reading and how to interpret changes in market sentiment.

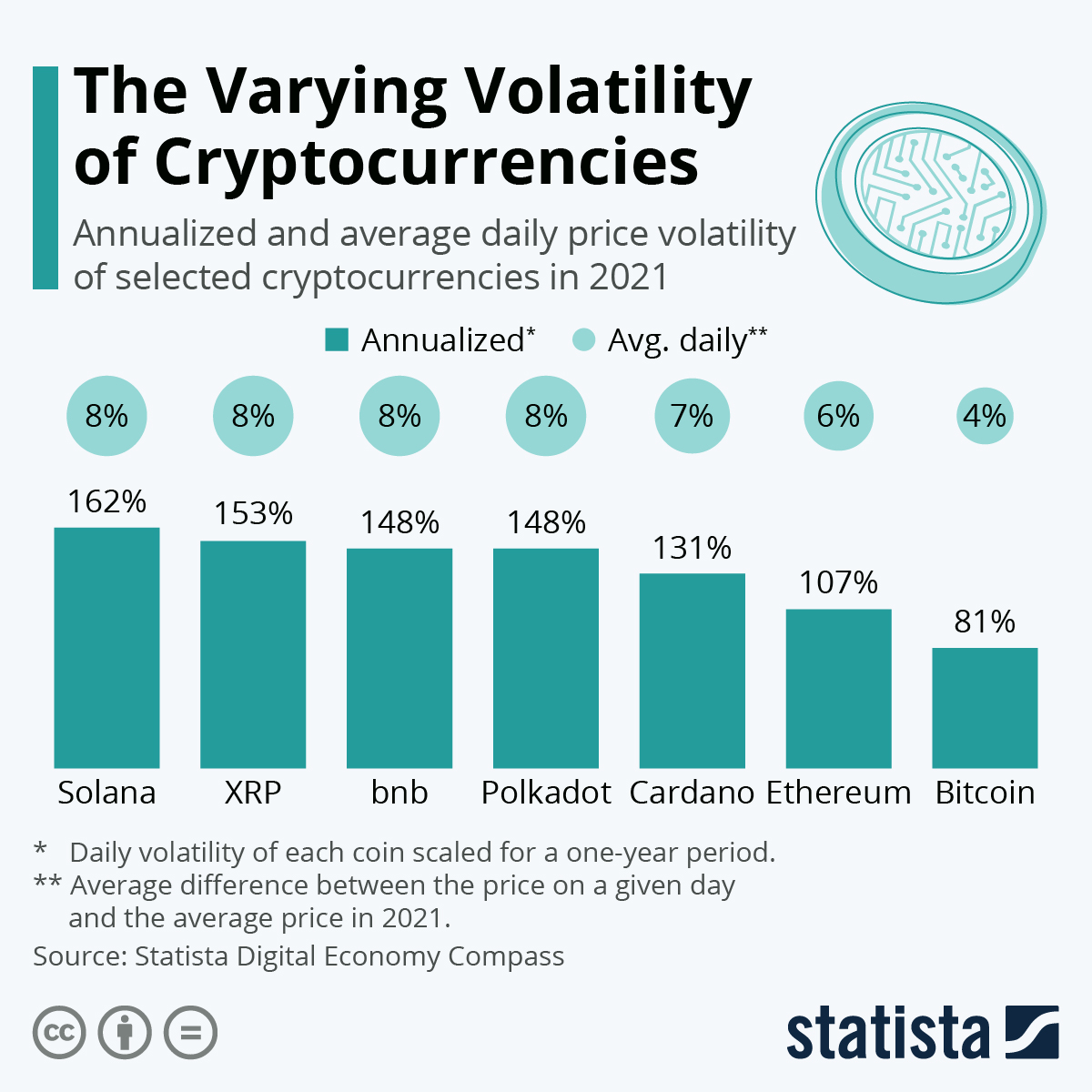

Volatility Analysis (25% Weight) forms the largest component of the index, reflecting the fundamental relationship between market uncertainty and price volatility. This component compares current Bitcoin volatility to its average levels over the previous 30 and 90 days, providing context for whether current market conditions represent normal fluctuations or unusual stress. Rising volatility typically indicates increased fear as investors become uncertain about future price direction, while declining volatility suggests growing confidence and a shift toward greed.

The volatility component captures more than just price movements; it reflects the underlying uncertainty that drives investor behavior. When markets experience high volatility, investors become more risk-averse, leading to selling pressure and further price declines. Conversely, periods of low volatility often coincide with growing investor confidence, creating conditions for sustained price appreciation. The 25% weighting reflects the strong historical correlation between volatility patterns and major market turning points.

Market Momentum and Volume (25% Weight) represents the second-largest component, analyzing buying and selling pressure through volume patterns. This component examines whether current trading volumes are unusually high or low compared to recent averages, providing insights into the intensity of market participation. High buying volumes during price increases typically indicate greed-driven behavior, as investors rush to participate in rising markets. Conversely, high selling volumes during price declines often reflect fear-driven capitulation.

The volume analysis goes beyond simple quantity measurements to examine the quality of market participation. Sustained high volumes during price advances suggest genuine buying interest rather than temporary speculation, while declining volumes during rallies may indicate weakening momentum. The component also considers the distribution of volume across different price levels, helping identify whether current market activity represents accumulation by long-term investors or distribution by those looking to exit positions.

Social Media Sentiment (15% Weight) captures the unique role that social platforms play in cryptocurrency markets, where news and opinions spread rapidly and can significantly impact prices. This component monitors hashtag interactions, engagement rates, and sentiment patterns across major social media platforms, particularly Twitter, where much of the crypto community’s discourse occurs. High engagement rates with positive sentiment typically indicate growing greed, while negative sentiment with high engagement often signals increasing fear.

The social media component employs sophisticated natural language processing algorithms to analyze not just the volume of mentions but also the emotional tone and context of discussions. This analysis helps distinguish between genuine sentiment shifts and artificial manipulation attempts, providing more reliable insights into authentic market psychology. The 15% weighting reflects the significant but not overwhelming influence of social media on actual trading behavior.

Direct Surveys (15% Weight) provide the most straightforward measurement of investor sentiment by directly asking market participants about their expectations and attitudes. These weekly surveys typically gather 2,000 to 3,000 responses from active crypto traders and investors, asking questions about market direction, risk appetite, and investment intentions. The survey component offers unique insights because it captures conscious investor attitudes rather than inferring sentiment from market behavior.

The survey methodology employs careful sampling techniques to ensure representative responses across different investor categories, from retail traders to institutional participants. Questions are designed to elicit honest responses about genuine investment intentions rather than wishful thinking or social desirability bias. The 15% weighting acknowledges that while surveys provide valuable direct insights, they may not always translate immediately into actual market behavior.

Bitcoin Dominance (10% Weight) reflects the unique dynamics of cryptocurrency markets, where Bitcoin often serves as a safe haven during periods of uncertainty. Rising Bitcoin dominance typically indicates fear-driven behavior, as investors retreat from riskier altcoins to the relative safety of Bitcoin. Declining dominance often signals greed-driven risk-taking, as investors venture into altcoins seeking higher returns.

The Bitcoin dominance component captures important portfolio allocation decisions that reflect broader risk appetite in the crypto ecosystem. During fear periods, investors tend to consolidate holdings in Bitcoin, viewing it as the most established and liquid cryptocurrency. During greed periods, investors diversify into altcoins, hoping to capture outsized returns from smaller, more volatile assets. The 10% weighting reflects the importance of this dynamic while acknowledging that dominance patterns can be influenced by factors beyond pure sentiment.

Google Trends Analysis (10% Weight) examines search patterns to understand public interest and concern about cryptocurrency markets. This component analyzes search queries related to Bitcoin and cryptocurrency, looking for patterns that indicate fear or greed. Searches for terms like “Bitcoin crash” or “crypto bubble” typically indicate fear, while searches for “how to buy Bitcoin” or “best cryptocurrency” suggest growing greed and interest.

The Google Trends component provides insights into broader public sentiment beyond active market participants, capturing the interest of potential new investors who may not yet be active in crypto markets. This forward-looking aspect makes it particularly valuable for identifying emerging trends before they fully manifest in market behavior. The search analysis also helps distinguish between different types of interest, separating genuine investment curiosity from crisis-driven information seeking.

Current Market Analysis: Navigating the Neutral Zone

The current Fear and Greed Index reading of 47, firmly planted in neutral territory, represents a fascinating inflection point in cryptocurrency market psychology. This reading comes after a dramatic journey from extreme greed territory just days ago, when the index reached 60 following Bitcoin’s historic ascent to $124,128. The rapid transition from greed to neutrality provides valuable insights into the current market dynamics and offers important clues about potential future direction.

The shift from greed to neutral sentiment coincides with Bitcoin’s correction from its all-time high, dropping approximately 9% to current levels around $113,000. This price action, while significant in absolute terms, represents a relatively modest correction by cryptocurrency standards, yet it has been sufficient to cool the excessive optimism that characterized the market just days earlier. The speed of this sentiment shift illustrates the hair-trigger nature of crypto market psychology, where confidence can evaporate quickly when prices begin to decline.

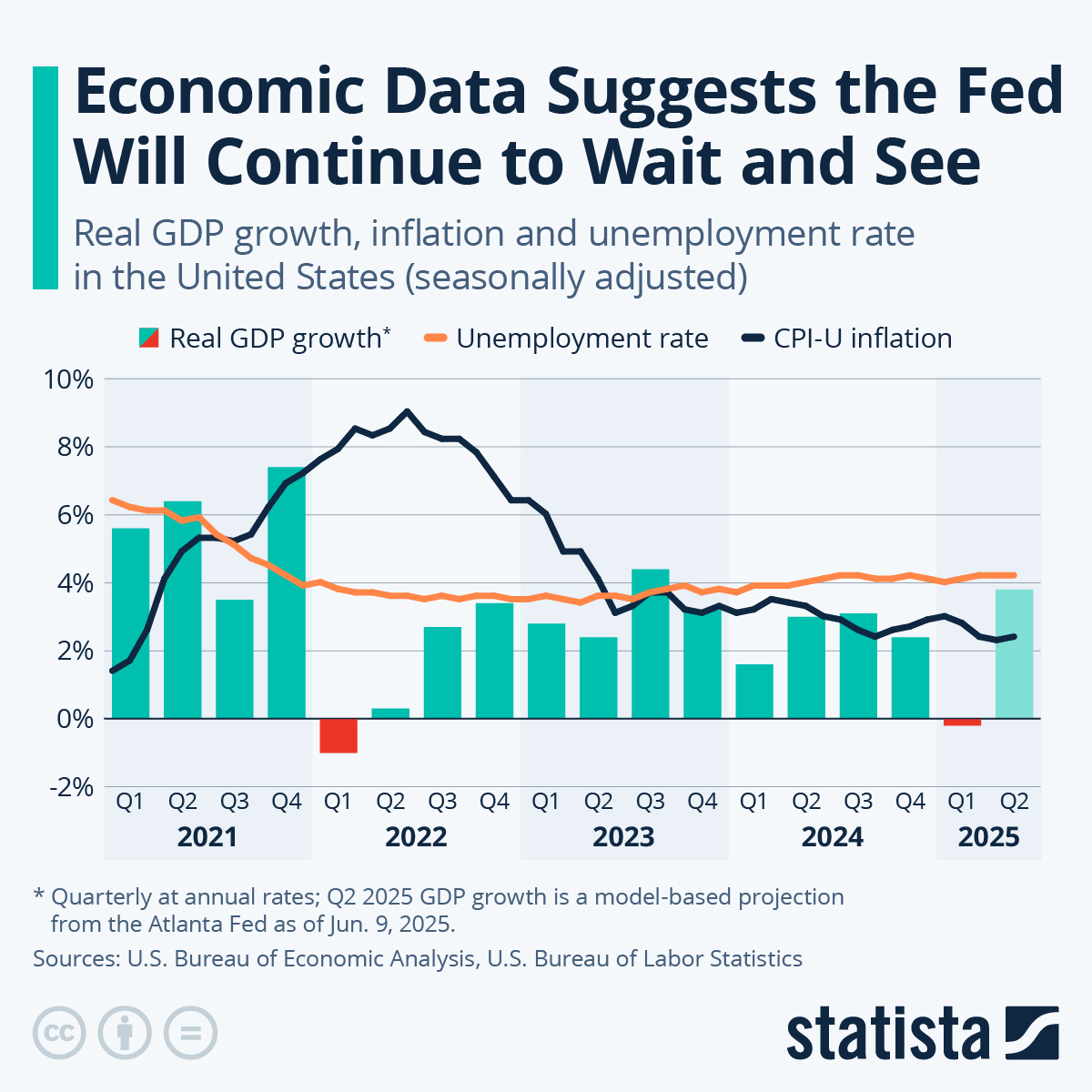

Several factors have contributed to the current neutral reading, creating a complex web of influences that traders must navigate carefully. The anticipation surrounding Federal Reserve Chairman Jerome Powell’s remarks at the Jackson Hole Symposium has introduced macroeconomic uncertainty that extends beyond cryptocurrency markets. This broader economic context has tempered the pure crypto-focused optimism that drove the recent greed reading, as investors consider how monetary policy changes might affect risk asset valuations.

The neutral reading also reflects a market in transition, where neither fear nor greed dominates decision-making processes. This psychological state often precedes significant directional moves, as markets consolidate sentiment before breaking toward new extremes. Historical analysis suggests that extended periods in neutral territory are relatively rare in cryptocurrency markets, which tend to gravitate toward emotional extremes more quickly than traditional financial markets.

From a technical perspective, the neutral sentiment aligns with Bitcoin’s current price action, which has been characterized by consolidation around key support levels rather than panic selling or euphoric buying. This price behavior suggests that while the immediate greed-driven momentum has subsided, underlying demand remains sufficient to prevent a descent into fear territory. The market appears to be digesting recent gains while evaluating new information that could drive the next major move.

The composition of the current neutral reading provides additional insights into market dynamics. The volatility component has increased as Bitcoin’s price swings have become more pronounced, contributing to the decline from greed territory. However, volume patterns remain relatively healthy, suggesting that current price action represents normal profit-taking rather than panic selling. Social media sentiment has cooled from the euphoric levels seen during Bitcoin’s run to new highs, but remains generally positive rather than turning negative.

Bitcoin dominance patterns offer another perspective on current market psychology. The recent stability in Bitcoin’s market share relative to altcoins suggests that investors are neither fleeing to safety (which would increase dominance) nor aggressively risk-seeking (which would decrease dominance). This balanced approach to portfolio allocation aligns with the neutral sentiment reading and suggests that investors are taking a wait-and-see approach to current market conditions.

The survey component of the index reveals interesting nuances in investor attitudes. While overall sentiment has cooled from extreme optimism, most respondents continue to express cautious optimism about medium-term prospects. This suggests that the current neutral reading may reflect temporary uncertainty rather than a fundamental shift in long-term bullish sentiment. Investors appear to be pausing to reassess rather than abandoning their positive outlook entirely.

Google Trends data provides additional context for the current sentiment reading. Search patterns show continued interest in cryptocurrency topics, but with a shift from purely speculative queries toward more educational and analytical searches. This pattern suggests that while immediate FOMO (fear of missing out) has subsided, underlying interest in cryptocurrency remains strong, potentially providing a foundation for future sentiment improvements.

Trading Strategies: Harnessing Sentiment for Profit

The Fear and Greed Index offers multiple strategic approaches for cryptocurrency traders and investors, each tailored to different risk tolerances, time horizons, and market philosophies. Understanding how to effectively incorporate sentiment analysis into trading decisions can significantly enhance returns while helping manage risk during volatile market conditions.

The Contrarian Approach represents the most fundamental application of Fear and Greed Index analysis, based on the principle that extreme sentiment readings often coincide with market turning points. This strategy involves buying when the index shows extreme fear (0-25) and selling when it indicates extreme greed (75-100). The contrarian approach recognizes that markets tend to overshoot in both directions, creating opportunities for those willing to act against prevailing sentiment.

Implementing contrarian strategies requires significant psychological discipline, as it involves buying when negative news dominates headlines and selling when optimism reaches fever pitch. Historical analysis shows that some of the most profitable cryptocurrency investments have been made during periods of extreme fear, when quality assets trade at significant discounts to their intrinsic value. Similarly, taking profits during extreme greed periods has helped investors avoid major drawdowns during subsequent corrections.

The contrarian approach works particularly well in cryptocurrency markets because of their tendency toward emotional extremes. Unlike traditional financial markets, where institutional participation and regulatory oversight moderate sentiment swings, crypto markets can experience rapid shifts from euphoria to despair. These extreme movements create more pronounced opportunities for contrarian investors willing to act against crowd psychology.

Successful contrarian trading requires careful position sizing and risk management. Rather than investing all available capital when the index reaches extreme fear, sophisticated traders scale into positions gradually, recognizing that sentiment can remain extreme longer than expected. Similarly, profit-taking during extreme greed periods should be systematic rather than all-or-nothing, allowing investors to capture gains while maintaining exposure to potential continued upside.

Divergence Analysis offers a more nuanced approach to sentiment-based trading, focusing on discrepancies between index readings and actual price movements. This strategy looks for situations where sentiment and price action tell different stories, potentially indicating underlying strength or weakness not reflected in current market psychology. For example, if the Fear and Greed Index shows extreme fear while Bitcoin’s price remains relatively stable or even increases, this divergence might suggest underlying buying pressure that could drive future price appreciation.

Divergence analysis requires careful attention to the relationship between sentiment and price action over time. Positive divergences occur when sentiment improves faster than prices, potentially indicating that a rally is building momentum. Negative divergences happen when sentiment deteriorates while prices remain elevated, possibly signaling that a correction is approaching. These patterns can provide early warning signals for major market moves.

The effectiveness of divergence analysis depends on understanding the typical lag between sentiment shifts and price movements. In some cases, sentiment changes precede price movements by days or weeks, while in others, price action leads sentiment changes. Experienced traders learn to recognize these patterns and adjust their strategies accordingly, using divergence analysis as a timing tool rather than a directional indicator.

Trend Confirmation Strategies use the Fear and Greed Index to validate signals from other technical or fundamental analysis tools. Rather than relying solely on sentiment readings, this approach combines index data with traditional indicators like moving averages, support and resistance levels, or fundamental metrics. When multiple indicators align with sentiment readings, it increases confidence in trading decisions and can lead to more successful outcomes.

For example, a trader might wait for both a technical breakout above key resistance and a shift from fear to neutral sentiment before entering a long position. This multi-factor approach reduces the likelihood of false signals and helps ensure that trades are supported by both technical and psychological factors. Similarly, the combination of negative technical signals and extreme greed readings might provide strong confirmation for short positions or profit-taking decisions.

Trend confirmation strategies work particularly well for traders who prefer higher-probability setups over frequent trading opportunities. By requiring alignment between sentiment and other factors, these strategies typically generate fewer signals but with higher success rates. This approach suits traders who prioritize capital preservation and prefer to wait for optimal entry and exit points rather than attempting to capture every market move.

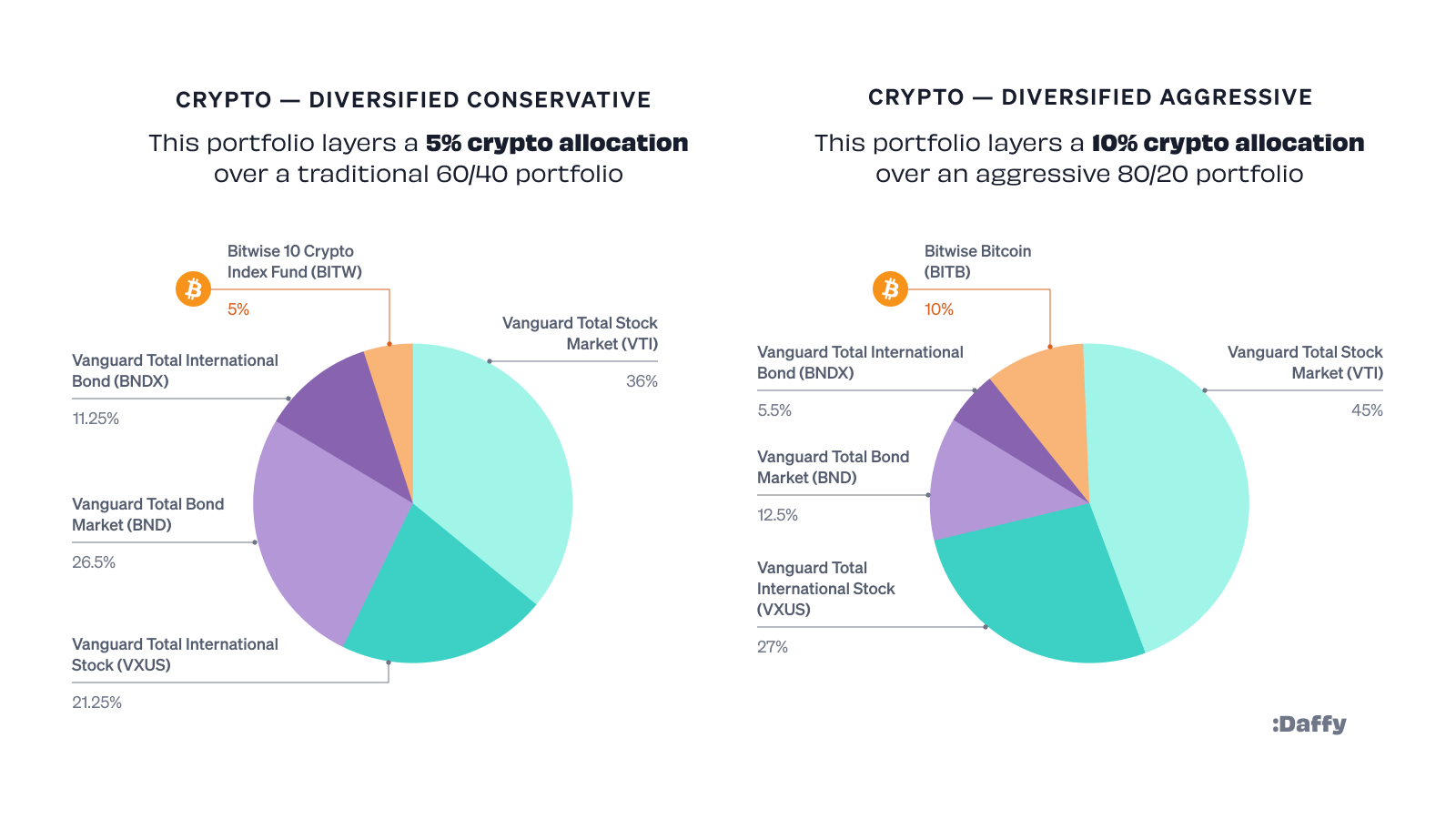

Dynamic Position Sizing represents an advanced application of sentiment analysis, where portfolio allocation adjusts based on current index readings. This strategy recognizes that risk-adjusted returns can be optimized by increasing exposure during periods of extreme fear and reducing exposure during periods of extreme greed. Rather than maintaining static position sizes, dynamic allocation allows investors to capitalize on sentiment-driven market inefficiencies.

The dynamic sizing approach typically involves establishing baseline portfolio allocations that adjust based on sentiment extremes. For example, an investor might maintain a 5% cryptocurrency allocation during neutral sentiment periods, increase to 10% during extreme fear, and reduce to 2% during extreme greed. These adjustments allow investors to increase exposure when assets are likely undervalued and reduce exposure when they may be overvalued.

Implementing dynamic position sizing requires careful planning and disciplined execution. Investors must establish clear rules for allocation adjustments and stick to them regardless of current market narratives or emotional impulses. The strategy also requires sufficient liquidity to make allocation changes without significant transaction costs or market impact.

Short-Term Momentum Trading uses rapid sentiment changes to identify short-term trading opportunities. This approach focuses on the speed of sentiment shifts rather than absolute readings, recognizing that rapid changes in market psychology often precede significant price movements. Traders using this strategy monitor the index for sudden shifts and position themselves to capitalize on the resulting price action.

Momentum trading based on sentiment requires quick decision-making and efficient execution capabilities. Traders must be prepared to act rapidly when sentiment shifts occur, as the most profitable opportunities often have short windows. This approach works best for experienced traders with access to advanced trading platforms and the ability to monitor markets continuously.

The key to successful momentum trading lies in distinguishing between genuine sentiment shifts and temporary noise. Experienced traders learn to recognize patterns in sentiment changes that typically precede significant price movements, allowing them to position themselves advantageously before the broader market reacts to changing psychology.

Risk Management and Limitations: Understanding the Boundaries

While the Fear and Greed Index provides valuable insights into market psychology, successful implementation requires understanding its limitations and incorporating appropriate risk management techniques. Like any analytical tool, the index is not infallible and should be used as part of a comprehensive trading and investment framework rather than as a standalone decision-making mechanism.

The Non-Predictive Nature of the index represents its most important limitation. The Fear and Greed Index measures current sentiment rather than predicting future price movements. While extreme sentiment readings often coincide with market turning points, the timing and magnitude of these turns cannot be precisely predicted using sentiment analysis alone. Markets can remain in extreme sentiment territory longer than expected, potentially causing significant losses for traders who assume immediate reversals.

This limitation requires traders to maintain realistic expectations about what sentiment analysis can and cannot accomplish. The index excels at identifying when markets may be psychologically stretched in one direction or another, but it cannot specify exactly when or how corrections will occur. Successful traders use sentiment readings to inform their decision-making process while relying on other tools for precise timing and risk management.

The non-predictive nature also means that sentiment-based strategies require patience and discipline. Contrarian positions taken during extreme sentiment periods may not immediately prove profitable, requiring traders to maintain positions through potentially adverse short-term price movements. This psychological challenge can be particularly difficult during extreme fear periods, when negative news continues to dominate headlines even after positions are established.

Market Correlation Risks present another significant limitation, particularly during periods of extreme market stress. While the Fear and Greed Index can help identify sentiment extremes, it cannot eliminate the correlation risks that characterize cryptocurrency markets during crisis periods. When broader financial markets experience significant stress, cryptocurrency assets tend to move together regardless of individual fundamentals or sentiment readings.

The correlation issue becomes particularly problematic during “risk-off” periods, when investors flee from all risky assets simultaneously. During such periods, even assets with strong fundamentals and attractive sentiment readings may experience significant declines as part of broader market liquidation. Traders must recognize that sentiment analysis works best during normal market conditions and may provide less reliable signals during systemic stress periods.

Understanding correlation risks requires monitoring broader financial market conditions alongside cryptocurrency-specific sentiment indicators. When traditional markets show signs of stress, cryptocurrency traders should adjust their expectations and risk management accordingly, recognizing that sentiment-based strategies may be less effective during periods of high correlation.

Data Quality and Manipulation Concerns represent ongoing challenges for sentiment-based analysis. The components of the Fear and Greed Index rely on various data sources, each with potential quality issues or manipulation risks. Social media sentiment, for example, can be artificially influenced through coordinated campaigns or bot activity. Similarly, survey responses may not always represent genuine trading intentions or may be biased toward particular outcomes.

The index creators employ various techniques to address data quality concerns, including filtering mechanisms for social media analysis and careful survey methodology design. However, traders should remain aware that no sentiment indicator is completely immune to manipulation or data quality issues. Diversifying across multiple sentiment indicators and combining sentiment analysis with other analytical approaches can help mitigate these risks.

Regular validation of sentiment signals against actual market behavior helps identify periods when data quality issues may be affecting index reliability. Experienced traders develop intuition for recognizing when sentiment readings seem disconnected from underlying market reality, allowing them to adjust their strategies accordingly.

Institutional vs. Retail Sentiment Divergence creates additional complexity in interpreting Fear and Greed Index readings. The index primarily captures retail investor sentiment through its various components, but institutional investor behavior may differ significantly from retail sentiment. During periods when institutional and retail sentiment diverge, the index may provide misleading signals about overall market direction.

This divergence can be particularly pronounced during major market transitions, when institutional investors may be accumulating positions while retail sentiment remains negative, or vice versa. Understanding the composition of market participants and their likely behavior patterns helps traders interpret sentiment readings more accurately and avoid potential pitfalls.

Monitoring institutional activity through on-chain analysis, exchange flows, and other indicators can provide complementary insights to retail-focused sentiment measures. Combining these different perspectives creates a more complete picture of market psychology and helps identify situations where sentiment-based strategies may be more or less effective.

Timing and Execution Challenges represent practical limitations that can significantly impact the effectiveness of sentiment-based strategies. Even when sentiment analysis correctly identifies market turning points, poor timing or execution can result in losses. The index updates every twelve hours, which may not provide sufficient granularity for short-term trading strategies, while longer-term strategies may require patience that many traders find difficult to maintain.

Successful implementation of sentiment-based strategies requires careful attention to execution details, including entry and exit timing, position sizing, and transaction costs. Traders must also consider market liquidity conditions, as sentiment extremes sometimes coincide with reduced liquidity that can make position establishment or liquidation more difficult and expensive.

Advanced Applications: Beyond Basic Sentiment Analysis

As cryptocurrency markets mature and institutional participation increases, sophisticated traders are developing advanced applications of Fear and Greed Index analysis that go beyond simple contrarian strategies. These advanced techniques combine sentiment analysis with other analytical frameworks to create more nuanced and potentially profitable trading approaches.

Multi-Timeframe Sentiment Analysis involves examining sentiment patterns across different time horizons to identify more robust trading opportunities. While the standard Fear and Greed Index provides daily readings, advanced traders construct their own sentiment indicators using different lookback periods and update frequencies. This approach helps distinguish between temporary sentiment fluctuations and more meaningful psychological shifts that are likely to drive sustained price movements.

The multi-timeframe approach typically involves analyzing short-term sentiment (daily readings), medium-term sentiment (weekly averages), and long-term sentiment (monthly trends). When sentiment readings align across multiple timeframes, it provides stronger conviction for trading decisions. Conversely, divergences between timeframes can signal potential turning points or highlight the need for additional caution.

Implementing multi-timeframe analysis requires careful data management and analytical capabilities. Traders must maintain historical sentiment data and develop systems for calculating rolling averages and identifying trend changes across different time horizons. This complexity makes the approach more suitable for sophisticated traders with advanced analytical tools and experience.

Sector-Specific Sentiment Analysis recognizes that different cryptocurrency sectors may experience varying sentiment patterns. While the standard Fear and Greed Index focuses primarily on Bitcoin and broad market sentiment, advanced traders develop specialized indicators for specific sectors like DeFi, NFTs, or layer-one protocols. This granular approach can identify opportunities in sectors that may be experiencing different psychological dynamics than the broader market.

Sector-specific analysis requires deep understanding of the unique factors that drive sentiment in different cryptocurrency niches. DeFi sentiment, for example, may be more influenced by regulatory developments and protocol innovations, while NFT sentiment might be more driven by cultural trends and celebrity endorsements. Developing effective sector-specific indicators requires specialized knowledge and data sources beyond those used in broad market analysis.

The sector approach can be particularly valuable during periods when cryptocurrency markets are experiencing rotation between different themes or sectors. By identifying sectors with improving sentiment while others deteriorate, traders can position themselves to benefit from these rotational dynamics rather than simply following broad market trends.

Sentiment Momentum Indicators focus on the rate of change in sentiment rather than absolute readings. These indicators recognize that rapid sentiment shifts often precede significant price movements, even when absolute sentiment levels remain within normal ranges. By measuring sentiment acceleration and deceleration, these indicators can provide earlier signals than traditional sentiment analysis approaches.

Momentum-based sentiment analysis typically involves calculating derivatives of sentiment readings, such as daily changes, weekly changes, and acceleration measures. When sentiment momentum reaches extreme levels, it often indicates that psychological conditions are building for significant market moves. This approach can be particularly effective for identifying turning points before they become apparent in absolute sentiment readings.

The momentum approach requires sophisticated mathematical analysis and careful parameter selection. Traders must determine appropriate lookback periods for momentum calculations and establish thresholds for identifying significant momentum shifts. The complexity of this analysis makes it more suitable for quantitative traders with strong mathematical backgrounds.

Cross-Asset Sentiment Correlation involves analyzing relationships between cryptocurrency sentiment and sentiment indicators from other asset classes. This approach recognizes that cryptocurrency markets do not exist in isolation and that broader financial market psychology can significantly influence crypto sentiment patterns. By understanding these relationships, traders can anticipate sentiment shifts in cryptocurrency markets based on developments in traditional finance.

Cross-asset analysis typically involves monitoring sentiment indicators for stocks, bonds, commodities, and currencies alongside cryptocurrency sentiment measures. During periods of high correlation, developments in traditional markets may provide leading indicators for cryptocurrency sentiment changes. Conversely, periods of low correlation may indicate that cryptocurrency markets are driven by crypto-specific factors rather than broader financial market psychology.

Implementing cross-asset sentiment analysis requires access to sentiment data from multiple markets and the analytical capability to identify meaningful relationships. This approach is most suitable for institutional traders or sophisticated individual investors with access to comprehensive market data and analytical tools.

The Future of Sentiment Analysis in Cryptocurrency Markets

As cryptocurrency markets continue to evolve and mature, sentiment analysis tools like the Fear and Greed Index are likely to become increasingly sophisticated and influential in trading decisions. Understanding the trajectory of these developments can help traders prepare for future opportunities and challenges in sentiment-based investing.

Artificial Intelligence and Machine Learning Integration represents one of the most promising areas for advancement in sentiment analysis. Current sentiment indicators rely primarily on relatively simple aggregation methods, but future versions are likely to incorporate advanced AI techniques that can identify more subtle patterns in market psychology. Machine learning algorithms could potentially identify sentiment patterns that human analysts miss, leading to more accurate and timely sentiment indicators.

AI-powered sentiment analysis could also address some current limitations, such as social media manipulation and data quality issues. Advanced algorithms could potentially distinguish between genuine sentiment expressions and artificial manipulation attempts, leading to more reliable sentiment readings. Natural language processing improvements could also enable more nuanced analysis of social media content, capturing subtle emotional nuances that current systems miss.

The integration of AI and machine learning will likely require significant computational resources and expertise, potentially creating advantages for institutional investors and sophisticated trading firms. However, as these technologies become more accessible, individual traders may also benefit from improved sentiment analysis tools that provide more accurate and actionable insights.

Real-Time Sentiment Processing represents another area of likely advancement, as current sentiment indicators typically update every twelve hours or daily. Future systems may provide real-time sentiment readings that update continuously as new data becomes available. This increased frequency could enable more responsive trading strategies and better timing of entry and exit decisions.

Real-time processing would be particularly valuable for short-term trading strategies that seek to capitalize on rapid sentiment shifts. However, it would also require careful filtering to distinguish between meaningful sentiment changes and temporary noise. The challenge will be developing systems that provide timely updates while maintaining the reliability and stability that make sentiment analysis useful for decision-making.

Institutional Sentiment Integration will likely become increasingly important as institutional participation in cryptocurrency markets continues to grow. Current sentiment indicators focus primarily on retail investor psychology, but future versions may need to incorporate institutional sentiment measures to provide complete market psychology pictures. This could involve analyzing institutional trading patterns, regulatory filings, and other data sources that reflect institutional investor attitudes.

The integration of institutional sentiment could significantly improve the predictive power of sentiment analysis, as institutional investors often have longer time horizons and different information sources than retail investors. Understanding when institutional and retail sentiment diverge could provide valuable insights into potential market turning points and help traders position themselves advantageously.

Regulatory Impact Assessment will become an increasingly important component of sentiment analysis as cryptocurrency regulation continues to develop globally. Future sentiment indicators may need to incorporate regulatory sentiment measures that assess how policy developments are likely to affect market psychology. This could involve analyzing regulatory announcements, policy proposals, and enforcement actions to gauge their potential impact on investor sentiment.

Regulatory sentiment analysis could help traders anticipate market reactions to policy developments and position themselves accordingly. As cryptocurrency markets become more sensitive to regulatory developments, understanding the sentiment implications of policy changes will become increasingly valuable for successful trading and investment strategies.

The evolution of sentiment analysis in cryptocurrency markets will likely create new opportunities for sophisticated traders while potentially reducing the effectiveness of simple sentiment-based strategies. As these tools become more widely available and understood, their predictive power may diminish, requiring traders to develop more advanced and nuanced approaches to sentiment-based investing.

Conclusion: Mastering the Psychology of Crypto Markets

The Cryptocurrency Fear and Greed Index represents far more than a simple market indicator—it serves as a window into the collective psychology that drives one of the world’s most dynamic and volatile financial markets. As we have explored throughout this comprehensive analysis, understanding and effectively utilizing sentiment analysis can provide significant advantages for traders and investors willing to master its complexities and limitations.

The current neutral reading of 47 offers a perfect case study in the practical application of sentiment analysis. This reading, representing a significant shift from the greed territory of just days ago, illustrates how quickly market psychology can change and how these changes can create both opportunities and risks for market participants. The transition from extreme optimism following Bitcoin’s new all-time high to more measured sentiment as prices corrected demonstrates the dynamic nature of cryptocurrency market psychology.

The six-component framework underlying the Fear and Greed Index provides a sophisticated approach to quantifying market sentiment that goes far beyond simple price-based indicators. By incorporating volatility analysis, volume patterns, social media sentiment, direct surveys, Bitcoin dominance, and search trends, the index captures multiple dimensions of market psychology that collectively provide insights into the emotional state of market participants. Understanding how these components interact and contribute to overall sentiment readings enables more nuanced interpretation of market conditions.

The trading strategies we have examined—from basic contrarian approaches to advanced multi-timeframe analysis—demonstrate the versatility of sentiment-based investing. Whether employed as a primary decision-making tool or as confirmation for other analytical approaches, sentiment analysis can enhance trading performance when properly implemented with appropriate risk management techniques. The key lies in understanding that sentiment analysis works best as part of a comprehensive analytical framework rather than as a standalone solution.

The limitations and risks associated with sentiment analysis underscore the importance of maintaining realistic expectations and implementing proper risk management techniques. The non-predictive nature of sentiment indicators, correlation risks during market stress, and potential data quality issues all require careful consideration when developing sentiment-based strategies. Successful practitioners learn to work within these limitations while maximizing the benefits that sentiment analysis can provide.

Looking toward the future, the evolution of sentiment analysis through artificial intelligence, real-time processing, and institutional integration promises to create new opportunities while potentially changing the effectiveness of current approaches. Traders who stay abreast of these developments and adapt their strategies accordingly will be best positioned to benefit from the continued evolution of sentiment analysis tools.

The current market environment, with its neutral sentiment reading and ongoing uncertainty about future direction, provides an excellent opportunity to apply the principles and strategies discussed in this analysis. Whether the market moves toward fear or greed territory in the coming days and weeks, understanding the psychological forces at work will help traders and investors make more informed decisions and potentially capitalize on the emotional extremes that characterize cryptocurrency markets.

Ultimately, mastering the Fear and Greed Index and sentiment analysis more broadly requires combining theoretical understanding with practical experience. The concepts and strategies outlined in this guide provide a foundation, but successful implementation requires practice, patience, and continuous learning. As cryptocurrency markets continue to evolve, those who understand the psychological forces driving market behavior will maintain significant advantages over those who focus solely on technical or fundamental analysis.

The Fear and Greed Index serves as a powerful reminder that behind every price movement, every market trend, and every trading opportunity lies human psychology in all its complexity. By learning to read and interpret these psychological signals, traders and investors can better navigate the challenging but potentially rewarding world of cryptocurrency markets, turning the emotional volatility that characterizes these markets from a source of risk into a source of opportunity.

References

[1] CoinStats. “Crypto Fear & Greed Index.” CoinStats, August 25, 2025. https://coinstats.app/fear-and-greed/

[2] TokenMetrics. “Crypto Fear and Greed Index – What it is and How to Use it?” TokenMetrics Blog, August 22, 2025. https://www.tokenmetrics.com/blog/crypto-fear-and-greed-index

[3] Alternative.me. “Crypto Fear & Greed Index – Bitcoin Sentiment.” Alternative.me, August 25, 2025. https://alternative.me/crypto/fear-and-greed-index/

[4] ChainCatcher. “Data: The current cryptocurrency fear and greed index is 46.” ChainCatcher, August 25, 2025. https://www.chaincatcher.com/en/article/2200237