As the world of cryptocurrency continues to mature, investors are increasingly looking for ways to gain exposure to this burgeoning asset class without directly purchasing volatile digital coins. Crypto-related stocks offer a compelling alternative, providing a way to invest in the underlying technology and infrastructure of the digital asset economy. With 2026 shaping up to be a pivotal year for the crypto market, now is an excellent time to consider which stocks are best positioned for growth. This guide will explore how to strategically invest $1000 in the most promising crypto stocks for the coming year.

The 2026 Crypto Landscape: A Perfect Storm for Growth?

Several key factors are converging to create a potentially explosive environment for the crypto market in 2026. Analysts are predicting a significant bull run for Bitcoin, with some forecasts projecting a price of over $140,000. This optimism is fueled by increasing institutional investment, particularly through spot crypto exchange-traded funds (ETFs), and a more favorable political climate in the United States. Furthermore, major financial institutions like Morgan Stanley are entering the crypto space, with plans to launch crypto trading on their E*TRADE platform in 2026. This confluence of events suggests that companies with exposure to the crypto ecosystem are poised for substantial growth.

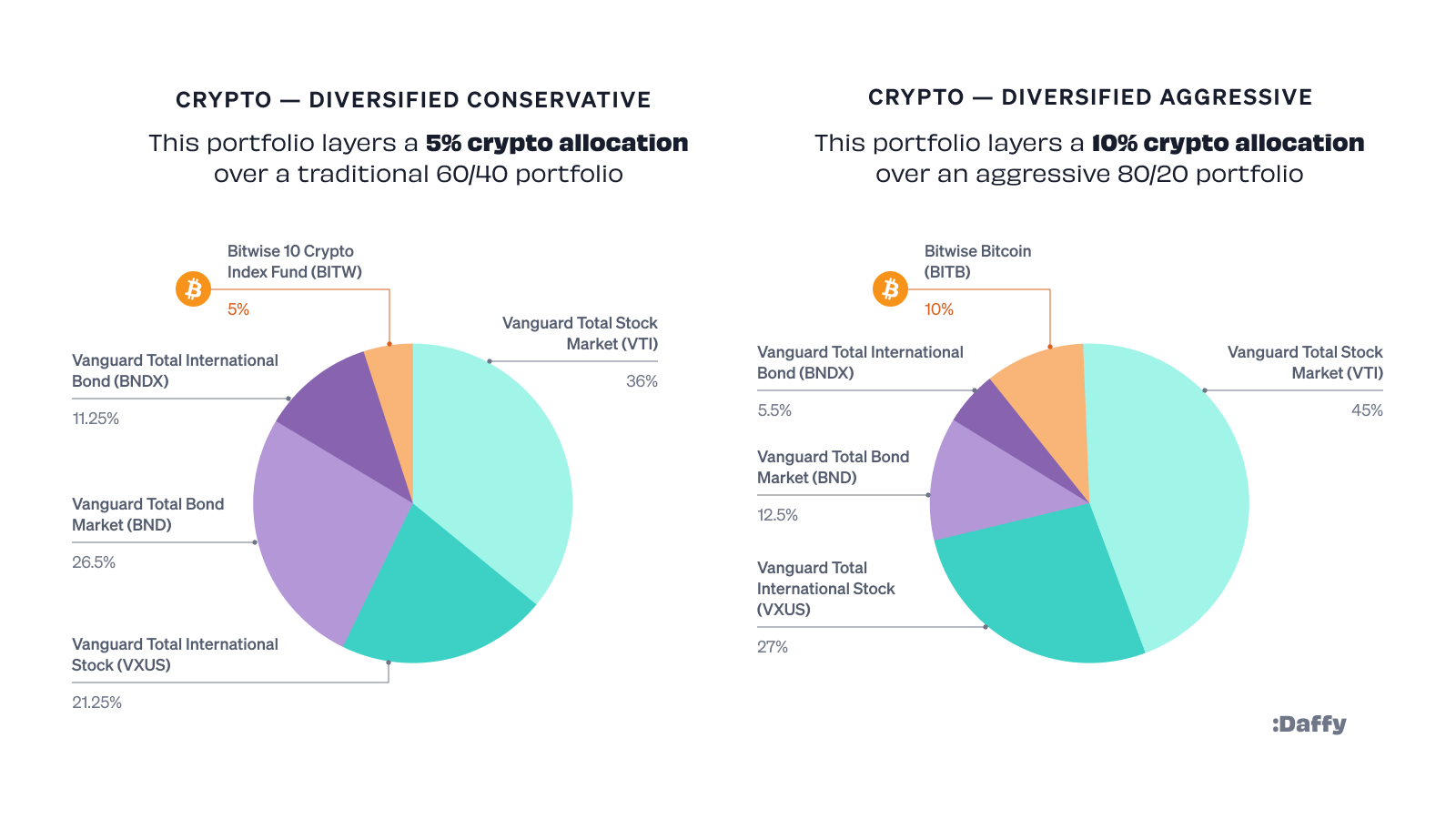

How to Invest $1000: A Diversified Approach to Crypto Stocks

With a $1000 investment, a diversified approach is crucial to mitigate risk while maximizing potential returns. A well-balanced portfolio could include a mix of cryptocurrency mining stocks and more established companies with significant blockchain and crypto-adjacent operations. This strategy allows you to capitalize on the high-growth potential of miners while also benefiting from the stability of larger, more diversified companies.

| Stock Category | Investment Allocation | Rationale |

| :— | :— | :— |

| Cryptocurrency Mining Stocks | 40% ($400) | Direct exposure to the profitability of crypto mining, which is highly correlated with cryptocurrency prices. |

| Blockchain & Crypto-Adjacent Stocks | 60% ($600) | Exposure to the broader blockchain ecosystem, including exchanges, payment processors, and technology providers, offering a more stable and diversified investment. |

Top Crypto Mining Stocks to Watch

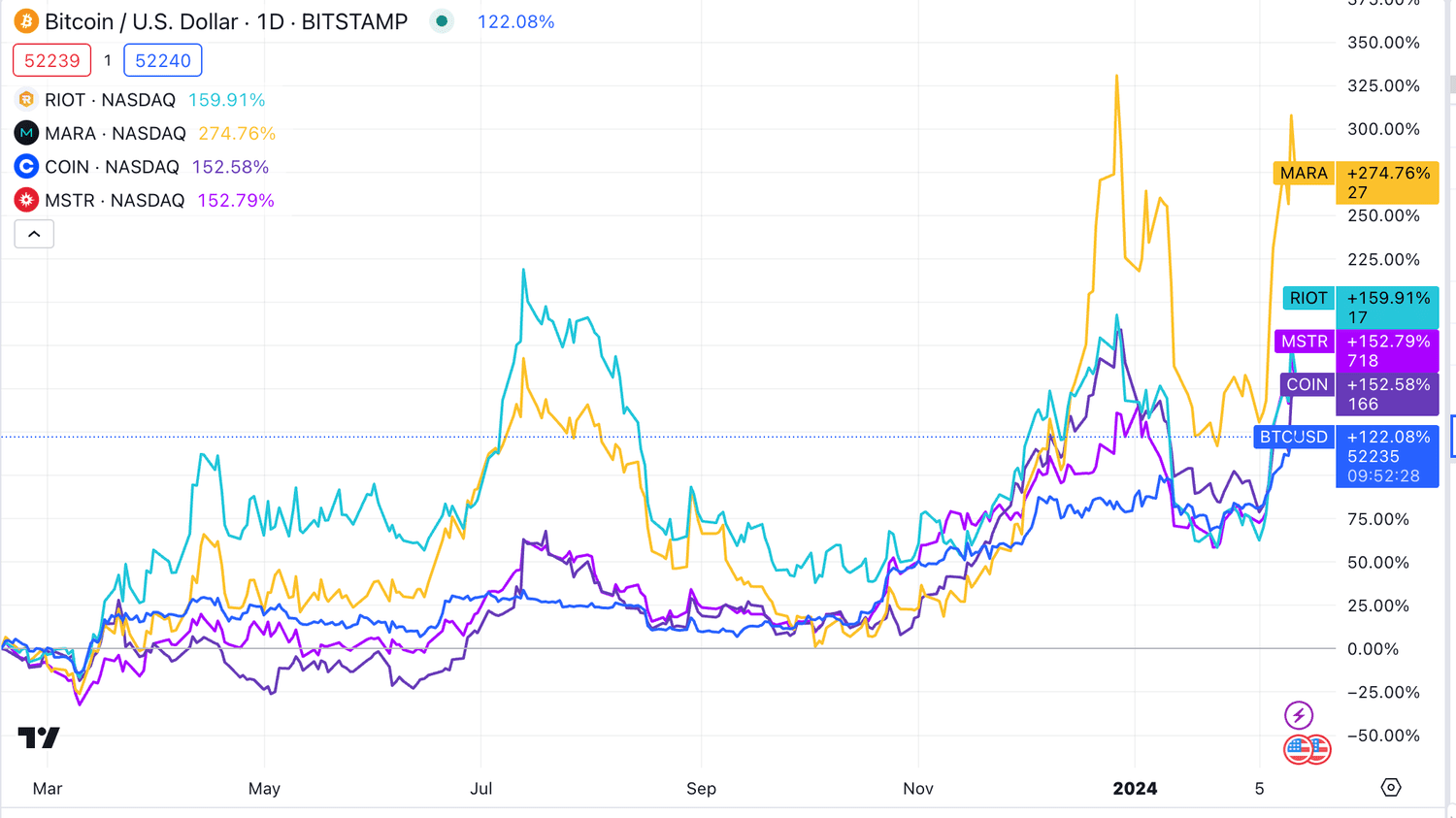

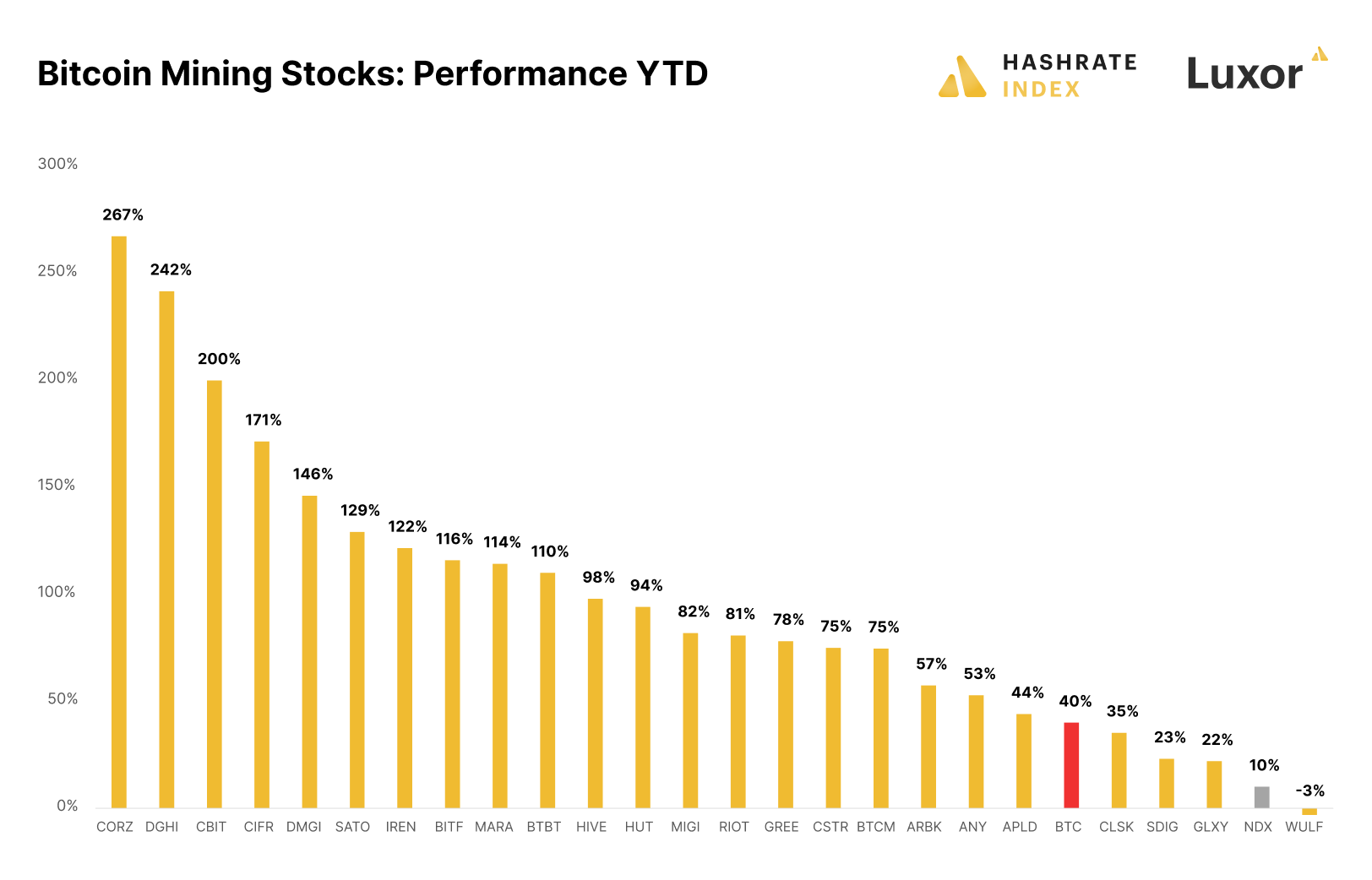

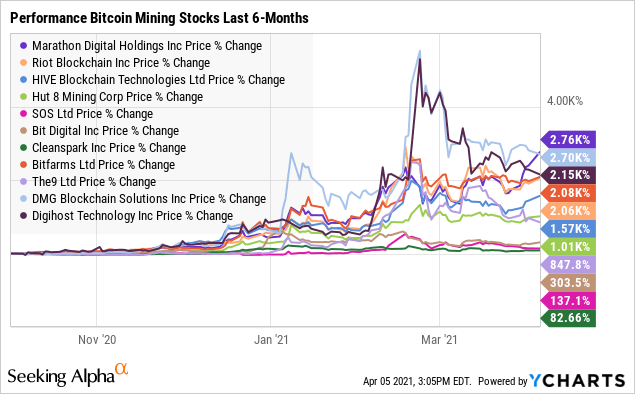

Cryptocurrency mining stocks are at the forefront of the digital asset revolution, and their performance is closely tied to the price of cryptocurrencies like Bitcoin. As crypto prices rise, so do the profit margins for miners, making these stocks a high-risk, high-reward investment.

Here are some of the top crypto mining stocks to consider for your 2026 portfolio:

- Marathon Digital Holdings (MARA): As one of the largest Bitcoin miners in the U.S., MARA has been aggressively expanding its operations and boasts a significant Bitcoin treasury. Its focus on efficiency and scale makes it a compelling investment.

- Riot Platforms (RIOT): RIOT is another major player in the Bitcoin mining space, with a strong balance sheet and a commitment to expanding its hash rate. The company’s strategic focus on low-cost energy makes it well-positioned for long-term growth.

- CleanSpark (CLSK): CLSK stands out for its commitment to sustainable energy, with a significant portion of its operations powered by low-carbon sources. This ESG-friendly approach, combined with its rapid growth, makes it an attractive option for socially conscious investors.

Top Blockchain and Crypto-Adjacent Stocks

For investors seeking a more diversified and less volatile entry into the crypto space, blockchain and crypto-adjacent stocks offer an excellent alternative. These companies are involved in various aspects of the crypto ecosystem, from exchanges and payment processing to the underlying technology that powers it all.

Here are some of the top blockchain and crypto-adjacent stocks to consider:

- Coinbase (COIN): As the leading U.S. cryptocurrency exchange, Coinbase is a direct beneficiary of the growing adoption of crypto. Its user-friendly platform and institutional-grade services make it a cornerstone of the crypto economy.

- Nvidia (NVDA): While primarily known for its graphics processing units (GPUs) used in gaming and AI, Nvidia’s technology is also essential for cryptocurrency mining. As the demand for high-performance computing continues to grow, so will the demand for Nvidia’s products.

- Block (SQ): Formerly known as Square, Block has embraced cryptocurrency with its Cash App, which allows users to buy and sell Bitcoin. The company is also actively developing other Bitcoin-related products and services, making it a key player in the future of finance.

Conclusion: Riding the Crypto Wave in 2026

The year 2026 is poised to be a landmark year for the cryptocurrency market. By strategically investing in a diversified portfolio of crypto-related stocks, you can position yourself to capitalize on the immense growth potential of this transformative technology. Whether you choose to invest in high-growth mining stocks or more established blockchain and crypto-adjacent companies, a well-researched and diversified approach will be key to navigating the exciting and ever-evolving world of crypto investing.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in cryptocurrency and crypto-related stocks involves significant risk, and you should always conduct your own research and consult with a qualified financial advisor before making any investment decisions.