Author: everythingcryptoitclouds.com

Introduction: A Paradigm Shift in Central Bank Digital Currency

The global race to develop Central Bank Digital Currencies (CBDCs) has been defined by a fundamental debate: should the digital currency bear interest? Most central banks, including the U.S. Federal Reserve and the European Central Bank, have historically answered with a resounding “No,” fearing the risk of “digital bank runs” that could destabilize commercial banks. However, China’s central bank, the People’s Bank of China (PBOC), has just shattered this consensus.

Effective January 1, 2026, the PBOC will implement a new framework requiring commercial banks to pay interest on balances held in Digital Yuan (e-CNY) wallets [1]. This strategic pivot transforms the e-CNY into the world’s first interest-bearing CBDC, marking a significant escalation in China’s efforts to drive mass adoption and setting a new precedent for the future of digital money.

The Adoption Challenge and the Interest Solution

Despite being the most advanced CBDC project globally, the e-CNY has faced a crucial challenge: gaining widespread usage against the dominance of private payment giants like Alipay and WeChat Pay. The e-CNY was initially designed to be non-interest-bearing, a feature intended to prevent users from pulling large amounts of money out of commercial bank deposits and into the central bank’s digital currency, which would have severely impacted the commercial banking sector.

However, this non-interest-bearing status made the e-CNY an unattractive store of value compared to traditional bank deposits, which earn interest. The PBOC’s new policy directly addresses this by linking the e-CNY interest rate to prevailing demand deposit rates, making the digital currency a more competitive financial instrument [2].

Implications for Commercial Banks: Intermediaries Under Pressure

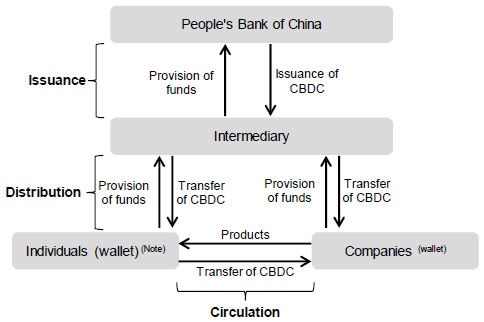

The PBOC’s two-tier system for the e-CNY relies on commercial banks as intermediaries for distribution and management. The new interest-bearing feature solidifies this role but also introduces a new dynamic of competition and cost.

Commercial banks have reportedly completed the necessary system upgrades to account for the digital yuan interest [3]. While this move forces banks to bear the cost of interest payments, it also ensures that the e-CNY is integrated directly into the existing financial ecosystem, rather than operating as a completely separate, disintermediating force.

The Global CBDC Race: A New Precedent

China’s decision to make its CBDC interest-bearing is a bold move that challenges the cautious approach taken by Western central banks.

- The West’s Stance: The general consensus among central banks in the U.S. and Europe has been that a non-interest-bearing CBDC is necessary to protect the stability of the fractional reserve banking system.

- China’s Strategy: By introducing interest, China is signaling that the benefits of mass adoption and increased usage—including greater monetary control and enhanced data visibility—outweigh the risks of disintermediation, or that they have developed sufficient tools to manage those risks.

This strategic shift places the e-CNY in direct competition with other global currencies and financial instruments, particularly in cross-border trade. An interest-bearing digital currency is inherently more appealing as a store of value, enhancing the e-CNY’s potential as a tool for internationalization [4].

Conclusion: The Future of Digital Money is Now

The introduction of interest payments on the Digital Yuan is a watershed moment in the evolution of CBDCs. It is a clear, aggressive strategy by the PBOC to overcome adoption hurdles and cement the e-CNY’s place in the daily lives of its citizens. By transforming the e-CNY from a mere payment token into a competitive financial asset, China is not only accelerating its own digital currency project but is also forcing other nations to re-evaluate their own CBDC designs. This development ensures that the e-CNY will remain a central topic in global finance and technology throughout 2026 and beyond.

References

[1] Bloomberg. China to Pay Interest on Digital Yuan in Bid to Boost Adoption. [URL: https://www.bloomberg.com/news/articles/2025-12-29/china-to-pay-interest-on-digital-yuan-in-bid-to-boost-adoption%5D

[2] Reuters. China’s digital yuan to become interest-bearing next year. [URL: https://www.reuters.com/world/asia-pacific/china-issue-digital-yuan-management-action-plan-2025-12-29/%5D

[3] Yicai Global. China to Require Banks to Pay Interest on Digital Yuan Wallets From 2026. [URL: https://www.yicaiglobal.com/news/china-to-require-banks-to-pay-interest-on-digital-yuan-wallets-from-2026%5D

[4] Ainvest. The Strategic Implications of China’s Interest-Bearing Digital Yuan. [URL: https://www.ainvest.com/news/strategic-implications-china-interest-bearing-digital-yuan-financial-institutions-cross-border-investors-2512/%5D